JM Smucker Co

Latest JM Smucker Co News and Updates

Who Makes Jif Peanut Butter? Brand Under Recall in 2022

J.M. Smucker's acquired the Jif peanut butter brand in 2002. Now, it makes the iconic peanut butter and serves as the brand's parent company.

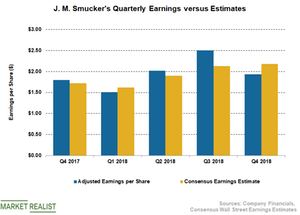

Why J.M. Smucker Missed Q4 Earnings Estimate

J.M. Smucker (SJM) reported weaker-than-expected fiscal Q4 earnings.

Here’s How Wall Street Reacted to General Mills’ Q2 2019 Results

Most analysts lowered their target prices on General Mills stock following the release of its results for the second quarter of fiscal 2019.

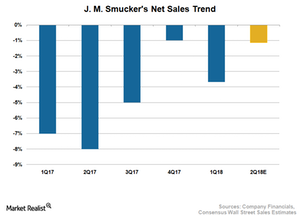

Behind J.M. Smucker’s Waning Sales

J.M. Smucker (SJM) has continued to disappoint on the sales front this year, having posted declines in sales for the past several quarters.

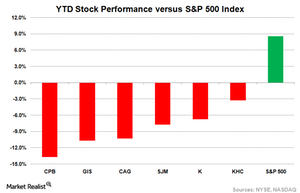

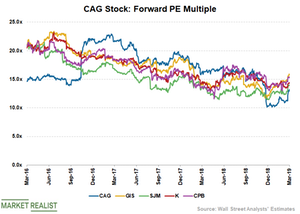

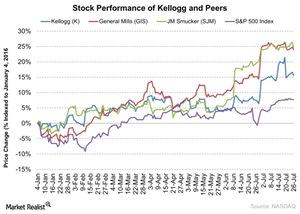

Why Food Stocks Aren’t Cooking

So far this year, food stocks have largely disappointed investors, and the outlook for the rest of the year appears no better. Stock prices for food manufacturers have been on a downtrend, underperforming the S&P 500 Index (SPX-INDEX) on a YTD (year-to-date) basis, as the graph below shows. As of July 3, Campbell Soup (CPB), General Mills (GIS), Conagra Brands (CAG), J. M. Smucker (SJM), Kellogg (K), and Kraft Heinz (KHC) have fallen 13.7%, 10.7%, 10.2%, 7.7%, 6.7%, and 3.3%, respectively, YTD. The S&P 500 Index has returned 8.5% during the same period.

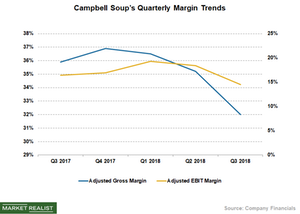

Campbell Soup’s Margins Could Continue to Contract

The Campbell Soup Company (CPB) continued to report sluggish margins as higher-than-expected inflation in commodities and transportation costs remained a drag.

What Analysts’ Price Target Indicates for J.M. Smucker Stock

Wall Street has a price target of $114.54 per share on the J.M. Smucker Company (SJM), implying a potential downside of 5.6% based on its closing price of $121.31 on June 24.

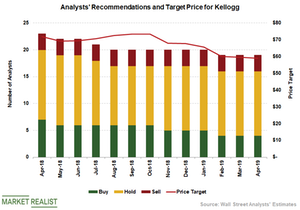

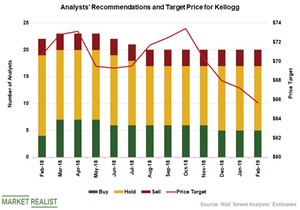

Kellogg: Analysts Recommend a ‘Hold’

Most of the analysts covering Kellogg continue to maintain a neutral outlook on the stock, which reflects near-term pressure on its earnings.

These Consumer Staples Stocks Marked Stellar Gains in Q1

The Consumer Staples Select Sector SPDR ETF (XLP) rose 10.5% in the first quarter of 2019.

Analyzing Conagra Brands’ Growth Drivers

Conagra Brands (CAG) shares have risen 21.1% since the company reported its third-quarter earnings on March 21.

Why General Mills’ Sales Growth Rate Could Decelerate

General Mills (GIS) posted stronger-than-expected sales during the third quarter of fiscal 2019.

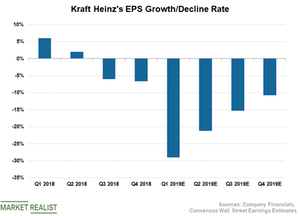

Why Kraft Heinz’s EPS Could See a Double-Digit Decline in 2019

Kraft Heinz’s (KHC) bottom line has remained under pressure in the past two quarters and disappointed investors.

Did Kraft Heinz’s Underperformance Ring an Alarm Bell?

Shares of Kraft Heinz (KHC) crashed more than 27% on Friday, February 22, as weaker-than-expected fourth-quarter results and sluggish guidance upset investors.

Kellogg Stock: Analysts’ Recommendations

Analysts continue to suggest a “hold” rating on Kellogg (K) stock. Analysts’ target price shows a downward trend.

Could McCormick’s Improving Fundamentals Boost Its Stock?

McCormick (MKC) has seen double-digit sales and earnings growth over the past couple of quarters.

Will General Mills Sustain Its Sales Momentum in Q3?

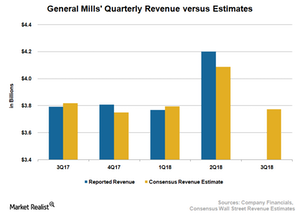

Analysts expect General Mills (GIS) to report sales of $3.8 billion in fiscal 3Q18, reflecting a marginal decline of 0.5% on a YoY (year-over-year) basis.

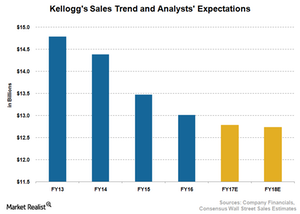

Why Analysts Expect Kellogg’s Sales to Fall

Kellogg (K) estimates a 3% decline in its top line for fiscal 2017, reflecting weakness in the cereal category and challenges in several markets.

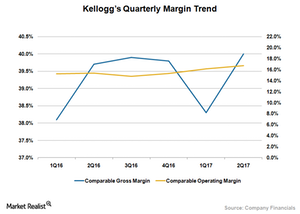

Why Kellogg’s 3Q17 Profit Margins Could Improve

Kellogg (K) posted improved profit margins despite lower sales, thanks to the company’s focus on efficiency and initiatives to reduce costs.

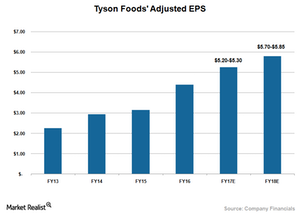

Tyson Foods Raises Fiscal 2017 Guidance

Tyson Foods (TSN) stock jumped about 8% on September 29, 2017, after the company raised its fiscal 2017 EPS (earnings per share) guidance.

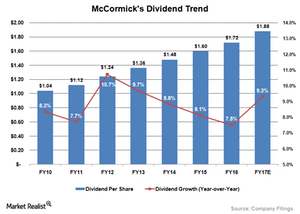

A Look at McCormick’s Strong Dividend History

In the past three fiscal years, McCormick has returned more than $1.0 billion to its shareholders in the form of dividends and share buybacks.

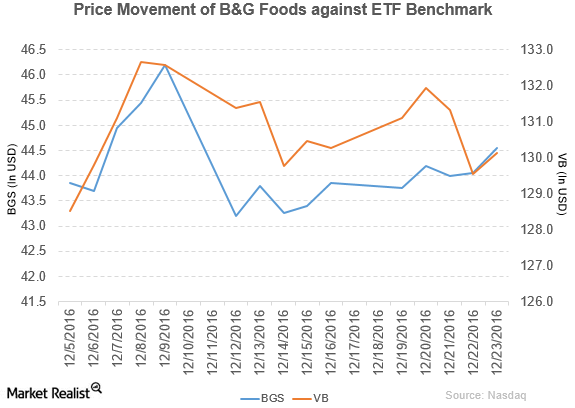

Citigroup Gives B&G Foods a ‘Neutral’ Rating

B&G Foods (BGS) rose 1.6% to close at $44.55 per share during the third week of December 2016.

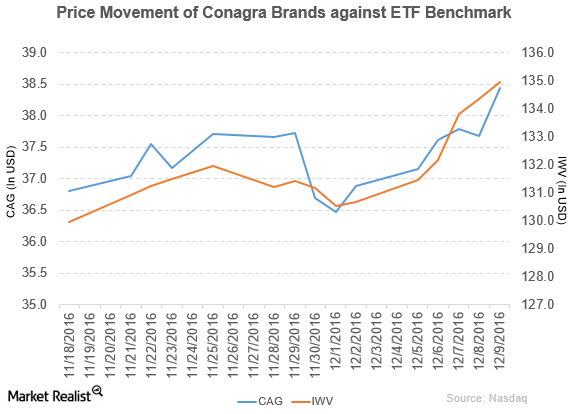

Conagra Brands Declares a Dividend and a New Board Appointment

Conagra Brands (CAG) rose 4.2% to close at $38.44 per share during the first week of December 2016.

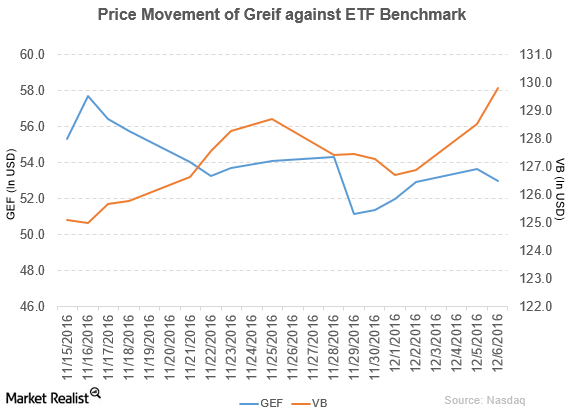

Greif Declared Quarterly Dividends

Greif (GEF) has a market cap of $2.8 billion. It fell 1.2% to close at $52.98 per share on December 6, 2016.

B&G Foods Acquired Victoria Fine Foods for $70 Million

B&G Foods (BGS) declared a quarterly cash dividend of $0.47 per share on its common stock. This dividend will be paid on January 30, 2017, to shareholders of record on December 30, 2016.

B&G Foods Acquired ACH Food Companies’ Business

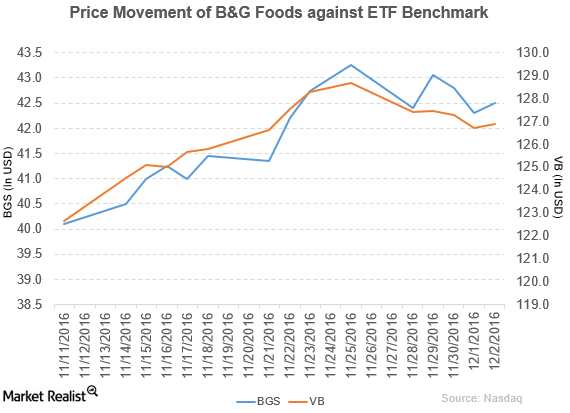

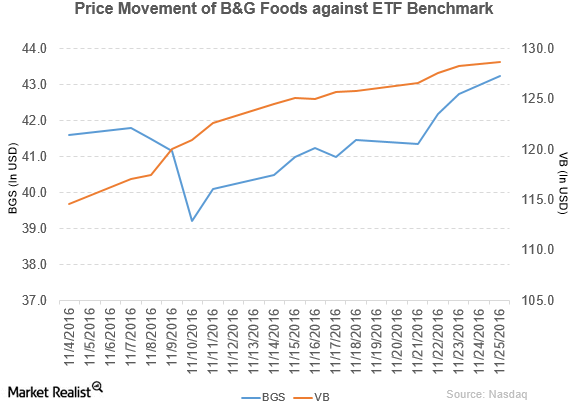

B&G Foods (BGS) rose 5.5% to close at $43.25 per share during the fourth week of November 2016.

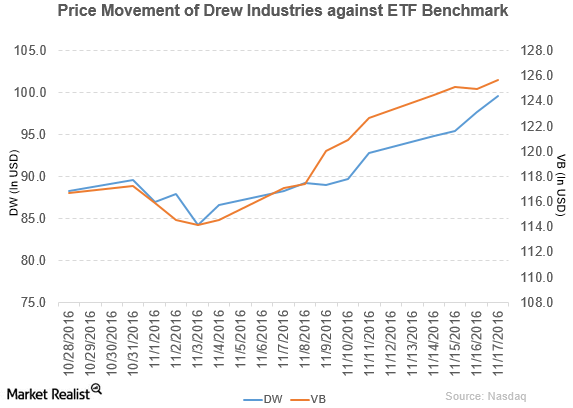

Drew Industries Declares Dividend of $0.50 Per Share

Drew Industries rose 1.9% to close at $99.60 per share on November 17. The stock’s weekly, monthly, and YTD price movements were 11.0%, 7.4%, and 65.5%.

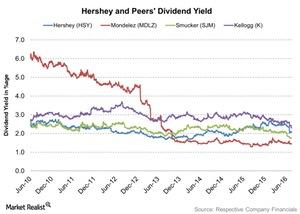

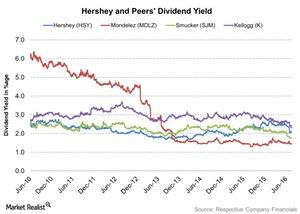

Hershey’s Returns, Including a 6% Dividend Hike, Hit a Sweet Spot

On July 28, 2016, Hershey (HSY) declared its 347th consecutive regular dividend on its common stock and 128th consecutive regular dividend on its Class B common stock.

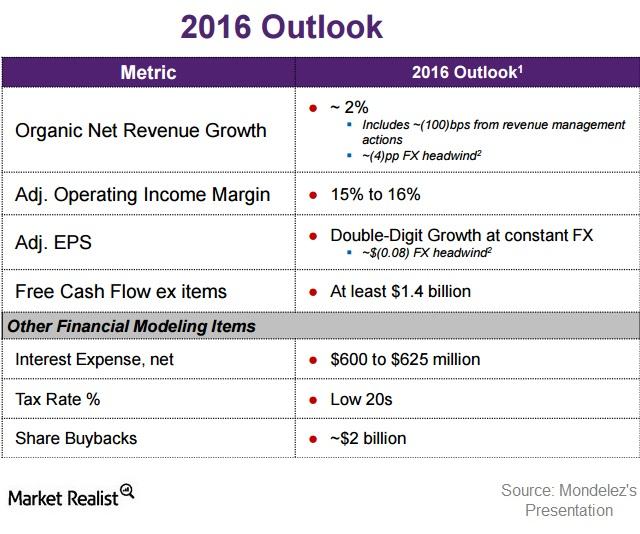

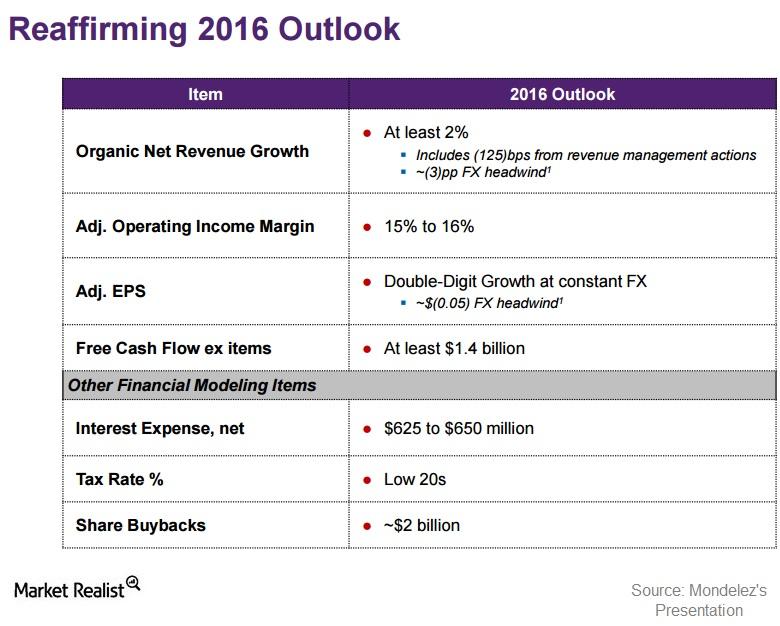

What’s Mondelez’s Outlook for Fiscal 2016?

Mondelez provided its fiscal 2016 outlook during the second quarter earnings call. It reduced its estimate for organic net revenue growth to ~2%.

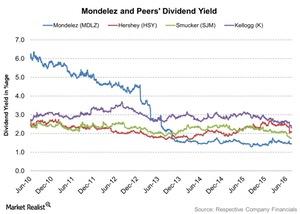

What’s Mondelez’s Increased Dividend for 2016?

A week before its 2Q16 results, Mondelez (MDLZ) declared a 12% increase in its quarterly dividend. It targets a dividend payout of 30% in 2016.

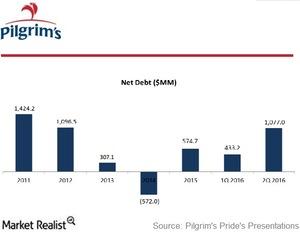

How Has Pilgrim’s Pride Made Room for Strategic Investments?

Consistent with its strategy to improve capital structure and generate shareholder value, Pilgrim’s Pride (PPC) paid $700 million, or $2.75 per share, in special dividends.

What Can Investors Expect from Kellogg’s 2Q16 Results?

Kellogg Company (K) is headquartered in Battle Creek, Michigan. It’s set to report its fiscal 2Q16 results on August 4, 2016, before the market opens.

Hershey Shareholders Thrive on 346 Straight Dividend Payouts

On May 4, Hershey (HSY) announced that its board of directors approved quarterly dividends of $0.58 on the common stock and $0.53 on the Class B common stock.

Mondelez’s Revenue Expectations for Rest of Fiscal 2016

In its fiscal 1Q16, Mondelez International (MDLZ) reaffirmed the fiscal 2016 outlook it announced during its 4Q15 results.

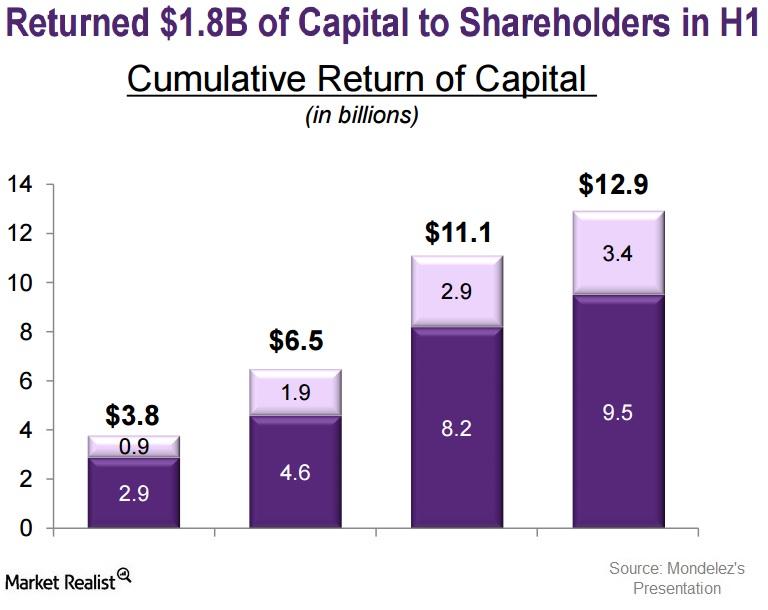

Mondelez Returns Billions of Dollars in Capital to Shareholders

In fiscal 1Q16, Mondelez returned a total of $1.5 billion in capital to shareholders through dividends and share repurchases.

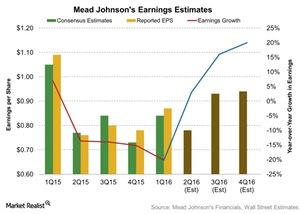

What Could Help Mead Johnson’s Earnings in 2Q16?

Analysts are expecting Mead Johnson’s adjusted EPS to be $0.78 compared to $0.76 in 2Q15.

Why Are So Many Analysts Rating B&G Foods a ‘Hold’?

Approximately 78% of analysts rate B&G Foods a “hold,” and 22% rate it a “buy.” None of the analysts rate it a “sell.”

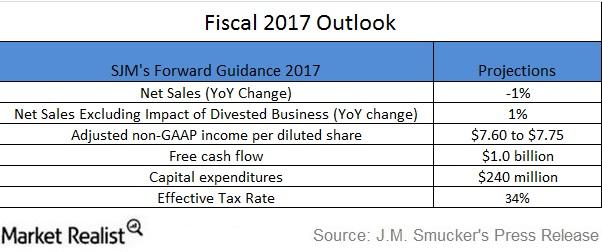

What Are J.M. Smucker’s Expectations for Fiscal 2017?

During its fiscal 4Q16 earnings release and in its investor presentation last week, the J.M. Smucker Company (SJM) discussed its outlook for fiscal 2017.

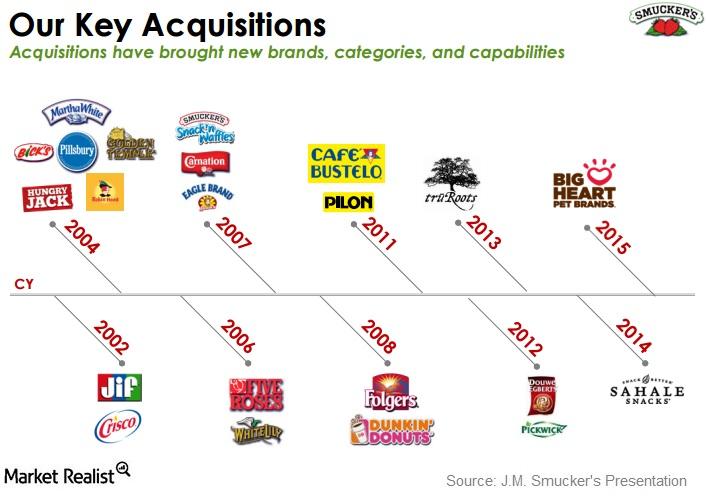

How Did Acquisitions and Innovations Lead J.M. Smucker’s Revenue?

The J.M. Smucker Company has made some key acquisitions since 2002. These acquisitions have brought in new brands, categories, and capabilities.

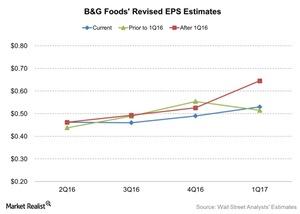

Analysts Have Revised EPS Estimates for B&G Foods: Why?

B&G Foods’ (BGS) earnings estimates have been on an upward trend since its fiscal 1Q16 impressive results. The Green Giant acquisition contributed to the results.

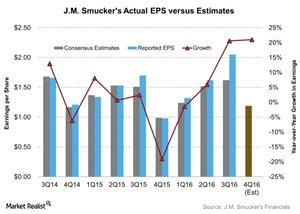

What Could Benefit J.M. Smucker’s 4Q16 Earnings?

Analysts are expecting J.M. Smucker’s adjusted EPS to be $1.19 in fiscal 4Q16—compared to 4Q15 EPS of $0.98. It represents a tremendous rise of 21%.

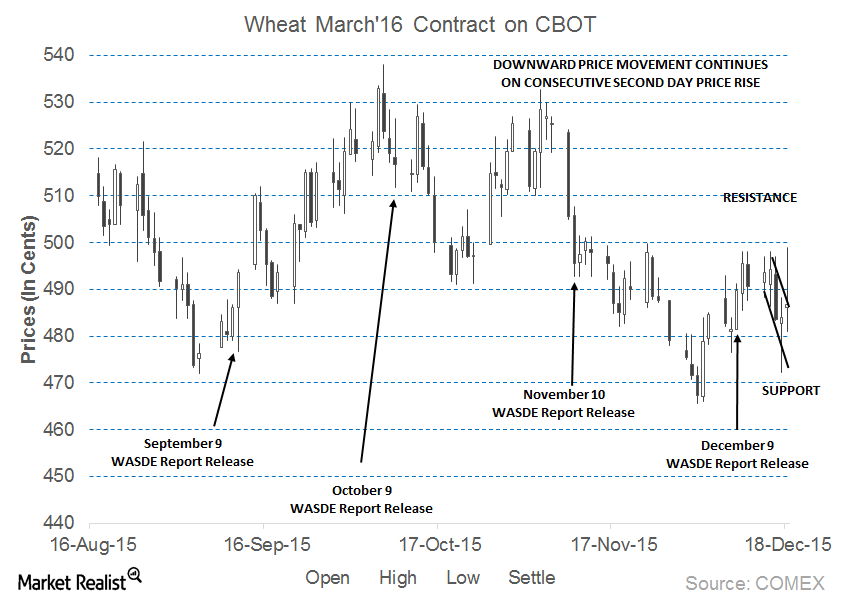

Wheat Prices Trade above 20-Day Moving Average

Wheat futures contracts for March expiry were trading above the key support level of 485 cents per bushel on December 18, 2015.

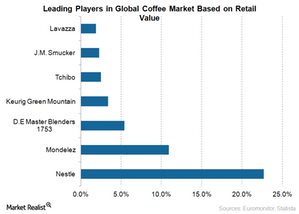

Jacobs Douwe Egberts: Its Impact on Coffee Industry Rivals

Jacobs Douwe Egberts will be a leading player in the coffee industry with powerful brands like Jacobs, Maxwell House, and Pilão. It will have a strong presence in emerging countries like China.