Sprott Gold Miners ETF

Latest Sprott Gold Miners ETF News and Updates

How Do US Economic Numbers Play on Gold?

Economic data from the United States on Tuesday, July 21, 2016, on home starts and building permits affected gold and other precious metals to a certain extent.

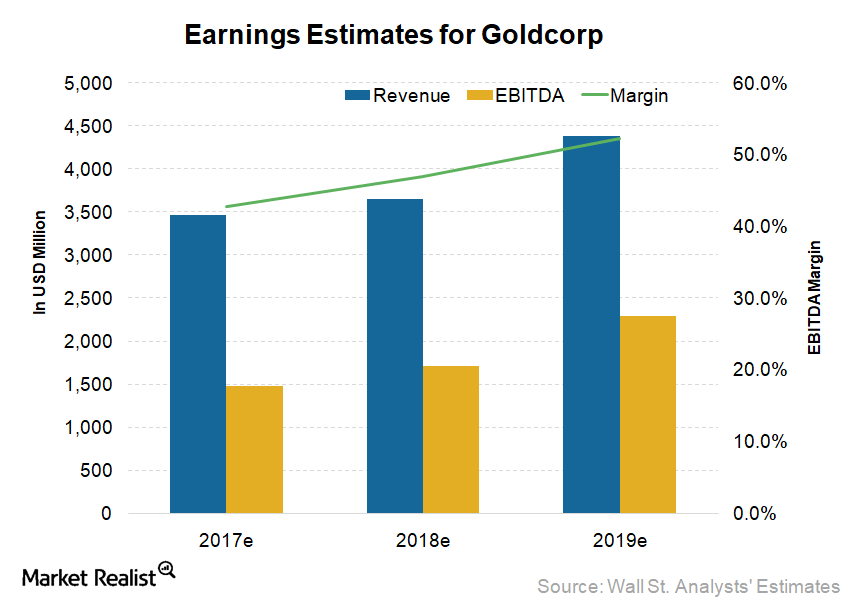

Do Goldcorp’s Earnings Estimates Reflect Analysts’ Increasing Optimism?

Goldcorp (GG) has given negative returns in 2017. Its stock has lost 6.1% of its value as compared to a gain of 12.8% in the iShares Gold Trust (GLD) and 11.1% in the VanEck Vectors Gold Miners ETF (GDX).

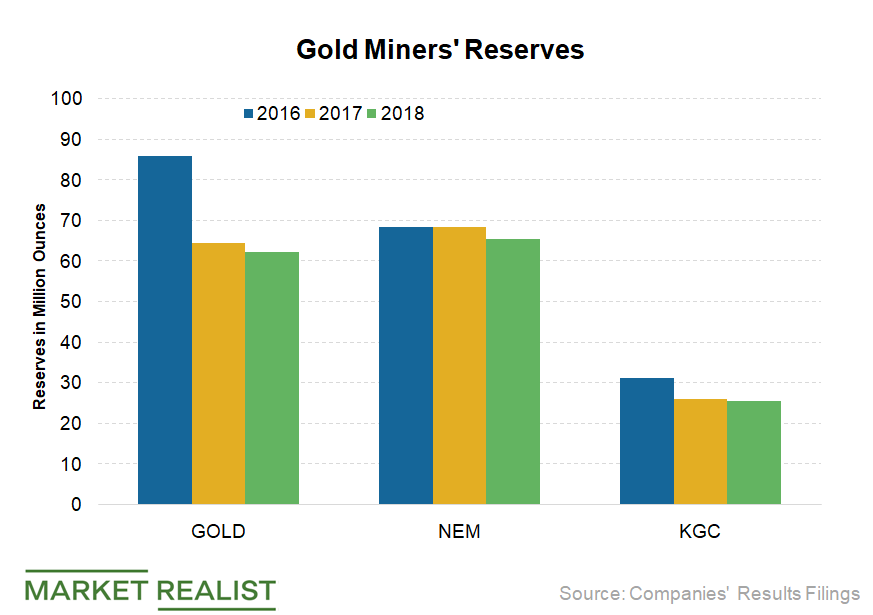

Why Did Barrick Gold’s Reserves Fall in 2018?

At the end of 2018, Barrick Gold (GOLD) reported mineral reserves of 64.5 million ounces—a decline of 3.4% YoY.

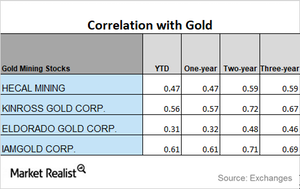

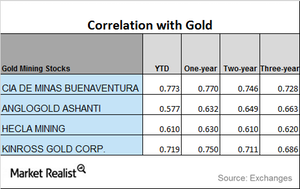

Comparing Mining Stocks’ Correlation with Gold

Mining stocks tend to move with gold prices. In this part, we’ll analyze the correlation between gold and four mining stocks.

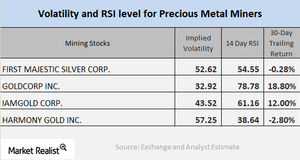

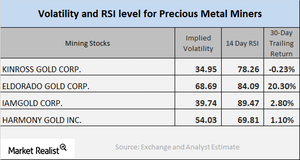

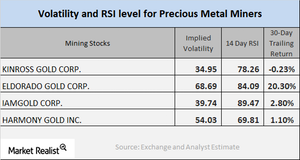

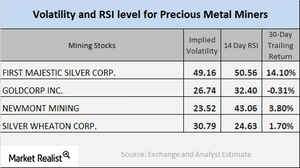

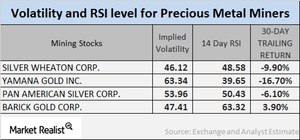

Reading the Technicals and Price Movements of Mining Stocks

In this article, we’ll do a technical analysis of a few select mining stocks. When investing in mining stocks, it’s crucial to read their indicators.

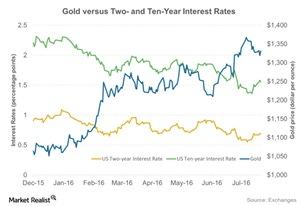

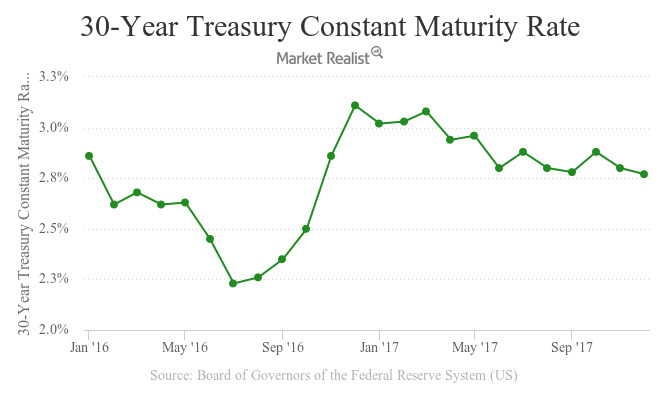

Is Gold Keeping Tabs on the US Interest Rate?

As we know, precious metals are closely tied to movements in US interest rates. Bonds and equities are both yield-bearing assets, so a rise in yields often causes a slump in demand for assets such as gold and silver.

Analyzing the Correlation between Miners and Gold in January

Most mining stocks have risen over the past one month due to the revival in gold prices.

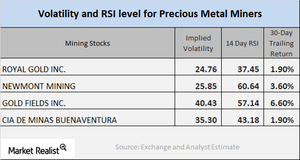

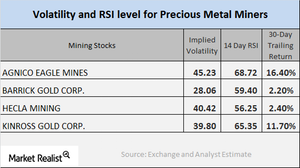

How Do Miners’ Technical Details Look?

Most of the mining companies have risen during the past few weeks. The miners tend to move according to precious metal prices rather than the equities market in general.

Correlation Reading of Miners and Funds in the Last 3 Years

During the past year, IamGold has seen the highest correlation to gold, while Eldorado Gold has the lowest correlation.

Reading Key Mining Stock Technicals as of December

Most of the mining companies have increased during the past two weeks due to the rise of gold and silver.

Will Gold Maintain Its Close Correlation to Inflation?

The rise in inflation could be a positive sign for the current scenario.

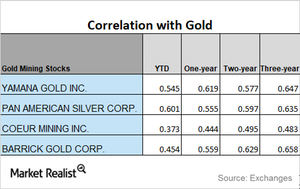

Where Are Miners’ Correlations with Gold Headed?

In this article, we’ll aim to study the correlations of Yamana Gold (AUY), Pan American Silver (PAAS), Coeur Mining (CDE), and Barrick Gold (ABX) with gold.

Today’s Correlation Study of Key Mining Stocks with Gold

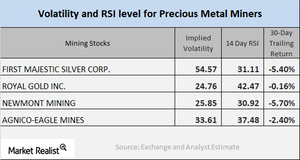

The Global X Silver Miners ETF (SIL) and the Sprott Gold Miners (SGDM) have fallen 3.5% and 4.4%, respectively, on a 30-day trailing basis.

Analyzing Mining Stocks’ Technical Indicators

Gold Fields, Coeur Mining, Hecla Mining, and IamGold have call implied volatilities of 40.4%, 46.7%, 33.6%, and 44.3%, respectively.

Behind the Technical Details of Key Mining Stocks Today

The Sprott Gold Miners (SGDM) and Global X Silver Miners (SIL) have fallen 0.21% and 1.9%, respectively, on a 30-day-trailing basis.

A Brief Analysis of Mining Stocks in November 2017

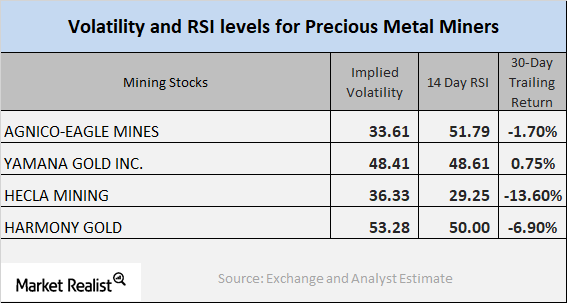

On November 7, Agnico-Eagle Mines (AEM), Yamana Gold (AUY), Hecla Mining (HL), and Harmony Gold (HMY) had implied volatility readings of 33.6%, 48.4%, 36.3%, and 53.3%, respectively.

What’s the Directional Trend in Key Miners’ Correlation?

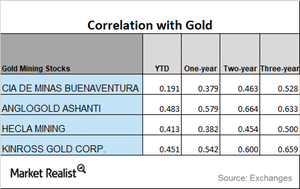

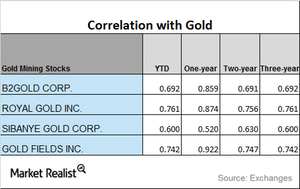

AngloGold Ashanti has had the lowest correlation with gold this year, while Gold Fields has had the highest correlation with gold.

Analyzing Miners’ Trends in October

Mining stocks’ correlation with precious metals Most of the time, mining stocks’ performance follows that of precious metals. However, they can deviate. Correlational analysis can give investors some insight into how mining stocks relate to gold and silver. In this part of our series, we’ll compare Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM). Mining […]

A Brief Analysis of Mining Stock Correlations with Gold

The iShares MSCI Global Gold Min (RING) and the Sprott Gold Miners (SGDM) rose with metals on Monday, climbing 1.2% and 0.83%, respectively.

Precious Metals in September: A Review

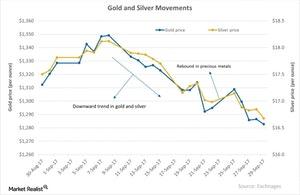

The negative sentiment toward gold prevailed on Friday, September 29, the last trading day of the month. Gold futures for November expiration fell 0.3%.

Reading Miners’ Gold Correlation Trends

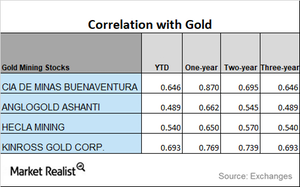

Correlation trends On September 26, precious metals and mining stocks fell. Analyzing mining stocks’ correlation with gold is important since it can give some idea of future stock movement. In our analysis, we’ll focus on Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC). Mining funds track precious metals and their price movements. Whereas the Global […]

Understanding Mining Company Technicals amid Today’s Turbulence

Many mining stocks saw a revival in prices on Monday, September 25, 2017, since precious metals saw an upswing.

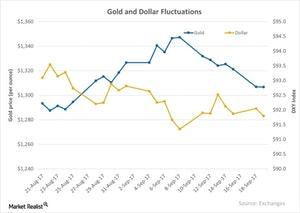

Precious Metals, Miners and the Scaling Dollar

Later in the day on September 20, after rising gold prices fell on the US Federal Reserve’s indication of one more interest rate hike in 2017.

Analyzing the Miners’ Crucial Indicators in September

On September 11, 2017, Agnico-Eagle, Barrick Gold, Hecla Mining, and Kinross had volatilities of 45.2%, 28.1%, 40.4%, and 39.8%, respectively.

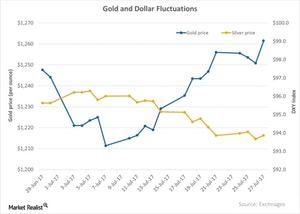

How the US Dollar Affected Gold

The US dollar has been on a downward swing over the past week.

What Do Mining Stocks’ Technicals Indicate?

Many of the fluctuations in precious metals have been a result of speculation about the Federal Reserve’s interest rate stance.

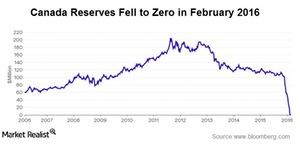

Why Canada Cut Its Gold Reserves

Canada is the only G7 nation that does not hold at least 100 tons of gold in its reserves. Its holdings rank it last of 100 central banks—behind Albania.

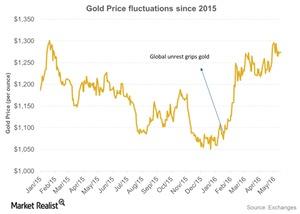

Why Is JPMorgan Chase Positive on Gold?

After seeing three straight years of losses, gold (GLD) performed extremely well at the beginning of 2016.

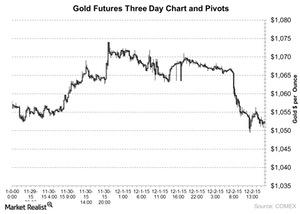

Gold Touched Its Lowest Levels in the Last Six Years on Wednesday

Gold futures trading on COMEX, the commodity division of the New York Mercantile Exchange, fell 0.91% on December 2, 2015. Also, platinum fell 0.36%.