ProShares UltraShort Bloomberg Crude Oil

Latest ProShares UltraShort Bloomberg Crude Oil News and Updates

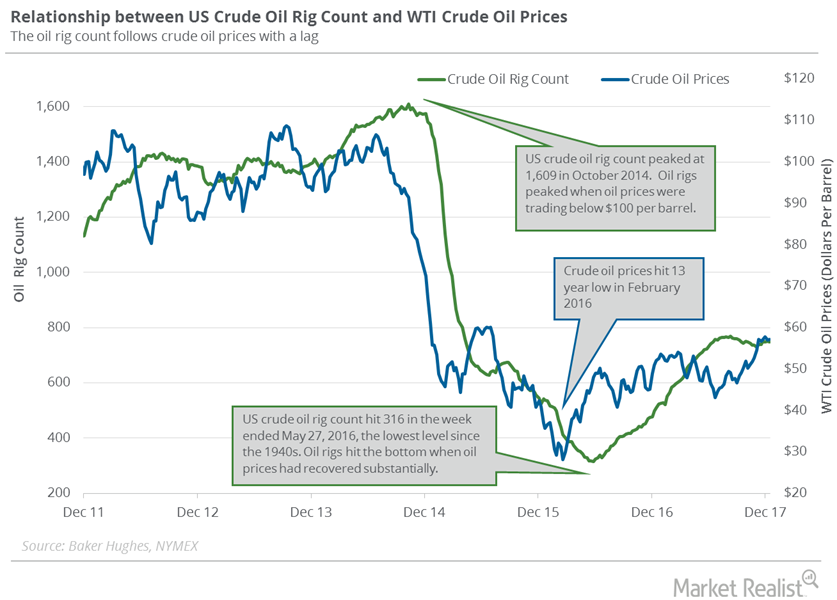

US Crude Oil Rigs Indicate Future US Crude Oil Production

Baker Hughes released its weekly US crude oil rig report on December 15, 2017. US crude oil rigs fell by four to 747 or 0.5% on December 8–15, 2017.

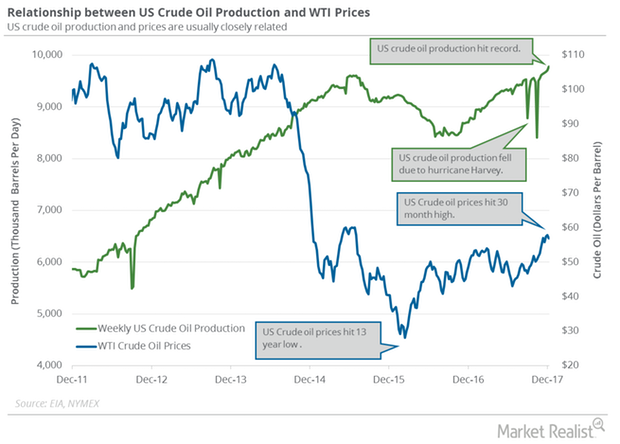

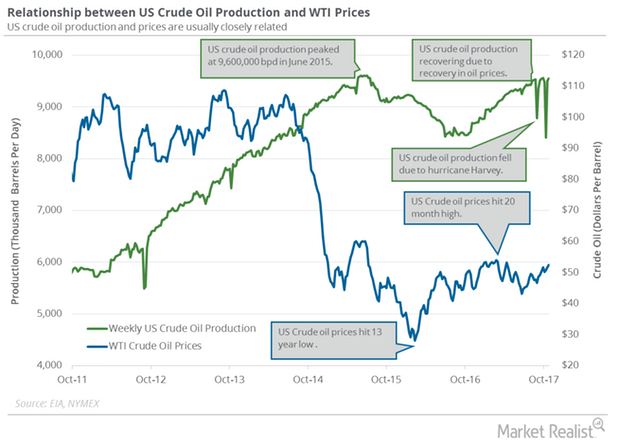

US Crude Oil Production Has Risen 16% since July 2016

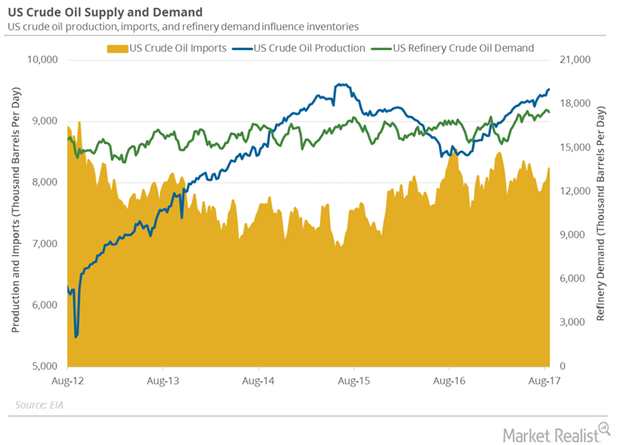

US crude oil production rose by 73,000 bpd (barrels per day) to 9,780,000 bpd on December 1–8, 2017, according to the EIA.

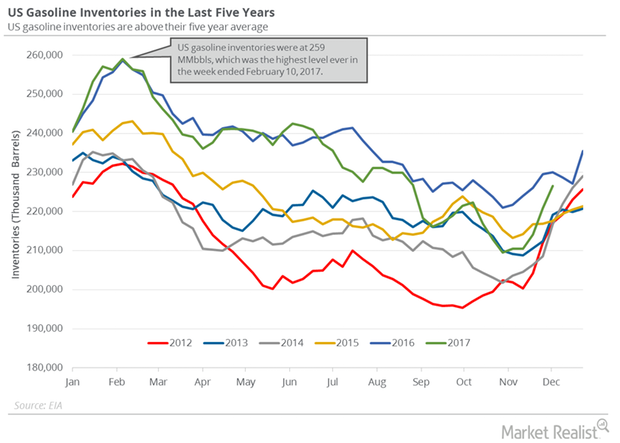

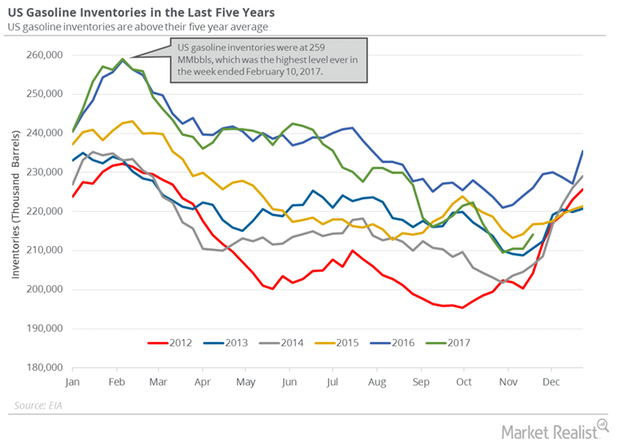

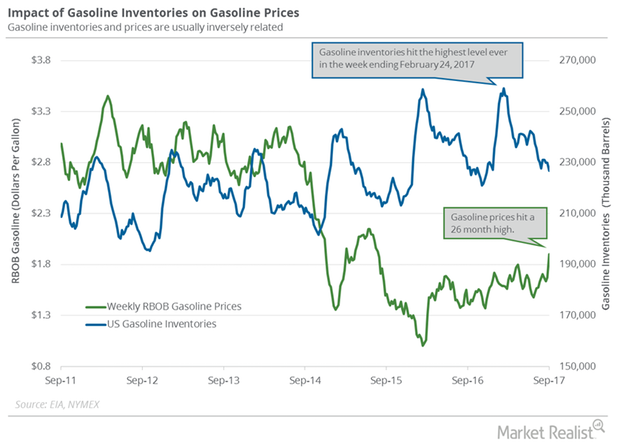

US Gasoline Inventories: Turning Point for Crude Oil Futures?

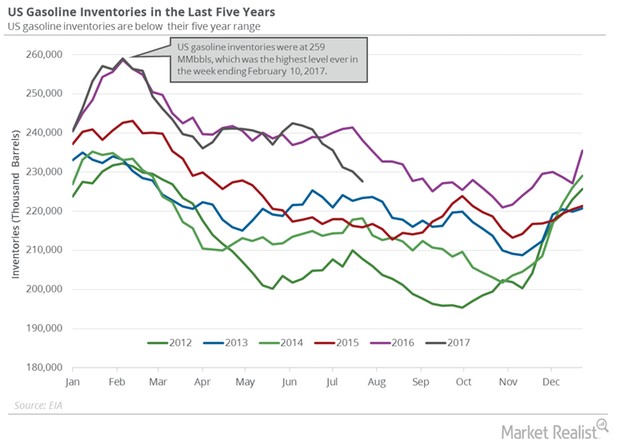

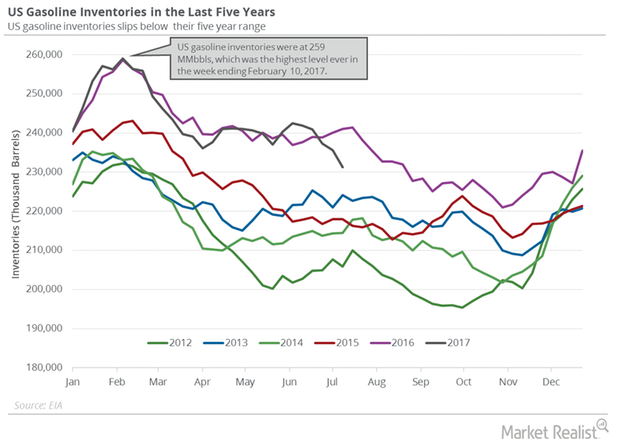

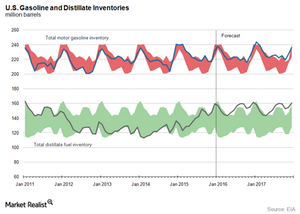

US gasoline inventories rose by 5.6 MMbbls (million barrels) or 2.6% to 226.5 MMbbls on December 1–8, 2017.

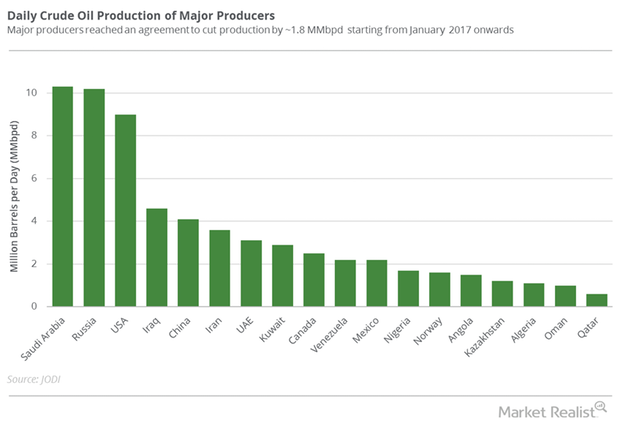

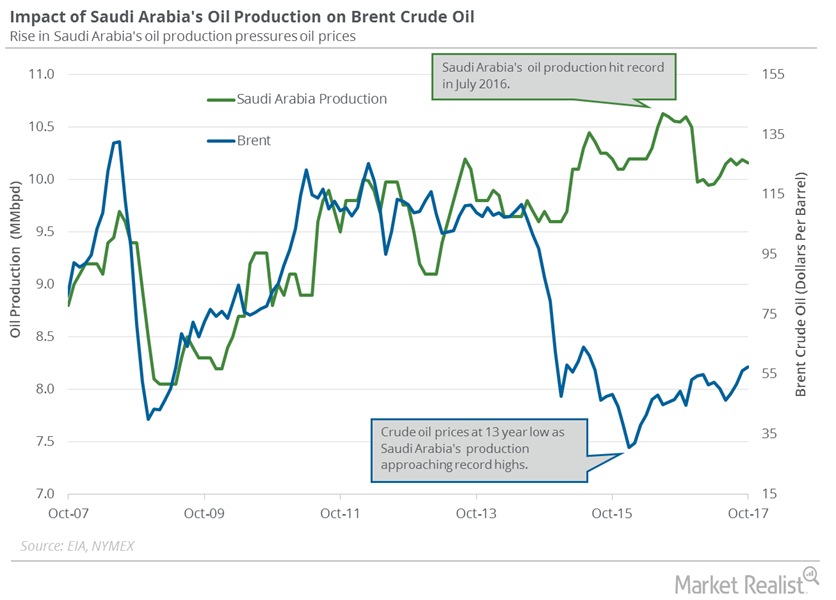

How OPEC and Russia Are Helping US Crude Oil Producers

January West Texas Intermediate (or WTI) crude oil (USO) (SCO) futures contracts fell 0.65% and were trading at $57.98 per barrel at 1:10 AM EST on December 4, 2017.

US Gasoline Inventories Weighed on Crude Oil Futures

US gasoline inventories rose by 3,627,000 barrels to 214 MMbbls (million barrels) on November 17–24, 2017, according to the EIA.

Saudi Arabia Could Help the Global Oil Market

Saudi Arabia’s crude oil exports to the US fell to 525,000 bpd in October 2017—the lowest in 30 years. Exports fell due to ongoing output cuts.

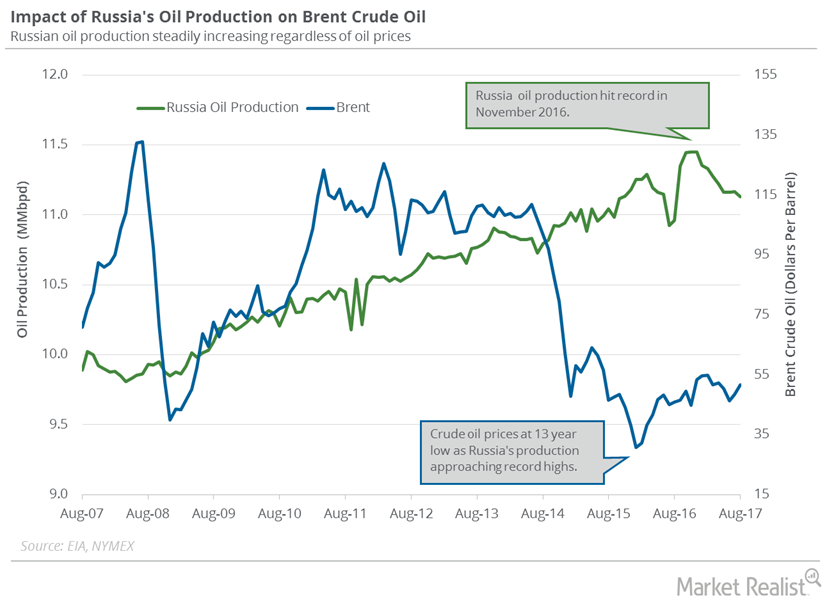

Russia’s Crude Oil Exports Could Pressure Oil Futures

Russia’s energy ministry estimates that the country’s crude oil exports rose 2% or by 160,000 bpd (barrel per day) in the first nine months of 2017.

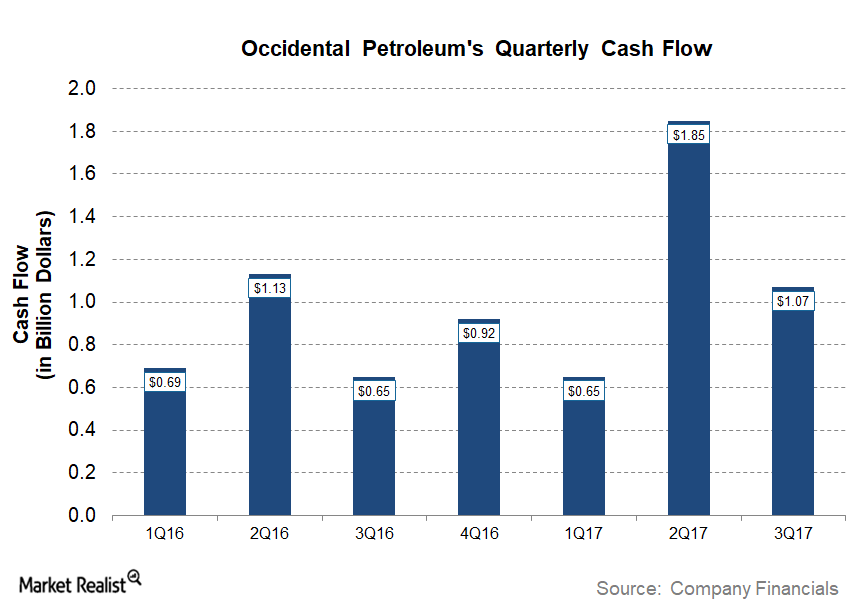

Did Occidental Petroleum Generate Positive Free Cash Flow in 3Q17?

On a year-over-year basis, OXY’s 3Q17 operating cash flow was ~65% higher than the ~$650 million it generated in 3Q16.

Will Non-OPEC and US Crude Oil Production Impact Oil Prices?

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 46,000 bpd to 9,553,000 bpd on October 20–27, 2017.

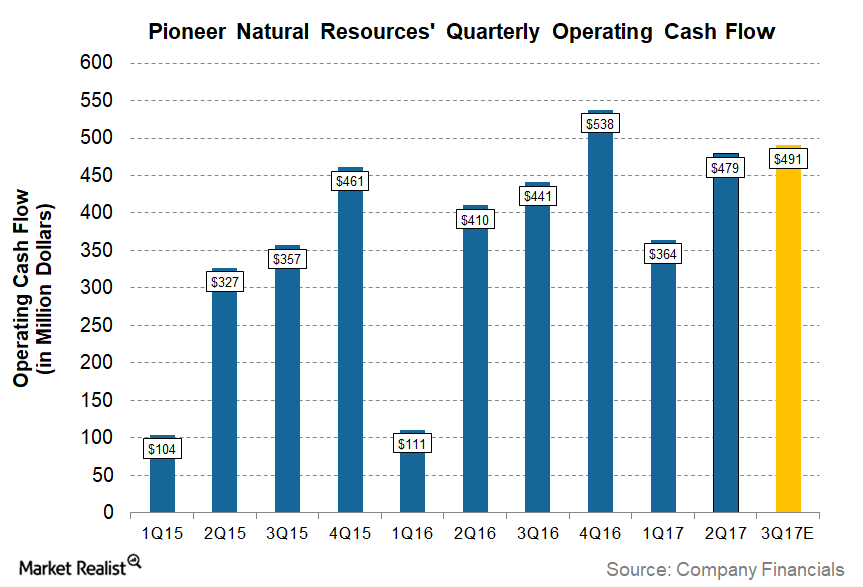

What to Expect from Pioneer Natural Resources’ Cash Flow in 3Q17

Wall Street analysts expect Pioneer Natural Resources (PXD) to report year-over-year higher cash flow of ~$491 million in 3Q17 compared to ~$441 million in 3Q16.

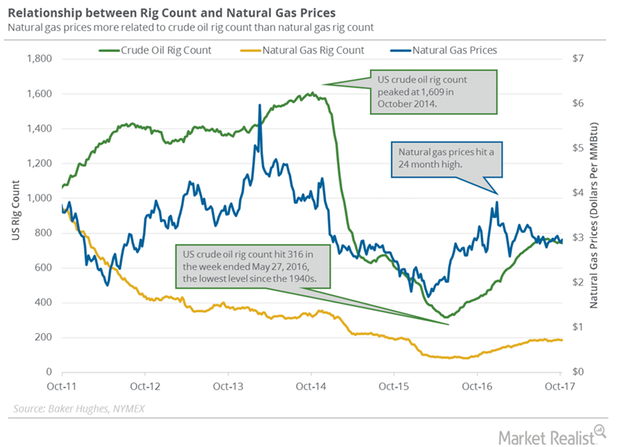

US Gas Rigs Hit 5-Month Low: Good or Bad for Natural Gas Futures?

Baker Hughes is scheduled to release its weekly US oil and gas rig report on October 27, 2017.

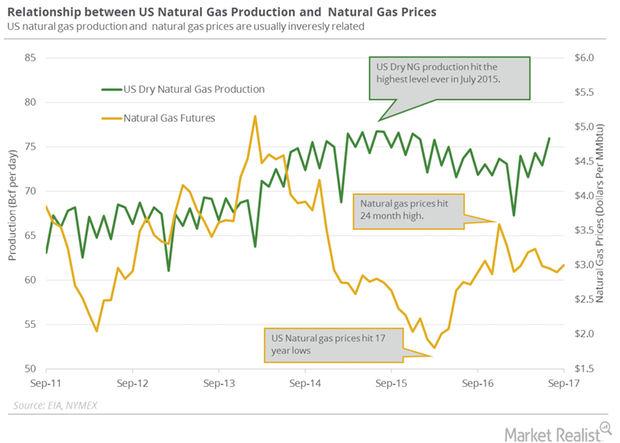

Is US Natural Gas Production Bearish for Natural Gas?

US dry natural gas production will likely average ~73.6 Bcf/d in 2017. It will likely rise by 4.9 Bcf/d or 6.6% to 78.5 Bcf/d in 2018.

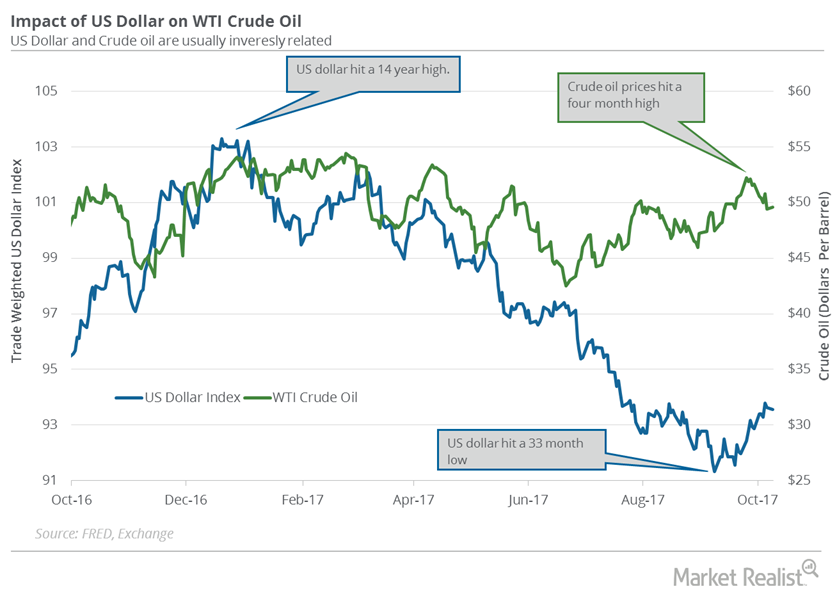

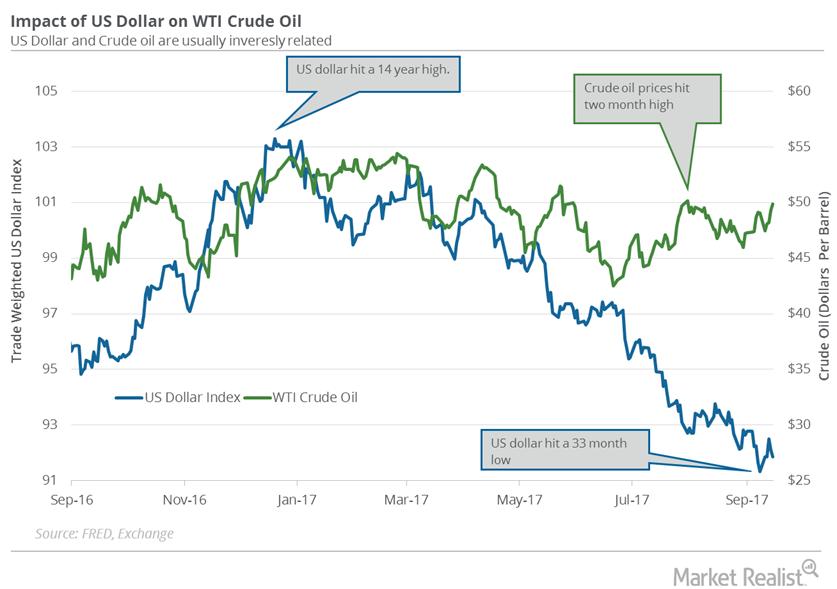

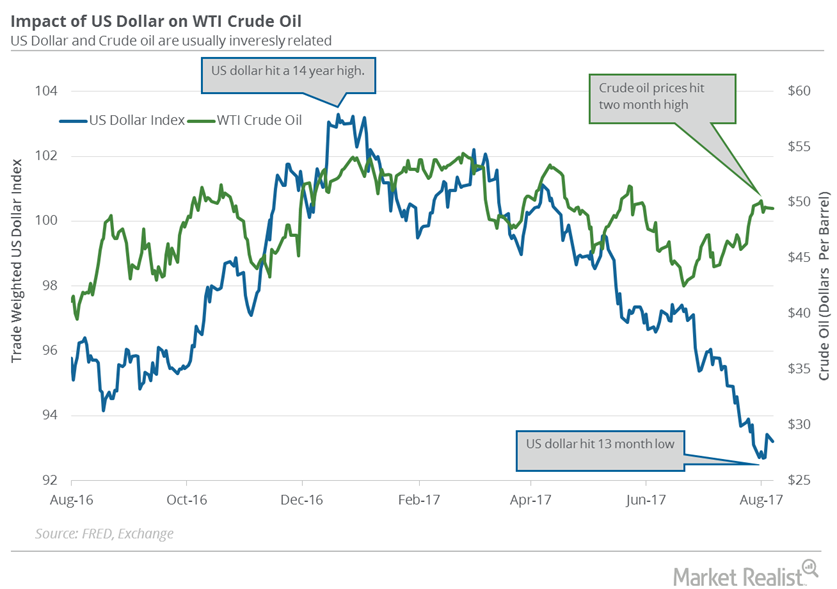

US Dollar Is near a 10-Week High, Could Upset Crude Oil Bulls

The US Dollar Index fell 0.1% to 93.55 on October 9, 2017. However, it rose almost 1.1% last week. The US dollar (UUP) is near a ten-week high.

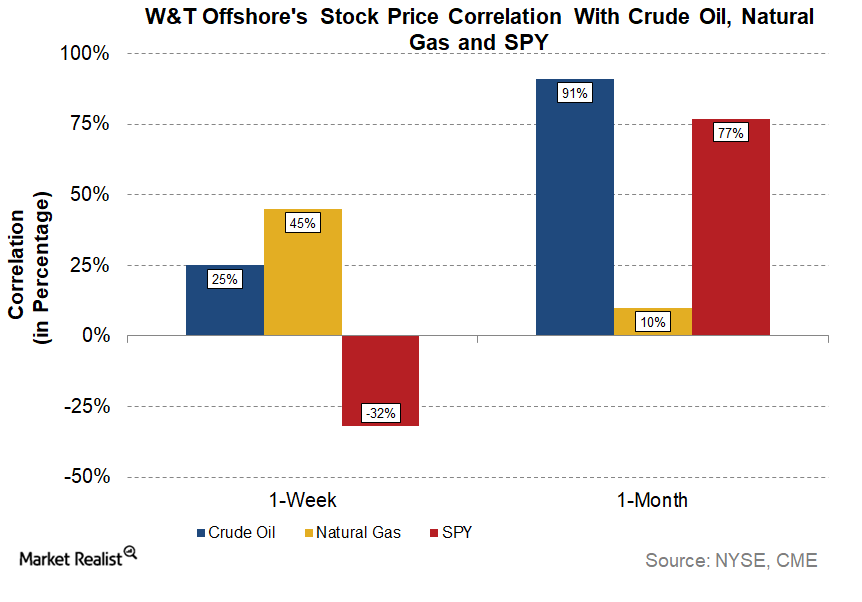

What Really Moved W&T Offshore Stock Last Week?

W&T Offshore (WTI) stock rose ~7% last week (ended September 29), while crude oil and the SPDR S&P 500 ETF (SPY) rose ~2% and ~0.7%, respectively.

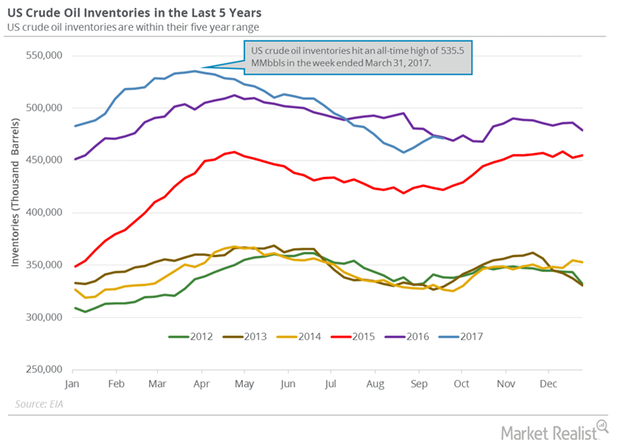

How Record US Crude Oil Exports Are Impacting Crude Oil Inventories and Prices

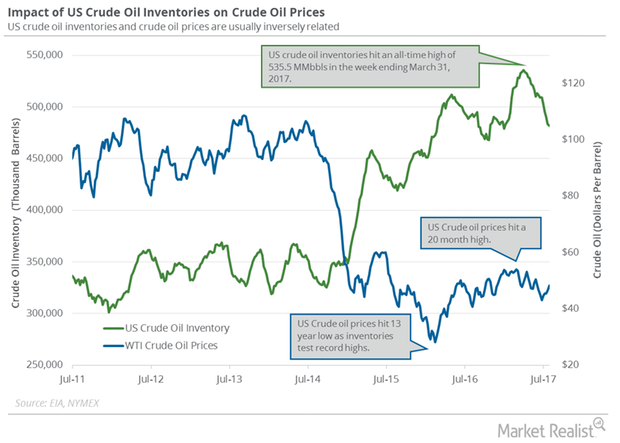

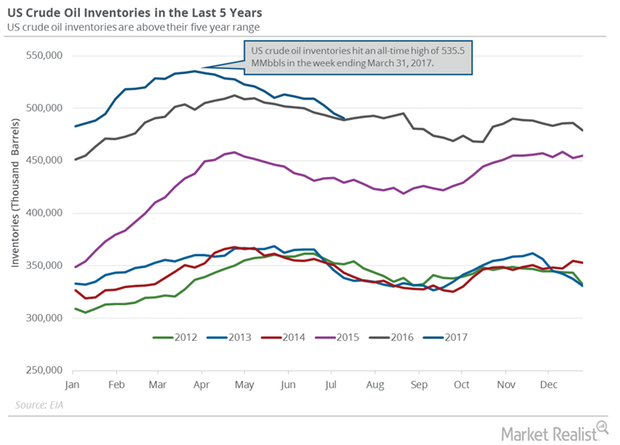

On September 27, the EIA released its weekly report, estimating that US crude oil inventories fell to 470.9 MMbbls from September 15–22, 2017.

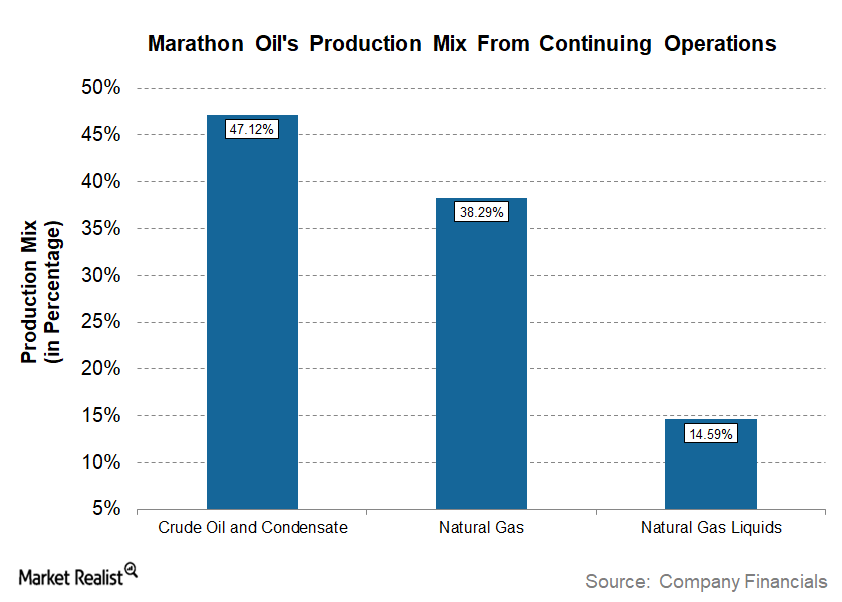

How Marathon Oil’s Divestiture Affected Its Production Mix

In 2Q17, Marathon Oil’s (MRO) production mix from continuing operations was ~47.0% crude oil and condensate, ~15.0% natural gas liquids, and ~38.0% natural gas.

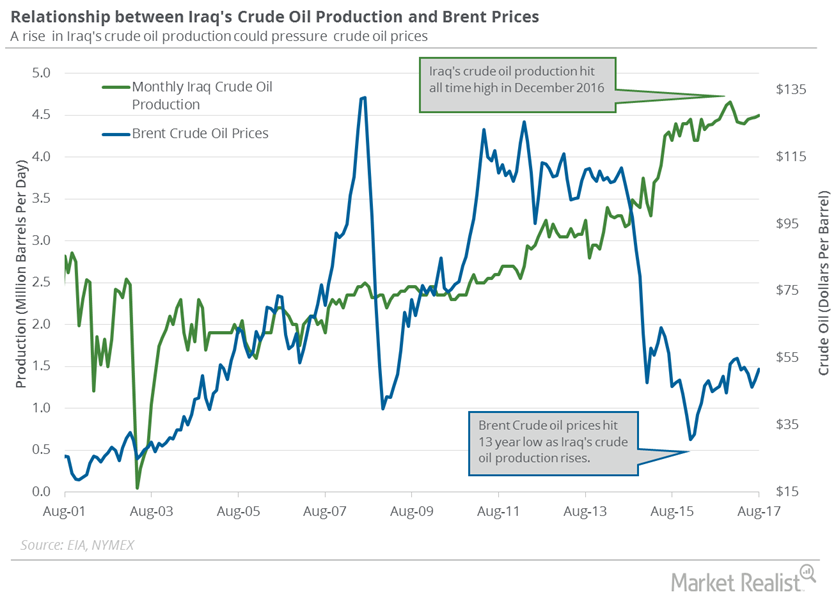

Why Kurdish Regions Are Crucial for Iraq’s Crude Oil Exports

Iraq is the second-largest OPEC producer. The EIA (U.S. Energy Information Administration) estimates that Iraq’s crude oil production rose by 25,000 bpd (barrels per day) to 4,500,000 bpd in August 2017.

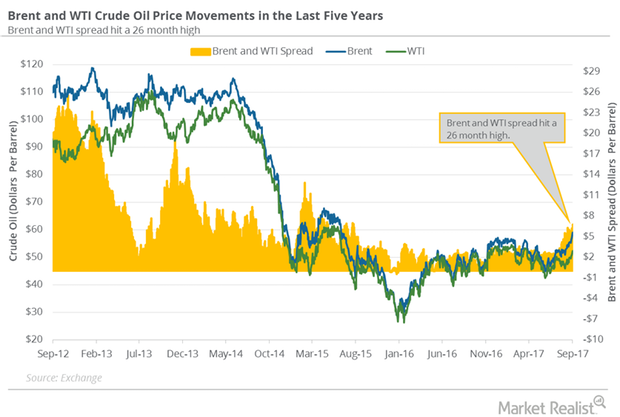

Why the Brent and WTI Crude Oil Spread Hit a 26-Month High

November WTI (West Texas Intermediate) crude oil (UWT)(DWT)(DBO) futures contracts fell 0.2% and were trading at $52.12 per barrel in electronic trading at 2:20 AM EST on September 26.

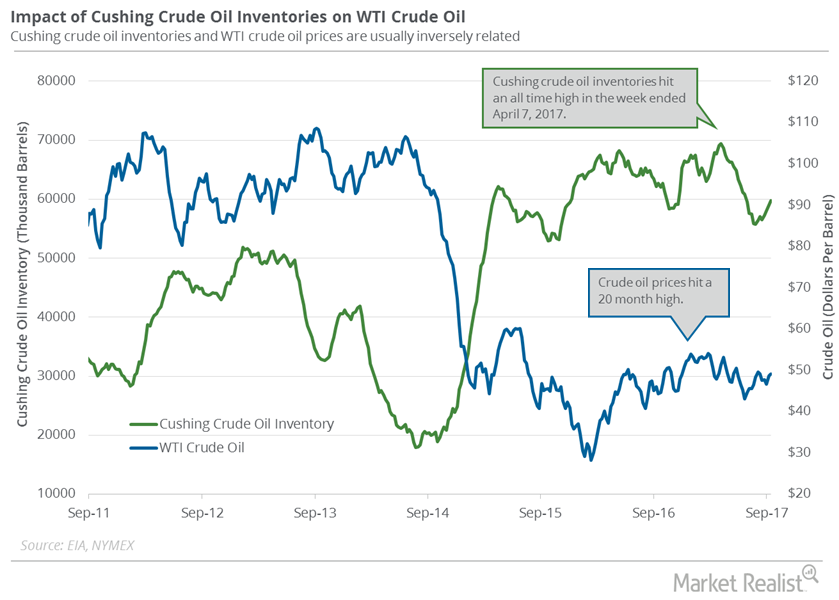

Cushing Crude Oil Inventories Rose for the Fourth Week

Cushing crude oil inventories rose on September 15–22, 2017. A rise in Cushing crude oil inventories is bearish for crude oil (UWT) (DWT) (USO) prices.

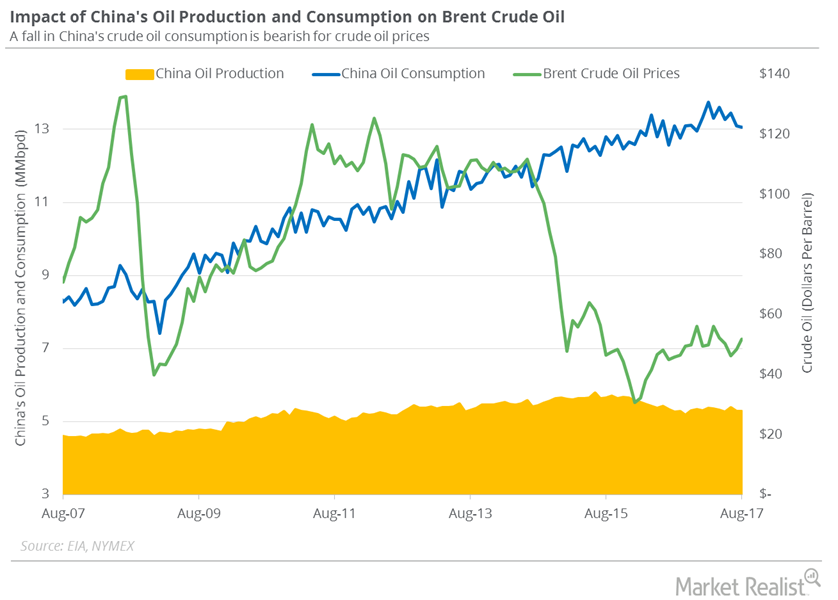

China’s Crude Oil Imports Hit a 2017 Low

China’s General Administration of Customs estimates that China’s crude oil imports fell by 180,000 bpd to 8 MMbpd in August 2017—compared to July 2017.

Are Crude Oil Futures Signaling a Breakout?

November US crude oil (UWT) (DWT) (USO) futures contracts rose 0.8% to $50.3 per barrel in electronic trading at 2:10 AM EST on September 20, 2017.

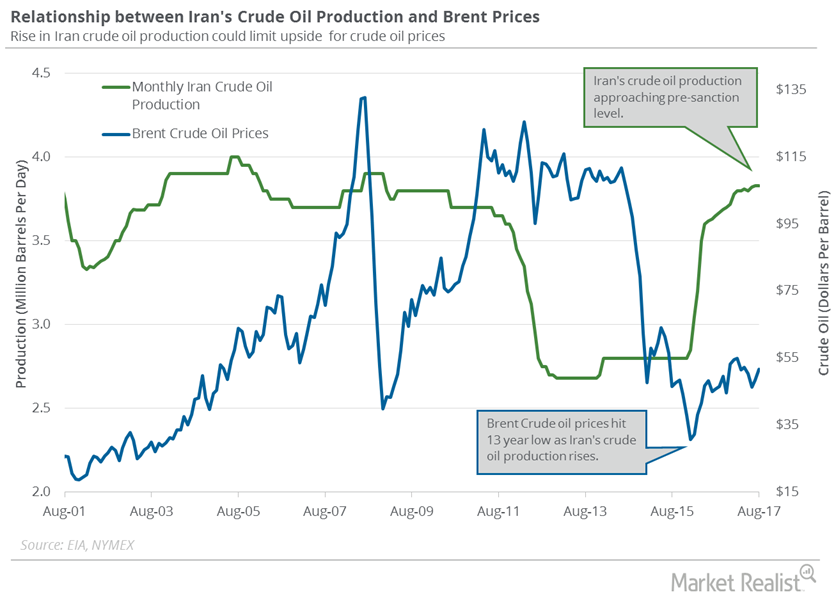

Iran’s Crude Oil Production Was Flat in August 2017

The EIA estimates that Iran’s crude oil production was flat at 3.8 MMbpd (million barrels per day) in August 2017—compared to July 2017.

Will the FOMC Meeting Drive the US Dollar and Crude Oil Futures?

The US Dollar Index fell 0.27% to 91.86 on September 15. It’s near a 33-month low. Prices fell due to the surprise decline in US retail sales in August.

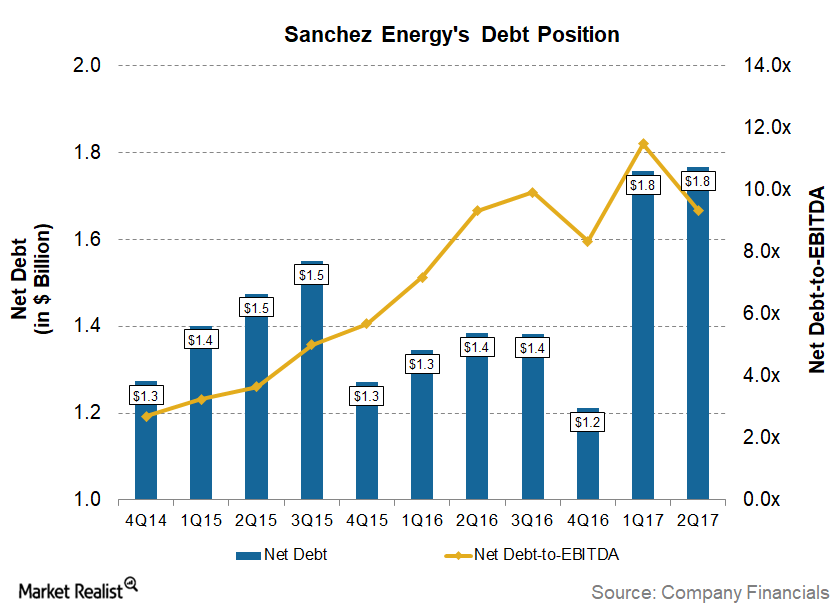

Is Sanchez Energy Repeating an Old Debt Mistake?

Since 1Q16, crude oil (USO)(SCO) prices have risen from lows of $26.05 per barrel to $49.30 per barrel as of September 13.

Why US Crude Oil Inventories Rose Again

On September 13, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report.

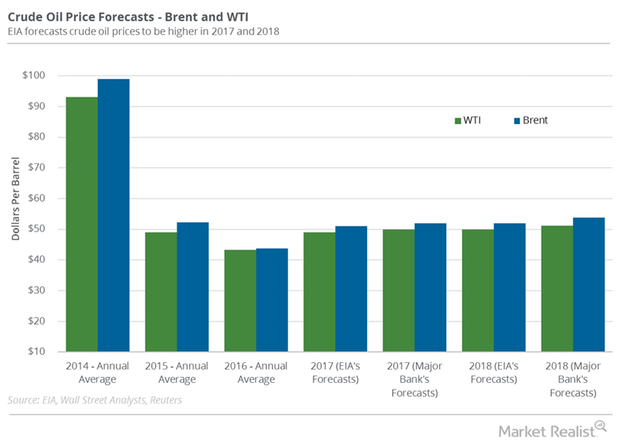

Why Were Crude Oil Price Forecasts Downgraded Again?

A Wall Street Journal survey estimates that US crude oil prices could average $51 per barrel in 2018—$2 per barrel lower than previous estimates.

How Hurricane Harvey May Impact US Crude Oil Production

US crude oil production The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 2,000 bpd (barrels per day) to 9,530,000 bpd between August 18 and 25, 2017. Production rose 1,042,000 bpd, or 12.3%, from the same period in 2016. It has risen for three consecutive weeks to August 25, and has reached […]

How Tropical Storm Harvey Impacts US Crude Oil and Gasoline Prices

WTI (West Texas Intermediate) crude oil (SCO)(BNO)(PXI) futures contracts for October delivery rose 0.4% and were trading at $46.8 per barrel in electronic trading at 2:05 AM EST on August 29.

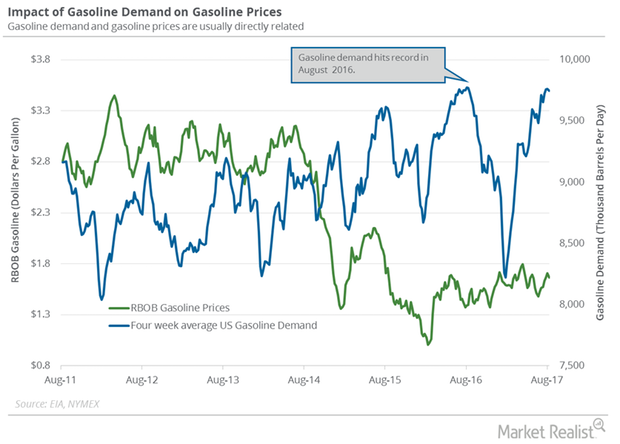

Could US Gasoline Demand Fall in the Coming Months?

The EIA estimates that US gasoline demand will fall 275.0 Mbpd (thousand barrels per day) to 9.5 MMbpd (million barrels per day) August 4–11, 2017.

Will US Crude Oil and Gasoline Inventories Support Oil Prices?

September WTI (West Texas Intermediate) crude oil (OIH) (SCO) (DIG) futures contracts rose 0.5% to $47.81 per barrel in electronic trading at 1:50 AM EST on August 16, 2017.

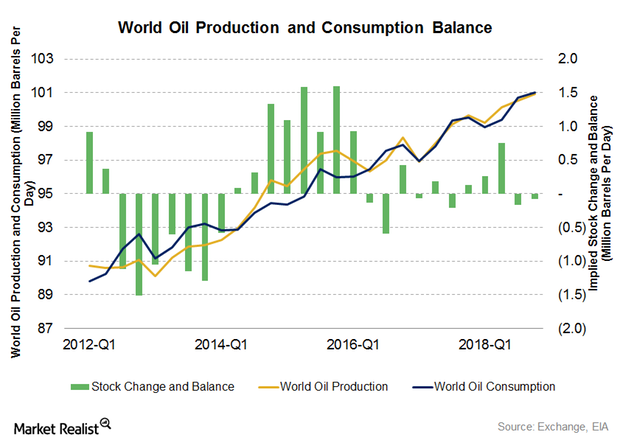

Will Global Oil Consumption Beat Production?

WTI (West Texas Intermediate) crude oil (PXI)(USL)(SCO) futures contracts for September delivery fell 0.1% and were trading at $48.78 per barrel in electronic trading at 2:00 AM EST on August 14, 2017.

Crude Oil Futures Fell despite OPEC’s Meeting and API Data

September US crude oil futures contracts fell 0.4% to $49.17 per barrel on August 8. Brent crude oil futures fell 0.4% to $52.14 per barrel on the same day.

US Dollar Recovers from a 13-Month Low

The US Dollar Index rose 0.77% to 93.7 on August 4, 2017. The US dollar rose due to the better-than-expected rise in US unemployment data.

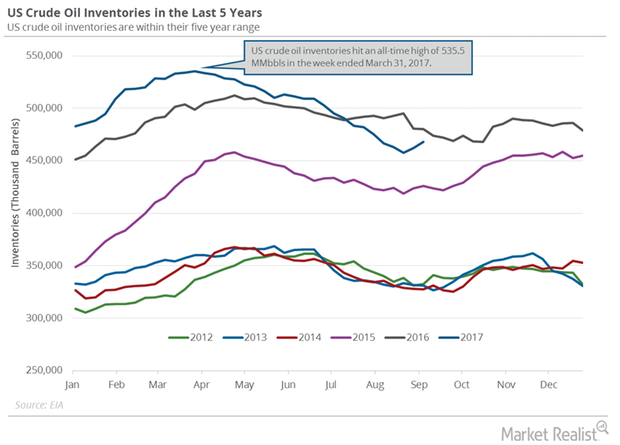

US Crude Oil Inventories Could Fall below the 5-Year Average

The EIA estimates that US crude oil inventories fell by 4.7 MMbbls (million barrels) to 490.6 MMbbls on July 7–14, 2017.

US Gasoline Inventories Drive Gasoline and Crude Oil Prices

The EIA reported that US gasoline inventories fell by 4.4 MMbbls (million barrels) to 231.2 MMbbls on July 7–14, 2017.

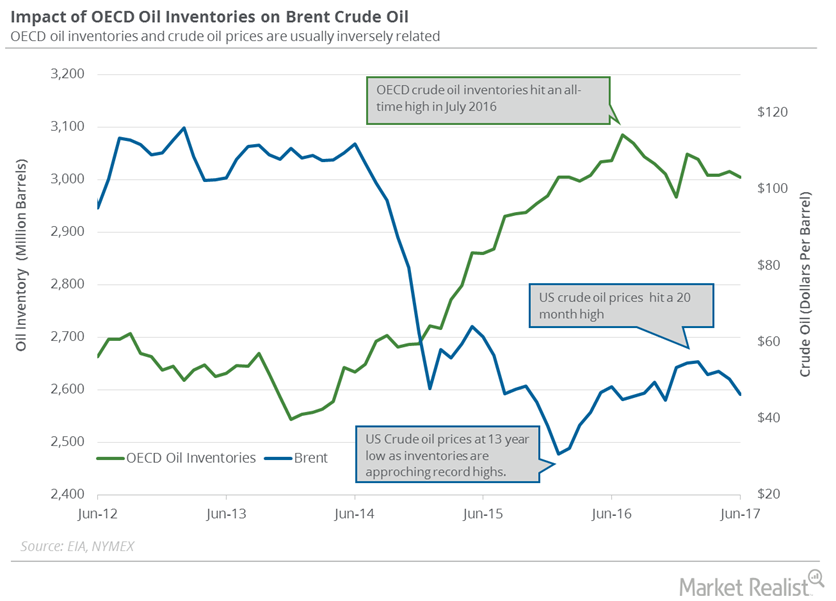

Will OECD’s Crude Oil Inventories Fall below the 5-Year Average?

The EIA estimates that OECD’s crude oil inventories fell by 10.13 MMbbls (million barrels) to 3,005 MMbbls in June 2017—compared to May 2017.

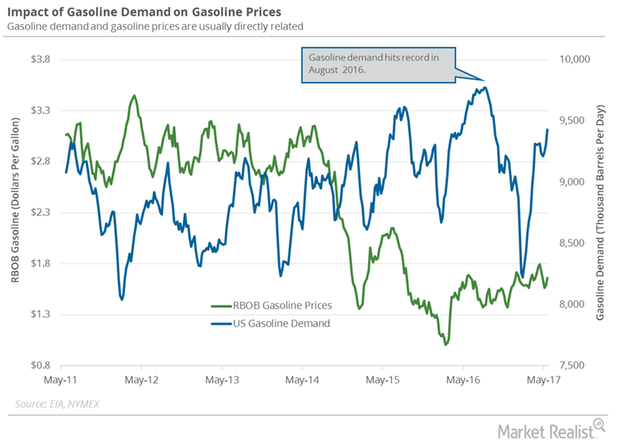

US Gasoline Demand Could Hit a Peak This Summer

The EIA estimated that four-week average US gasoline demand rose by 124,000 bpd (barrels per day) to 9,430,000 bpd on May 12–19, 2017.

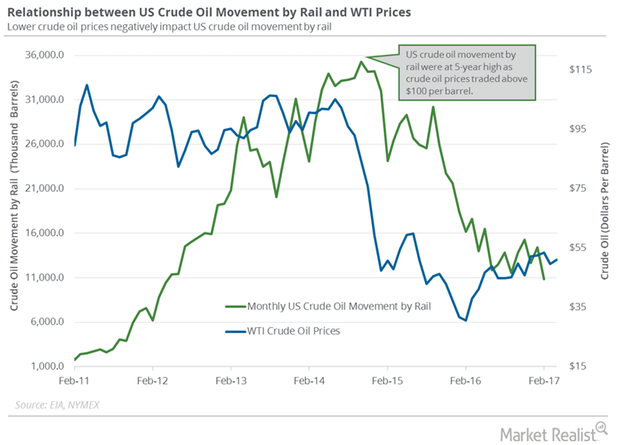

How Did Crude Oil Movement by Rail Trend in February 2017?

The US Energy Information Administration estimates that US crude oil movement by rail fell by 3,546,000 barrels to 10,850,000 barrels in February 2017.

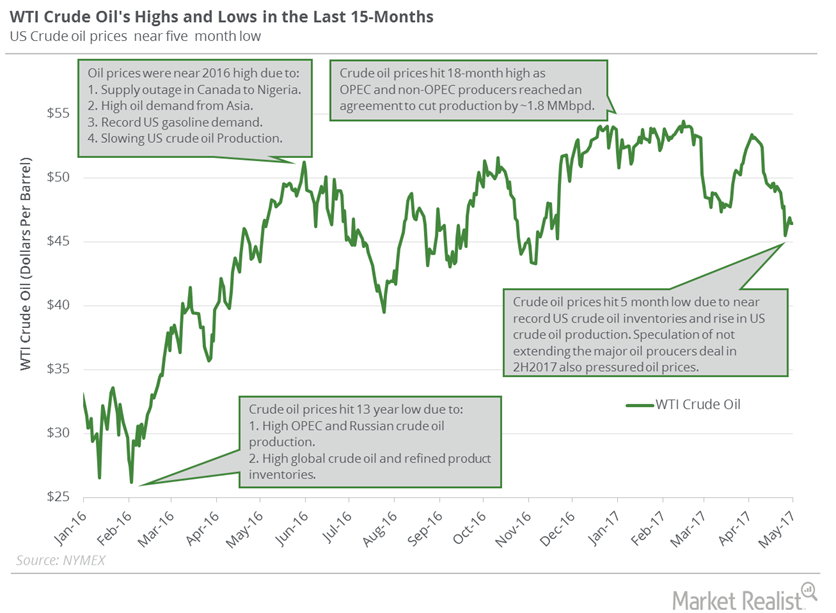

Could Crude Oil Prices Hit Lows from 2016?

WTI (West Texas Intermediate) crude oil (FXN) (SCO) (FENY) futures contracts for June delivery are near a five-month low as of May 9, 2017.

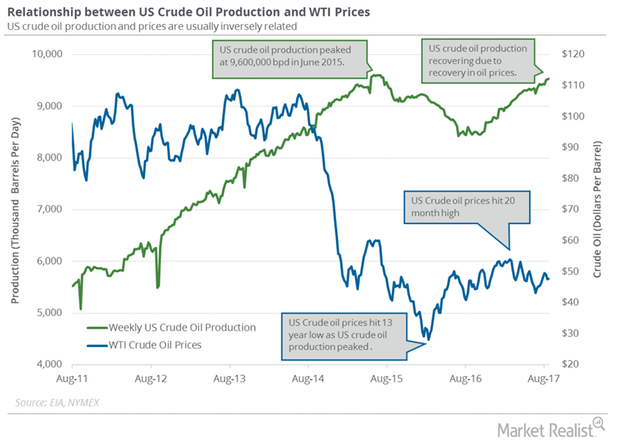

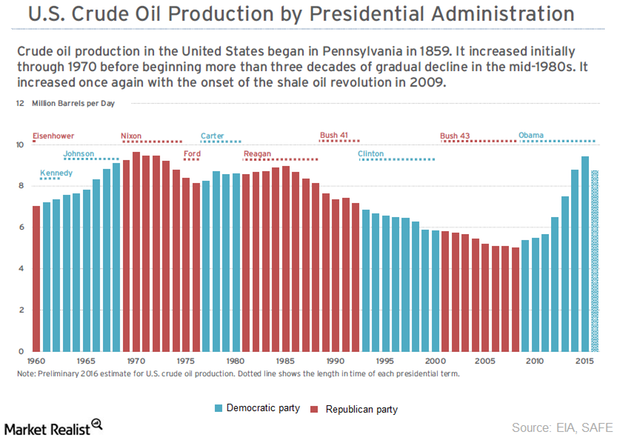

How Political Parties Impact US Crude Oil Production

Under President Obama’s tenure, US crude oil production rose 92% and peaked at 9.6 MMbpd (million barrels per day) in June 2015.

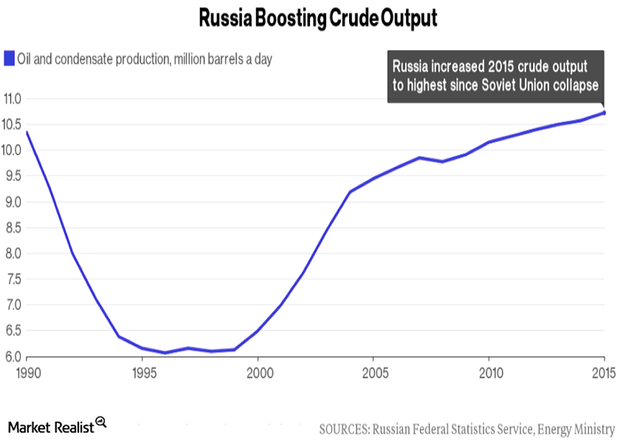

Russia’s Crude Oil Production Will Pressure the Crude Oil Market

Russia’s crude oil production rose to 10.84 MMbpd in June 2016—compared to the previous month—according to sources from the Russian Energy Ministry.

Why Did Crude Oil Prices Diverge before OPEC’s Meeting?

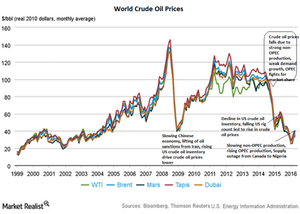

July WTI (West Texas Intermediate) crude oil futures contracts trading in NYMEX fell by 0.47% and settled at $49.1 per barrel on Tuesday, May 31, 2016.

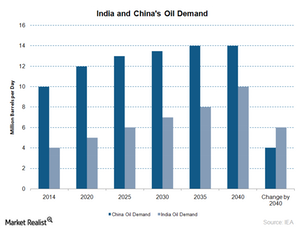

How Will China and India Impact the Crude Oil Market in 2016?

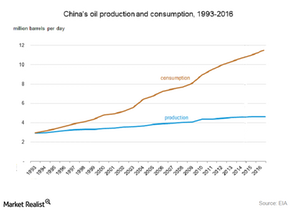

China’s crude oil production fell to the lowest level in four years. It fell by 5.6% YoY (year-over-year) to 16.6 metric tons in April 2016.

India’s Crude Oil Demand Will Likely Drive the Crude Oil Market

The EIA reported that India produced 1 MMbpd (million barrels per day) of crude oil in 2014 and 2015. It’s expected to increase marginally in 2016 and 2017.

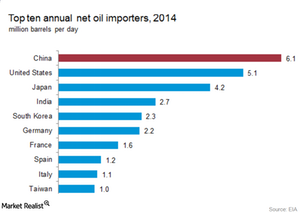

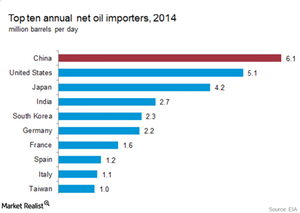

Top Crude Oil Importers’ Role in 2016

China and the United States are the largest crude oil importers in the world. In 2015, they consumed about 30.5 MMbpd (million barrels per day) of crude oil and liquid fuels, per the EIA.

Gasoline and Distillate Inventories Overshadow Crude Oil Market

The EIA (U.S. Energy Information Administration) reported that the US gasoline inventory rose by 8.4 MMbbls to 240.4 MMbbls for the week ending January 8, 2016.

China’s Crude Oil Imports: Bright Spot in 2016 Oil Market?

Market estimates from Bloomberg suggest that China’s crude oil imports in 2016 may rise by 8% to 7.2 MMbpd (million barrels per day).

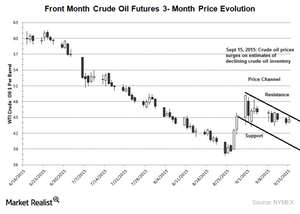

Crude Oil Prices Are Trading in a Downward Trending Range

October WTI crude oil futures rose for the first time after falling for two consecutive days. Slowing US crude oil production is driving crude oil prices.