United States Natural Gas ETF

Latest United States Natural Gas ETF News and Updates

EIA Upgrades US Natural Gas Production for 2018

US dry natural gas production was flat at 76.1 Bcf (billion cubic feet) per day on December 7–13, 2017, according to PointLogic.

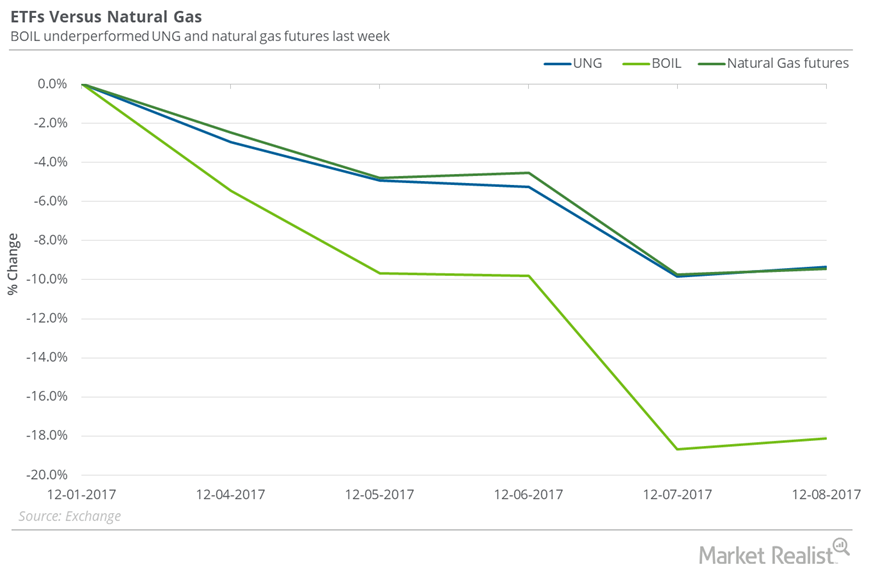

Natural Gas: Fall Impacts Natural Gas ETFs

On December 1–8, 2017, the United States Natural Gas Fund (UNG), which holds near-month natural gas futures contracts, fell 9.3%.

Are Natural Gas Supply Fears Rising?

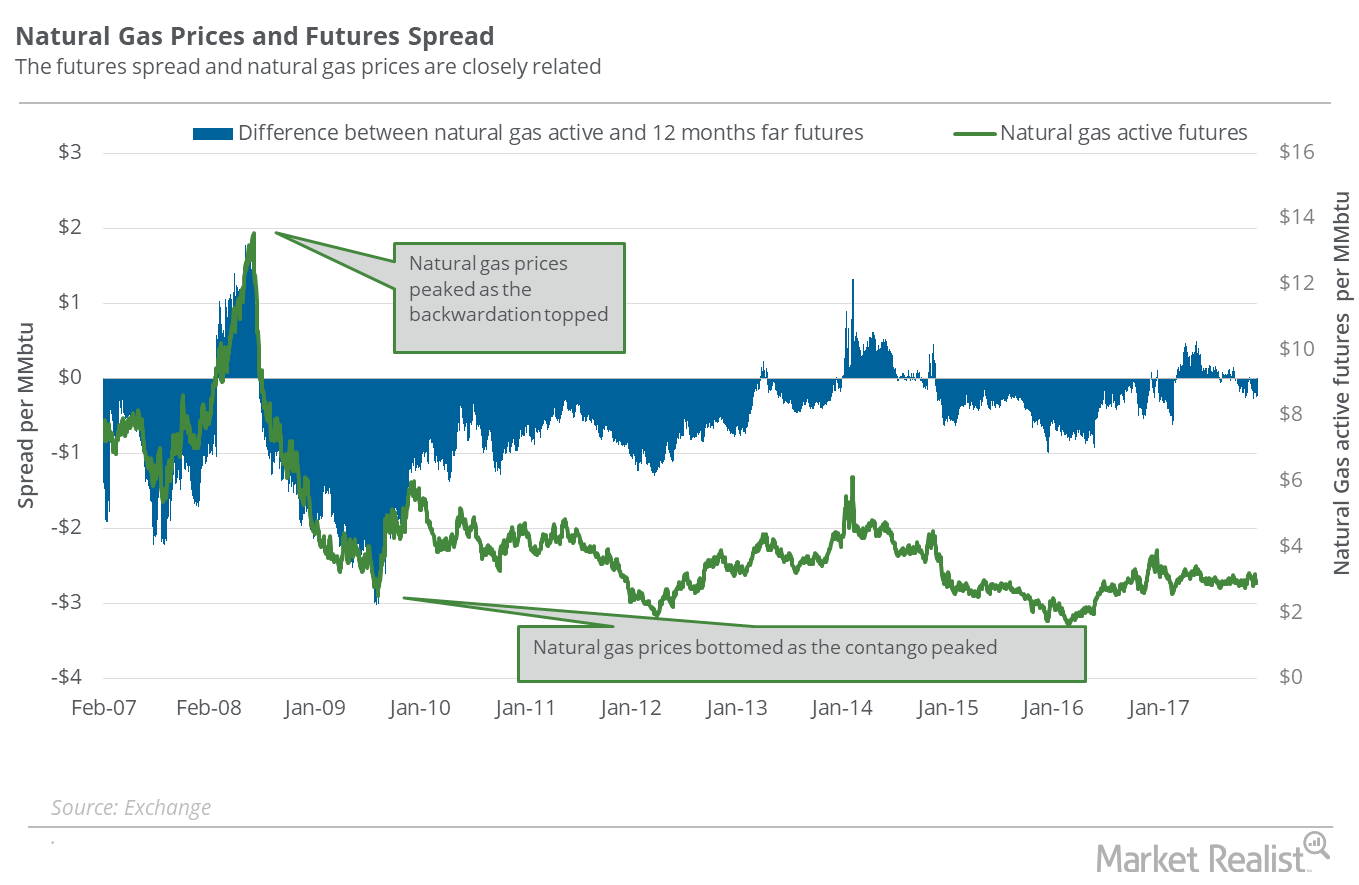

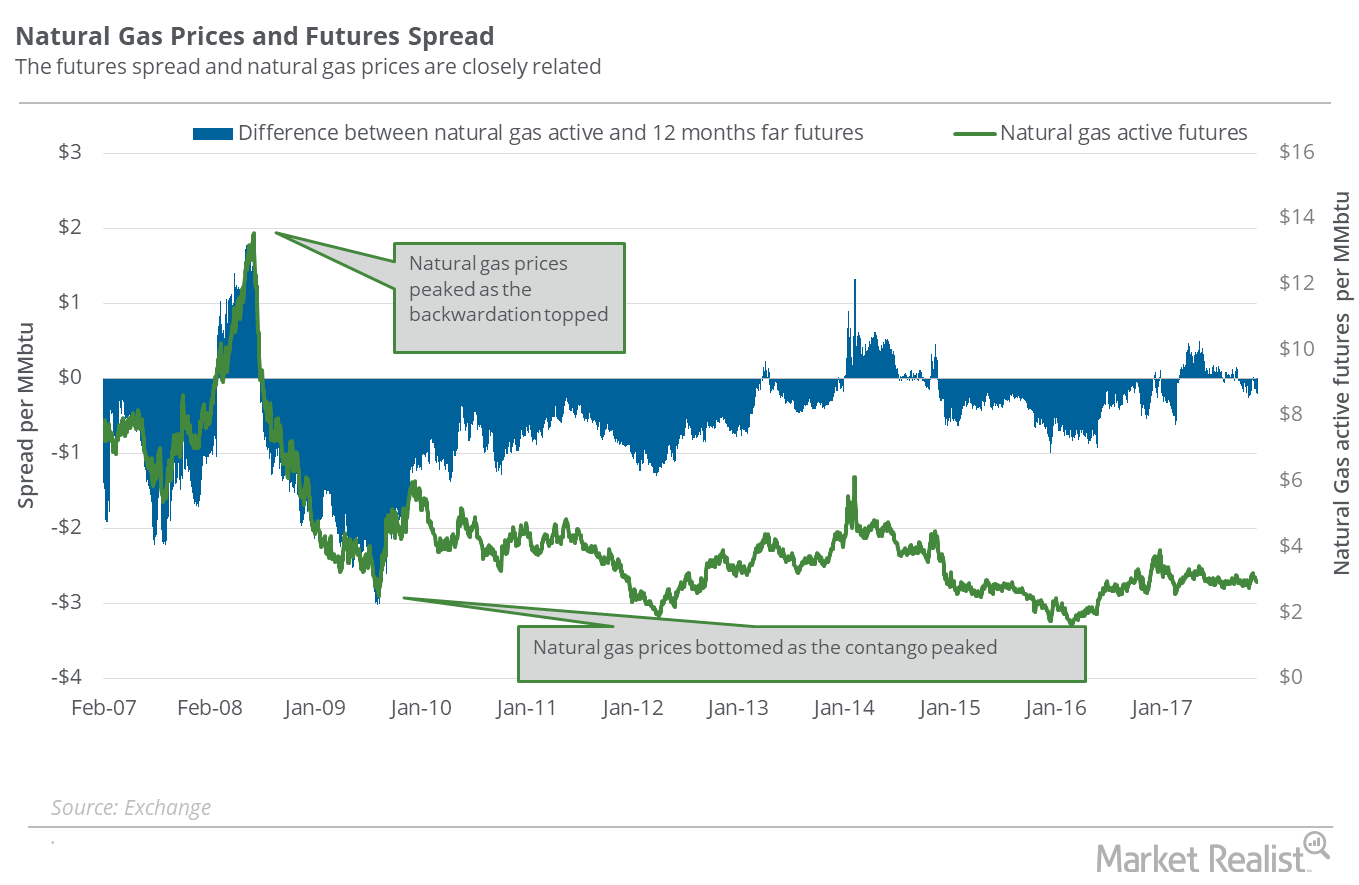

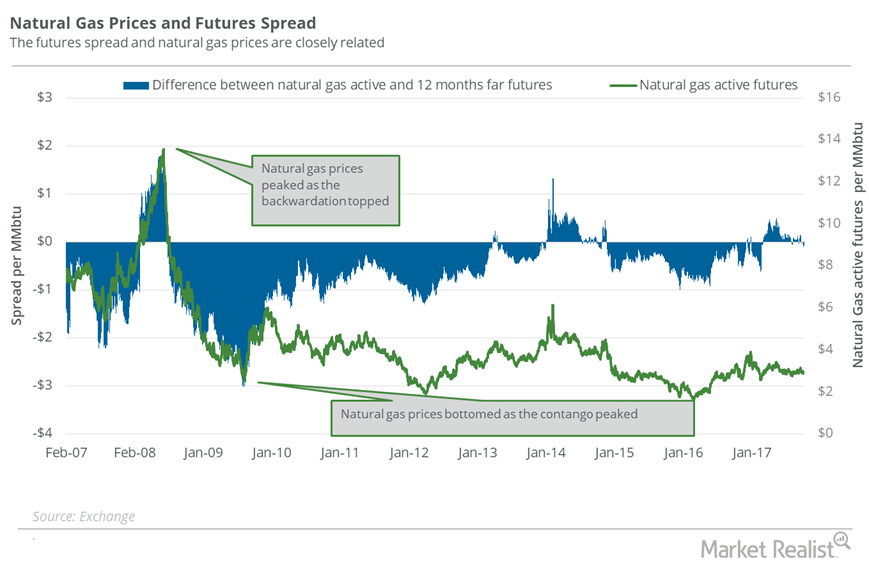

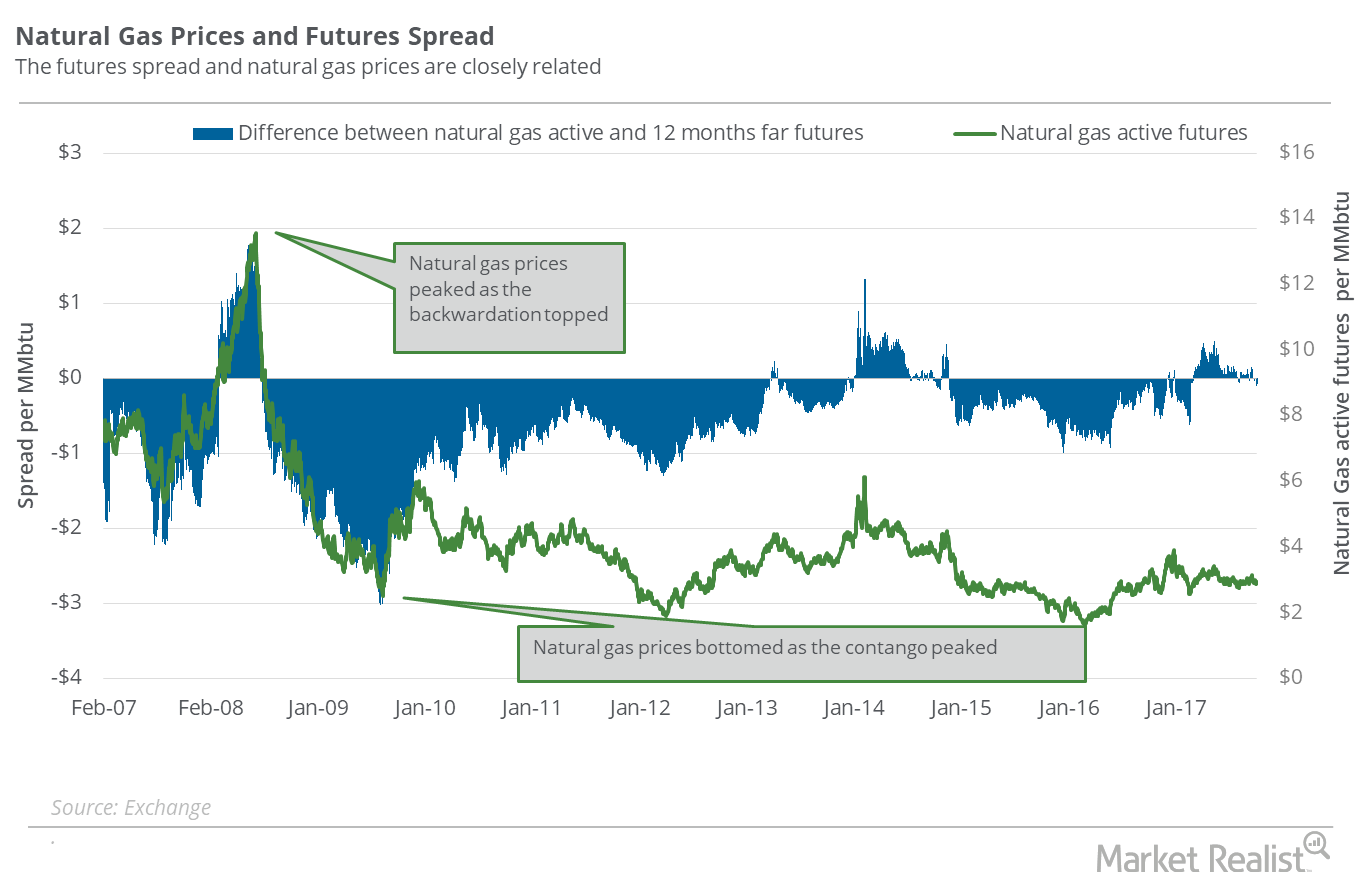

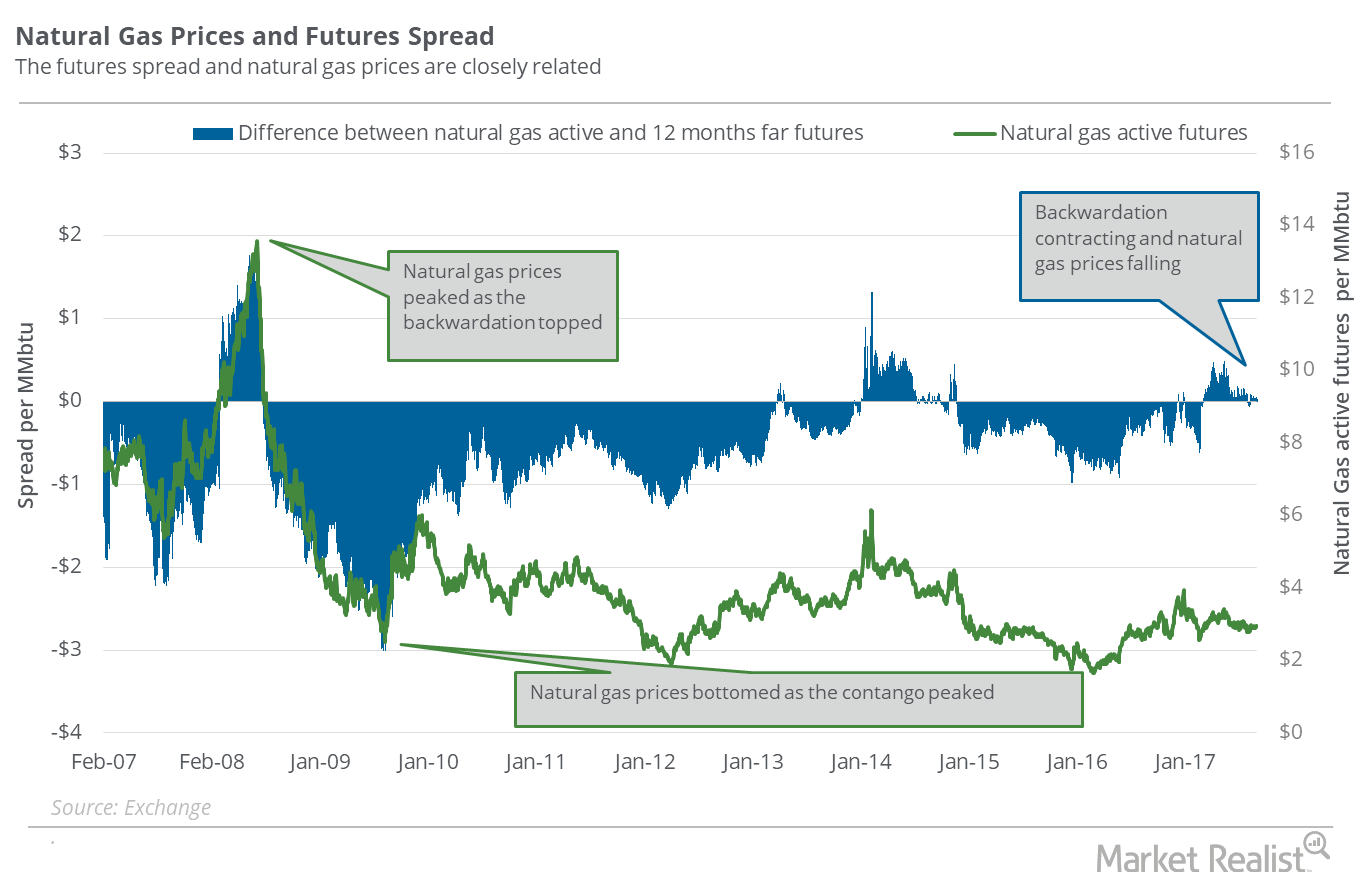

On December 6, natural gas (UNG)(BOIL) January 2018 futures traded at a discount of ~$0.24 to January 2019 futures. This price difference between January 2018 futures and January 2019 futures is called the “futures spread.”

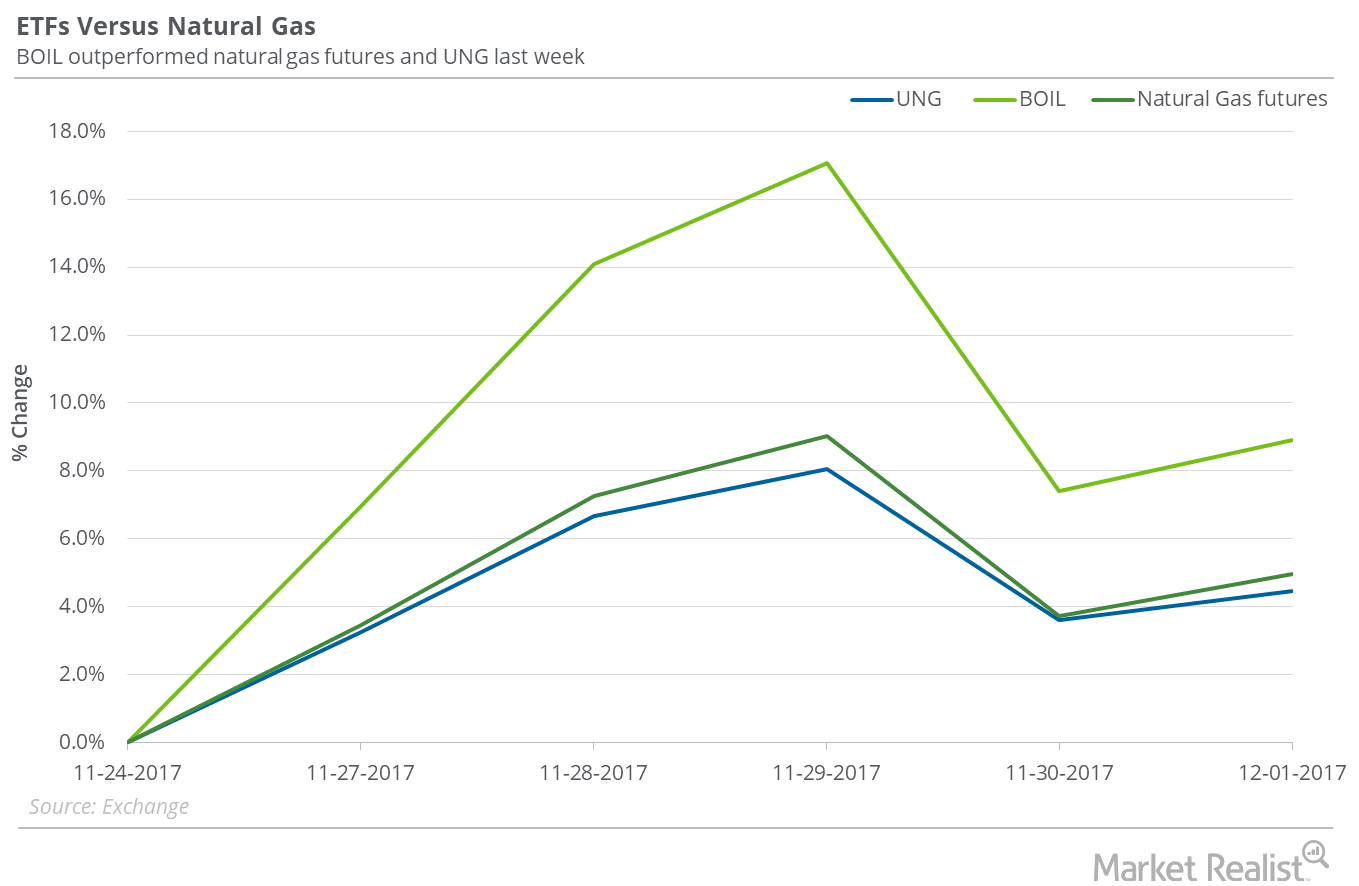

Rise in Natural Gas Impacts Natural Gas ETFs

On November 24–December 1, 2017, the United States Natural Gas Fund (UNG), that follows near-month natural gas futures contracts, rose 4.5%.

US Natural Gas Future Fell after the Natural Gas Inventory Report

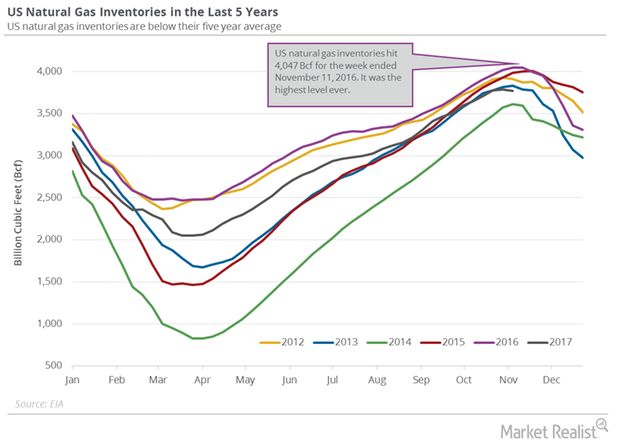

The EIA released its natural gas inventory report on November 30, 2017. US natural gas inventories fell by 33 Bcf to 3,693 Bcf on November 17–24, 2017.

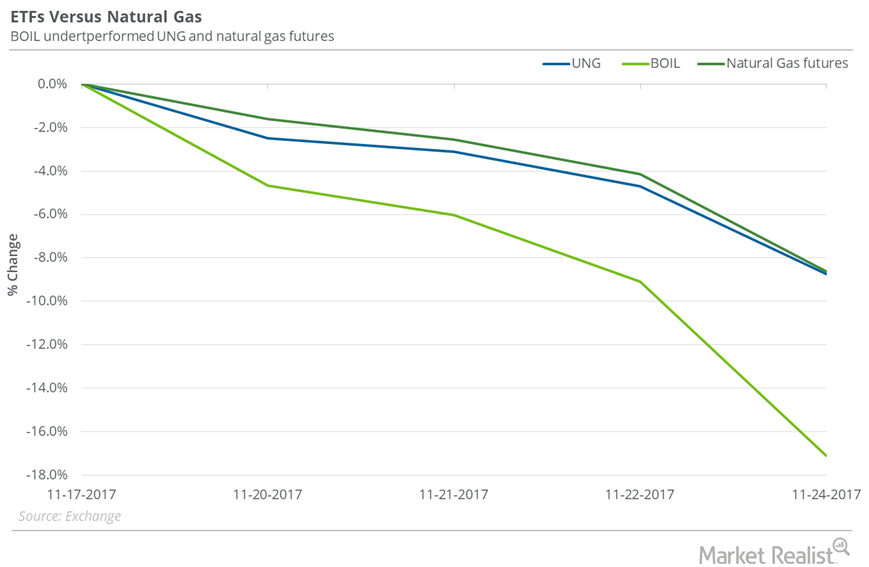

How Are Natural Gas ETFs Adjusting to Fall in Natural Gas Prices?

Between November 17 and November 24, 2017, the United States Natural Gas Fund LP (UNG) fell 8.8%.

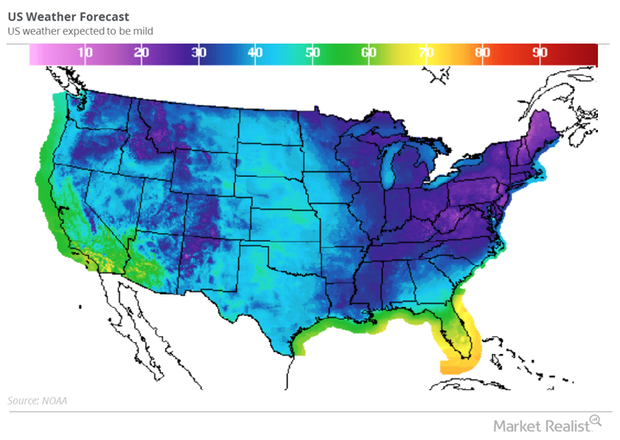

Weather Impacts the US Natural Gas Market

January US natural gas (DGAZ) (UNG) futures contracts fell 1.4% to $3.01 per MMBtu in electronic trading at 1:05 AM EST on November 24, 2017.

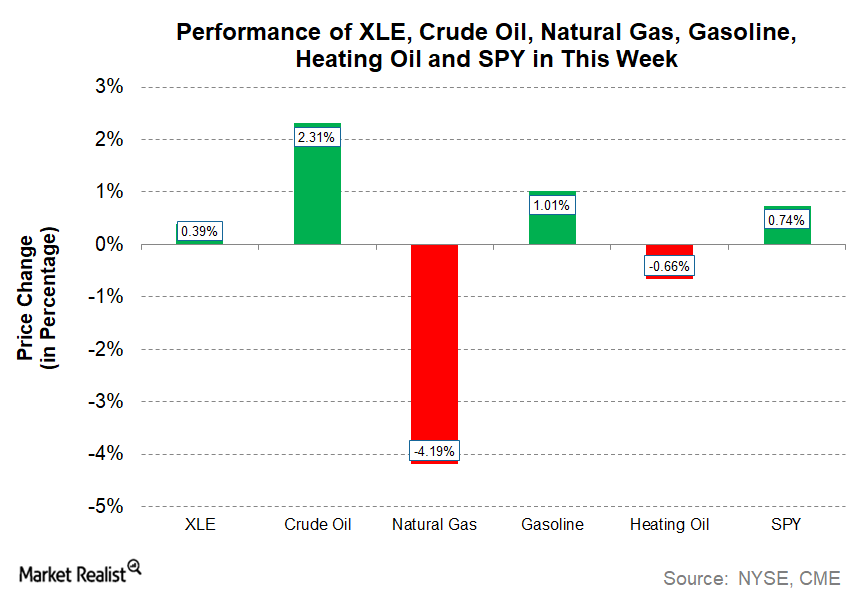

Energy Sector Saw a Mixed Performance This Week

With the mixed performance from natural gas and crude oil, the energy sector is showing a modest increase this week.

Are Oversupply Concerns Gripping Natural Gas Prices?

On November 22, natural gas (UNG)(BOIL) January 2018 futures closed at a discount of ~$0.2 to January 2019 futures.

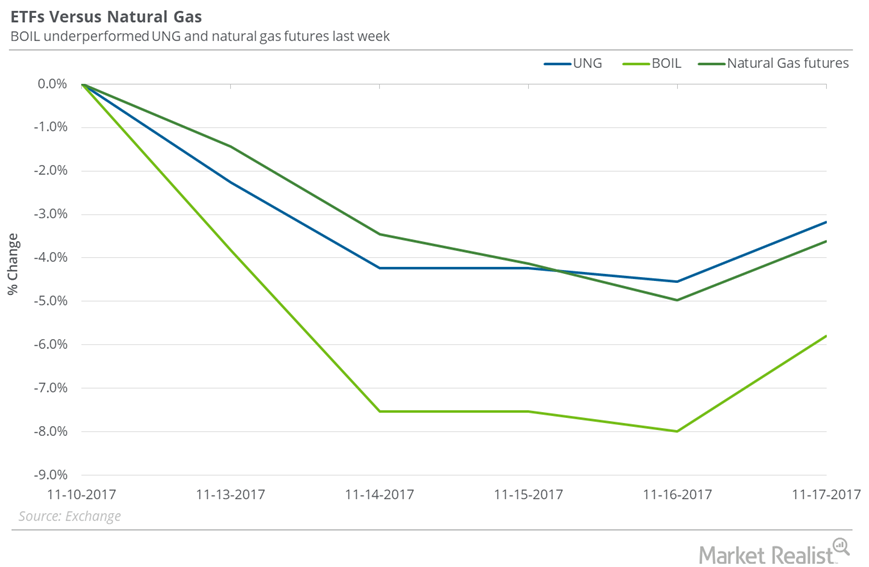

Are Natural Gas ETFs Doing Any Better than Natural Gas?

Between November 10 and November 17, the United States Natural Gas Fund LP (UNG) fell 3.2% while natural gas active futures fell 3.6%.

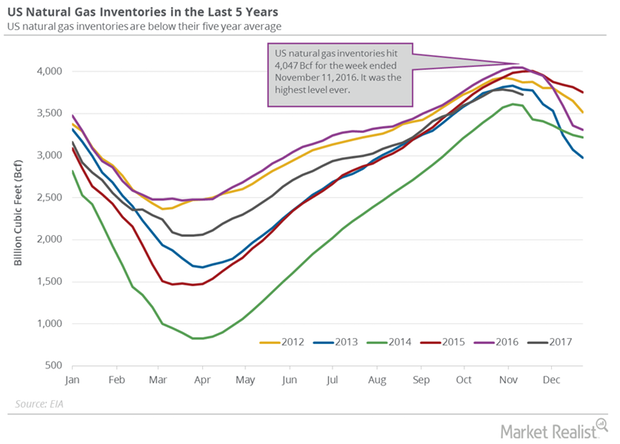

Traders Are Tracking US Natural Gas Inventories

The EIA reported that US gas inventories fell by 18 Bcf (billion cubic feet) to 3,772 Bcf on November 3–10, 2017.

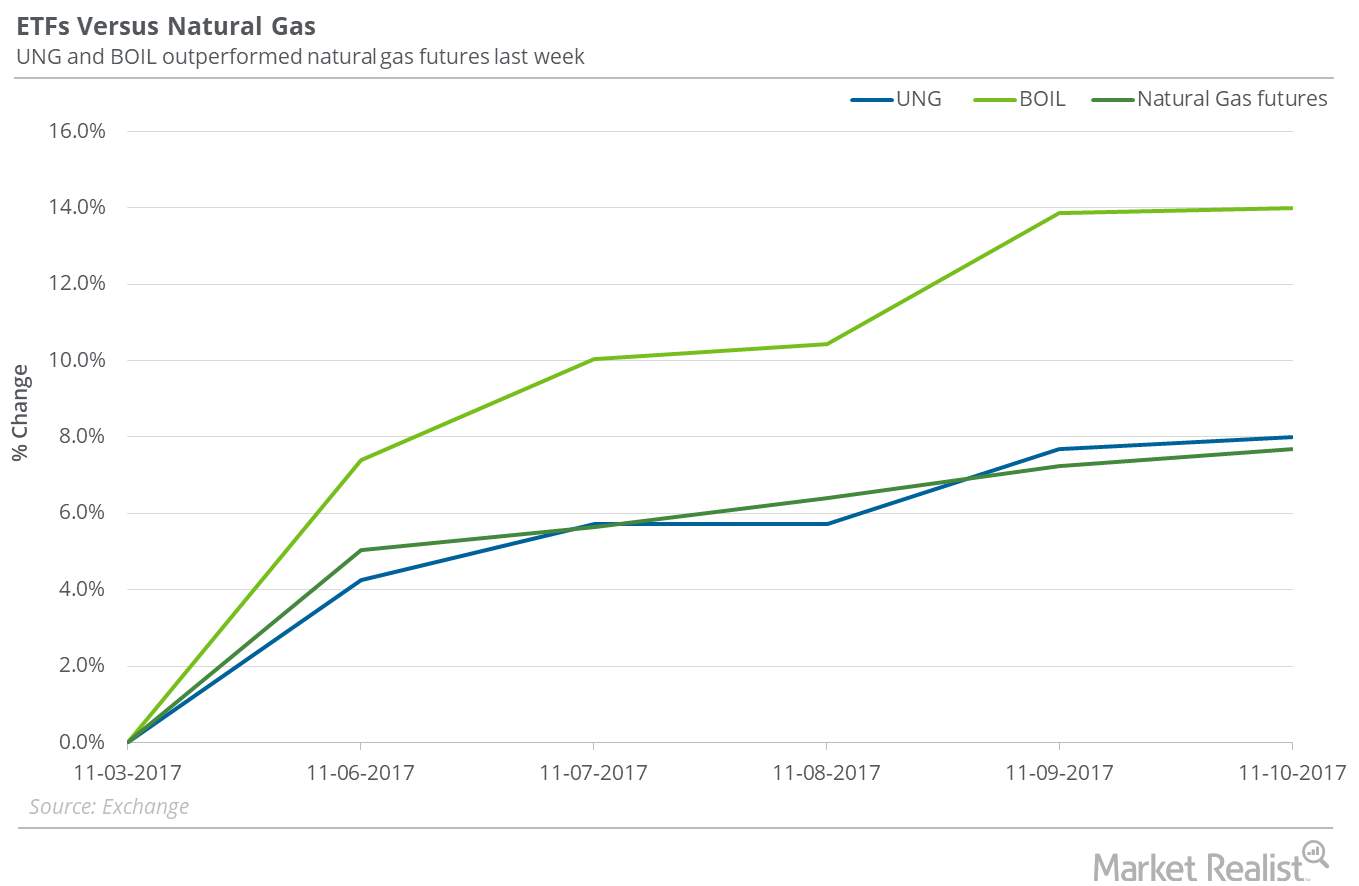

Did Natural Gas ETFs Outperform Natural Gas Last Week?

Between November 3 and November 10, 2017, the United States Natural Gas Fund LP (UNG) rose 8%, only 30 basis points above the gain in natural gas December futures.

Natural Gas versus Natural Gas ETFs Last Week

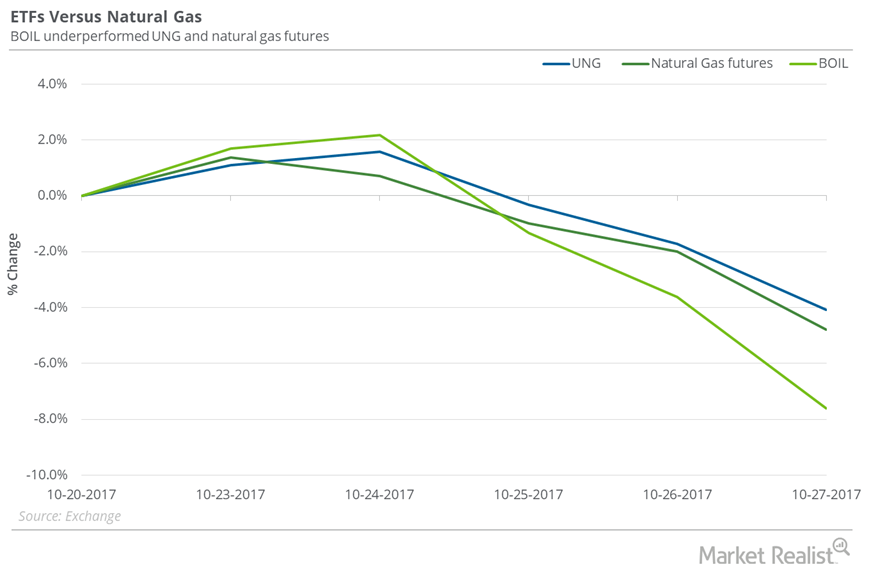

On October 20–27, natural gas (FCG) (GASL) (GASX) December futures fell 4.8%. During this period, the United States Natural Gas Fund LP (UNG) fell 4.1%.

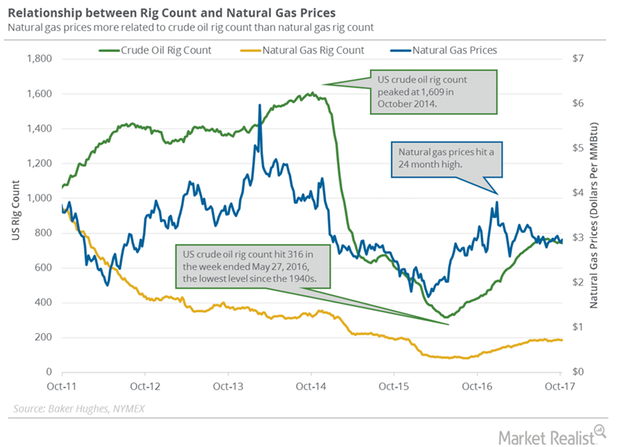

US Gas Rigs Hit 5-Month Low: Good or Bad for Natural Gas Futures?

Baker Hughes is scheduled to release its weekly US oil and gas rig report on October 27, 2017.

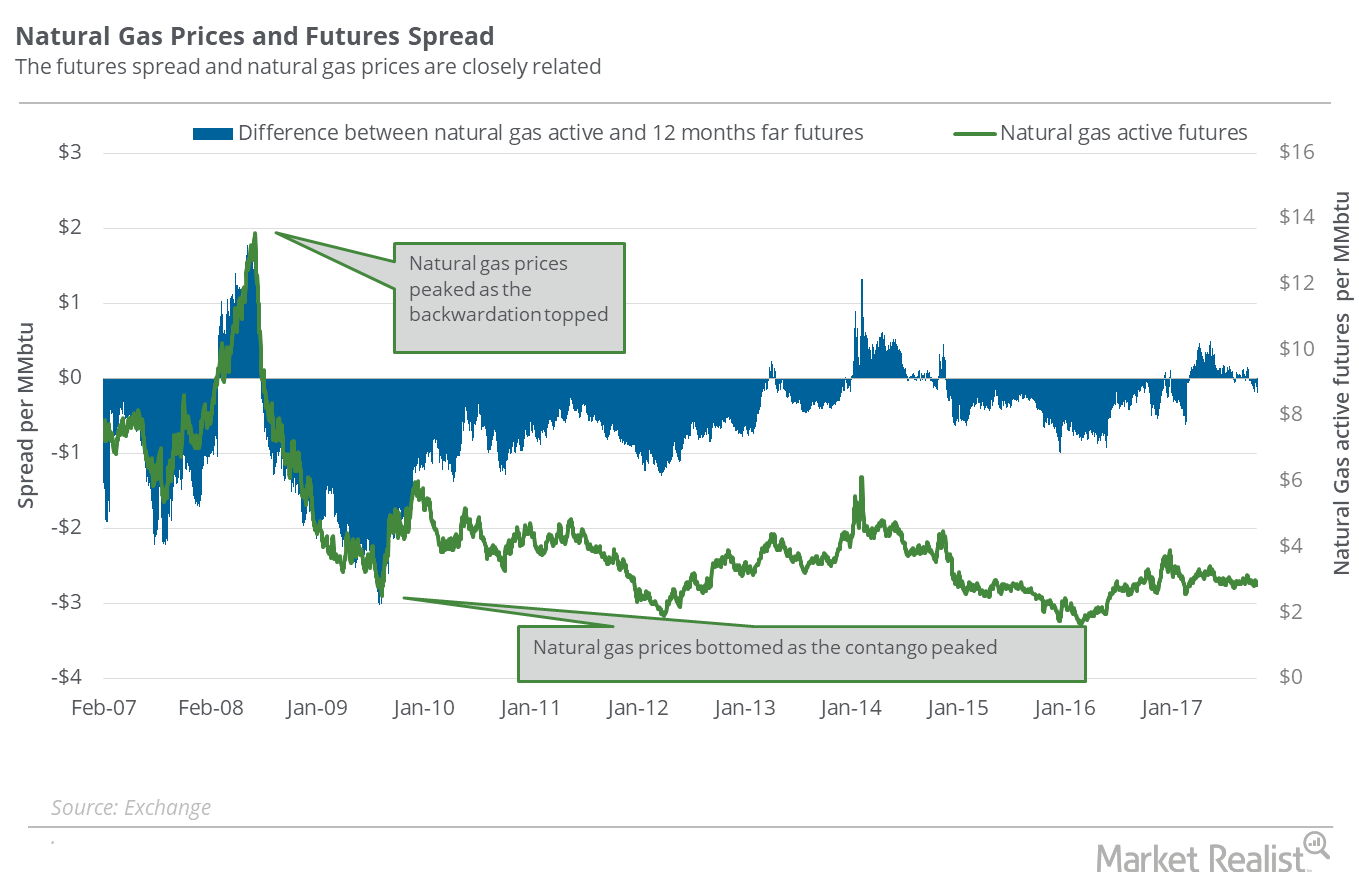

Understanding the Natural Gas Futures Spread—And What It Means for Prices

On October 25, 2017, natural gas December 2018 futures closed $0.11 above the December 2017 futures.

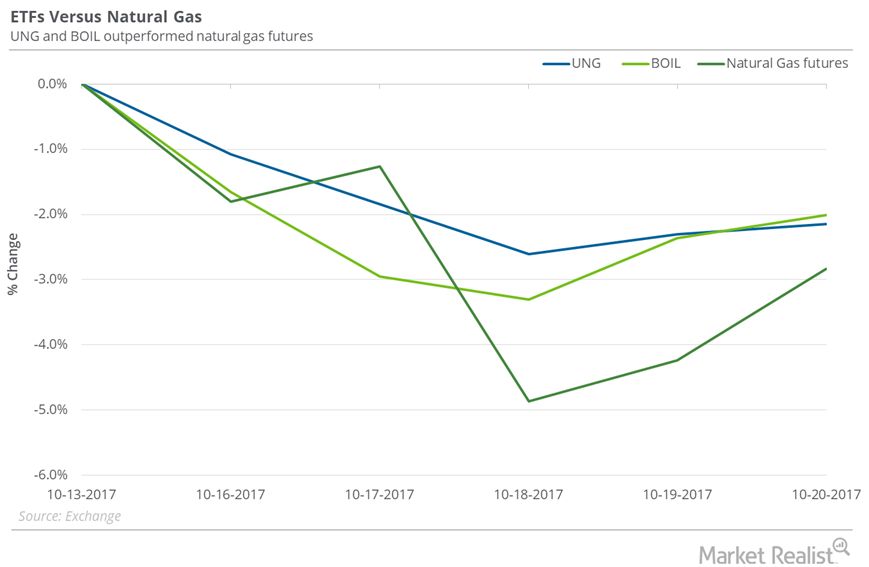

Where Natural Gas ETFs Stood next to Natural Gas Last Week

Between October 13 and October 20, 2017, the United States Natural Gas Fund LP (UNG) fell 2.2%, and natural gas November futures fell 2.8%.

Will Natural Gas Fall to $2.7 Levels Next Week?

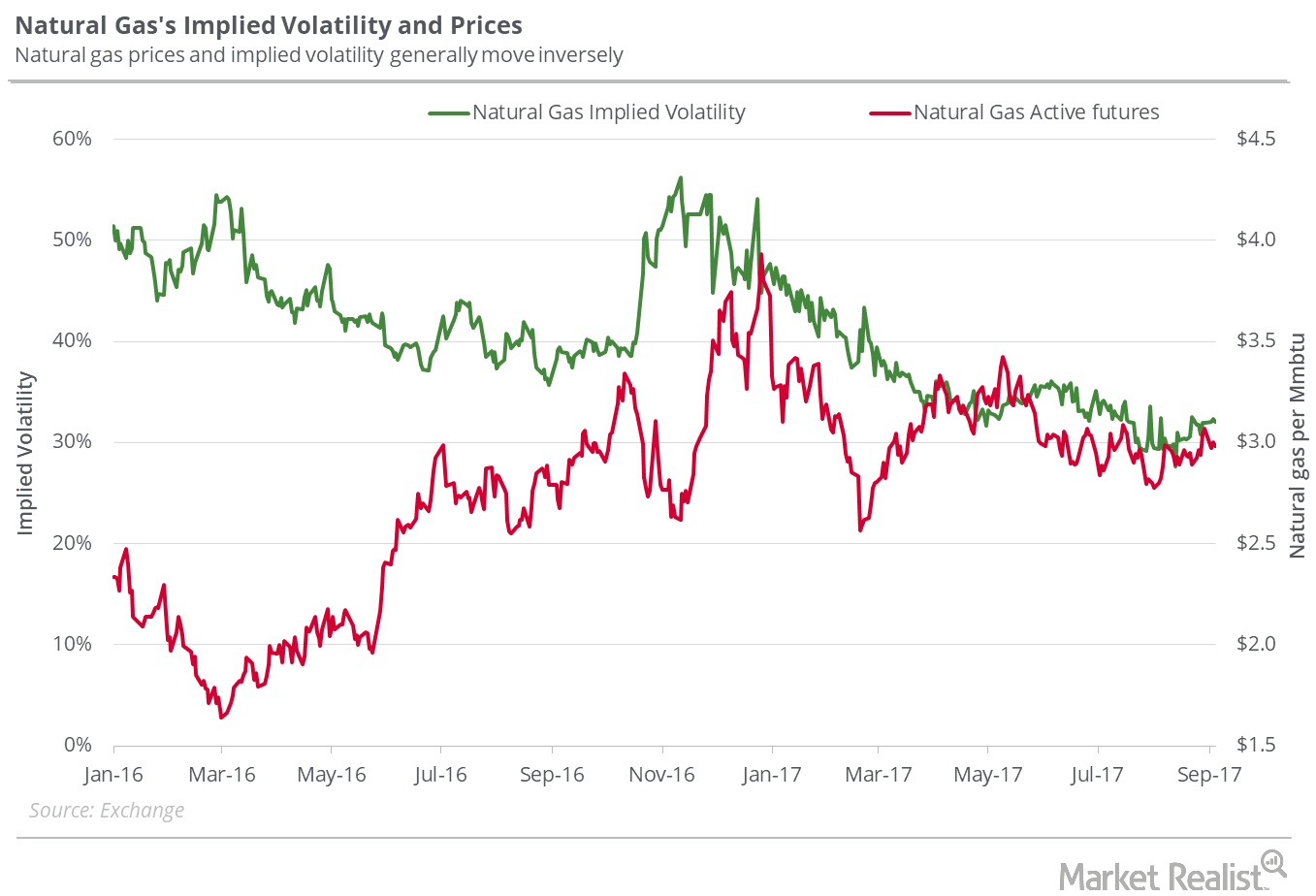

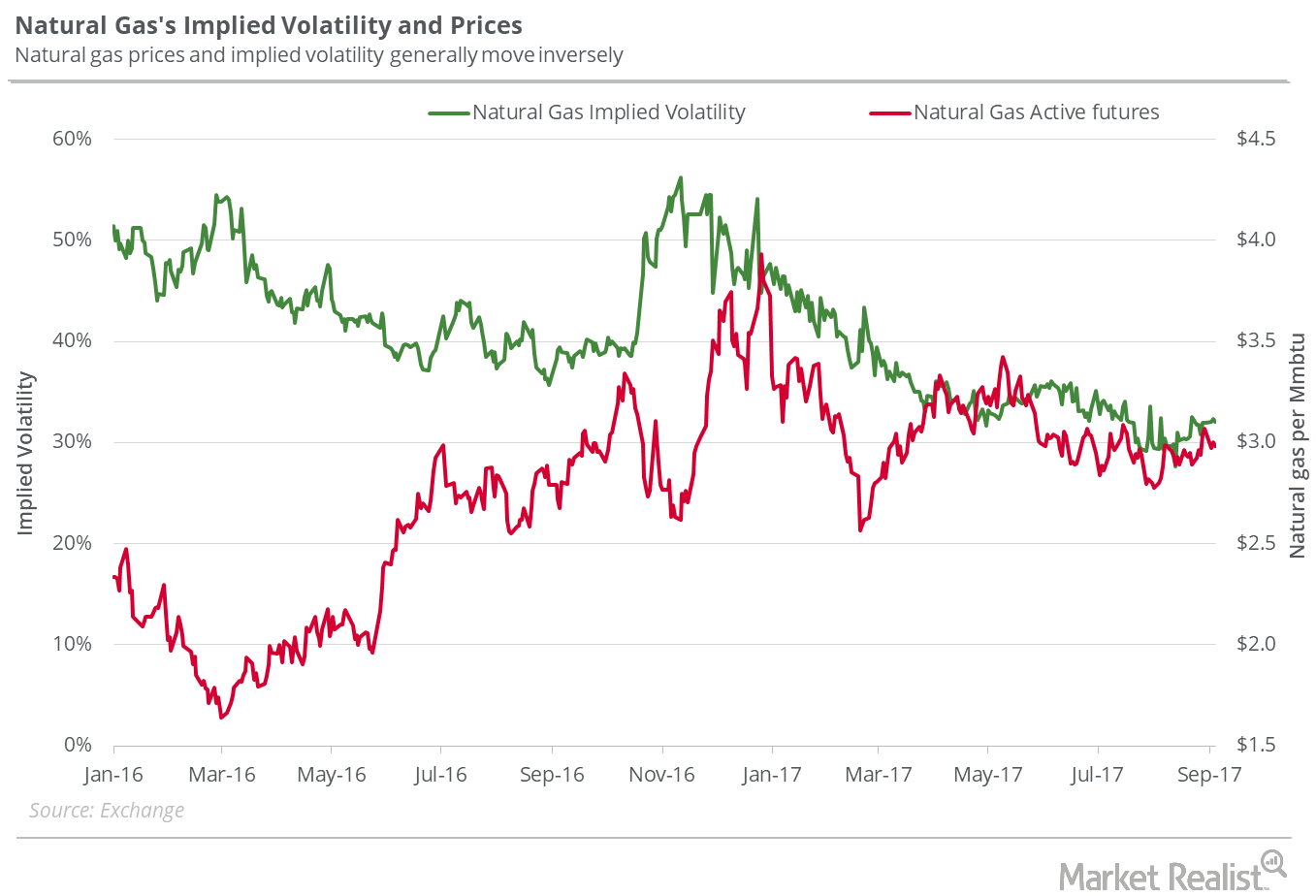

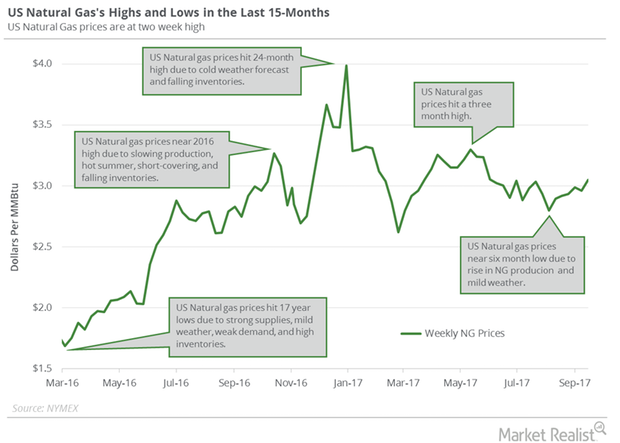

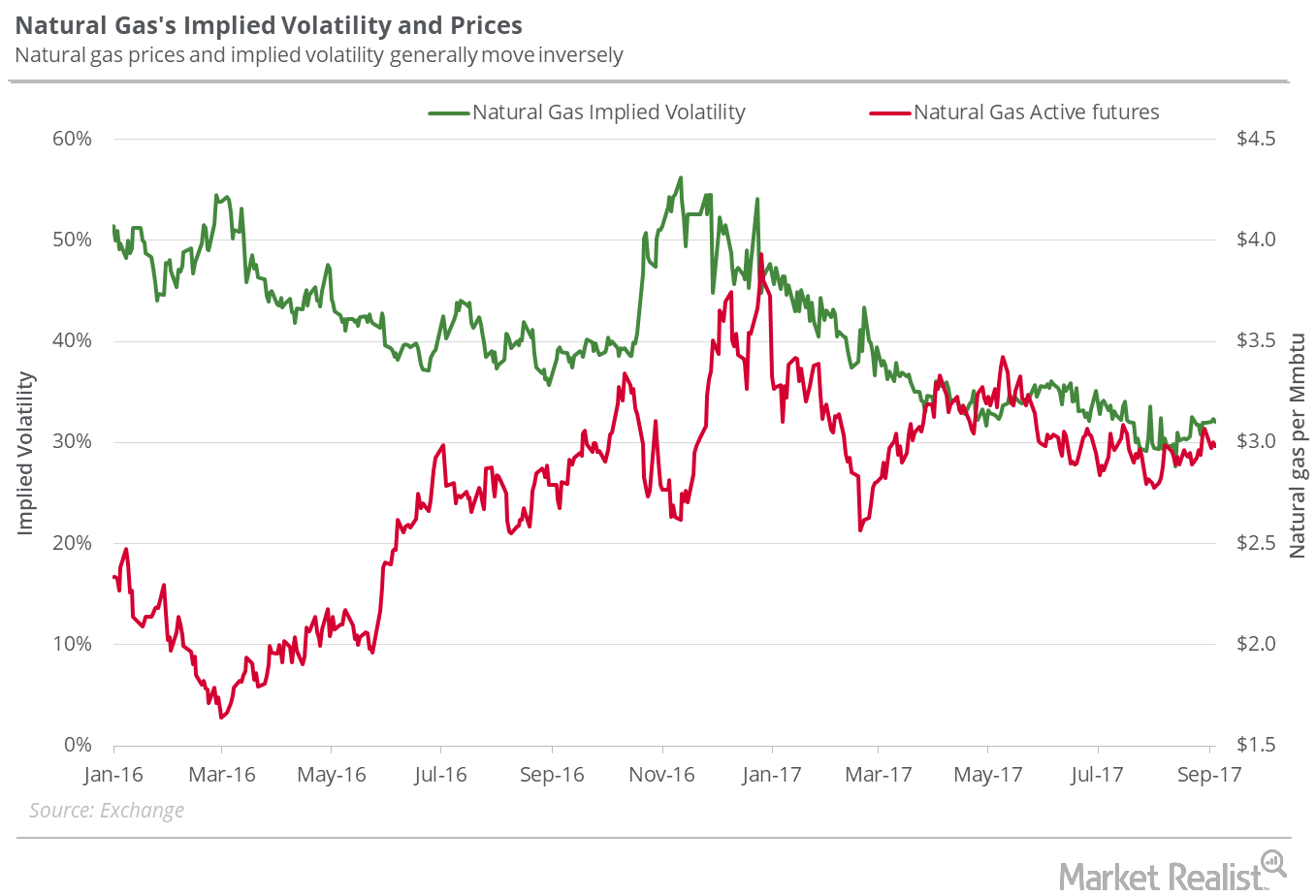

On October 19, 2017, natural gas futures’ implied volatility was 38.8%, 9.6% above its 15-day average.

The Smell of Natural Gas: Ripe for a Pullback?

On October 18, natural gas November futures closed at $2.85 per MMBtu (million British thermal units)—3.6% below the last trading session’s closing price.

Why the Natural Gas Futures Spread Is Concerning Markets

When the futures spread is at a premium, or the premium rises, it could hamper the rise in natural gas prices.

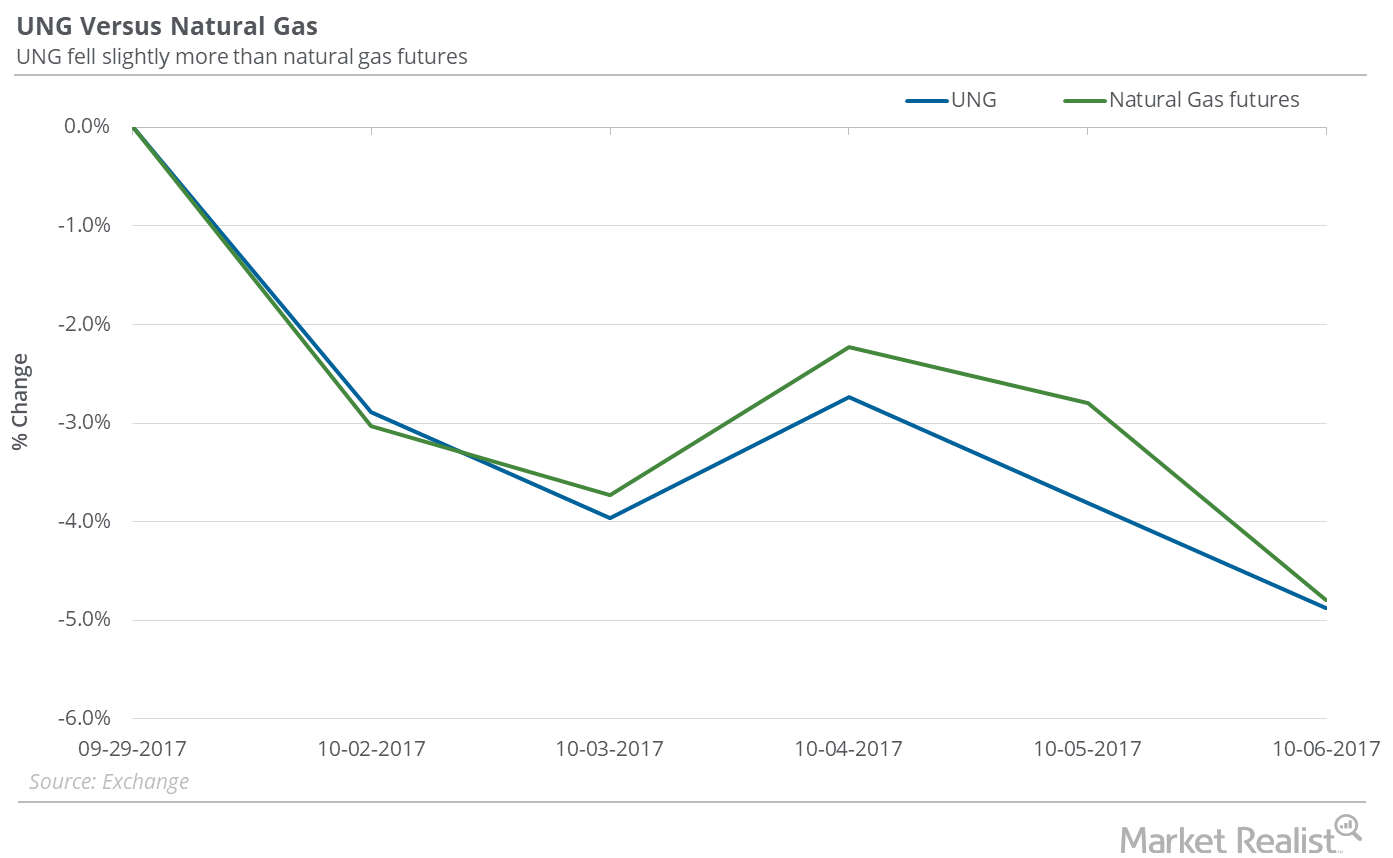

Did UNG Outperform Natural Gas in the Week Ended October 6?

Between September 29 and October 6, 2017, the United States Natural Gas Fund ETF (UNG) fell 4.9%, while natural gas (BOIL) (GASX) November futures fell 4.8%.

Could Natural Gas Fall below the $2.8 Mark Next Week?

On October 5, 2017, the implied volatility of US natural gas active futures was at 33.1%, or 7.3% below the 15-day average.

Futures Spread: A Look at Natural Gas Supply–Demand Concerns

On October 4, 2017, natural gas (UNG) (GASL) November 2018 futures traded $0.08 above the November 2017 futures.

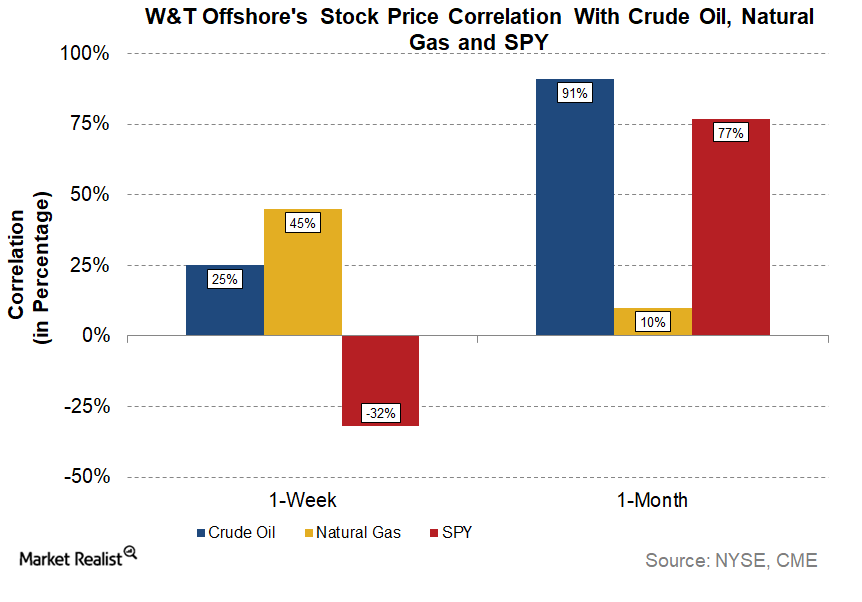

What Really Moved W&T Offshore Stock Last Week?

W&T Offshore (WTI) stock rose ~7% last week (ended September 29), while crude oil and the SPDR S&P 500 ETF (SPY) rose ~2% and ~0.7%, respectively.

How UNG Fared Compared to Natural Gas Last Week

On September 22–29, 2017, the United States Natural Gas Fund LP (UNG) rose 0.2%, while natural gas (BOIL) November futures fell 0.5%.

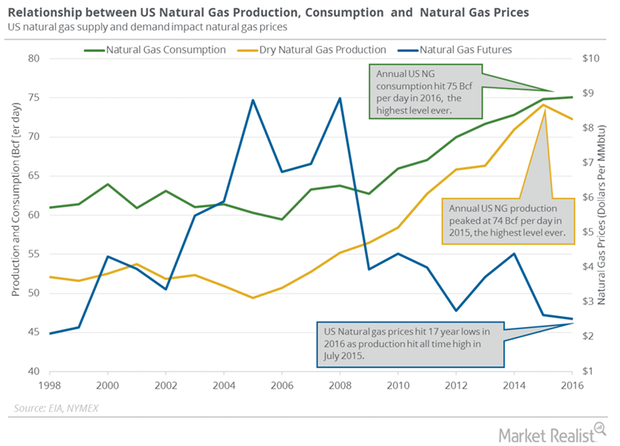

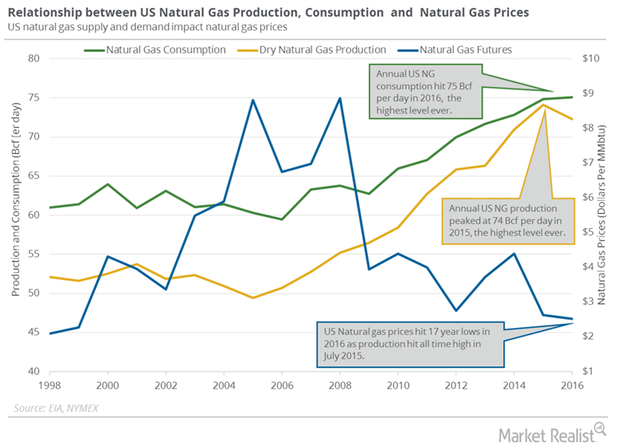

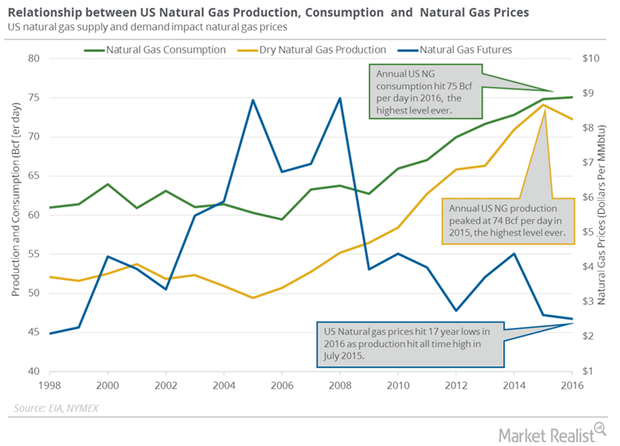

How US Natural Gas Production and Consumption Are Driving Prices

Market data provider PointLogic estimates that weekly US dry natural gas production fell by 0.2 Bcf (billion cubic feet) per day to 74.3 Bcf per day from September 21 to 27, 2017.

Will US Natural Gas Consumption Outweigh Production?

PointLogic estimates that weekly US natural gas consumption fell 6.6% to 52 Bcf per day from September 7 to 13. Consumption fell 13% year-over-year.

Why US Natural Gas Futures Hit a 2-Week High

US natural gas (DGAZ)(UGAZ)(UNG) futures contracts for October delivery rose 0.32% to $3.07 per MMBtu (million British thermal units) on Thursday, September 14.

Is Natural Gas a Good Short for Bears at $3?

On September 13, natural gas October futures closed at $3.058 per MMBtu (million British thermal units). The same day, natural gas prices rose 1.9%.

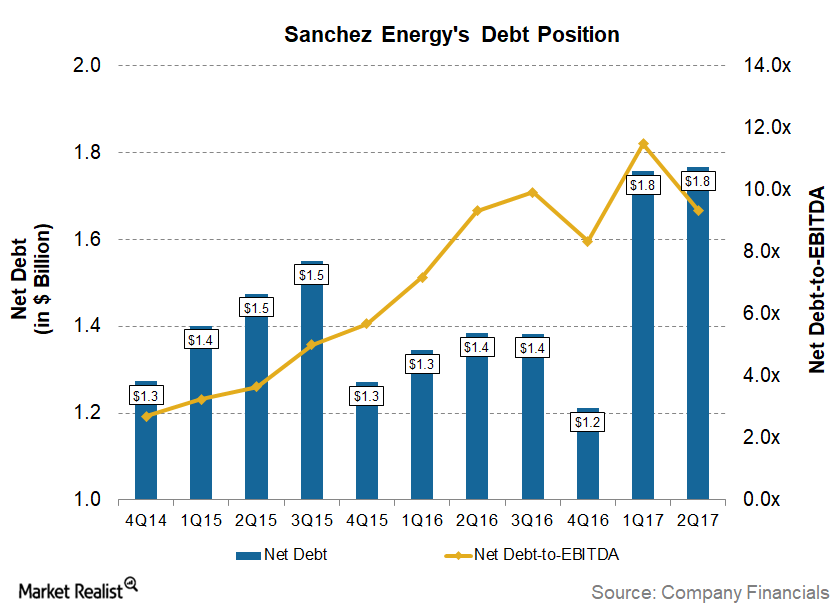

Is Sanchez Energy Repeating an Old Debt Mistake?

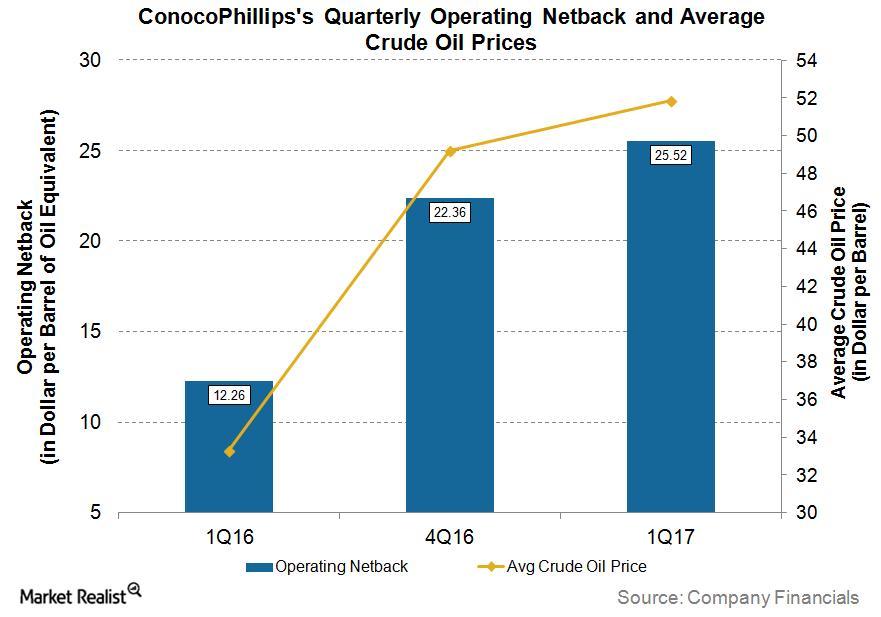

Since 1Q16, crude oil (USO)(SCO) prices have risen from lows of $26.05 per barrel to $49.30 per barrel as of September 13.

Natural Gas Could Regain the $3 Mark Next Week

In the next seven days, natural gas October futures could close between $2.85 and $3.11 per MMBtu (million British thermal units).

Natural Gas: Analyzing the Futures Spread

On August 30, 2017, natural gas October 2018 futures traded at a discount of ~$0.03 to October 2017 futures.

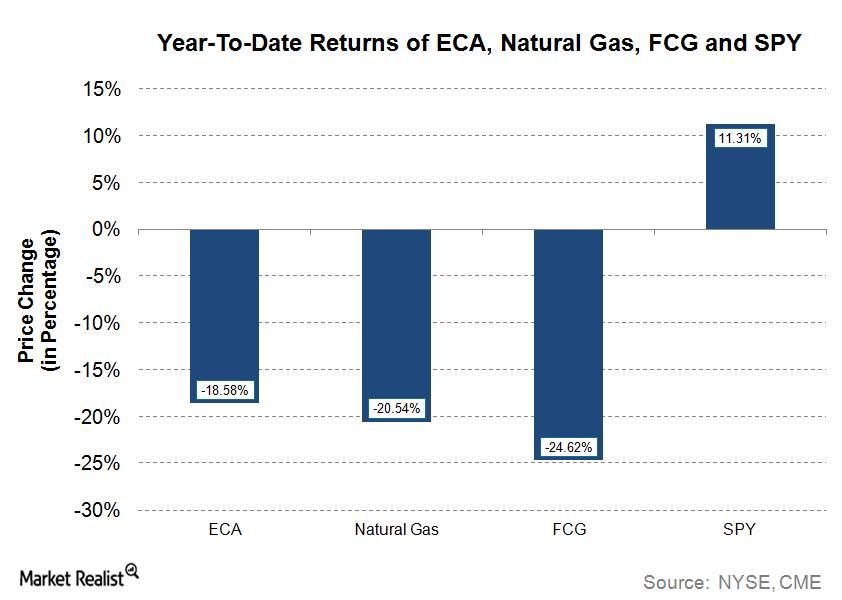

How Encana Stock Has Performed This Year

Year-to-date, Encana’s (ECA) stock has fallen ~19% to $9.53. The stock is trading below its 50-week and 200-week moving averages.

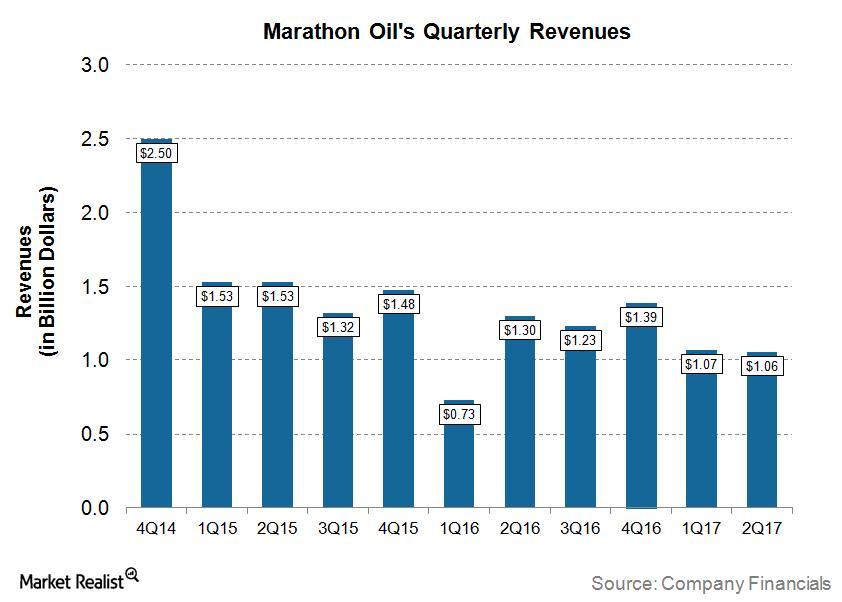

Analyzing Marathon Oil’s 2Q17 Revenues

For 2Q17, Marathon Oil (MRO) reported revenues of ~$1.06 billion, which was higher than Wall Street analysts’ consensus for revenues of ~$1.02 billion.

Chart in Focus: ConocoPhillips’s Operating Netback

What is the operating netback? The operating netback (also referred as production netback) is oil and gas revenue realized per boe (barrel of oil equivalent) after all costs to bring one boe to the market are subtracted from the realized price. The operating netback is derived by subtracting production expenses (or field operating expenses), production taxes, […]

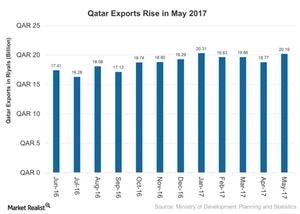

Qatar’s Exports Could Rise despite the Crisis in 2017

Qatar’s exports stood at 20.2 billion riyals in May 2017—an increase of 8% compared to a fall of 5% in the previous month.

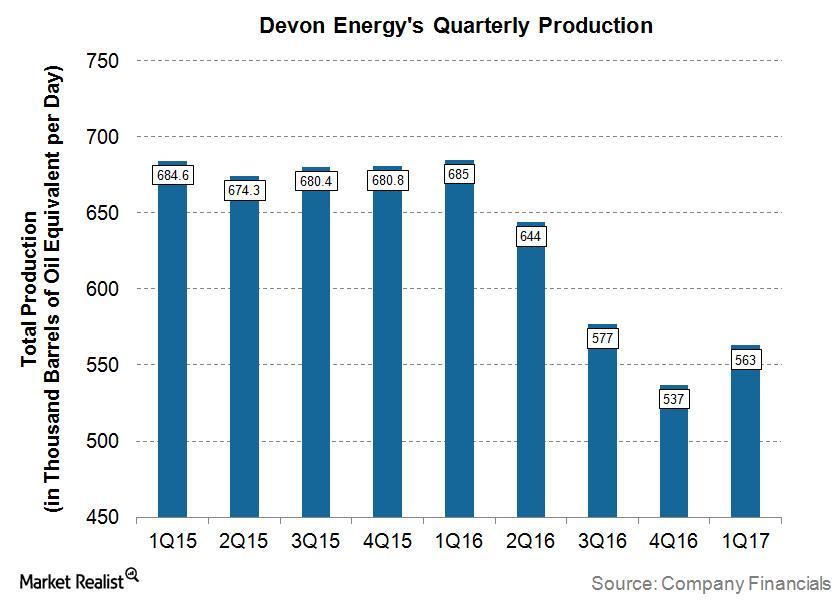

Understanding Devon Energy’s Production Volumes

For 1Q17, Devon Energy (DVN) reported total production of 563 MBoepd, which is ~18% lower when compared with 1Q16.

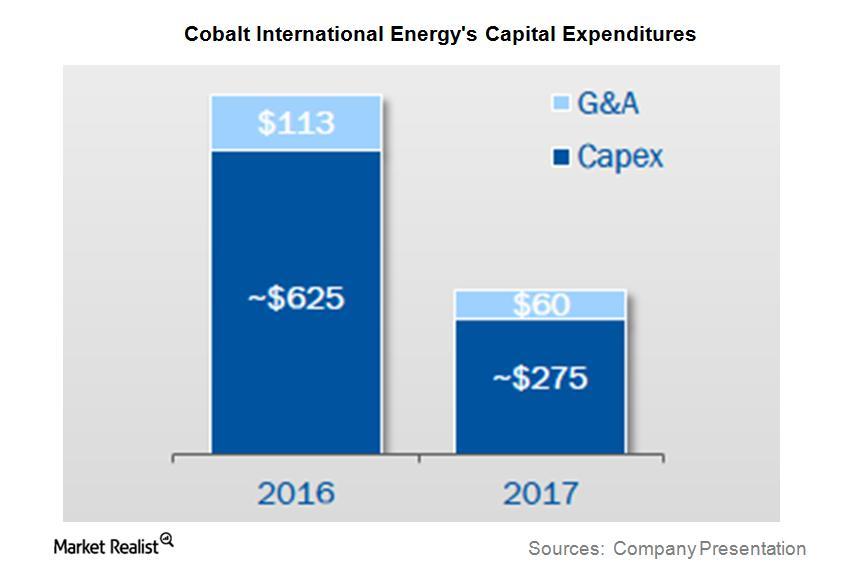

Cobalt International Energy’s Capital Expenditure Guidance

For fiscal 2017, Cobalt International Energy (CIE) plans to spend significantly lower on capex (capital expenditure), or ~56.0% less than fiscal 2016.

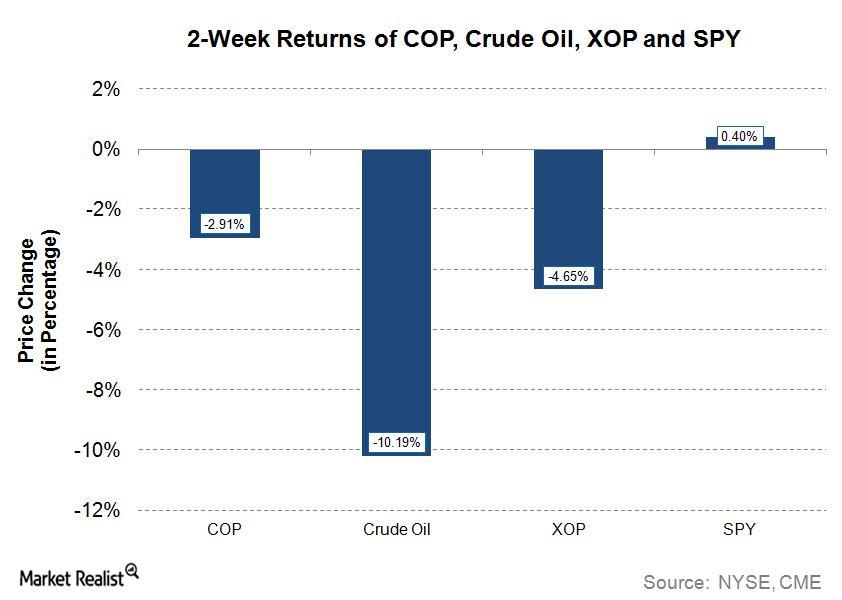

Why ConocoPhillips Stock Is Outperforming Crude Oil and Peers

In the last two weeks, the stock of ConocoPhillips (COP), a crude oil (USO) and natural gas (UNG) producer, has outperformed crude oil prices.

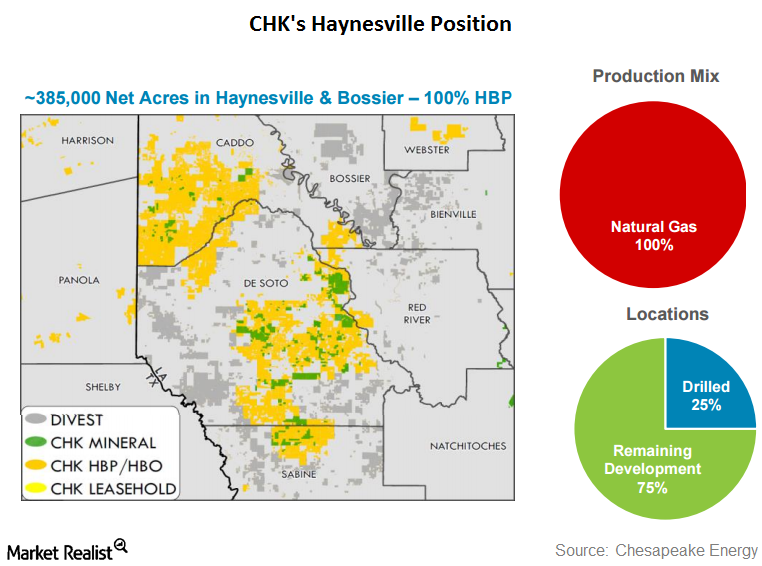

Chesapeake Energy Announces Haynesville Asset Divestiture

Chesapeake Energy (CHK) announced on December 5 that it had agreed to sell 78,000 net acres in Louisiana’s Haynesville Shale for $450 million. The buyer is an undisclosed private player.

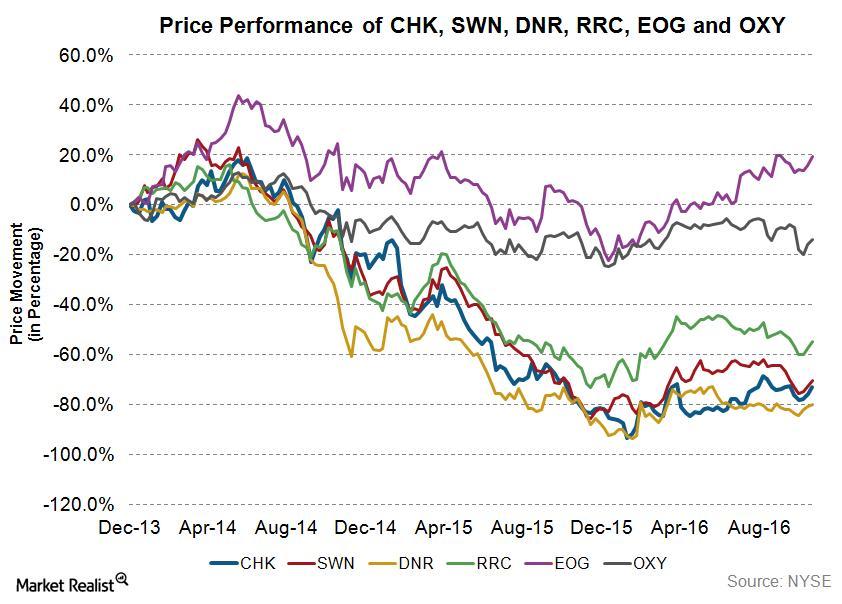

Are Companies That Have Done Acquisitions Outperforming?

Upstream companies’ performance In the last two parts of this series, we have seen that some upstream companies, namely Range Resources (RRC), EOG Resources (EOG), and Occidental Petroleum (OXY), have taken advantage of lower crude oil (USO) and natural gas (UNG) prices through acquisitions. In this part, we’ll see if these companies are outperforming Chesapeake […]

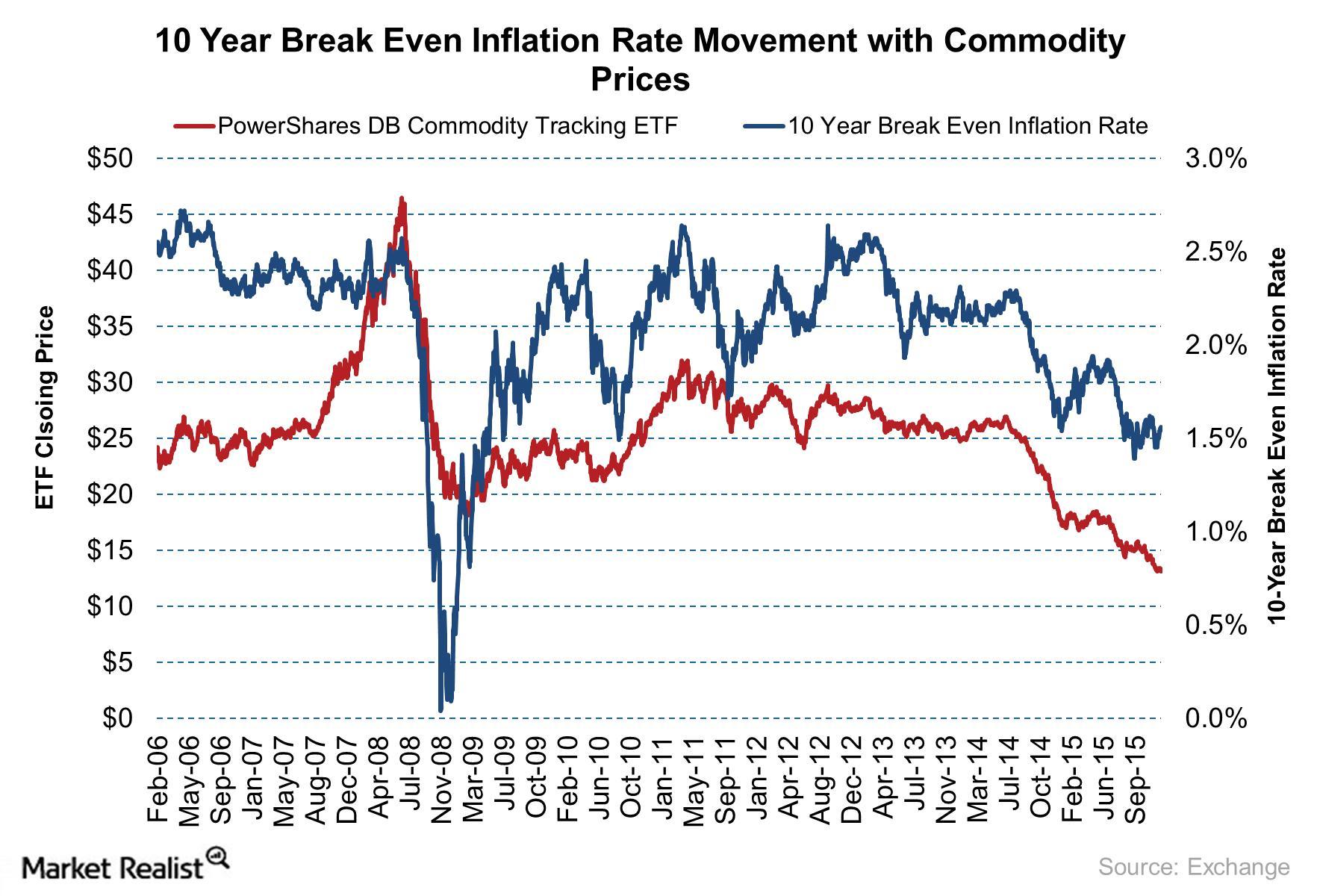

Goldman Sachs Is Long on the 10-Year US Breakeven Inflation Rate

After the announcement of the US election results, the 10-Year US Breakeven Inflation Rate showed an uptick. Goldman Sachs has advised investors to go long on the rate.

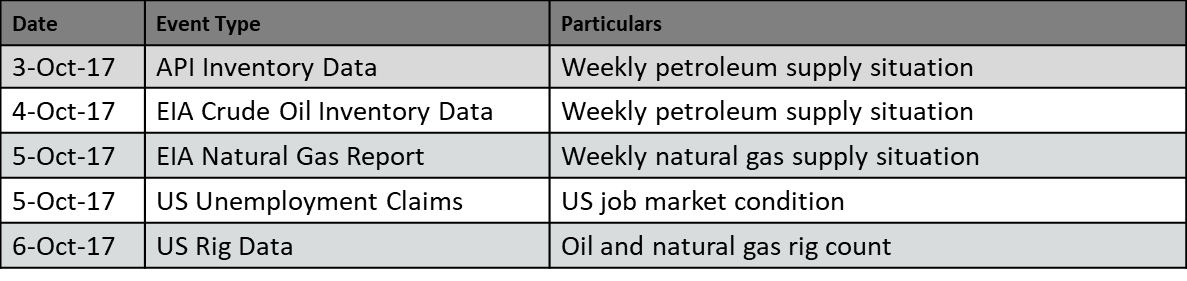

What’s the Natural Gas Outlook for This Week?

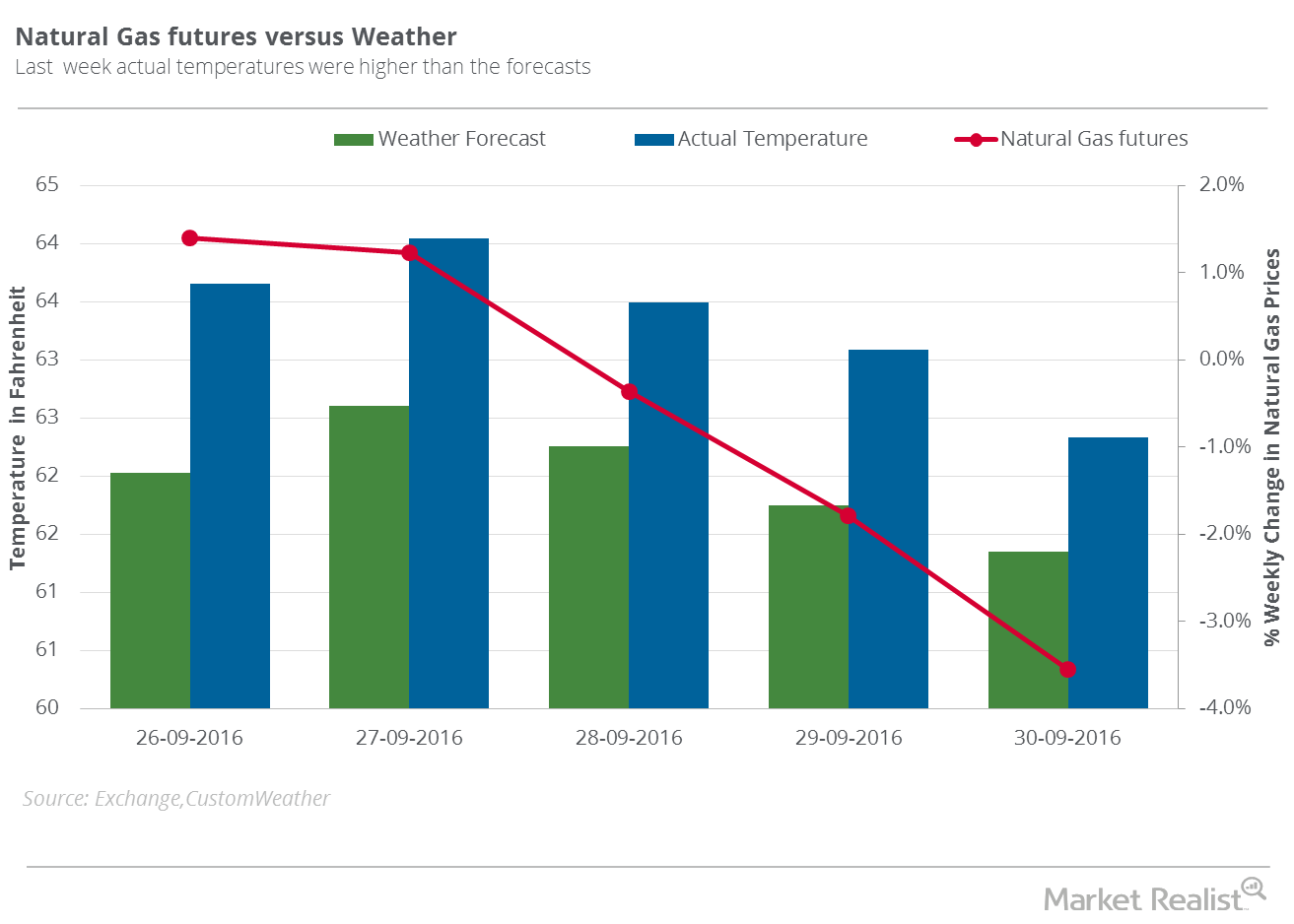

The weather forecast for October 3 to October 9, 2016, indicates that temperatures in the United States could remain higher than the five-year average for the period between October 3 and October 6.

Why the Weather Could Mean Trouble for Natural Gas Bulls

The weather forecast for September 26 to October 2 indicates that temperatures in the US could remain lower than the five-year average for the period.

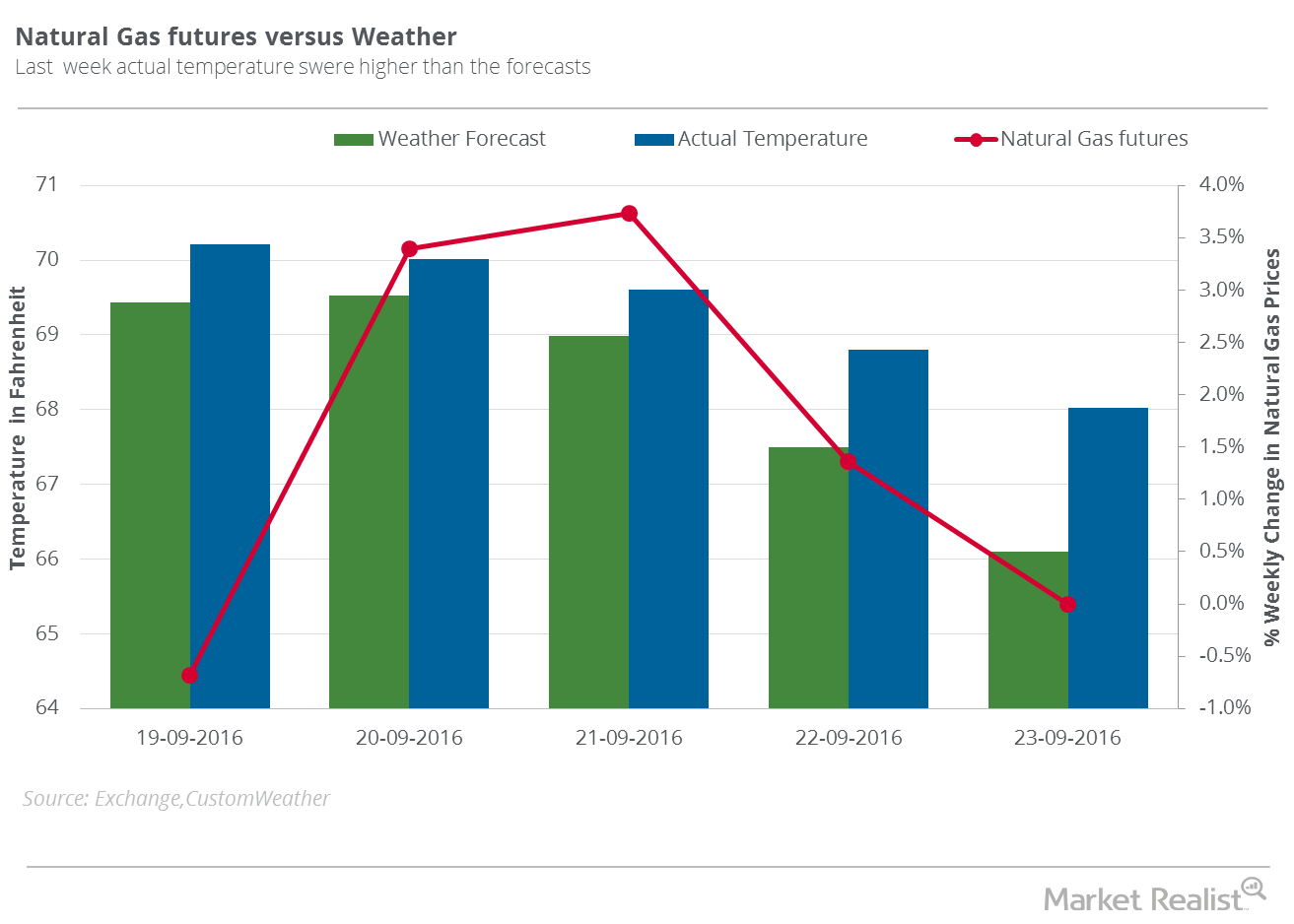

Natural Gas Traders Should Watch This Weather Report

The weather forecast for September 19–25, 2016, indicates that temperatures in the United States could remain higher than the five-year average for the same period.

How Weather Could Be a Bullish Catalyst for Natural Gas

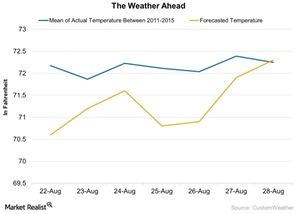

The weather forecast for September 12–18, 2016, indicates that US temperatures could remain higher than the five-year average for the same period.

How Could the Weather Impact Natural Gas Prices?

Weather forecasts for September 5–11 indicate that temperatures in the United States could remain higher than the five-year average for the same period, except on September 5.

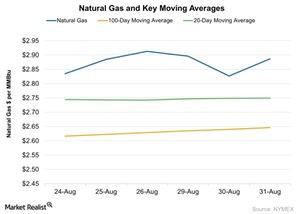

What Does The Price Action in Natural Gas Indicate?

In the last five trading sessions, natural gas October futures have risen by 1.8%. They closed at ~$2.89 per MMBtu on August 31, 2016.

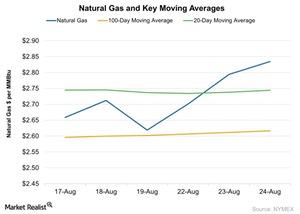

What’s Driving Natural Gas Prices Higher?

Natural gas prices broke above the 20-day moving average on August 23. This indicates short-term bullishness in natural gas prices.

How Will Weather Affect Natural Gas Prices This Week?

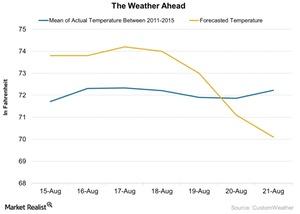

Lower temperatures decrease the use of natural gas (UNG) (DGAZ) (BOIL) (FCG) (UGAZ) (GASL) for cooling purposes during the summer.

How Will the Weather Impact Natural Gas This Week?

In the week ending August 12, temperatures were higher than the forecast for the week. Natural gas futures fell 6.7% for the week ending on August 12.