Praxair Inc

Latest Praxair Inc News and Updates

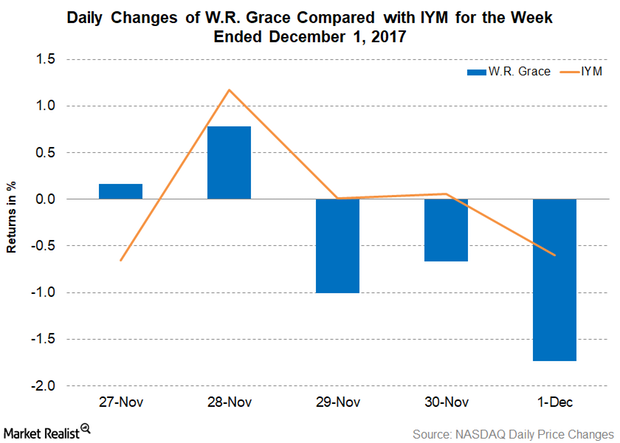

W.R. Grace Signs a Spree of New Contracts

On November 27 and 28, 2017, W.R. Grace (GRA) signed a spree of new contracts for its Unipol license.

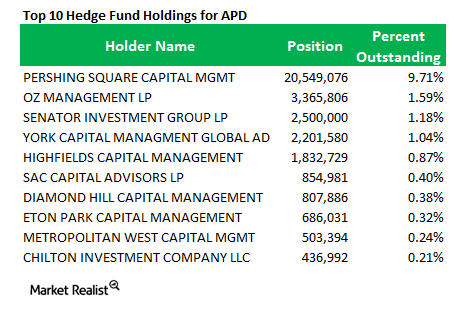

Why Pershing Square increased its stake in Air Products and Chemicals

Pershing Square increased its position in Air Products and Chemicals, Inc. from 21.31% in 3Q 2013 to 27.91% in 4Q 2013.

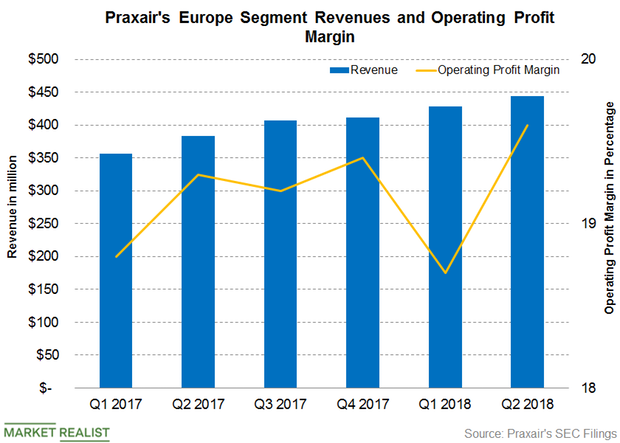

How Praxair’s European Revenue Is Trending

Praxair’s (PX) European segment contributed 14.5% of its total revenue in Q2 2018, compared with 13.5% in Q2 2017.

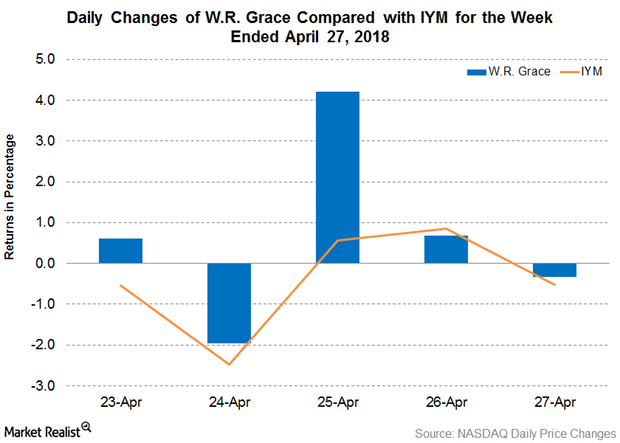

W. R. Grace Bags New UNIPOL Technology Client

On April 24, W. R. Grace (GRA) announced that it would be licensing its UNIPOL PP Process Technology to Inter Pipeline to be used in its Heartland Petrochemical complex in Alberta, Canada

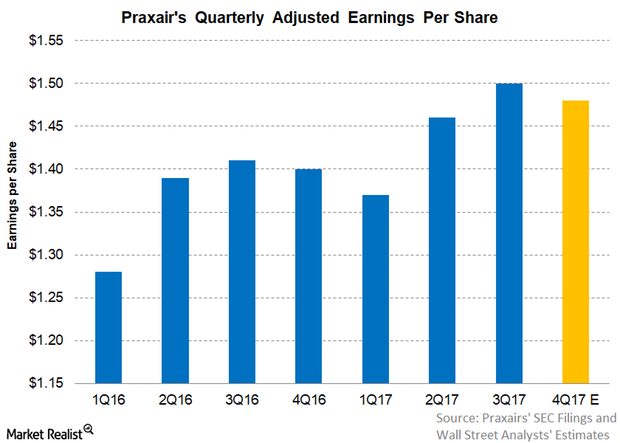

Can Praxair Meet Analysts’ Adjusted Earnings Per Share Estimate?

As of January 15, 2018, analysts are expecting Praxair (PX) to report adjusted EPS (earnings per share) of $1.48, an increase of 5.7% on a year-over-year basis.

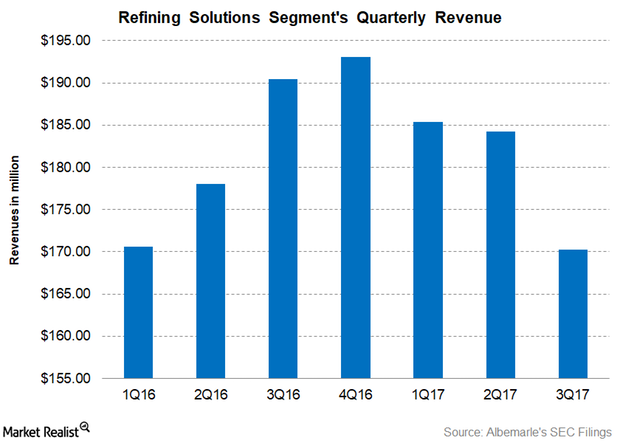

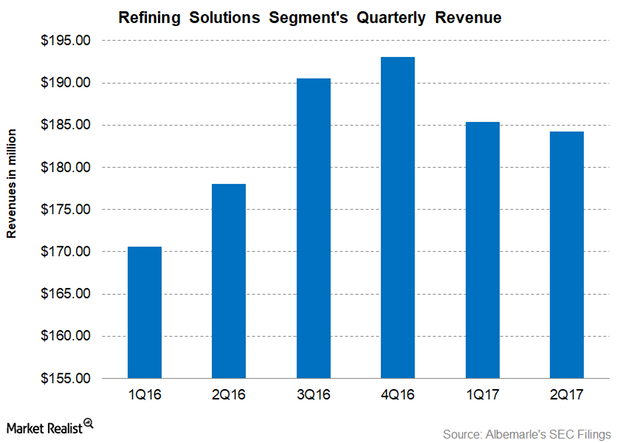

Why Albemarle’s Refining Solutions Segment Fell in 3Q17

Albemarle’s (ALB) Refining Solutions segment is the company’s lowest revenue generator, accounting for 22.6% of its total revenues in 3Q17 compared to 29.1% in 3Q16.

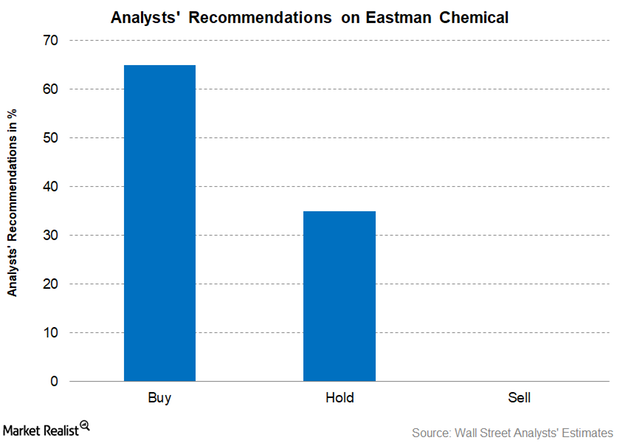

What Analysts Recommend for Eastman Chemical

Analysts’ consensus on EMN’s mean target price is on the rise from $89.92 in July to the current target price of $93.38 as of September 12, 2017.

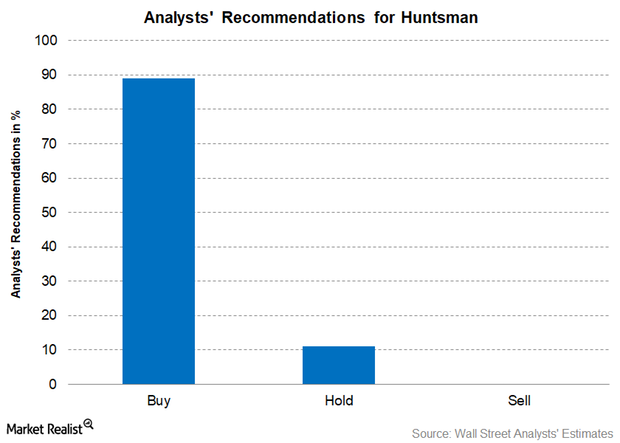

Why Most Analysts Recommend ‘Buy’ for Huntsman

Analysts’ consensus for Huntsman The number of analysts covering Huntsman (HUN) stock has increased from eight analysts to nine analysts in the last month. Among them, 89% of the analysts have recommended “buy,” and 11% have recommended “hold.” There were no “sell” recommendations. Analysts have raised Huntsman’s 12-month target price to $30.11 from $28.71, implying a potential […]

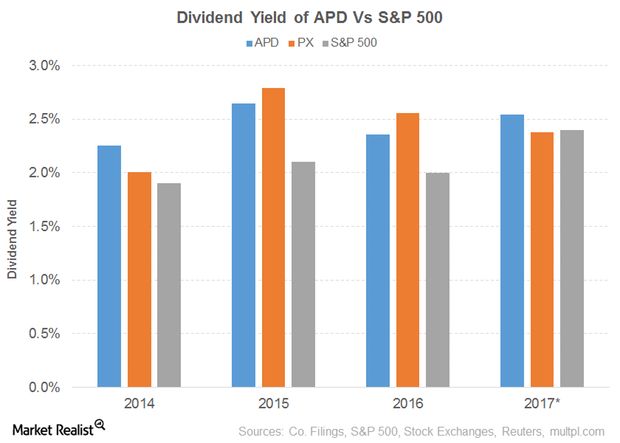

Dividend Yield of Air Products & Chemicals

In this series, we’ll be looking at ten dividend aristocrats with low PE ratios. Dividend aristocrats are S&P 500 stocks that have raised their dividend payouts for at least 25 successive years.

How Albemarle’s Refining Solutions Segment Performed in 2Q17

Albemarle’s (ALB) Refining Solutions is the company’s lowest revenue generator, accounting for 25.0% of its total revenues in 2Q17 compared to 26.6% in 2Q16.

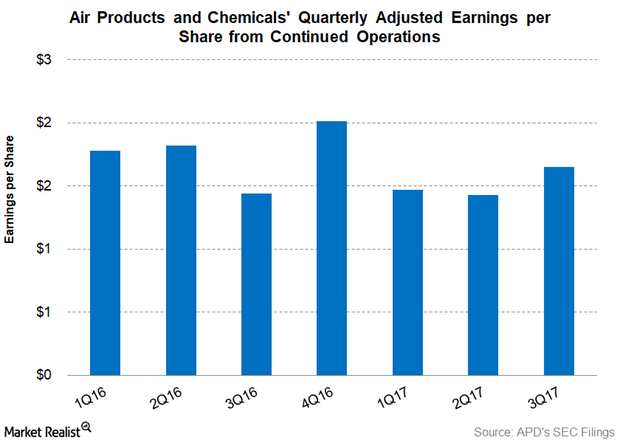

Air Products & Chemicals’ Stock Price Rose

Air Products & Chemicals (APD) announced its fiscal 3Q17 earnings on August 1, 2017. Its adjusted EPS from continuing operations was $1.65.

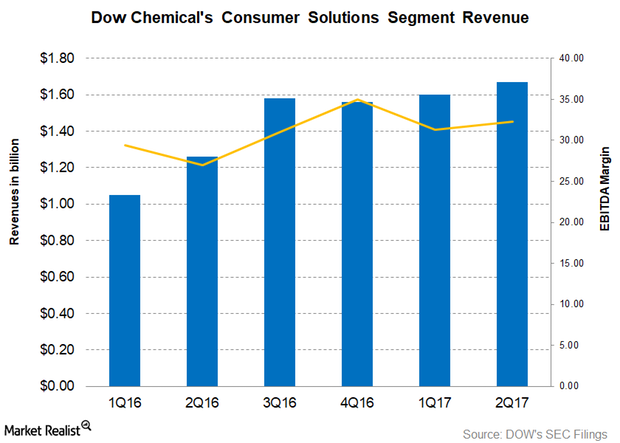

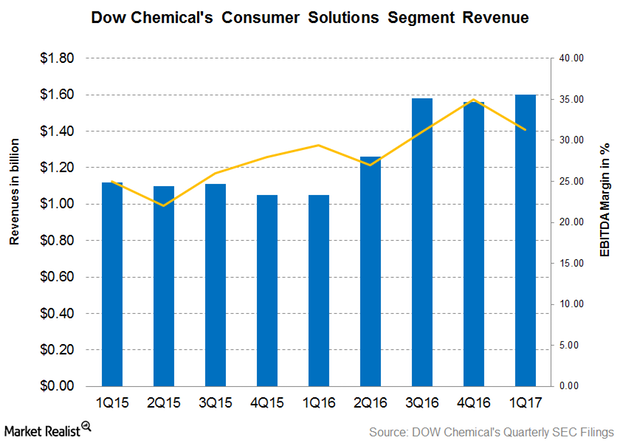

How Dow Chemical’s Consumer Solutions Segment Performed in 2Q17

Dow Chemical’s (DOW) Consumer Solutions segment is the fourth largest segment in terms of revenue.

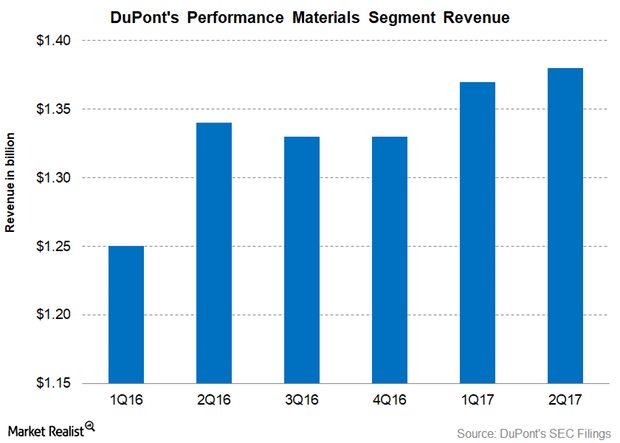

DuPont’s Performance Materials Segment’s Revenue Rose in 2Q17

In 2Q17, DuPont’s Performance Materials segment reported revenue of $1.38 billion—a increase of 3.40% on a YoY (year-over-year) basis.

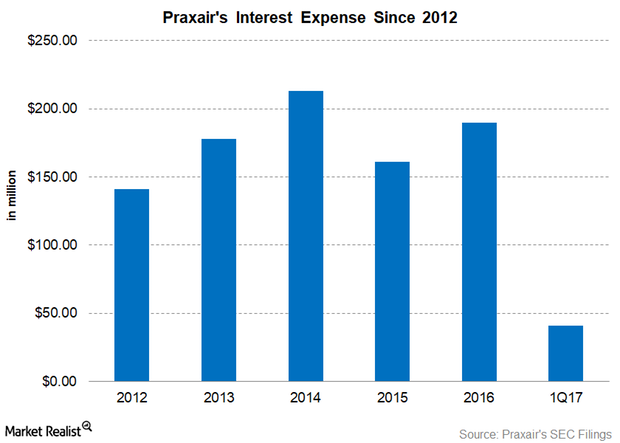

Can Praxair Manage Its Interest Expense?

Praxair’s (PX) interest expense has been on an upward trend since 2012 when its debt grew.

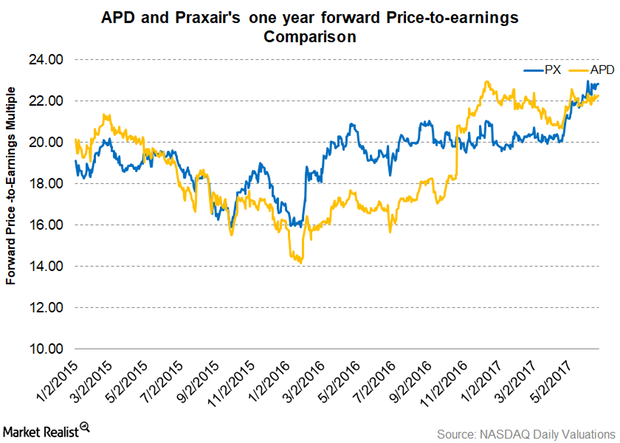

Why APD’s Latest Valuations Matter

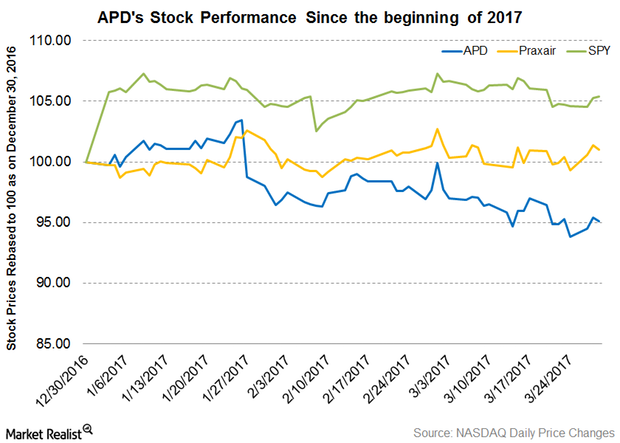

On June 19, 2017, Air Products and Chemicals (APD) was trading at a one-year forward PE ratio of 22.3x Praxair’s one-year forward PE ratio stood at 22.8x.

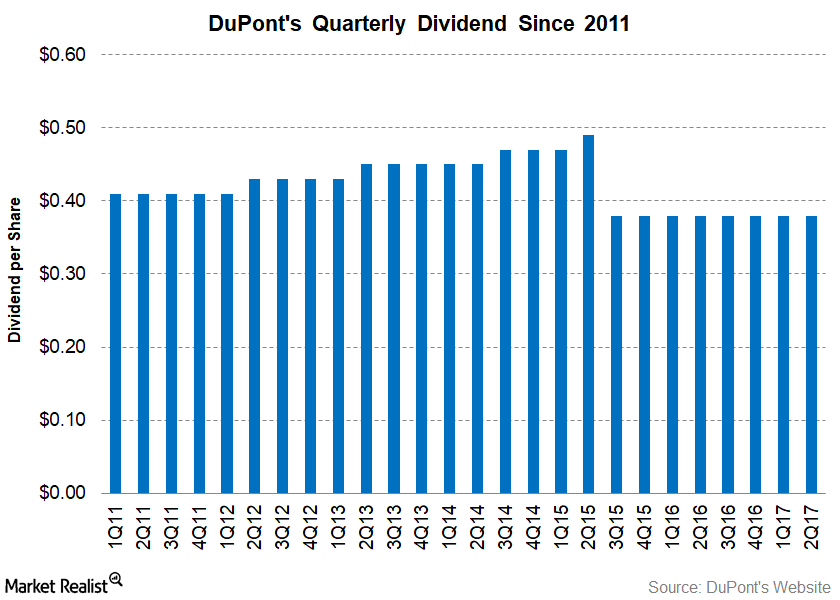

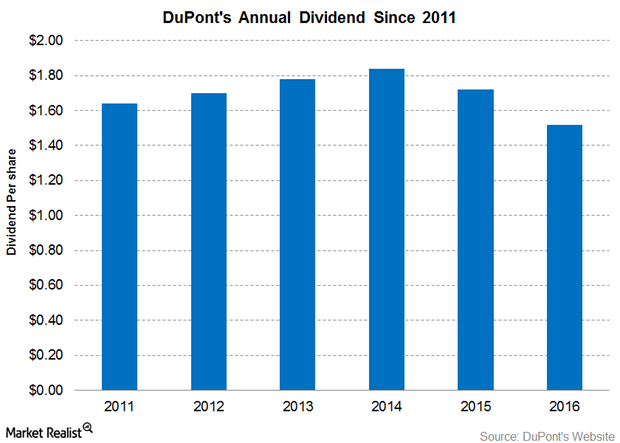

Are Investors Disappointed with DuPont’s Dividend Rate?

On April 26, 2017, DuPont (DD) declared a dividend of $0.38 per share on its outstanding common stock for fiscal 2Q17. The dividend will be payable on June 12, 2017.

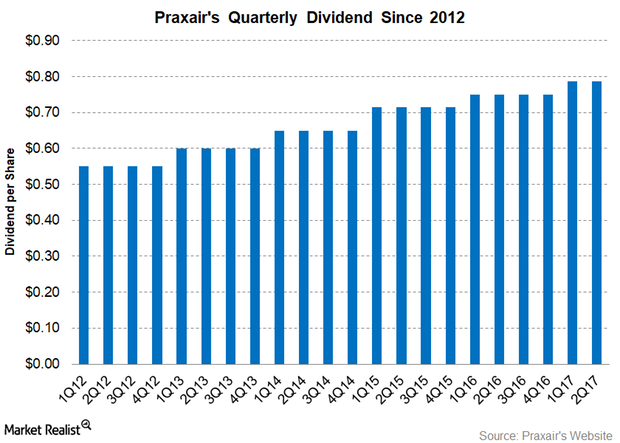

Will Praxair’s 2Q17 Dividend Inspire Investors?

On April 27, 2017, Praxair (PX) announced a dividend of ~$0.79 per share for 2Q17 on the company’s outstanding common stock.

Dow Chemical’s Consumer Solutions Segment Revenue Rose in 1Q17

Dow Chemical’s (DOW) Consumer Solutions segment reported revenue of $1.6 billion in 1Q17, a 51.7% rise year-over-year compared to $1.1 billion in 1Q16.

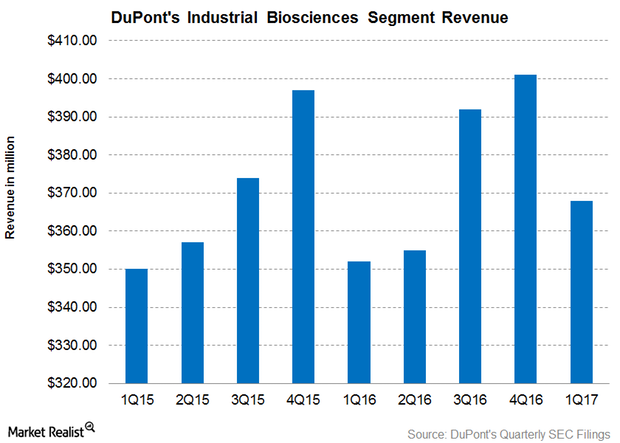

How Did DuPont’s Industrial Biosciences Segment Perform in 1Q17?

DuPont’s Industrial Biosciences segment in 1Q17 DuPont’s (DD) Industrial Biosciences segment, its smallest revenue contributor, accounted 4.8% in 1Q17. The segment reported revenue of $368 million in 1Q17, an increase of 4.5% from the $352 million seen in 1Q16. Increased demand of biomaterials for carpeting and new product launches in bioactives boosted sales volumes. However, revenue […]

Air Products & Chemicals Stock: 2017 Performance So Far

As of March 29, 2017, Air Products & Chemicals’ (APD) year-to-date stock performance was negative, falling 4.9% to date.

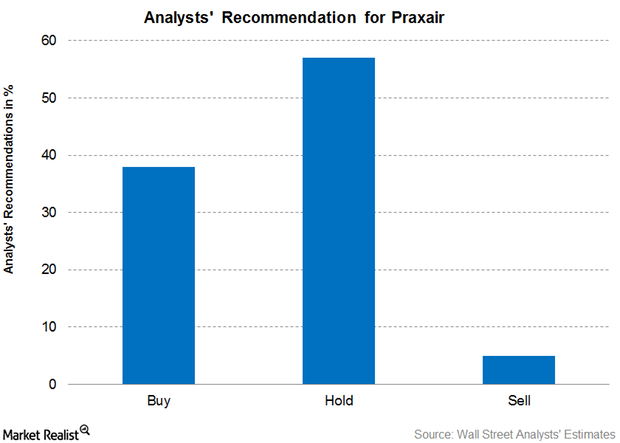

What Analysts Think about Praxair

As of March 14, 2017, 21 brokerage firms were tracking Praxair (PX) stock actively.

DuPont Set to Pay Its 450th Consecutive Quarterly Dividend

On January 27, 2017, DuPont (DD) declared a dividend of $0.38 per share for 1Q17 on the company’s outstanding common stock.

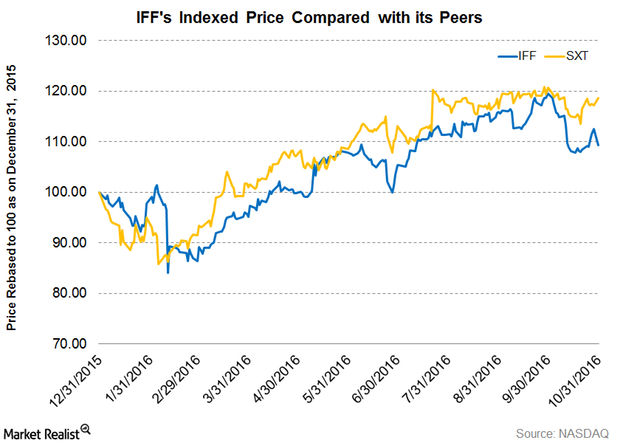

IFF Is Trading High: Can This Continue ahead of Its 3Q16 Results?

International Flavors and Fragrances (IFF) is set to report its 3Q16 earnings after the market closes on November 7, 2016.

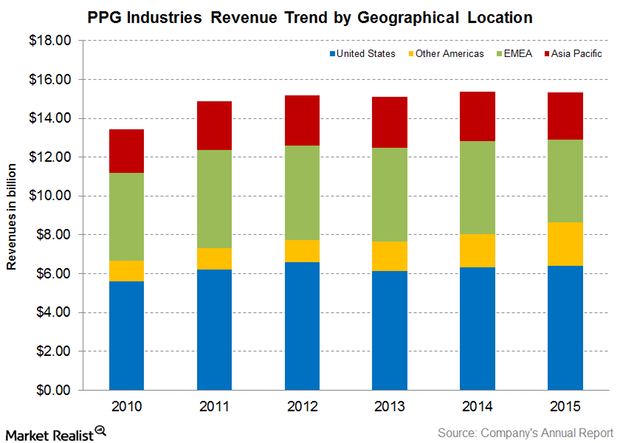

PPG Industries’ Geographical Revenue Mix

PPG Industries (PPG) is a leading global player in the paint and coatings segment, operating in 70 global locations. Let’s look at their revenue contributions to PPG.

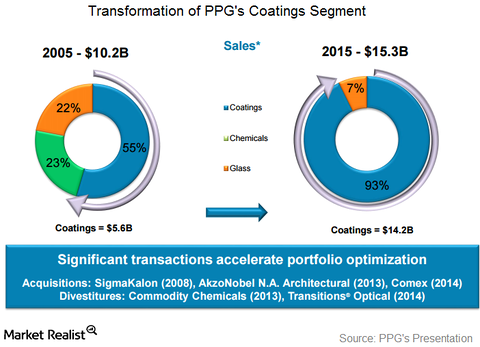

PPG Industries’ Business Model Aids Its Coatings Segment

PPG Industries’ (PPG) coatings segment has been growing at a CAGR of 7.1% since 2010. PPG has been able to increase its revenues basically through acquisitions.

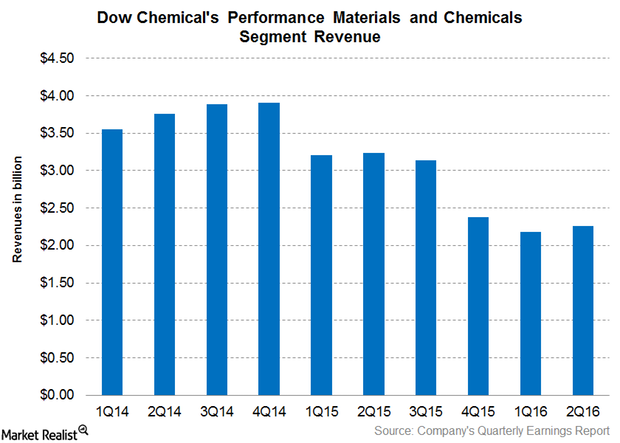

Why Dow’s Performance Materials and Chemicals’ Revenue Fell

Dow Chemical’s Performance Materials and Chemicals segment is the second largest revenue contributor to its total revenue.

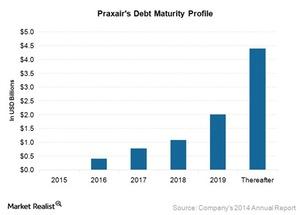

Does Praxair Have a Sustainable Debt Maturity Profile?

Praxair’s total debt has increased significantly, rising from $6.6 billion in 2011 to $9.3 billion in 2014.