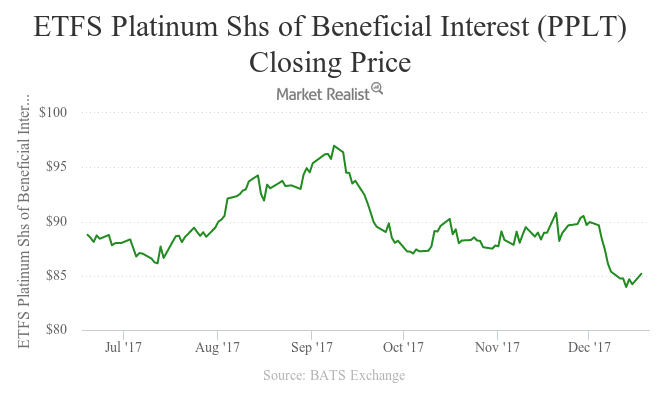

ETFS Physical Platinum

Latest ETFS Physical Platinum News and Updates

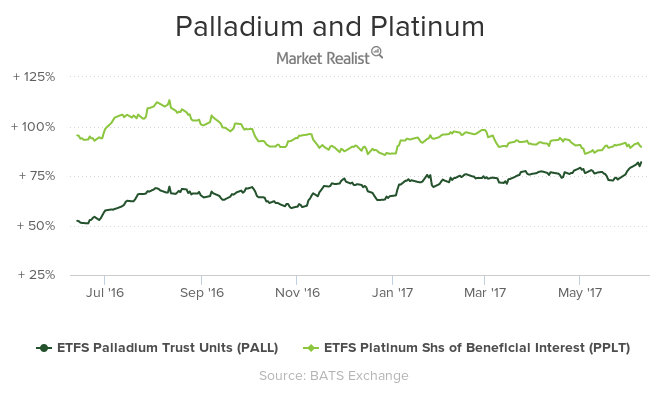

Platinum Touched Its Six-and-a-Half-Year Low in 2015

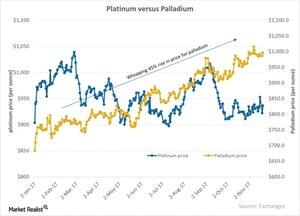

As automobile catalysts comprise ~44% of the demand for platinum, the Volkswagen scandal curbed the demand for diesel-fueled cars that use platinum as a catalyst. This pulled down the already depressed platinum and comparatively strengthened palladium.

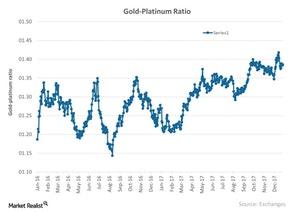

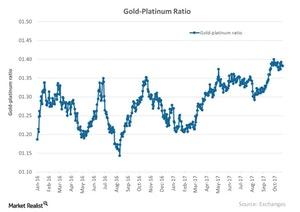

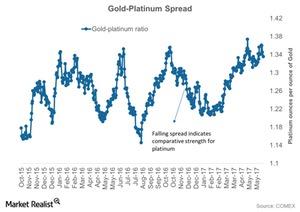

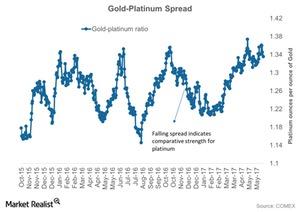

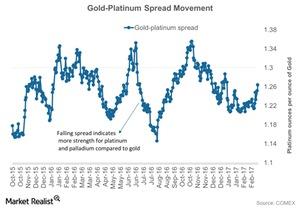

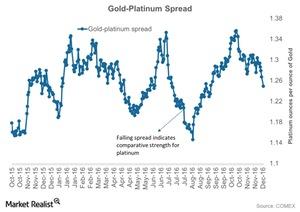

Understanding the Recent Gold-Platinum Cross Rate

When analyzing platinum markets, it’s important to compare the metal’s performance with that of gold, which is the most crucial of the precious metals.

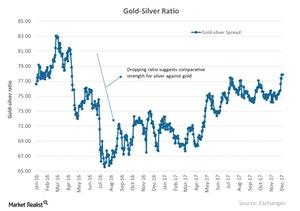

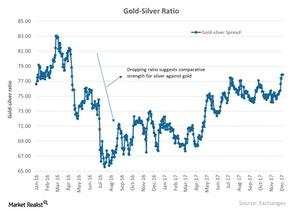

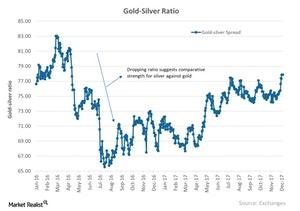

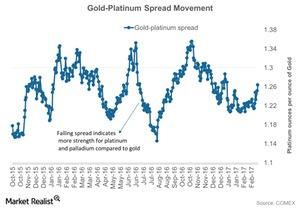

A Look at the Gold Spreads at the End of 2017

A gold-silver spread of 77.3 suggests that it requires almost 78 ounces of silver to buy a single ounce of gold.

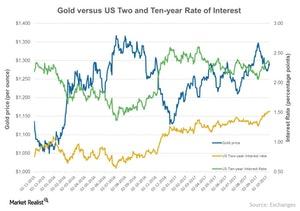

All 4 Precious Metals Rose on December 20, 2017

All four precious metals had an up day on December 20, 2017. Gold increased 0.43% on the day and closed at $1,267.80 per ounce.

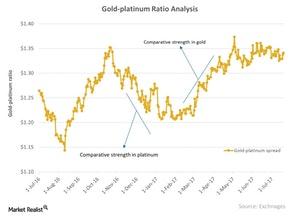

A Brief Look at December 2017’s Precious Metal Spread Measures

In this article, we’ll discuss the gold-silver, gold-platinum, and gold-palladium spreads. These three spreads stand at 77.9, 1.38, and 1.23, respectively.

Why Platinum Led the Precious Metals Pack on December 18

All four precious metals except palladium witnessed an up day on December 18, 2017. Platinum touched the day’s high of $915.3 and ended up at $913.2 per ounce.

Where Are Precious Metal Spreads Moving?

In this part of the series, we’ll look at the gold-silver spread, the gold-platinum spread, and the gold-palladium spread.

Insight into the Platinum Markets in November 2017

The gold-platinum ratio was ~1.4 on November 22, 2017.

An Overview of the Platinum and Palladium Markets in 2017

In September 2017, palladium prices overtook the price of platinum.

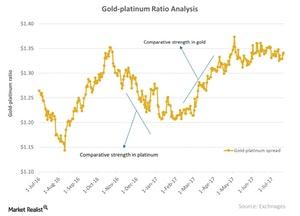

Platinum Ratio Analysis: Which Way Is Platinum Moving?

The gold-platinum spread was ~1.38 on October 23. The RSI (relative strength index) level for the gold-platinum spread is now at 93.9.

How Gold and Platinum Are Moving in Tandem

Like silver, platinum has industrial uses and has seen growing demand in China.

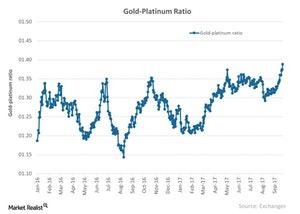

Platinum Market: Reading the Gold-Platinum Ratio

When reading the platinum market, it’s important to look at the relative performance of platinum and gold by using the gold-platinum ratio.

Gold-Platinum Ratio: Is Platinum a Long-Term ‘Buy’?

When reading the platinum market, it’s important to analyze the comparative performance of platinum and gold by using the gold-platinum ratio or spread.

Inside the Gold-Platinum Spread Now

The platinum industry is now headed for its third-straight year of surplus, likely due to the higher demand for petroleum-based cars.

Palladium Skyrockets: A Look at What’s in Store Next

Although gold and silver had a down day on Friday, June 9, 2017, platinum and palladium rose about 0.23% and 1.2%, respectively.

Platinum Is the Worst Performer So Far—Reading Its Spread

The gold-platinum spread was ~1.3 on April 26, 2017. The gold-platinum spread RSI on that day was 59.

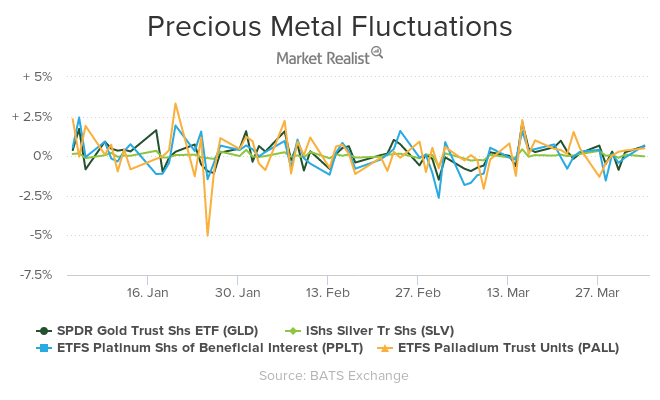

Reading the Performances of Precious Metals in 1Q17

Precious metals had a bright first quarter, which ended March 31, 2017. Gold rose about 8.4%, marking its best quarter in almost a year.

Where’s the Platinum Spread Headed in 2017?

Among the four precious metals, platinum has been the worst-performing precious metal and has seen a year-to-date rise of only 5.8%.

A Look at the Gold-Platinum Ratio

The demand for platinum has been very fragile over the past few years due to concerns about sales of diesel-based vehicles.

Where the Gold-Platinum Spread Is Headed

Platinum is known for its use in jewelry and as an autocatalyst for diesel-based automobile engines. The demand has been very fragile over the past few years.

How the Gold-Platinum Spread Could Move More

The demand for platinum has been very fragile over the past few years, affected by the reduced market forecast for sales of diesel-based vehicles.

Analyzing the Gold-Platinum Ratio in 2017

The gold-platinum spread was ~1.2 on January 11, 2017. Platinum’s RSI (relative strength index) was 38.

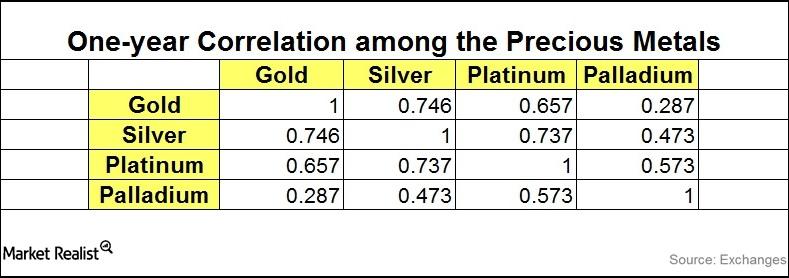

What Does the Precious Metal Correlation Suggest?

Gold and silver have a strong correlation close to 75%. This suggests that about 75% of the time, a fall in gold prices leads to a fall in silver prices.