iShares US Energy

Latest iShares US Energy News and Updates

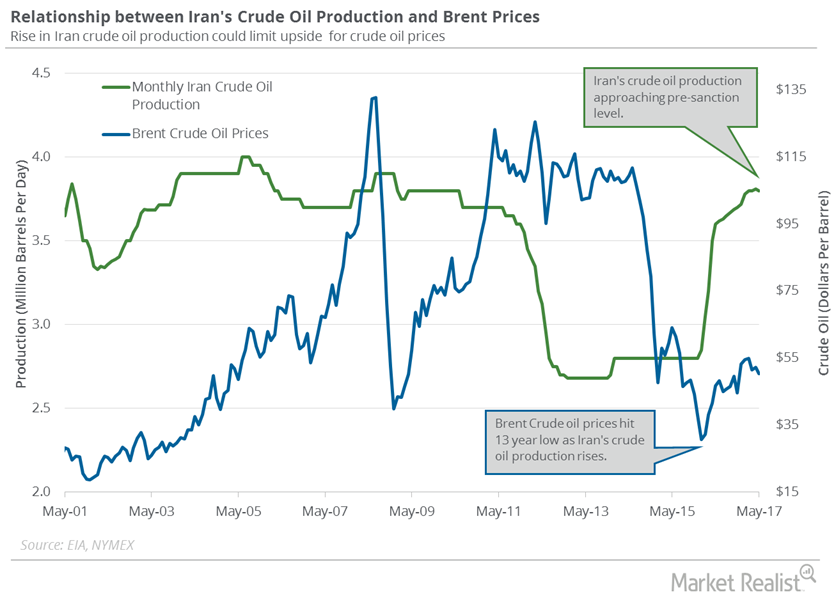

Iran’s Crude Oil Exports and Production: Crucial for Oil Prices

Iran’s crude oil exports are expected to fall 7% in July 2017, according to Reuters. Exports are expected to fall to 1.86 MMbpd in July 2017.

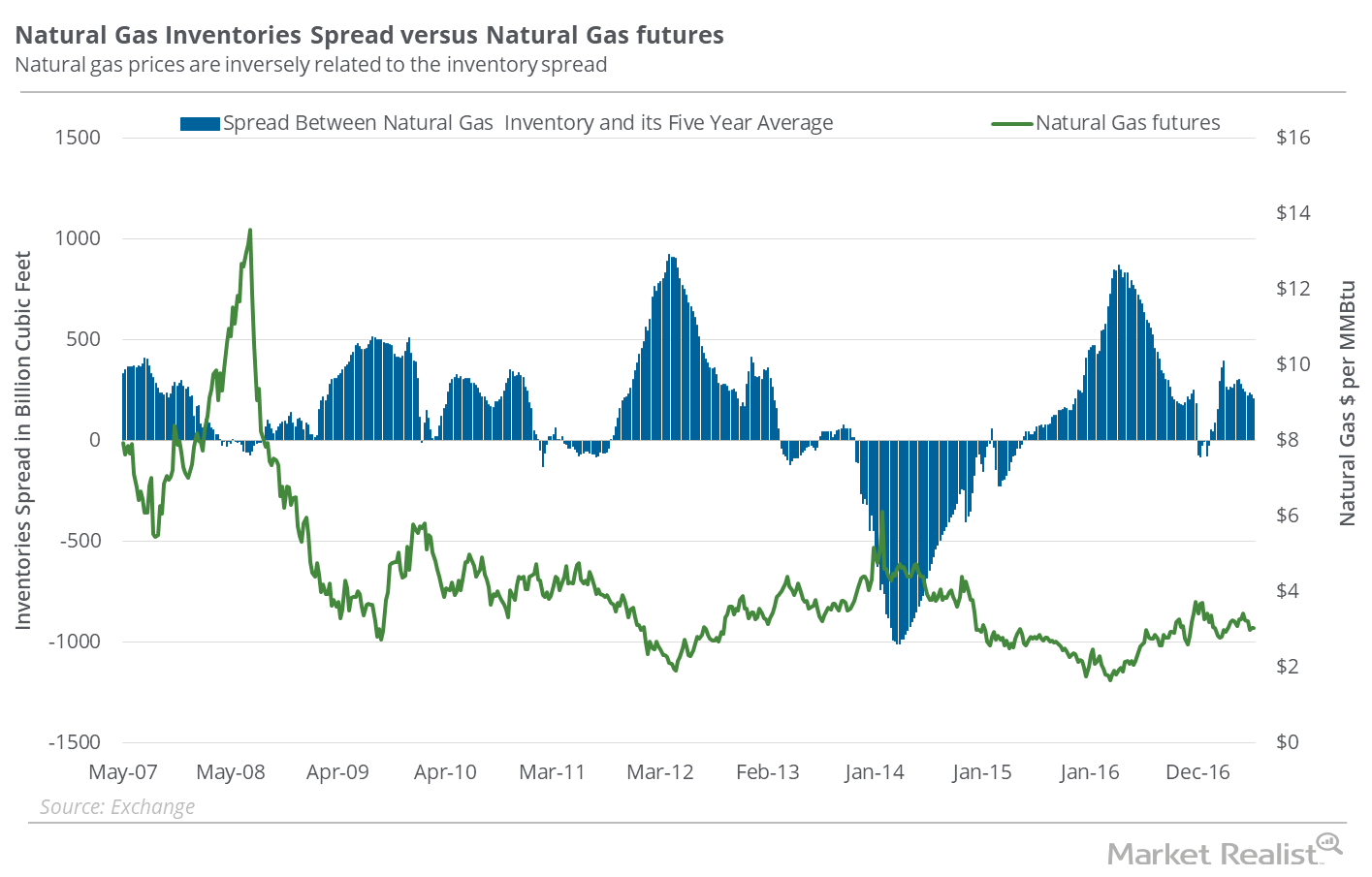

Why the Natural Gas Inventory Spread Supports Its Recent Recovery

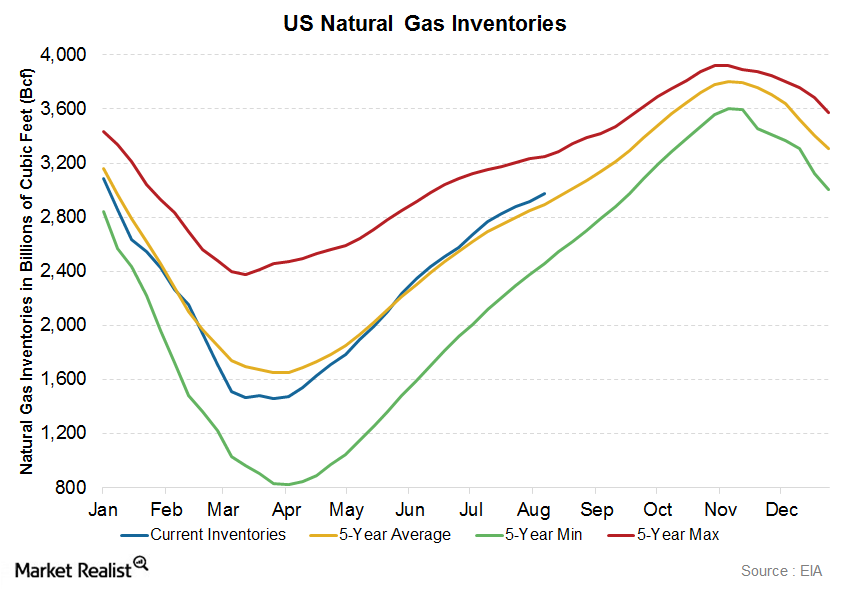

In the week ended June 16, 2017, natural gas inventories rose 61 Bcf (billion cubic feet) to 2,770 Bcf based on EIA data released on June 22, 2017.

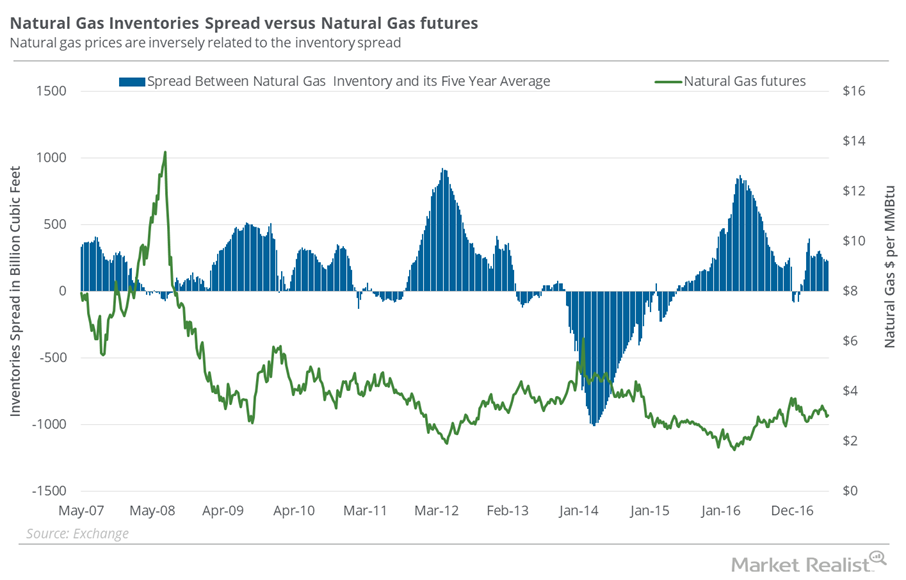

Natural Gas Inventories Spread: Savior for Natural Gas Bulls?

The EIA reported that natural gas inventories rose by 78 Bcf (billion cubic feet) to 2,709 Bcf in the week ending June 9, 2017.

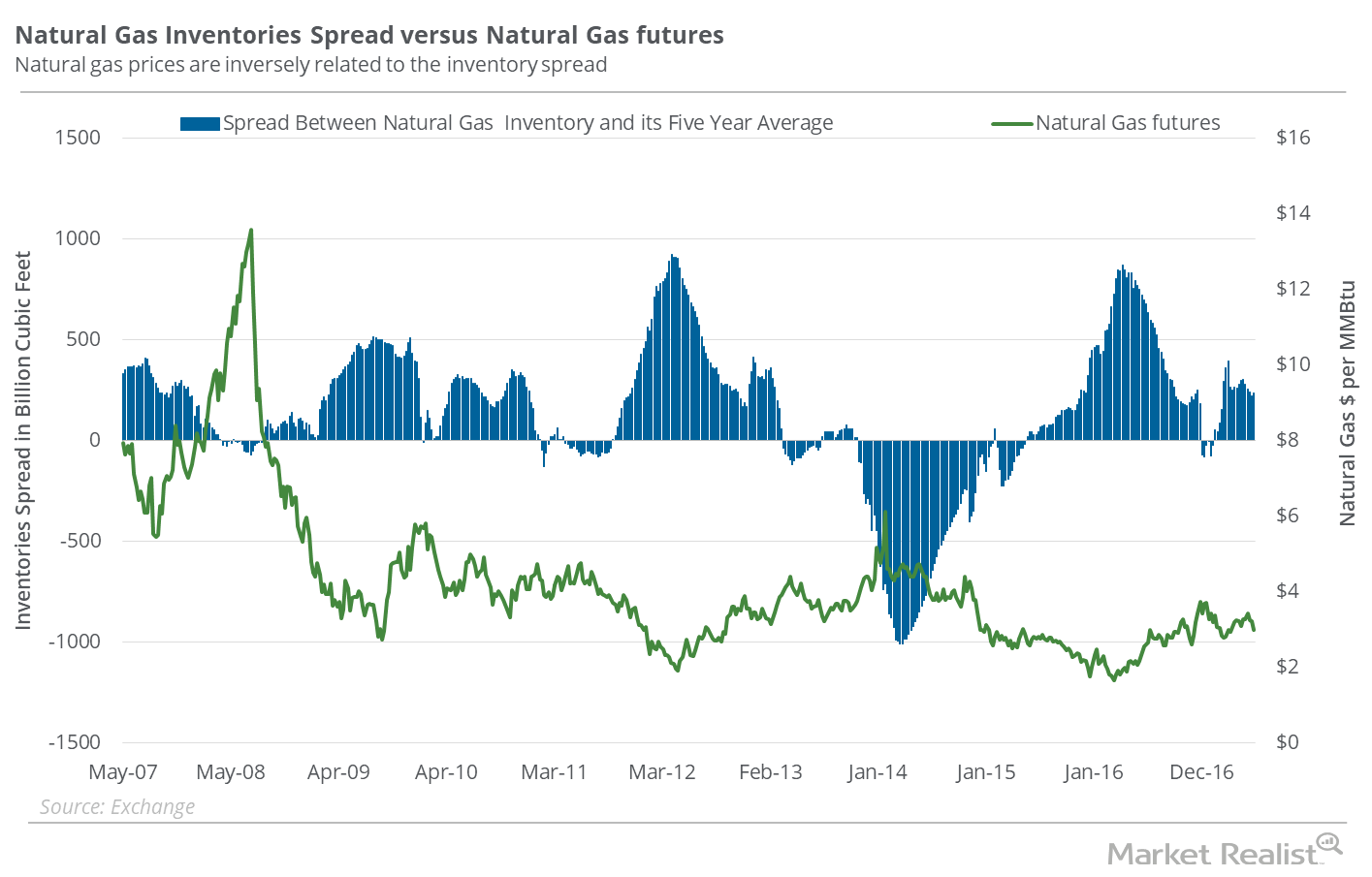

What’s in the Natural Gas Inventory Spread—Bears?

In the week ended June 2, 2017, natural gas inventories rose by 106 Bcf.

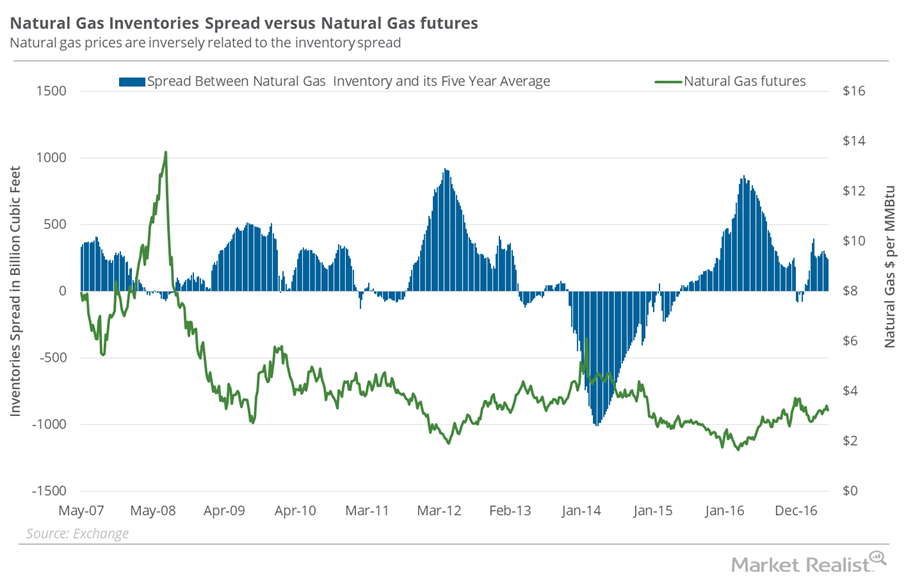

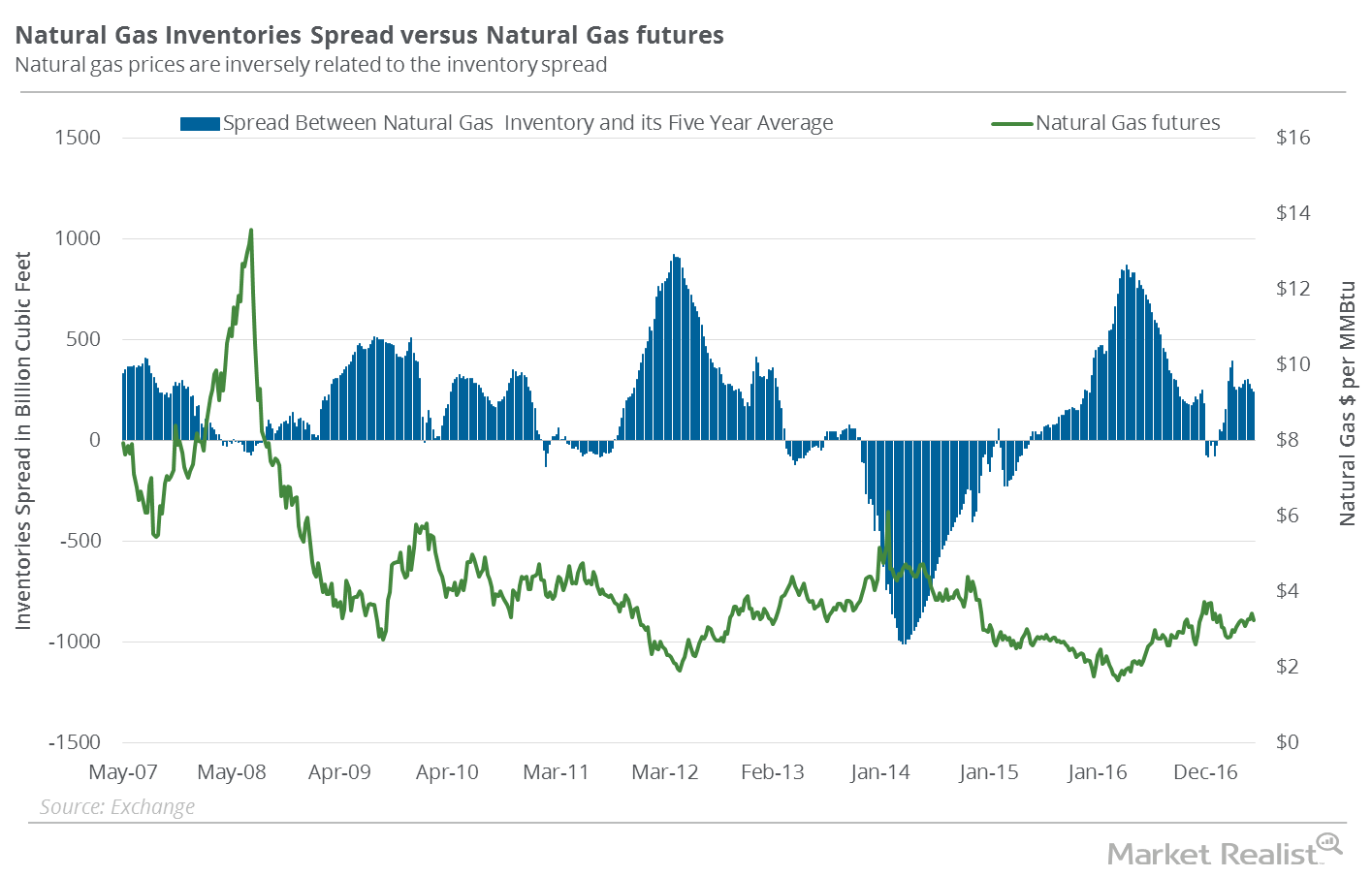

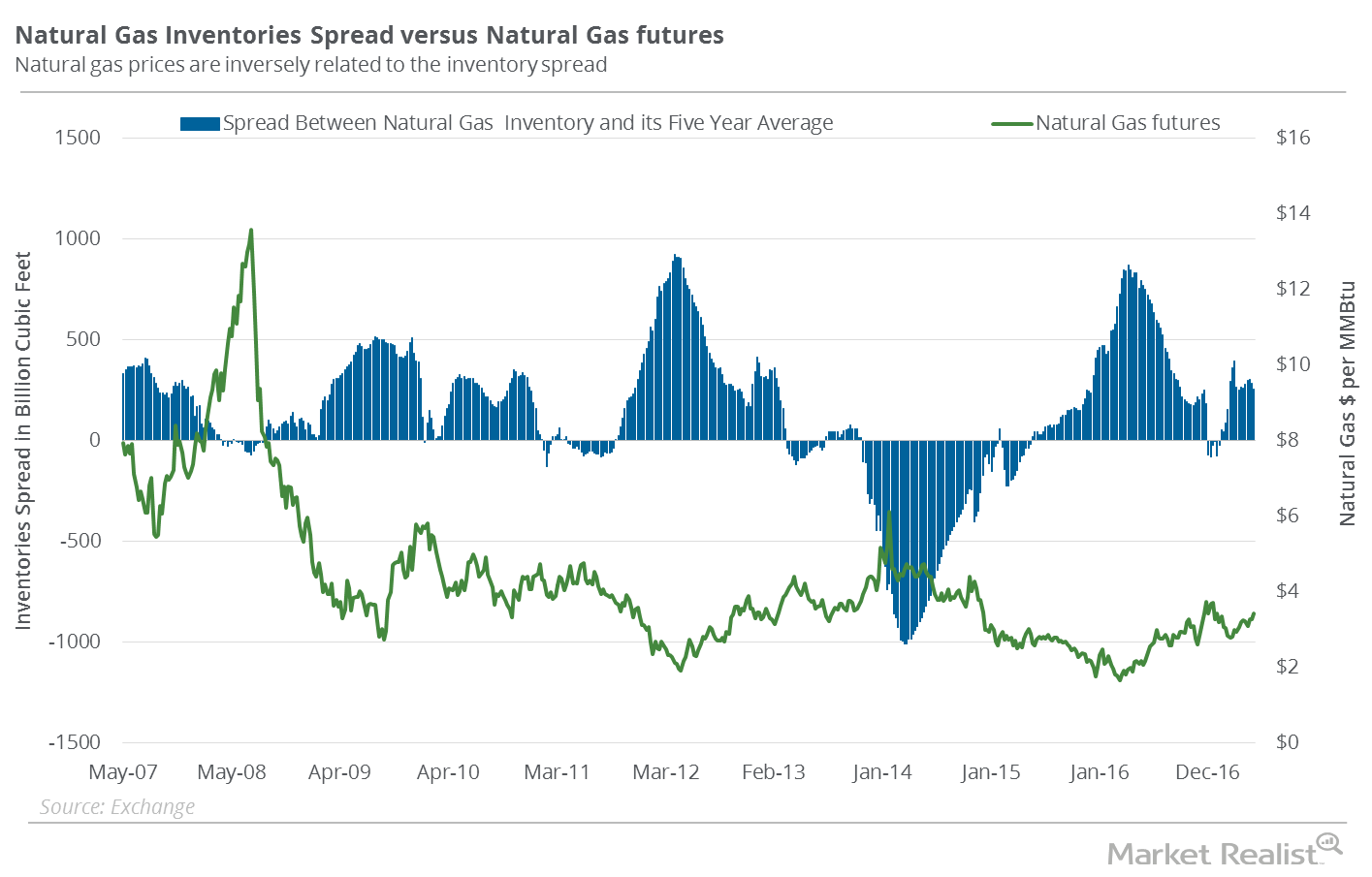

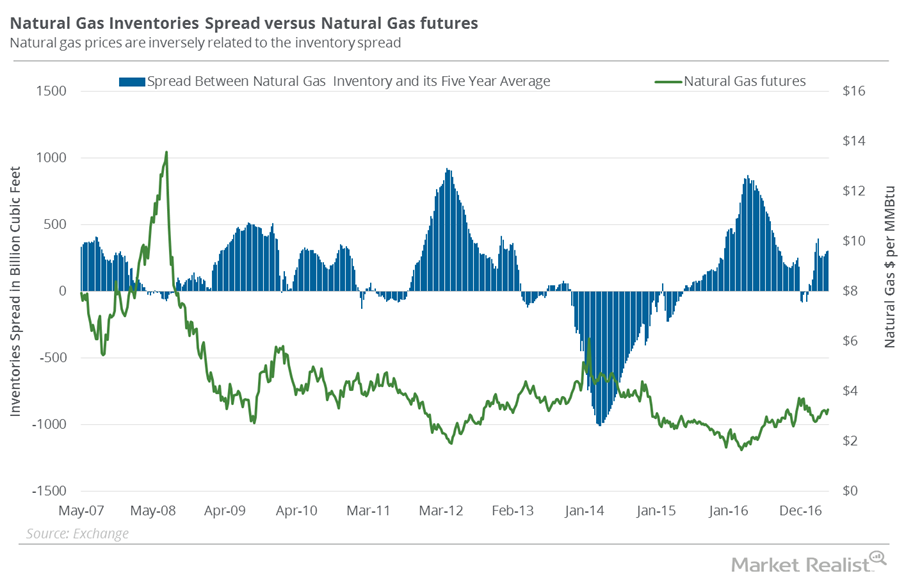

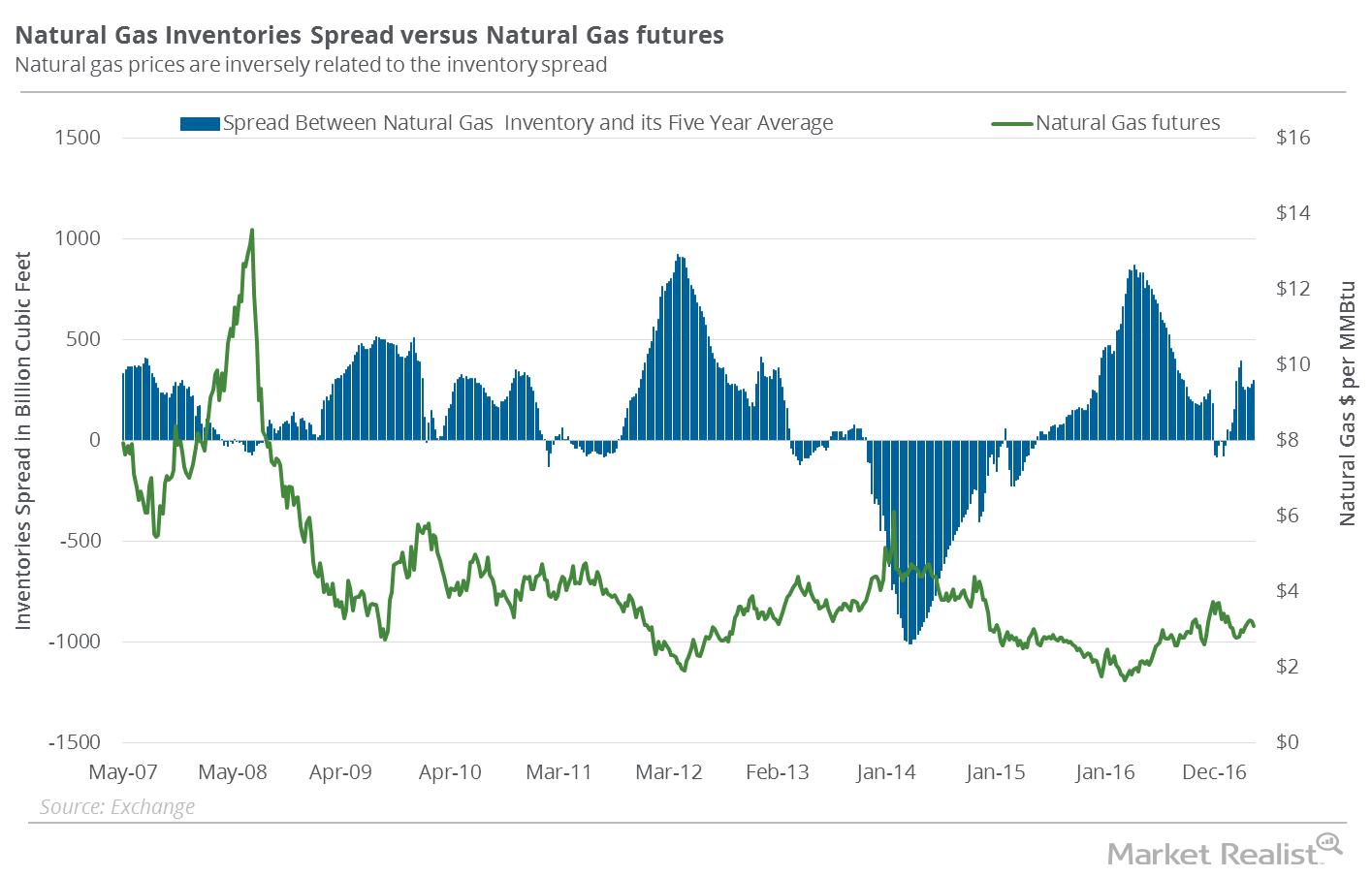

Chart in Focus: The Natural Gas Inventory Spread

Between January 27–June 7, 2017, natural gas active futures fell 10.9%. Natural gas inventories moved above their five-year average in the week ended January 27, 2017.

Why the Inventory Spread Could Make Natural Gas Bulls Happy

On a week-over-week basis, natural gas inventories rose by 75 Bcf (billion cubic feet) and were at 2,444 Bcf for the week ended May 19, 2017.

Natural Gas Inventory Spread Is Falling: Will Gas Prices Soar?

According to EIA data announced on May 18, there was an addition of 68 Bcf to natural gas (GASX) (FCG) (GASL) inventories for the week ending May 12, 2017.

Is the Natural Gas Inventory Spread Optimistic?

According to data from the EIA on May 4, natural gas (GASX) (FCG) (GASL) inventories rose by 67 Bcf (billion cubic feet) during the week ending April 28.

The Natural Gas Inventory Spread: Another Bearish Indicator?

According to data from the EIA released on April 27, 2017, natural gas inventories rose 74 Bcf (billion cubic feet) during the week ended April 21, 2017.

Natural Gas Inventories Spread: What Investors Should Know

According to data from the EIA released on April 20, 2017, natural gas (GASX) (FCG) (GASL) inventories rose by 54 Bcf during the week ending April 14, 2017.

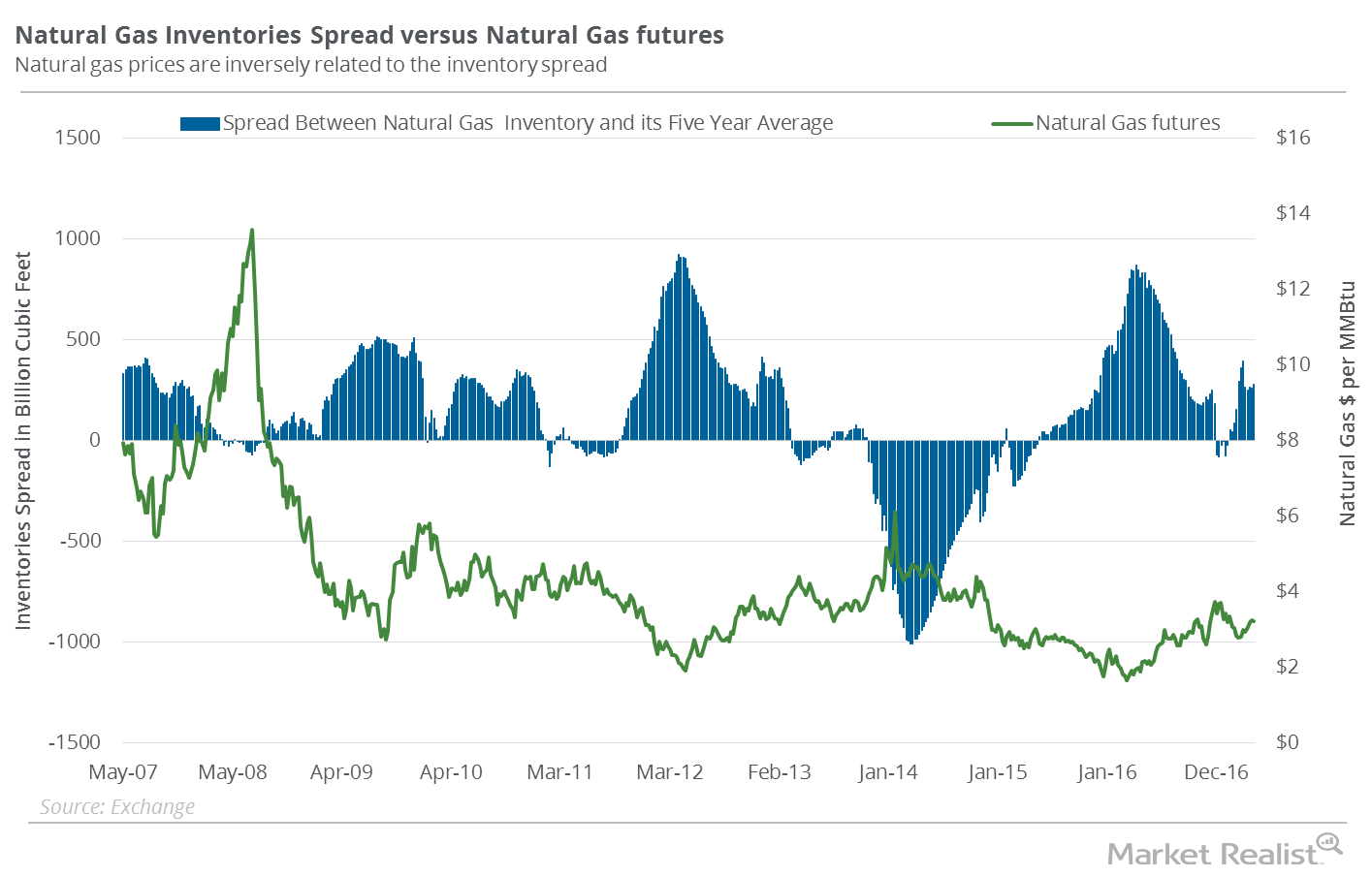

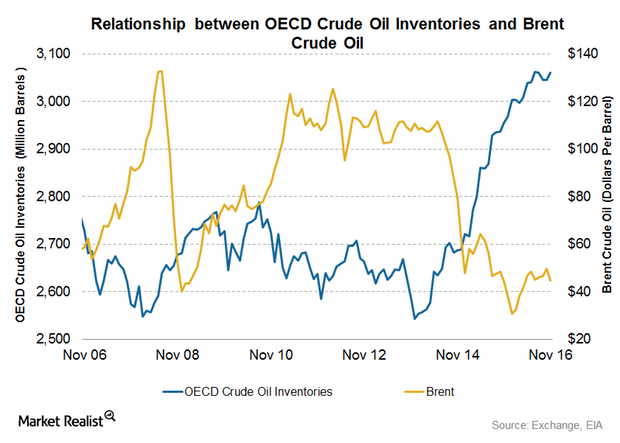

OECD’s Crude Oil Inventories Impact Crude Oil Futures

The EIA estimates that OECD’s crude oil inventories fell by 7.69 MMbbls (million barrels) to 2,977 MMbbls in March 2017—compared to the previous month.

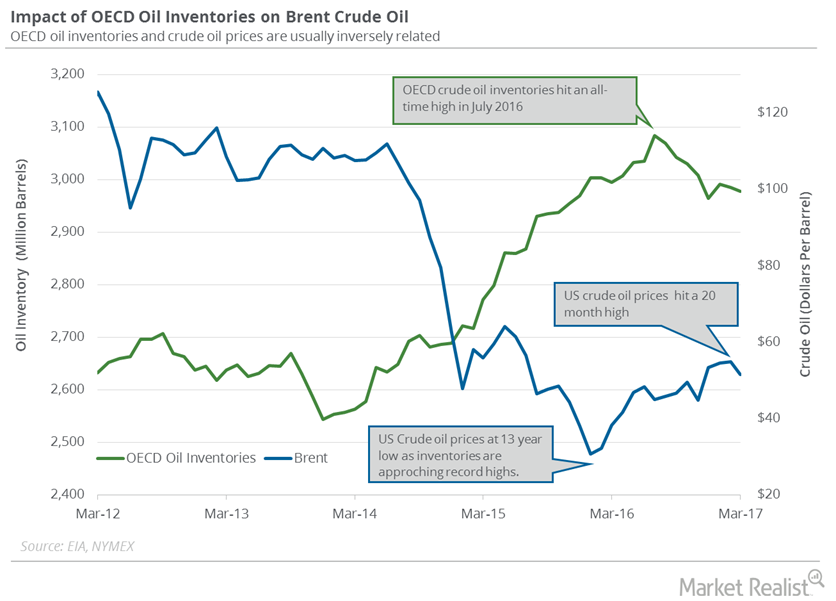

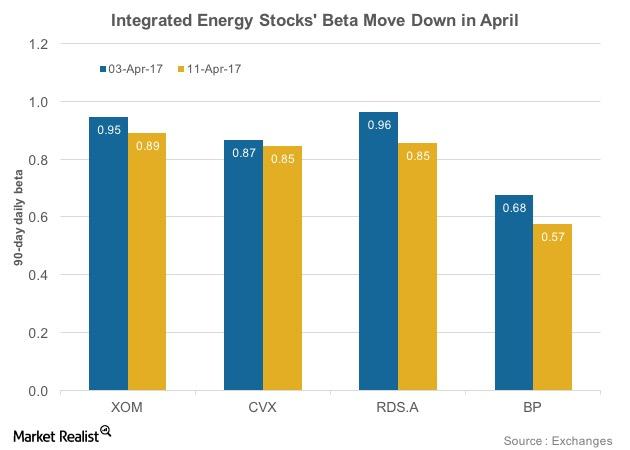

Understanding Integrated Energy Stocks’ Betas in April 2017

Royal Dutch Shell’s (RDS.A) 90-day daily beta fell from 0.96 on April 3, 2017, to 0.85 on April 11, 2017.

Will OECD Crude Oil Inventories Impact Crude Oil Prices in 2017?

The EIA estimates that OECD crude oil inventories rose by 15.9 MMbbls to 3,061 MMbbls in November 2016—compared to the previous month.

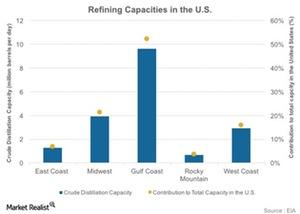

US Gulf Coast: The Largest Refining Region in the Country

The Gulf Coast, a key US refining region, accounted for 9.6 MMbpd of total refining capacity, which represents 52% of the total refining strength in the US.

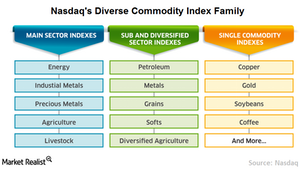

Nasdaq Commodity Index: Reflecting the Global Commodity Market

On the commodities side, we have broad-based commodity benchmark, the Nasdaq Commodity Index, aptly named.

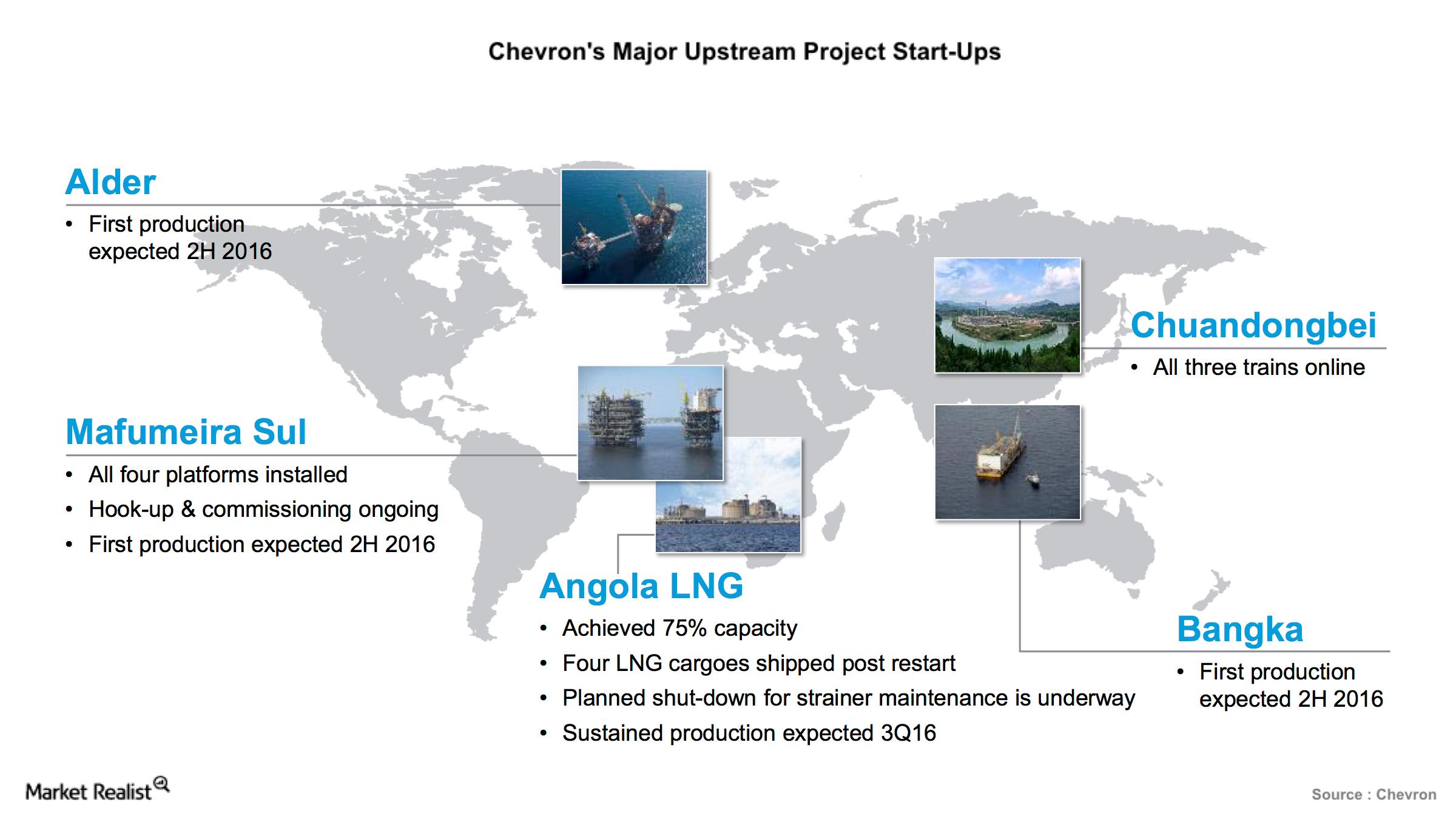

Chevron’s Upstream Portfolio: Major Projects to Start in 2016–2017

Chevron’s (CVX) Upstream segment production is poised to grow, with some of the major projects starting up in 2016–2017.

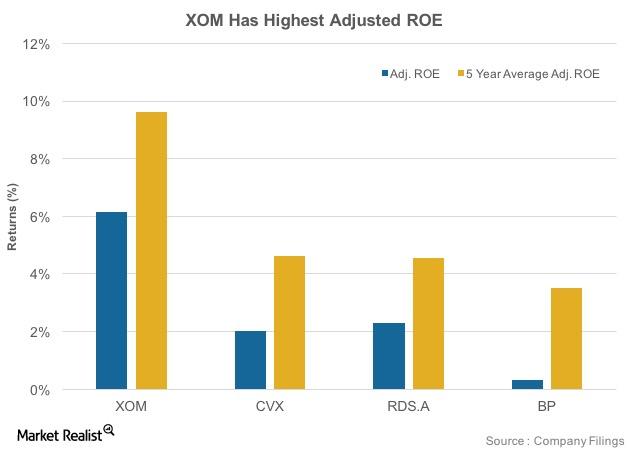

Look to This Energy Company for the Best ROE

Battered by falling oil prices, the 2Q16 ROE numbers for ExxonMobil (XOM), Chevron, Royal Dutch Shell, and BP were lower than their five-year average historical ROE figures.

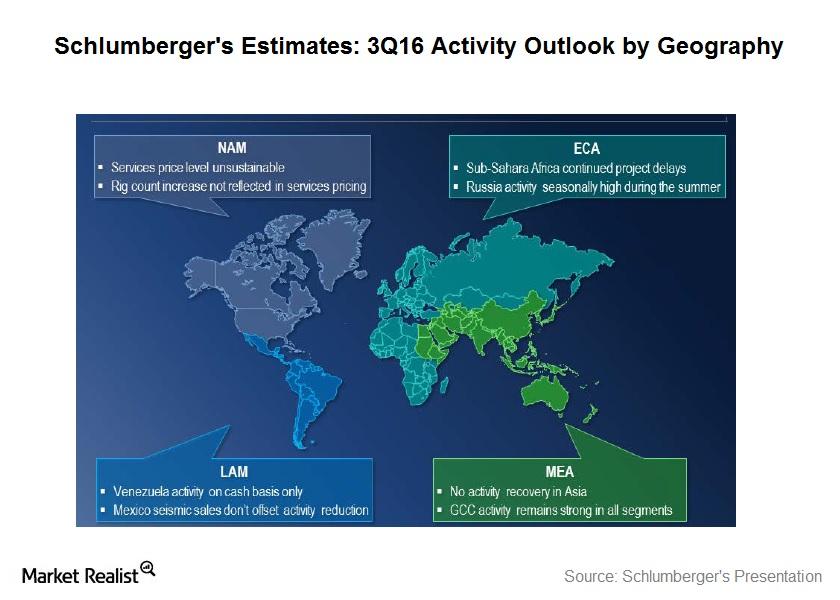

Which Geography Is Working the Best for Schlumberger?

Schlumberger’s business model is diversified and not overly dependent on any particular line of business, catering to upstream companies’ needs.

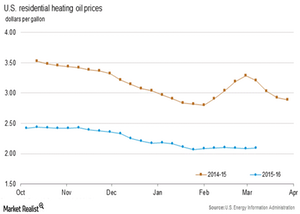

Why Did Heating Oil and Diesel Fuel Prices Rise?

US on-highway diesel fuel prices rose by 2% and were at $2.02 per on March 7, 2016. The current diesel prices are 46% lower than they were a year ago.

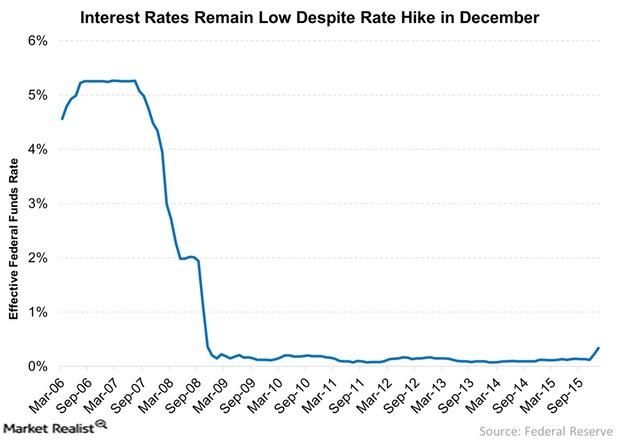

What Can You Expect from Markets in 2016?

While I don’t have a crystal ball, here are three things I believe all investors need to know about returns in 2016.

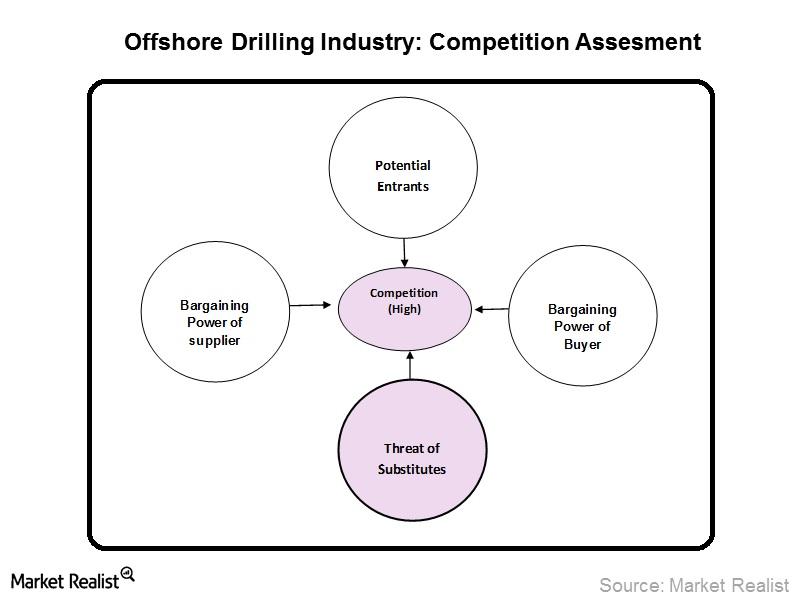

The Intense Competition in the Offshore Drilling Industry

The offshore drilling industry has a high degree of financial and operating leverage, which forces participants to engage in price competition.

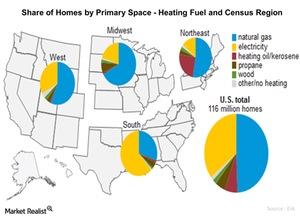

US Households Prefer Electricity and Natural Gas for Home Heating

Natural gas is used as heating fuel in 48% of the homes across the country, electricity is used for heat in 38% of homes, and the rest of the fuels are used for heat in the remaining 14% of homes.

Natural Gas Inventories Beat Expectations: How Will Prices React?

On Thursday, August 13, the EIA (U.S. Energy Information Administration) published its “Natural Gas Weekly Update” for the week ended August 7.

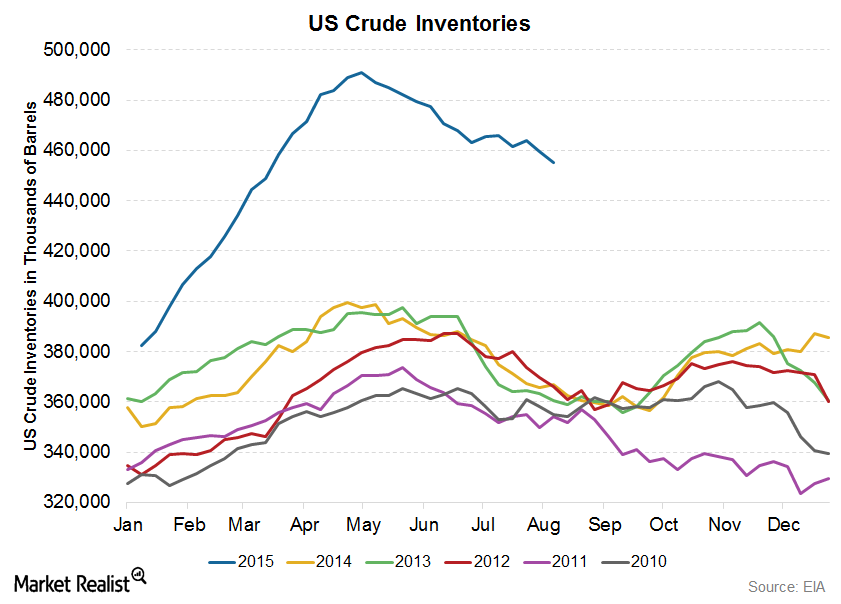

Crude Oil Inventories Fell, but Why Did WTI Crude Prices Slump?

The U.S. Energy Information Administration reported a decrease of 4.4 million barrels in crude oil inventories for the week ended July 31.

Biggest US Rig Count Rise in a Year: What Does It Change?

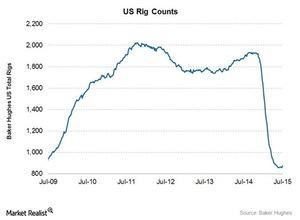

Despite recent rises, at 876, the US rig count is still at its lowest level since January 2003. In September 2014, the average rig count came close to the record, reaching 1,931.

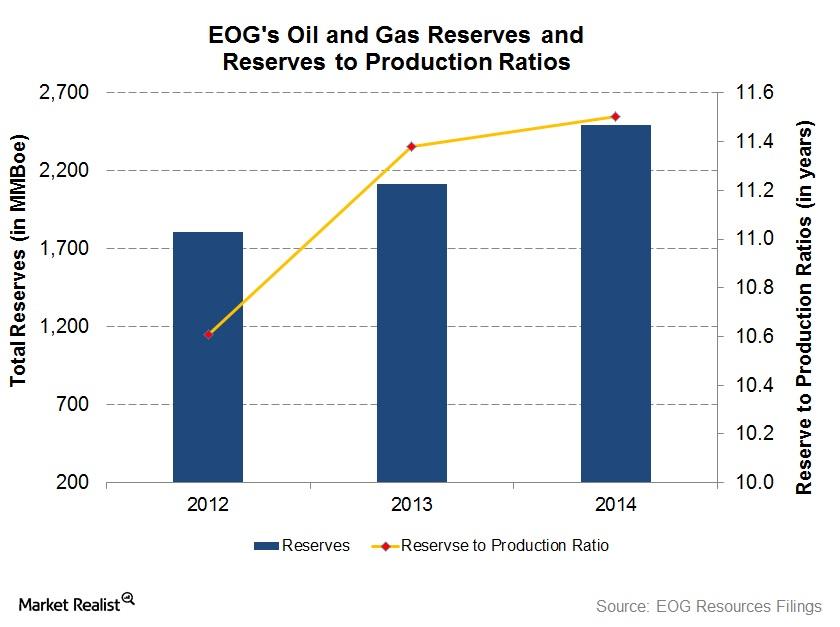

Growth in EOG Reserves Outpaces Production

EOG’s reserves-to-production ratio, or reserve life, increased from 10.6x in 2012 to 11.5x in 2014. It would take EOG 11.5 years to deplete its proved reserves at its 2014 production rate.

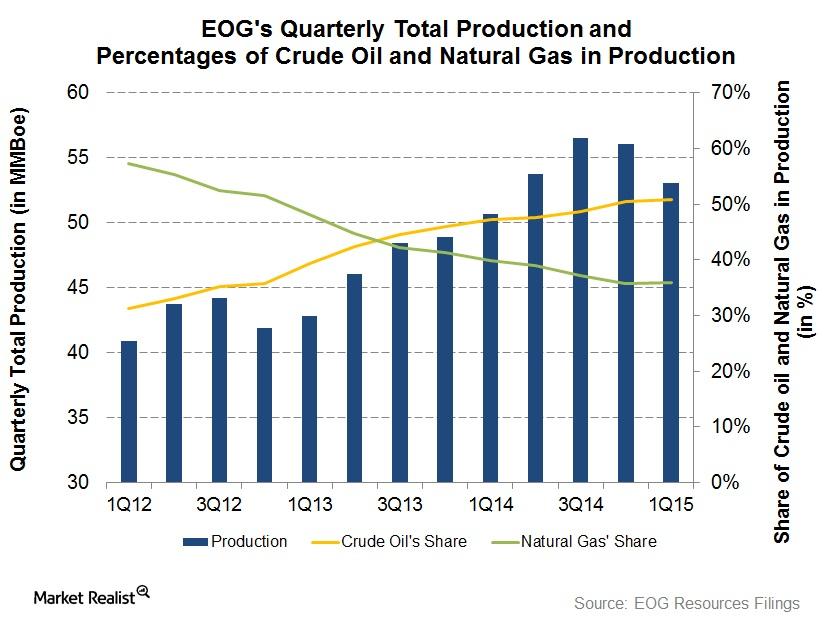

EOG Production Adjusts to Weak Energy Prices

On the heels of weak energy prices, EOG Resources wants to maintain steady production. This may result in flat production growth in 2015.

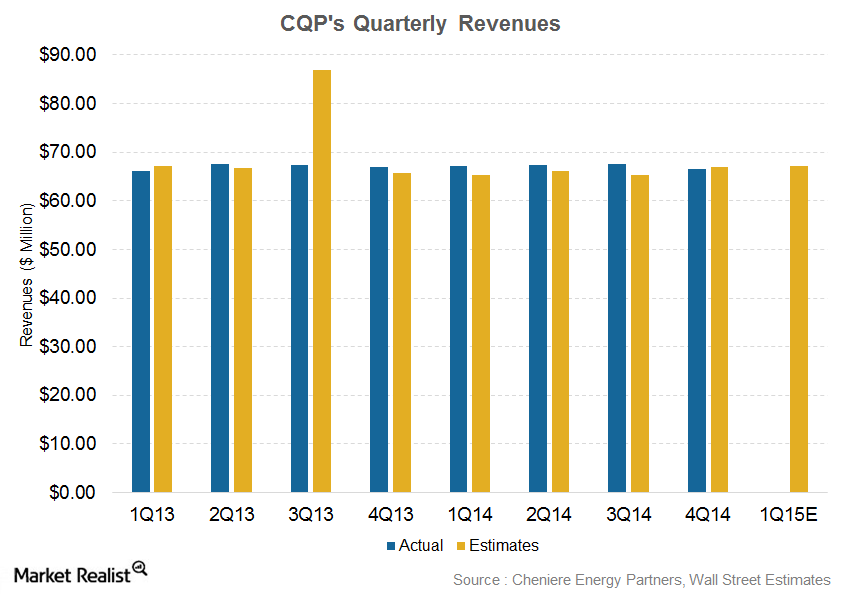

Analyzing Cheniere Energy Partners’ Historical Performance

For 1Q15, analysts are expecting Cheniere Energy Partners’ revenue to come in at $67.1 million. The loss per share estimates have been pegged at -$0.113.

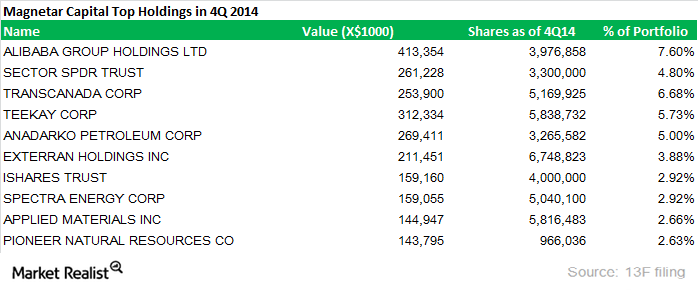

Magnetar Capital Initiated New Positions in 4Q14

Magnetar Capital was established in 2005 by Alec Litowitz and Ross Laser. Currently, the hedge fund manages assets in excess of $12 billion.

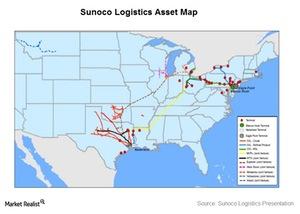

An Overview of Sunoco Logistics Partners

Sunoco Logistics Partners (SXL) is an energy midstream master limited partnership. It operates crude oil, natural gas, refined products, and natural gas liquids pipeline and terminal assets.

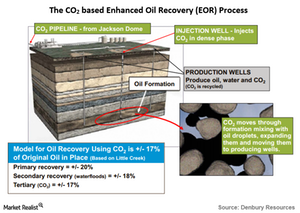

What’s special about Denbury Resources’s oil recovery method?

ConocoPhillips produces oil and gas via primary or secondary recovery methods. Denbury Resources mainly uses a tertiary, EOR method to produce its oil.

Russia’s sovereign credit rating downgraded to junk

Russia’s sovereign credit rating now stands on par with countries such as Turkey and Indonesia. The oil price crisis isn’t helping matters.

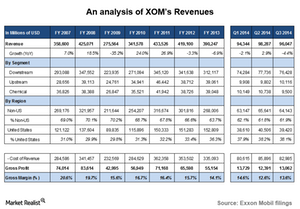

A key analysis of ExxonMobil’s revenues

ExxonMobil’s businesses and revenues depend on crude oil and natural gas’ price levels. In the first three quarters of 2014, ExxonMobil reported revenues of ~$290 billion.

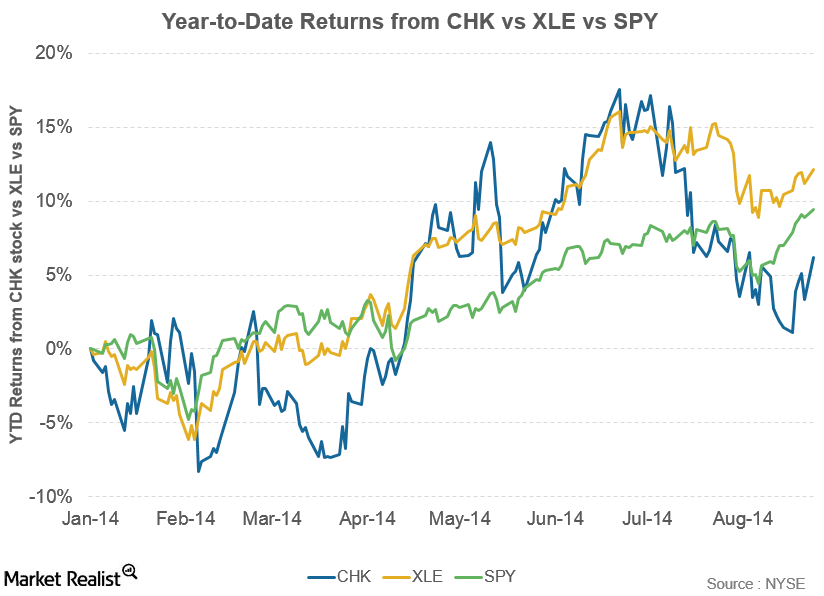

An investor’s must-read introduction to Chesapeake Energy

Chesapeake Energy (CHK) is an eminent energy exploration and production company in the U.S. Its operations span across the Marcellus, Utica, Niobrara, Mississippian Lime, Eagle Ford, Barnett, and Haynesville shales.