iShares US Energy

Latest iShares US Energy News and Updates

Must-know: A quick look into the Antero Midstream IPO

On October 27, Antero Resources Corporation announced the initial public offering of Antero Midstream Partners LP.

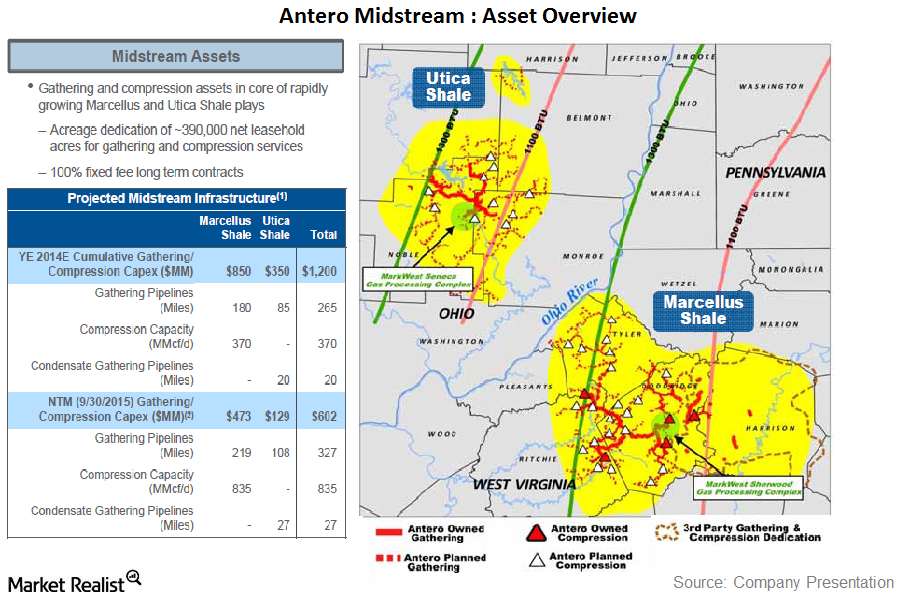

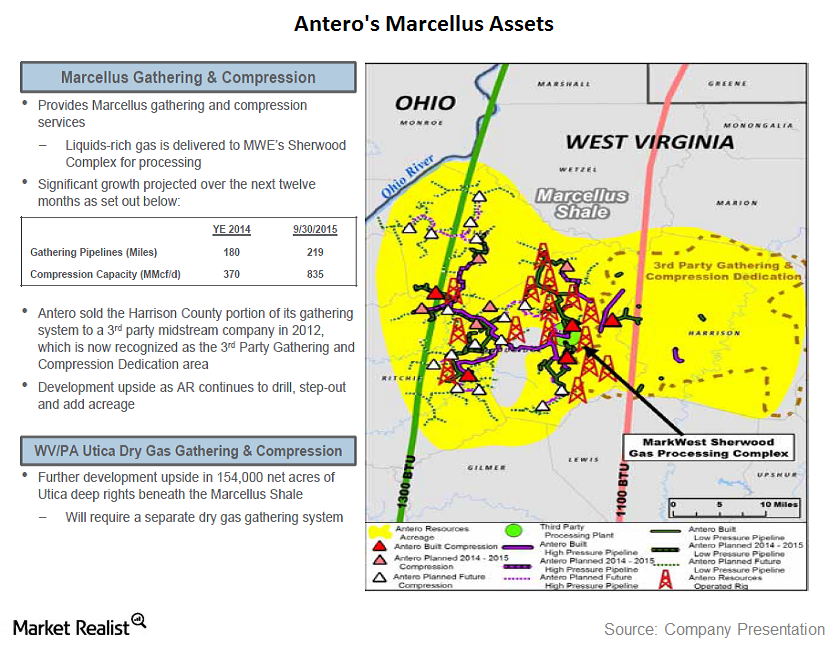

Key update on Antero Midstream’s assets

Antero Resources’ current acreage is focused in the Marcellus Shale in West Virginia and the Utica Shale in Ohio.

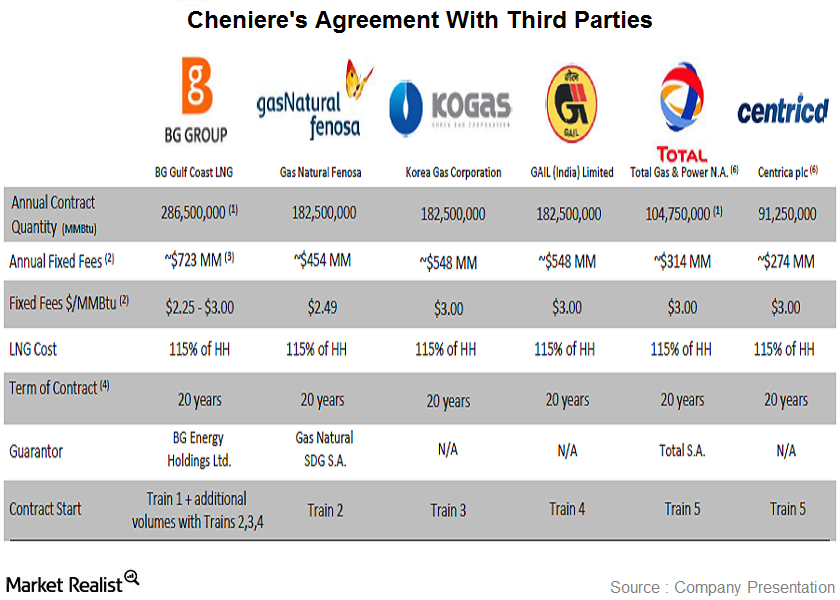

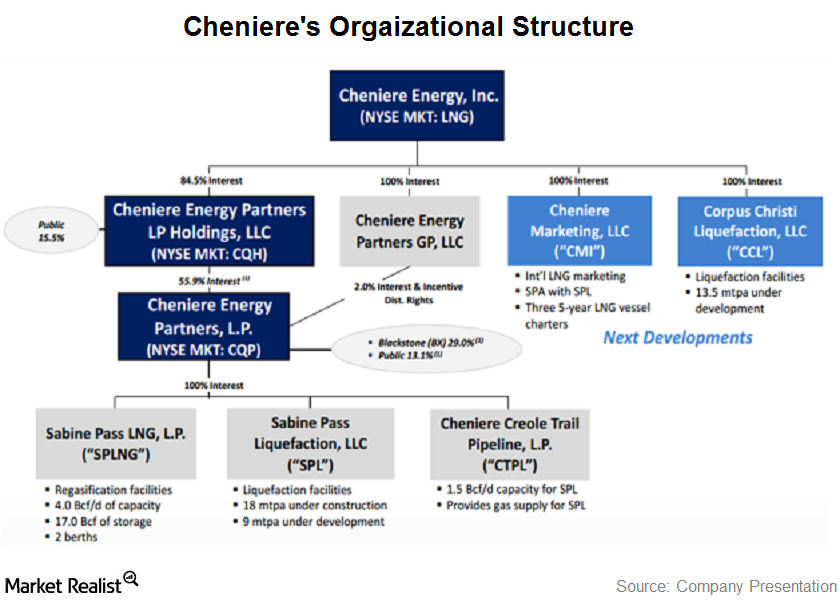

Overview of Cheniere’s sale and purchase contracts

Cheniere Energy, Inc.’s MLP company’s Sabine Pass liquefaction project has already secured four fixed-price, 20-year sales and purchase agreements with third parties.

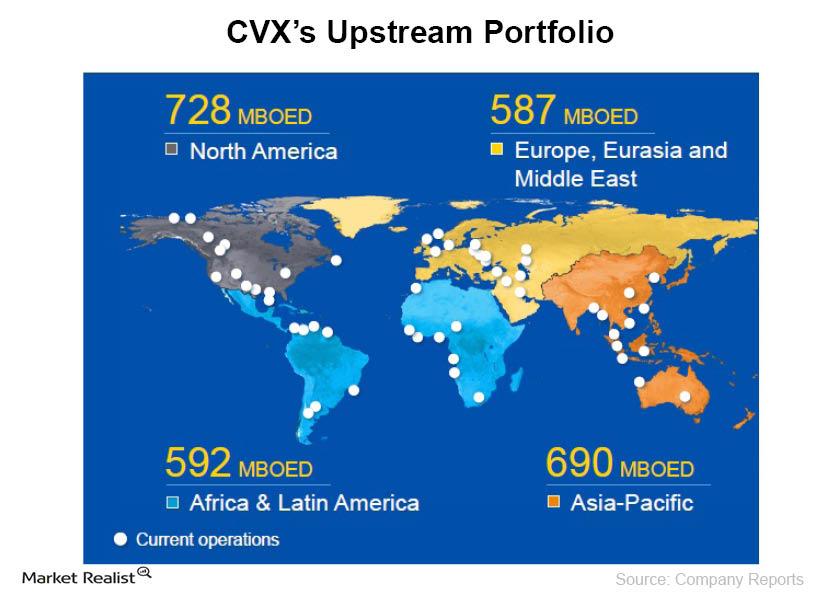

Chevron Corporation: A must-know brief overview

Chevron Corporation is currently trading at EV-to-2014E EBITDA of 5x, has an approximately $239 billion market cap, and ~$245 billion enterprise value.

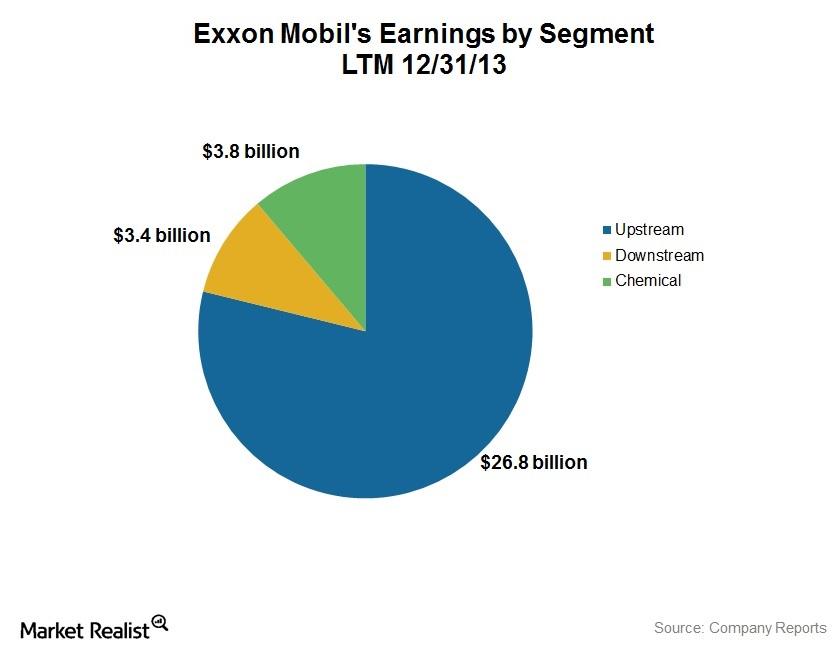

An essential guide to Exxon Mobil: XOM’s major areas of operation

Exxon Mobil has three major business segments: Upstream, Downstream, and Chemical. Upstream contributes the most to XOM’s earnings.

Why Did Crude Oil Prices Rise?

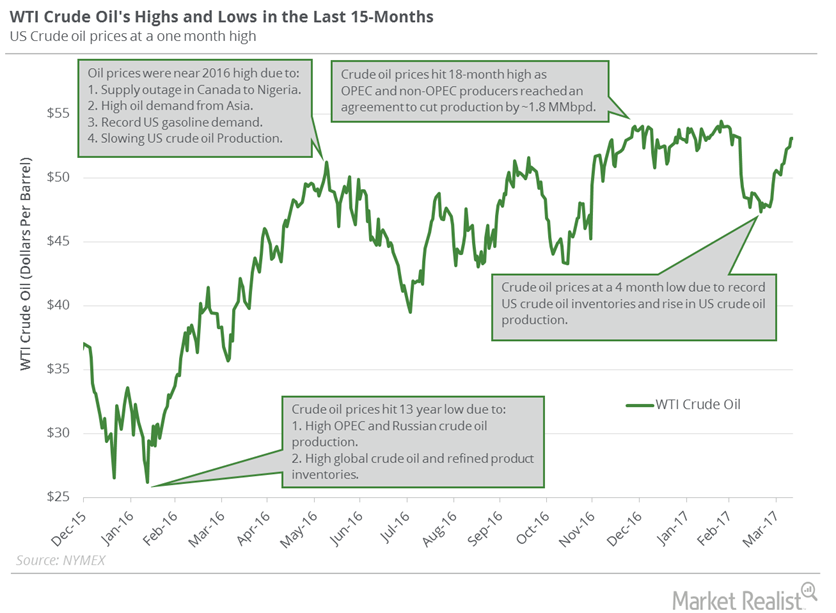

On February 9, 2017, US crude oil futures contracts for March delivery closed at $53.00 per barrel—an ~1.3% rise compared to the previous trading session.

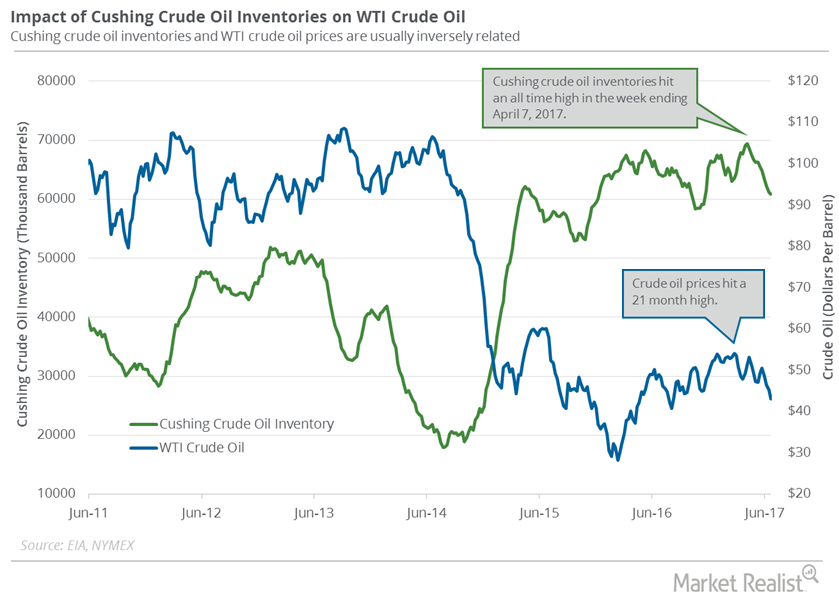

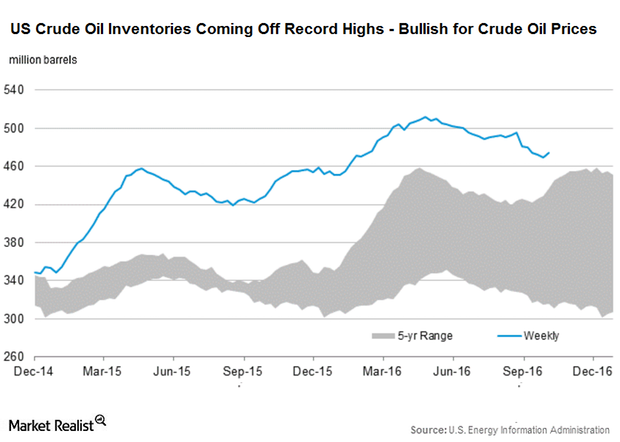

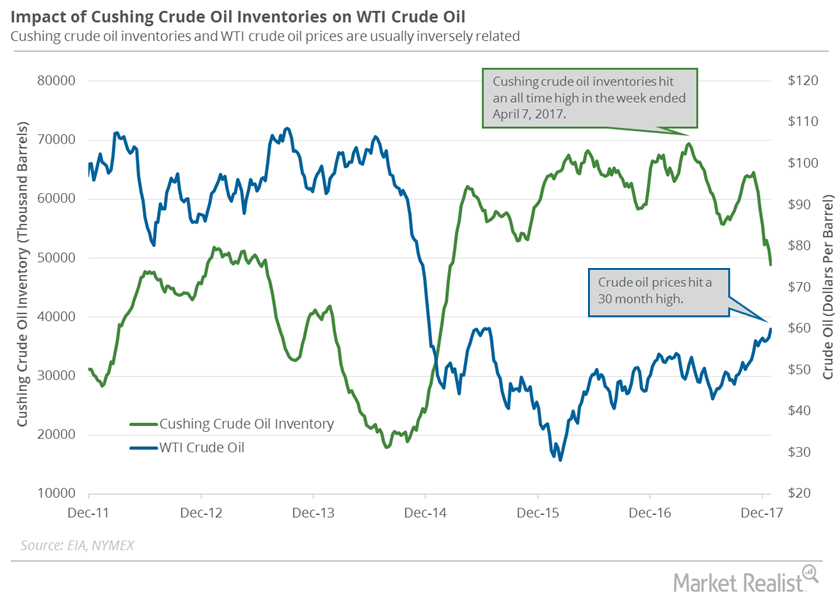

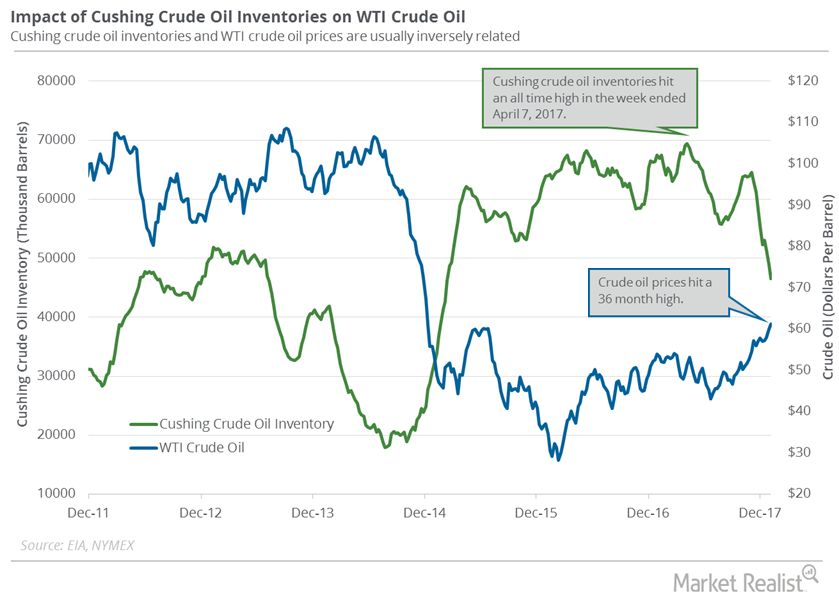

Cushing Inventories Have Fallen 10% in the Last 10 Weeks

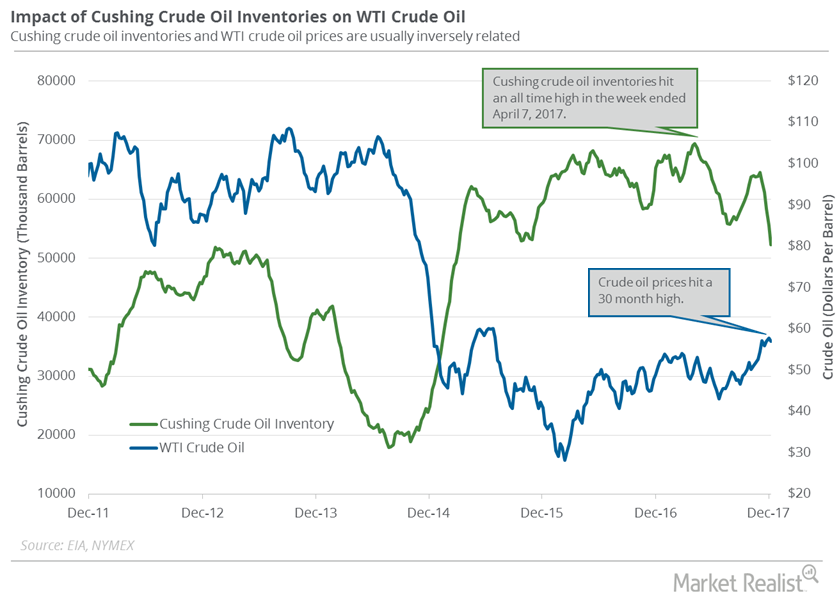

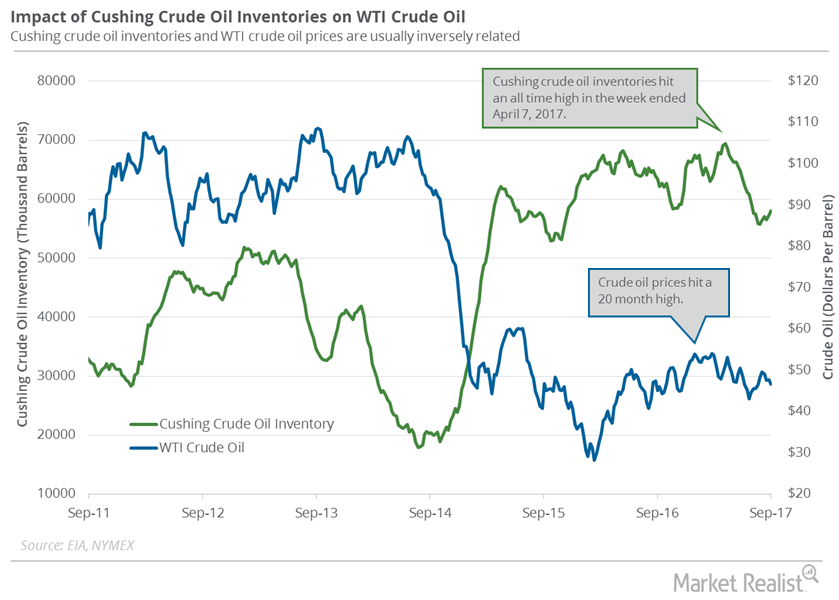

Cushing crude oil inventories have fallen 10% in the last ten weeks. A better-than-expected fall in Cushing inventories could support US crude oil prices.

A must-know overview of Cheniere Energy

Cheniere Energy, Inc., is a Houston-based energy company engaged in the liquefied natural gas business.The Sabine Pass liquefaction project is one of the first projects to receive the necessary government permits to export liquefied natural gas.

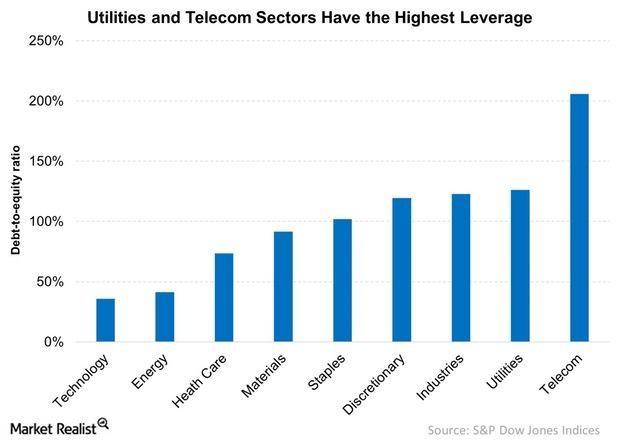

How a Rate Hike Could Affect High-Leverage Sectors

Industrials, utilities, and telecommunications have much higher leverage, as these sectors have massive capital needs.

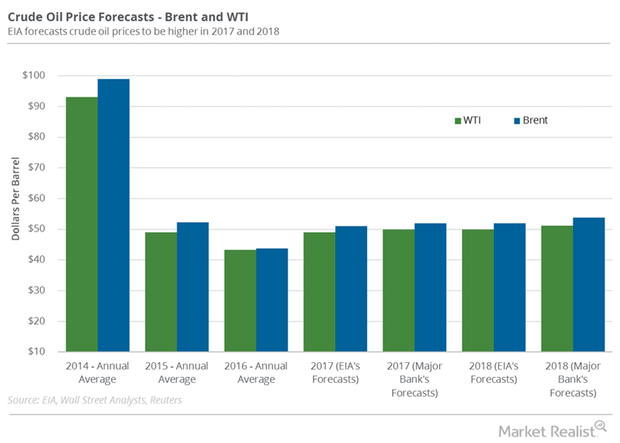

Crude Oil: Price Forecasts and Hedge Funds’ Position

Hedge funds increased their net long positions in US crude oil futures and options by 43,861 contracts or 18.4% to 282,362 contracts on July 25–August 1.

Will API Inventory Report Limit Upside for Crude Oil Prices?

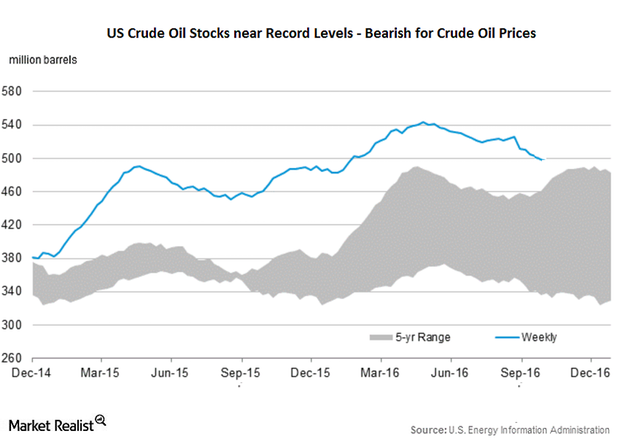

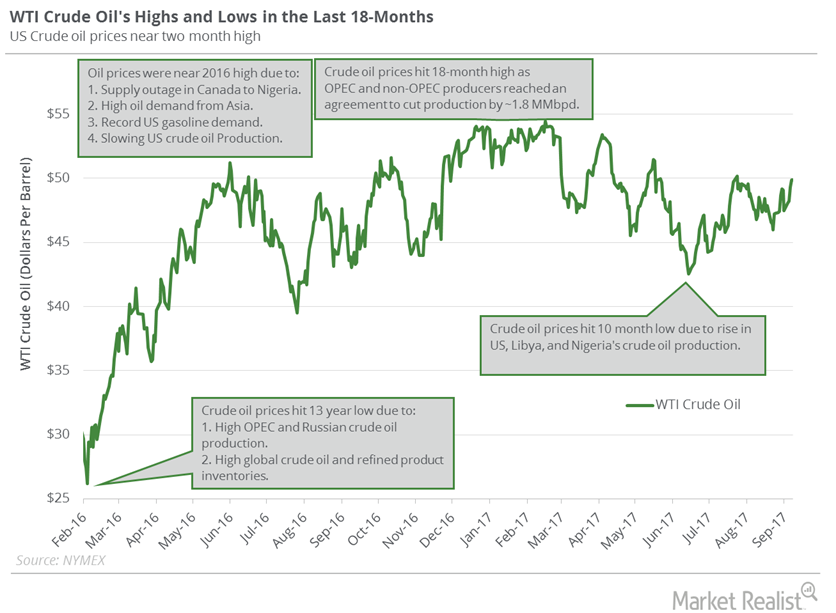

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.32% to $50.97 per barrel in electronic trade at 5:10 AM EST on October 12, 2016.

Will US Crude Oil Futures Rise above $50 per Barrel This week?

September US crude oil prices are on a rollercoaster ride in 2017 due to bullish and bearish drivers. US crude oil prices are near a two-month high.

Credit Default Swaps as Insurance against Junk Bond Market Crash

Carl Icahn mentions the use of credit default swaps as a form of protection against credit events. He implies that investors should possess sophisticated knowledge of the fixed income markets to enter that playing field.

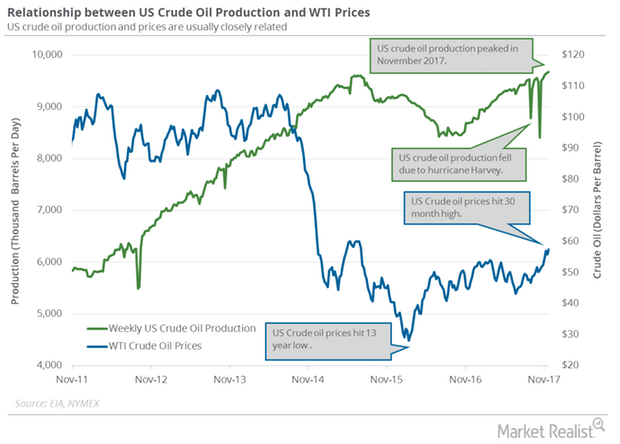

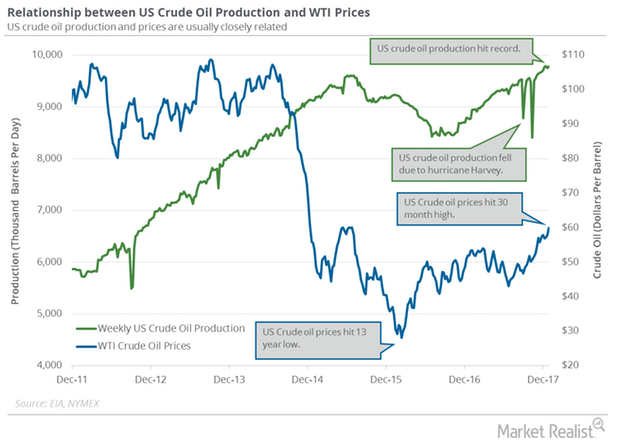

Traders Track US Crude Oil Production and Exports

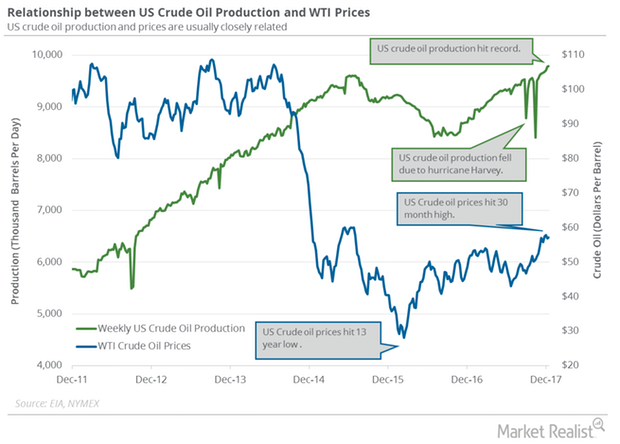

US crude oil production rose by 290,000 bpd (barrels per day) or 3.1% to 9,481,000 bpd in September 2017—compared to the previous month.

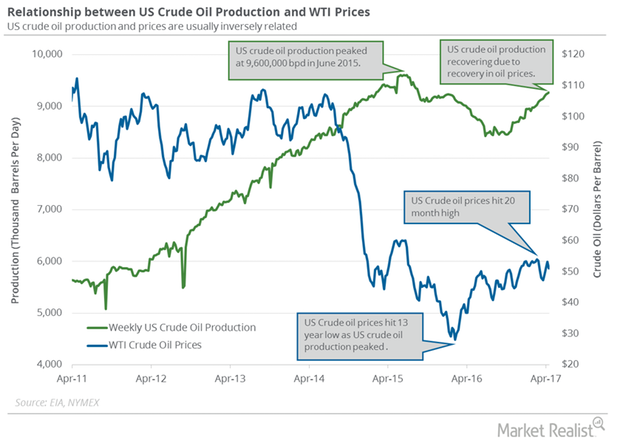

US Crude Oil Production Is near August 2015 High

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 13,000 bpd (barrels per day) to 9,265,000 bpd on April 14–21.

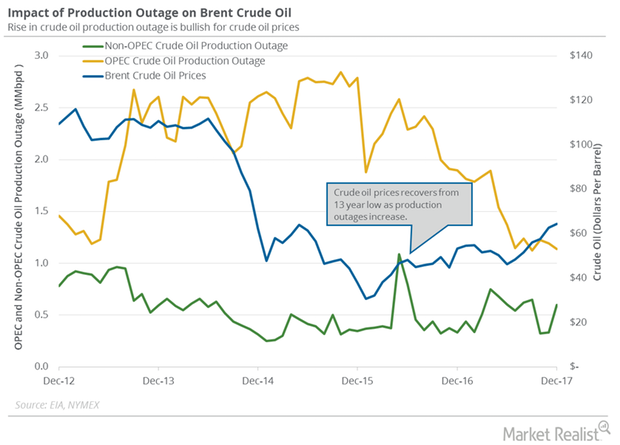

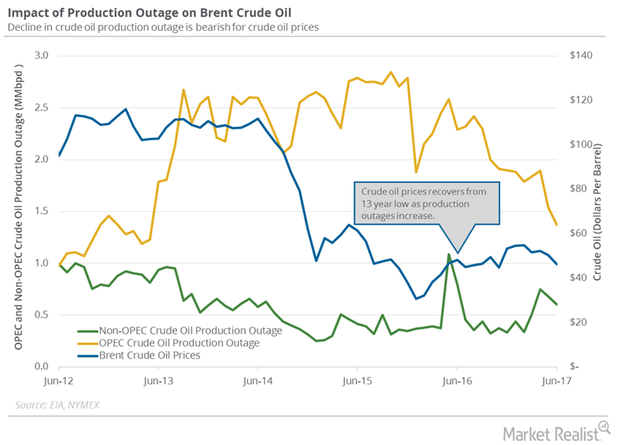

Global Crude Oil Supply Outages Are near a 4-Month High

Global crude oil supply outages increased by 208,000 bpd (barrels per day) to 1,738,000 bpd in December 2017—compared to the previous month.

Will Crude Oil Prices Hit a New High?

US WTI crude oil prices were at $54.45 per barrel on February 23—the highest level since June 2015. As of April 10, prices were 2.5% below their high.

Global Crude Oil Supply Outages Near 5-Year Low

The US Energy Information Administration estimates that global crude oil supply outages fell by 247,000 bpd (barrels per day) to 2.0 MMbpd (million barrels per day) in June 2017.

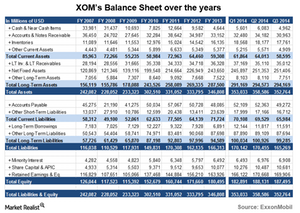

An essential analysis of ExxonMobil’s balance sheet

On a combination of several factors such as its earnings, share buybacks, and XTO acquisition, XOM’s balance sheet has grown.

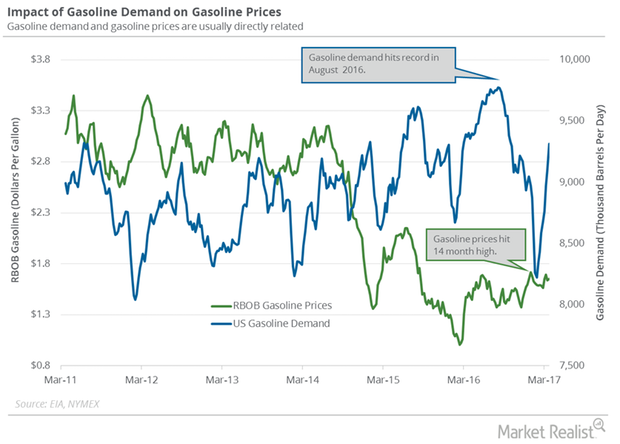

US Gasoline Demand: Key Crude Oil Driver in 2017

The EIA estimated that four-week average US gasoline demand rose by 210,000 bpd (barrels per day) to 9,312,000 bpd from March 17–24, 2017.

US Crude Oil Prices Are Trading Near a 2016 High!

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.5% and settled at $50.44 per barrel on October 13.

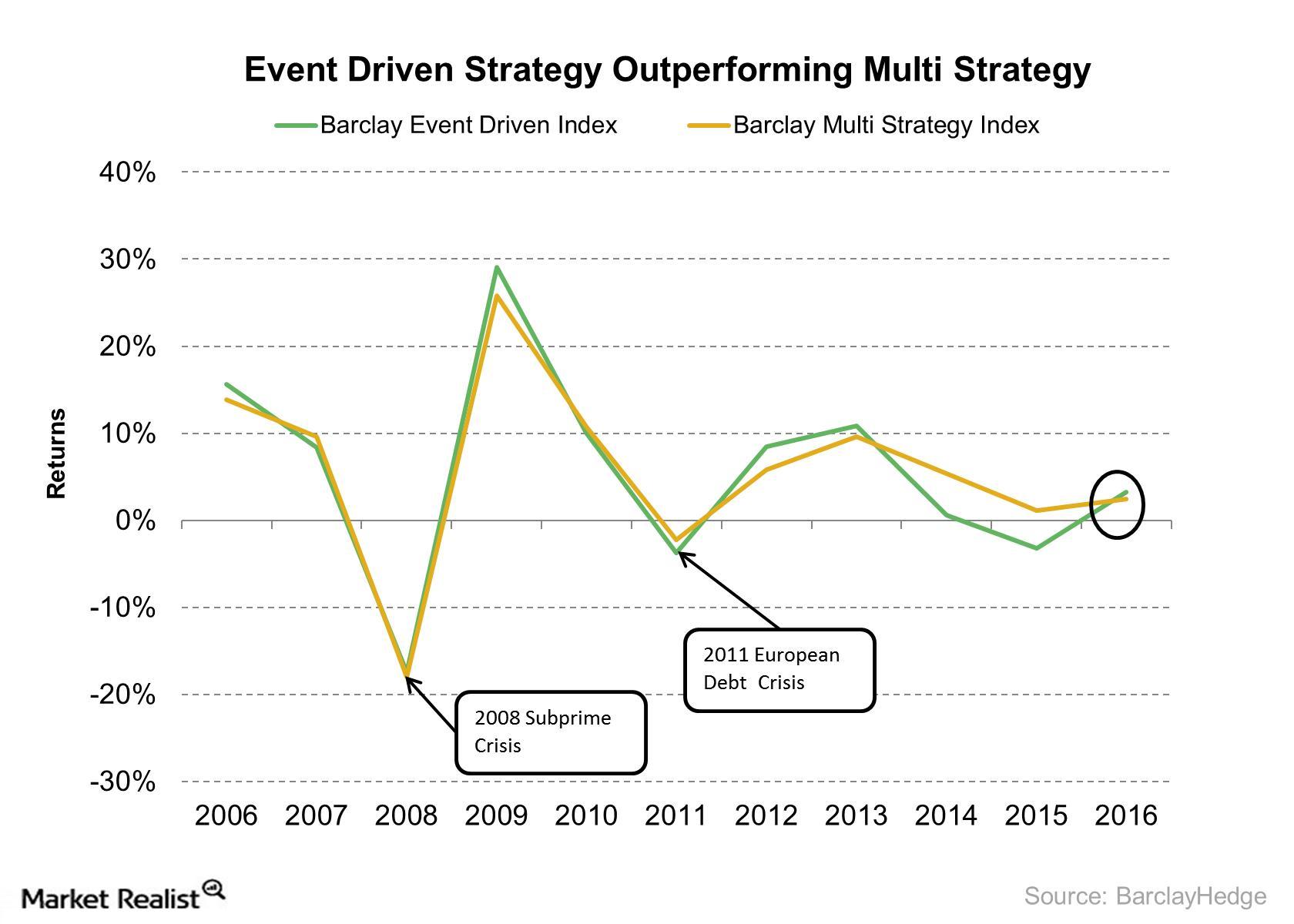

Event-Driven Strategy in a Volatile Market

Event-driven strategy is designed to make an investment in special situations, including mergers and acquisitions, restructuring, split-offs, bankruptcy, and other major events.

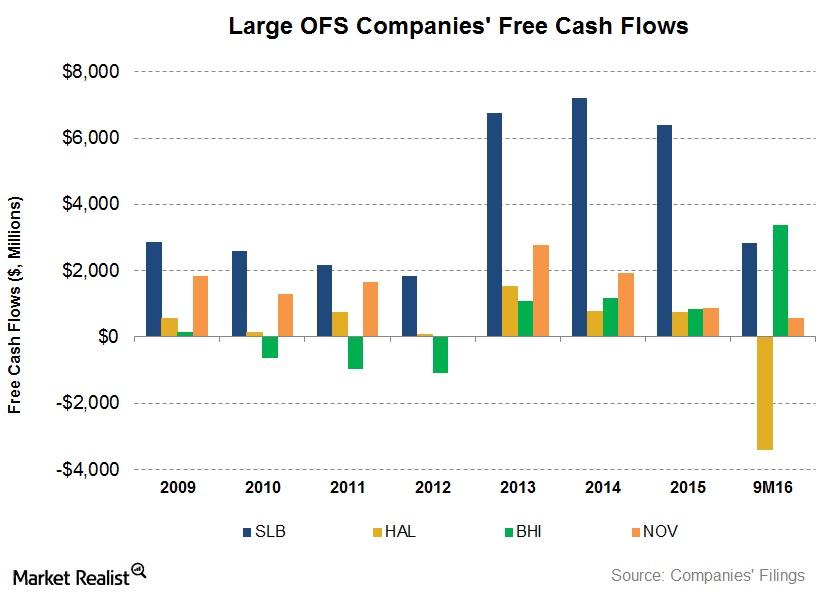

Free Cash Flow Trends: Are OFS Companies Burning Cash?

Many oilfield equipment and services (or OFS) companies’ cash flows have taken a beating following the energy price weakness in the past two years.

Cushing Inventories Hit February 2015 Low

A Bloomberg survey estimated that the crude oil inventories at Cushing could have fallen by 1.5 MMbbls between December 29, 2017, and January 5, 2018.

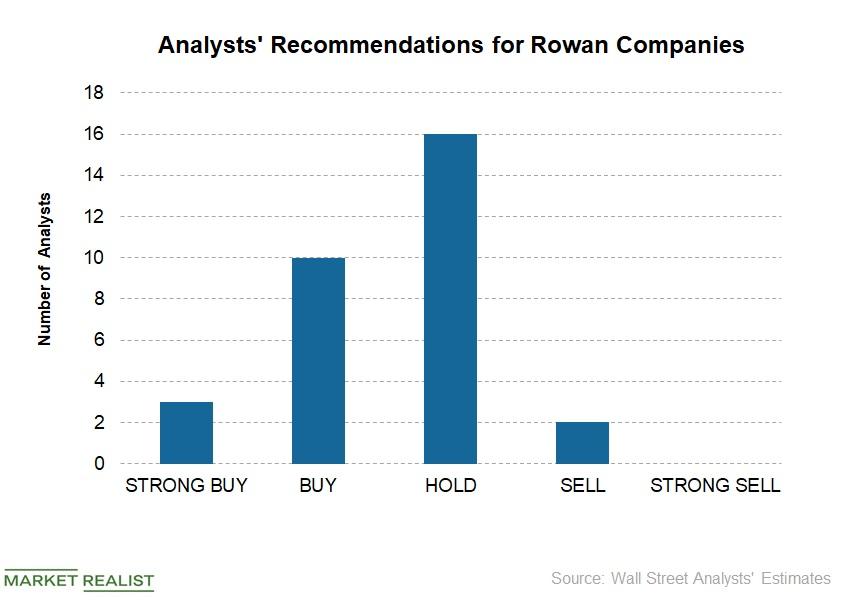

Wells Fargo Upgrades Rowan Companies to ‘Outperform’

RDC’s analyst recommendations Analysts’ consensus rating for Rowan (RDC) is 2.6, which means a “hold.” Peers Transocean (RIG), Diamond Offshore (DO), Noble (NE), and Ensco (ESV) also have “hold” ratings. Of the 31 analysts covering Rowan (RDC), 39% recommend “buy” or some equivalent, 55% recommend “hold,” and 6% recommend “sell.” Among the top offshore drilling stocks […]

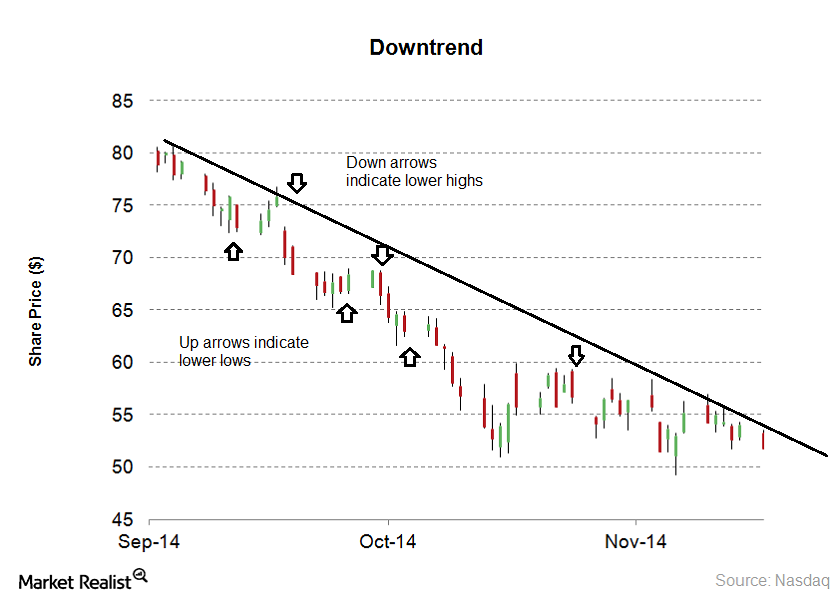

Why downtrends and sideways trends impact investors

It’s advisable to sell stocks on bounces when the stock is in a downtrend. In a sideways trend, it’s advisable to buy stock at support levels and sell at resistance levels.

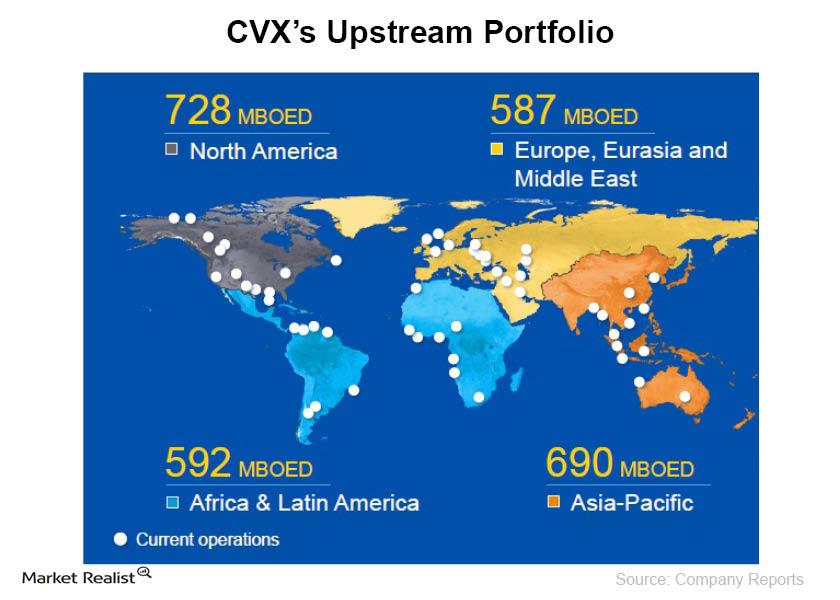

Must-know: An overview of Chevron Corporation

CVX is headquartered in San Ramon, California. It’s an energy company that engages in oil and gas exploration, production, refining, marketing, and transportation of oil and gas.Energy & Utilities Southwestern is among the largest US oil and natural gas producers

Headquartered in Houston, Texas, Southwestern Energy Corporation (SWN) is one of the largest independent natural gas and oil producers in the United States.

Will US Crude Oil Production Undermine Crude Oil Futures?

According to the EIA, US crude oil production increased by 28,000 bpd (barrels per day) to 9,782,000 bpd on December 22–29, 2017.

Cushing Inventories Fell 33% from the Peak

Analysts expect that Cushing crude oil inventories could have declined on January 5–12, 2018. A fall in Cushing inventories is bullish for oil prices.

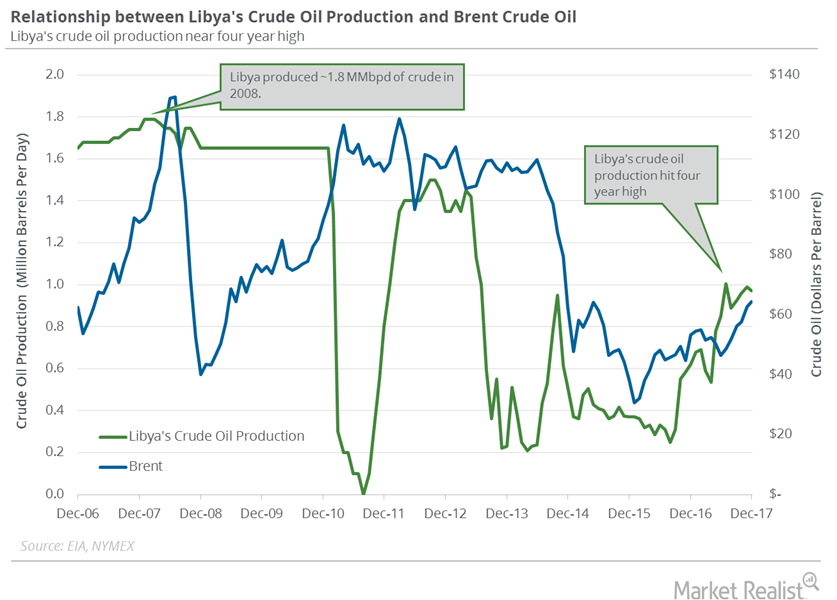

Restarting the Wintershall Oilfields in Libya Could Impact Oil Prices

On January 21, the NOC (National Oil Corporation) of Libya said that it would restart the Wintershall AG’s Sara oilfield. NOC is a state-owned oil company.

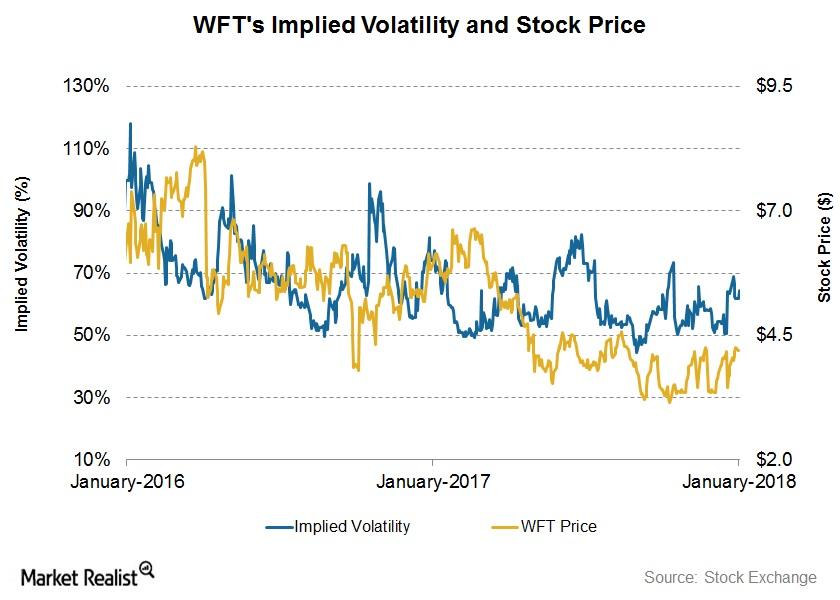

Weatherford’s Stock Price Forecast

On January 16, Weatherford International’s (WFT) implied volatility (or IV) was ~64%. Its 3Q17 earnings were announced on November 1, 2017. Since then, its implied volatility has increased from 54% to the current level.

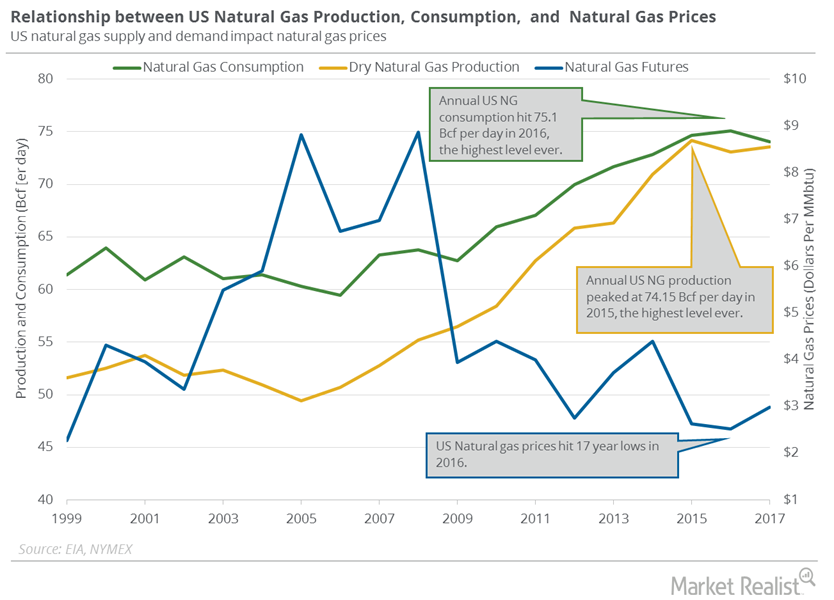

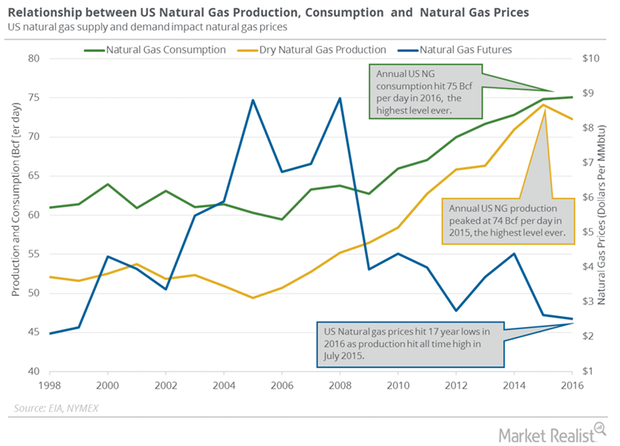

US Natural Gas Consumption Could Hit a Record in 2018 and 2019

US natural gas consumption fell 14.4% to 102.6 Bcf (billion cubic feet) per day on January 4–10, 2018, according to PointLogic.

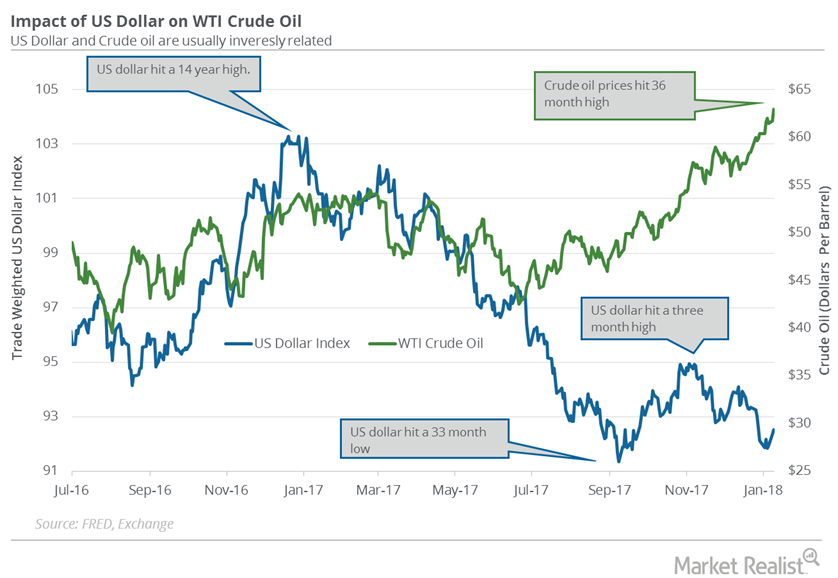

US Dollar Recovering from 3-Month Low: Bearish for Crude Oil?

The US Dollar Index fell ~9.8% in 2017. The dollar fell partly due to the improving economy outside the US. It was the worst annual drop since 2003.

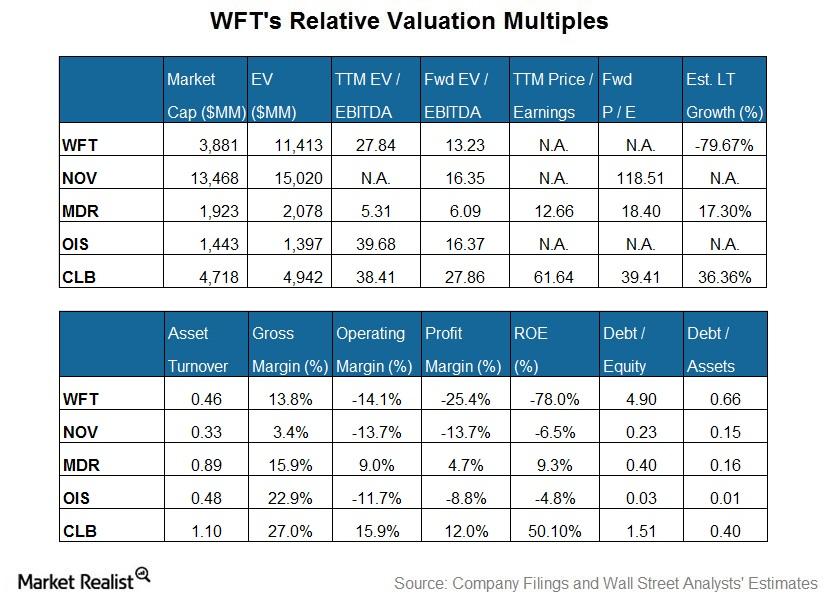

Weatherford International’s Valuation Compared to Its Peers

Weatherford International’s (WFT) EV (enterprise value) when scaled by a trailing 12-month adjusted EBITDA is close to the peer average in our group.

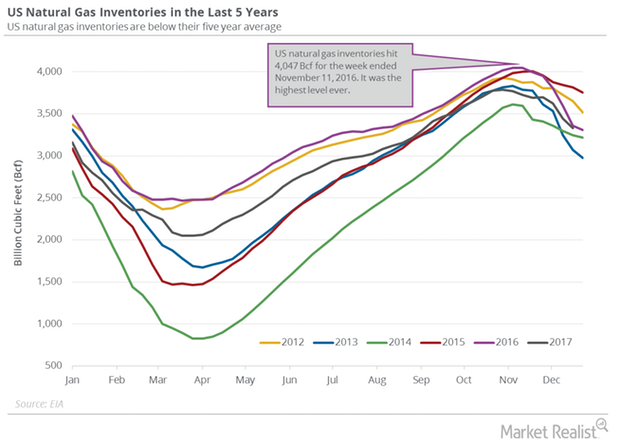

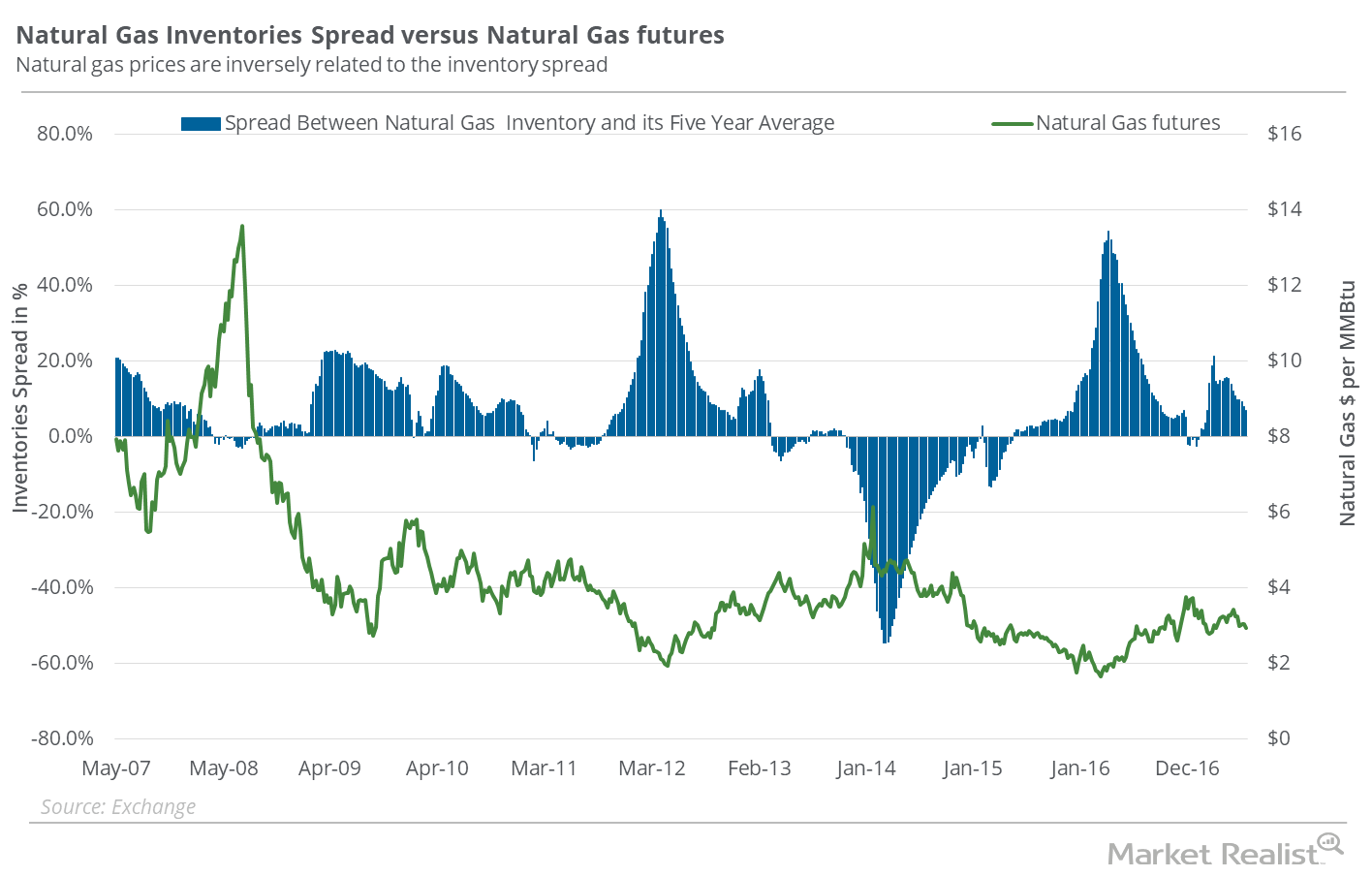

Natural Gas Inventories Could Help US Natural Gas Prices

A larger-than-expected withdrawal in US natural gas inventories compared to historical averages would help natural gas prices this week.

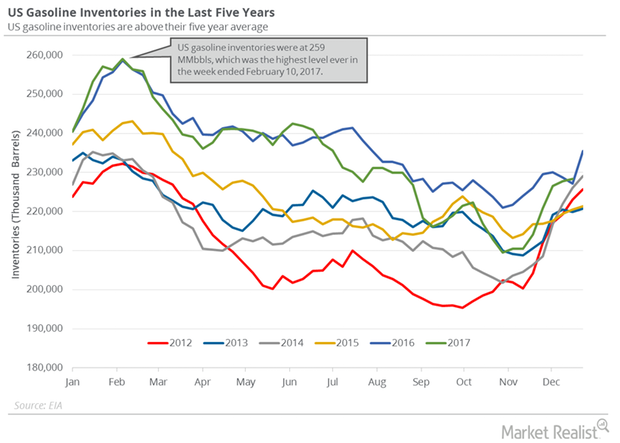

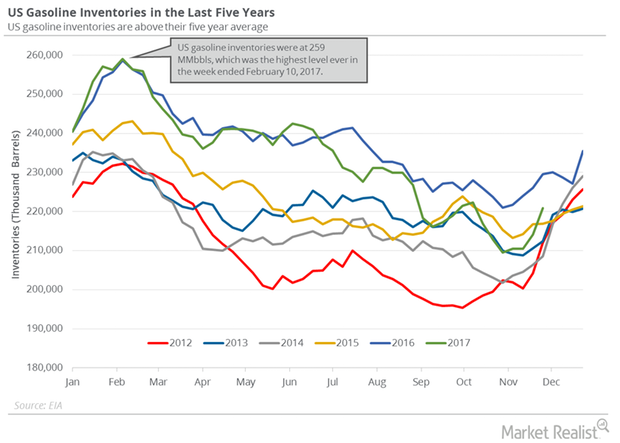

Why Oil Traders Are Tracking US Gasoline Inventories

US gasoline inventories rose by 0.5 MMbbls (million barrels) or 0.3% to 228.3 MMbbls from December 15 to 22, 2017, per the EIA.

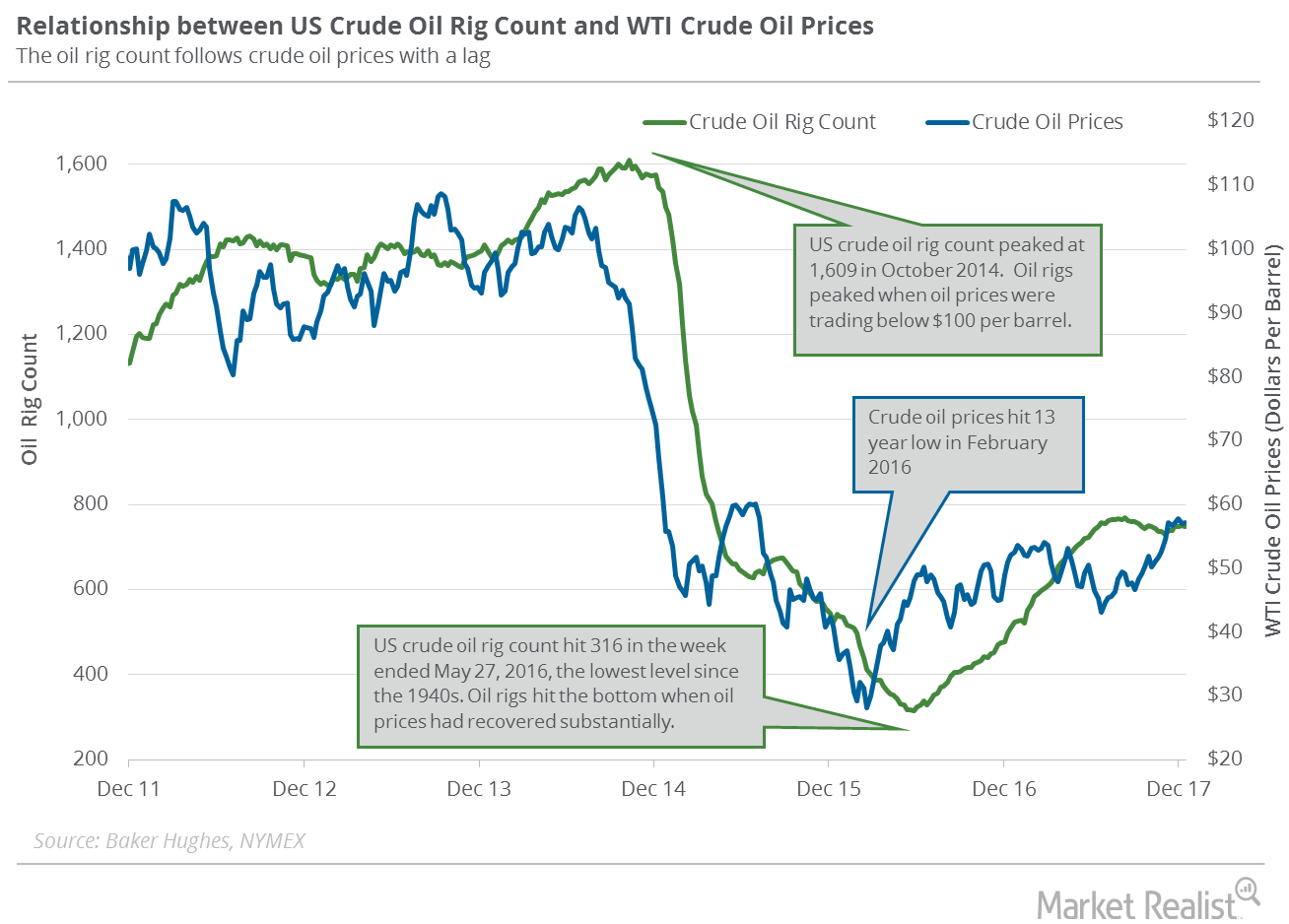

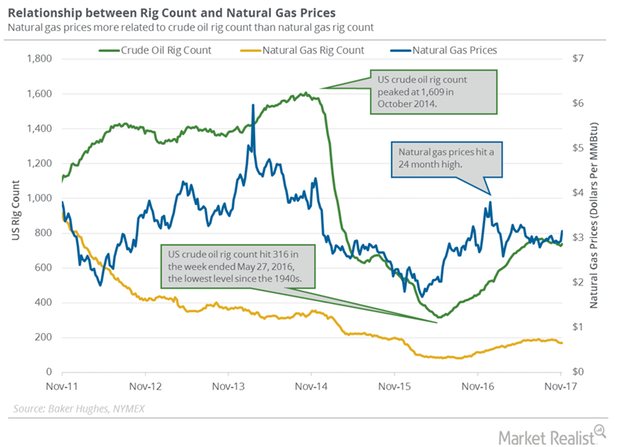

US Crude Oil Rig Count: Almost Flat in the Last 5 Weeks

Baker Hughes published its US crude oil rig report on December 22, 2017. The US crude oil rig count was flat at 747 on December 15–22, 2017.

Crude Oil Prices: Which Factor Could Change the Trend?

The EIA estimated that US crude oil production rose by 9,000 bpd (barrels per day) to 9,789,000 bpd on December 8–15, 2017.

Cushing Inventories: Largest Weekly Fall since 2009

Cushing inventories fell by 3,317,000 barrels to 52.2 MMbbls (million barrels) on December 1–8, 2017, according to the EIA.

EIA Upgrades US Natural Gas Production for 2018

US dry natural gas production was flat at 76.1 Bcf (billion cubic feet) per day on December 7–13, 2017, according to PointLogic.

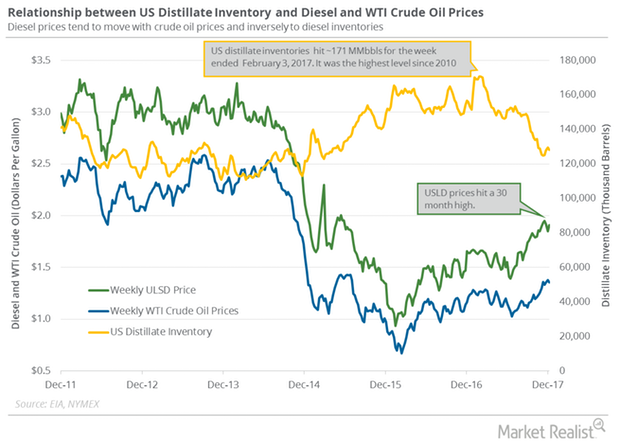

US Distillate Inventories Fell for the First Time in 4 Weeks

US distillate inventories fell by 1.3 MMbbls (million barrels) to 128.1 MMbbls on December 1–8, 2017, according to the EIA.

US Gasoline Inventories Add More Pain to Crude Oil Futures

According to the EIA, US gasoline inventories rose by 6,780,000 barrels to 220.8 MMbbls (million barrels) on November 24–December 1, 2017.

Production Cut Extension Could Influence US Natural Gas Rigs

Baker Hughes, a GE company, is scheduled to release its US crude oil and natural gas rig count report on December 1, 2017.

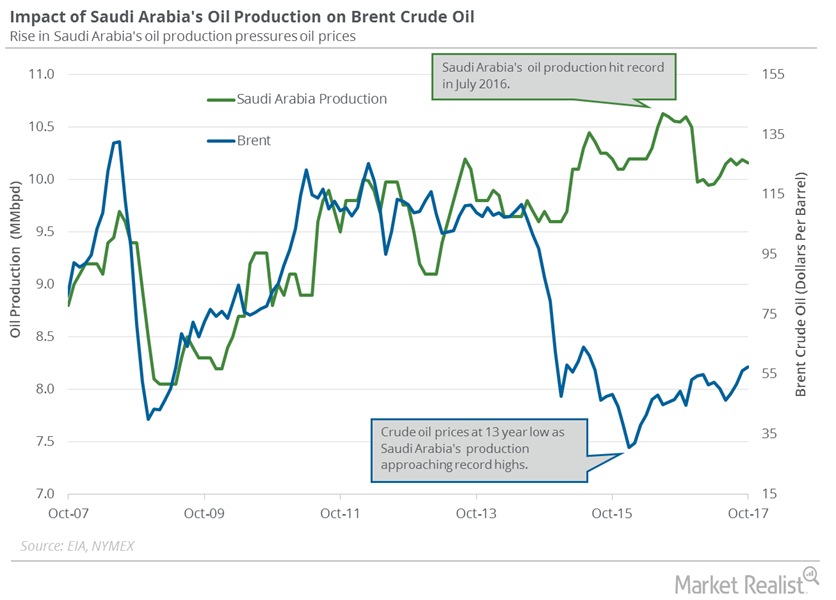

Saudi Arabia Could Help the Global Oil Market

Saudi Arabia’s crude oil exports to the US fell to 525,000 bpd in October 2017—the lowest in 30 years. Exports fell due to ongoing output cuts.

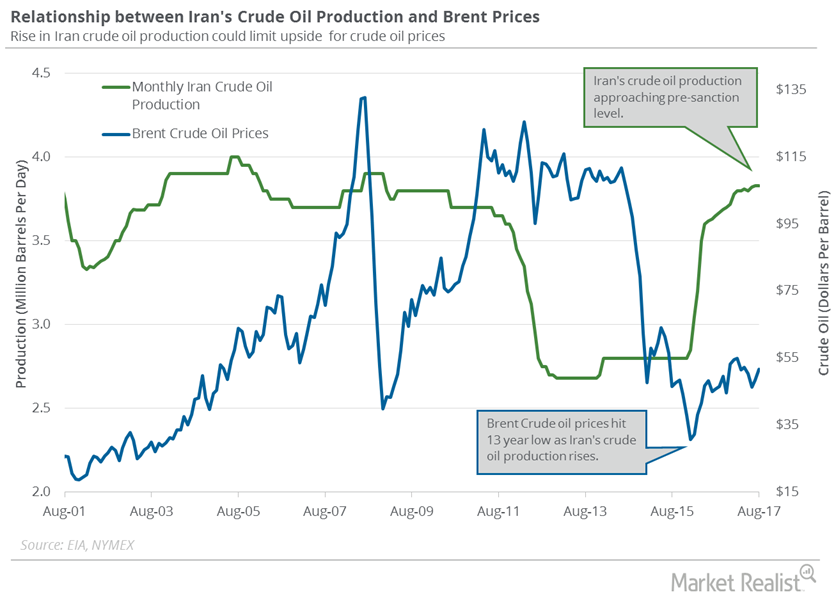

Iran’s Crude Oil Production Was Flat in August 2017

The EIA estimates that Iran’s crude oil production was flat at 3.8 MMbpd (million barrels per day) in August 2017—compared to July 2017.

Will US Crude Oil Futures Break $50 per Barrel?

Let’s track some important events for crude oil and natural gas traders between September 18 and September 22.

Why Cushing Crude Inventories Rose for the 4th Time in 5 Weeks

A market survey estimates that Cushing crude oil inventories fell from September 1 to 8, 2017. Cushing crude oil inventories rose for the fourth time in the last five weeks.

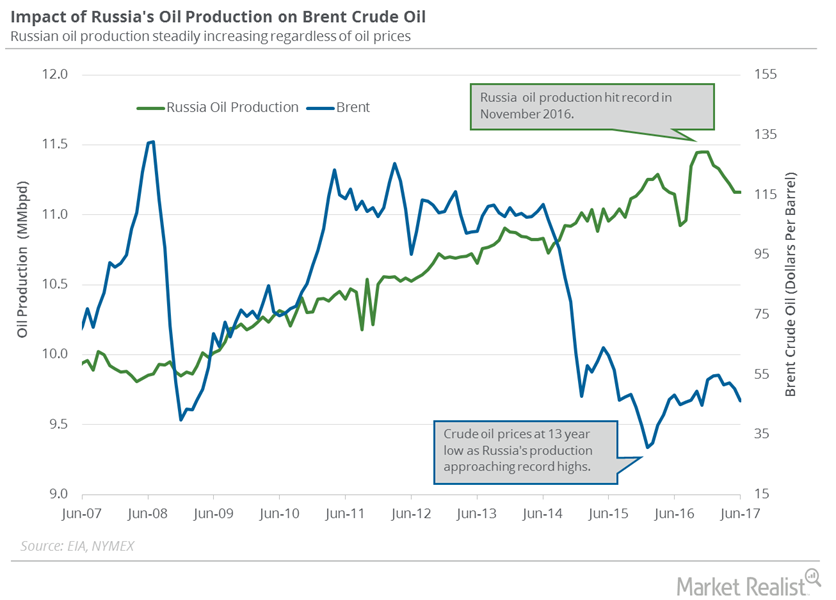

Russia’s Crude Oil Production Was Flat Again

The Russian Energy Ministry estimates that Russia’s crude oil production was flat at 10.95 MMbpd in July 2017—compared to the previous month.

Can the Natural Gas Inventories Spread Rescue Natural Gas Bulls?

In the week ended June 23, 2017, natural gas inventories were at 2,816 Bcf (billion cubic feet)—46 Bcf more compared to the week earlier.