First Trust US Equity Opportunities ETF

Latest First Trust US Equity Opportunities ETF News and Updates

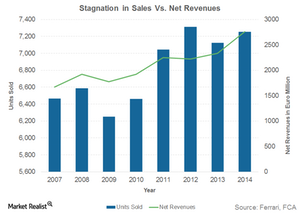

How Ferrari Got Its Start

Ferrari (RACE) is one of the most prestigious brands in the automobile industry. The Italian racing and sports car manufacturer entered the business in 1947.

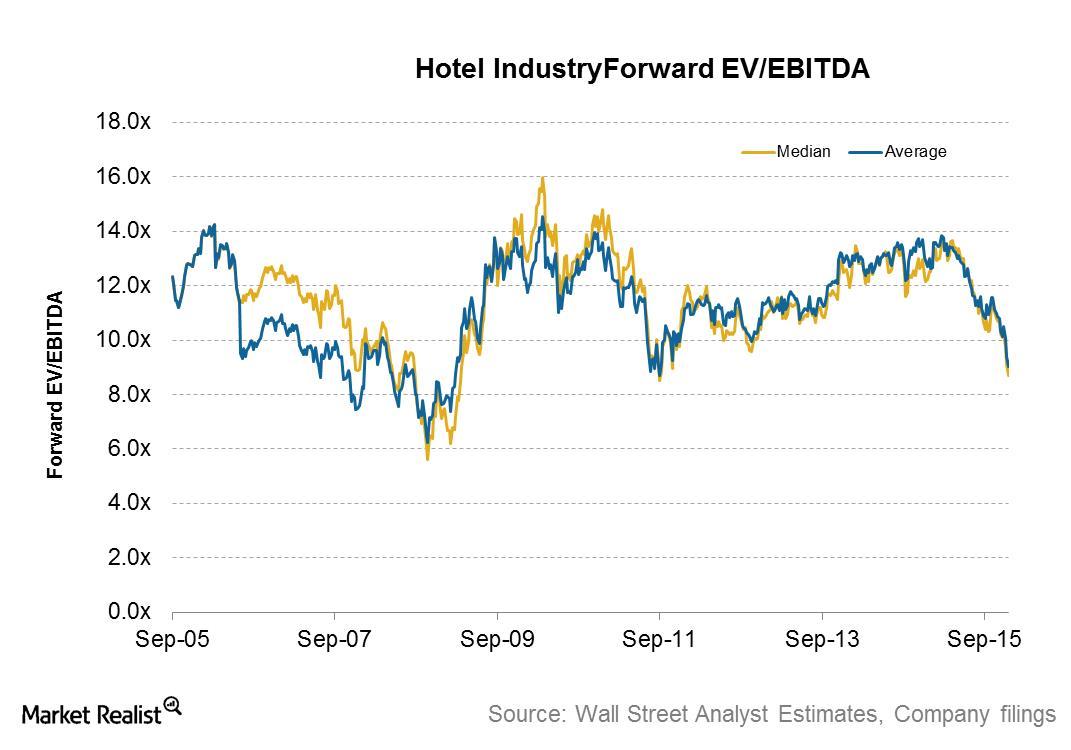

Understanding Marriott International’s Valuation Multiple

In fiscal 2014, Marriott had forward EV-to-EBITDA multiple of 15.3. It was trading at 11.2 as of January 1, 2016, which was the highest among peers.

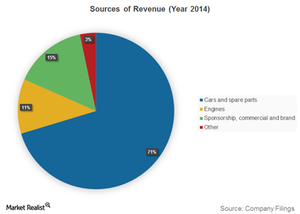

How Ferrari Manages to Remain Profitable

By focusing on extraordinary vehicle design and exclusivity, Ferrari is able to sell luxury cars with high-profit margins to end consumers.

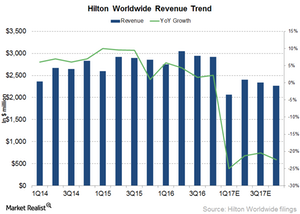

Will Hilton’s Top Line Grow in 2017?

For 1Q17, analysts are estimating Hilton’s (HLT) revenue to fall 25% to $2.1 billion.

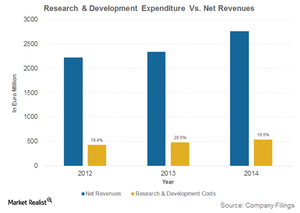

Why Ferrari Spends So Extravagantly on Research and Development

Ferrari spends extravagantly on research and development to stay ahead of its peers and to keep its products unique.

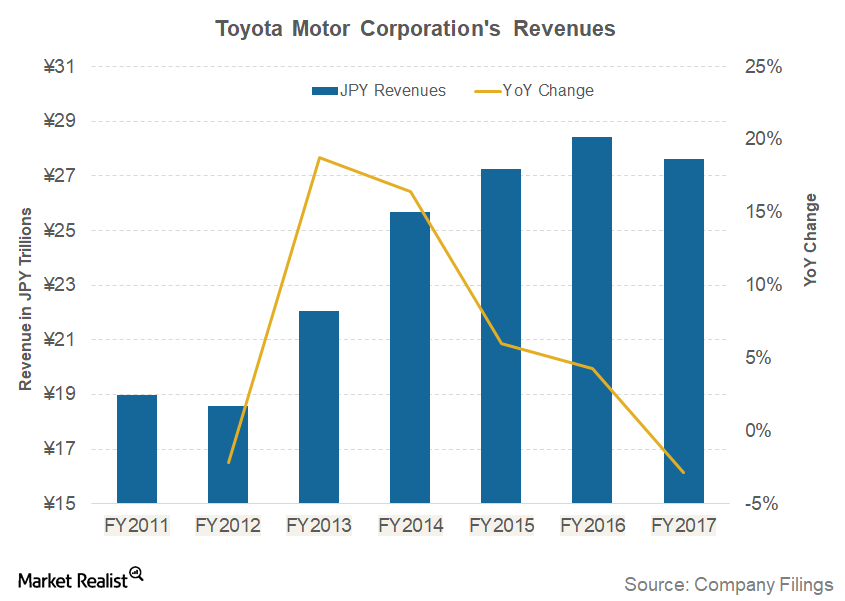

Why Toyota’s Fiscal 2017 Revenues Fell

In the calendar year 2016, Toyota (TM) stood as the second-largest automaker by volume in the world after Volkswagen (VLKAY).

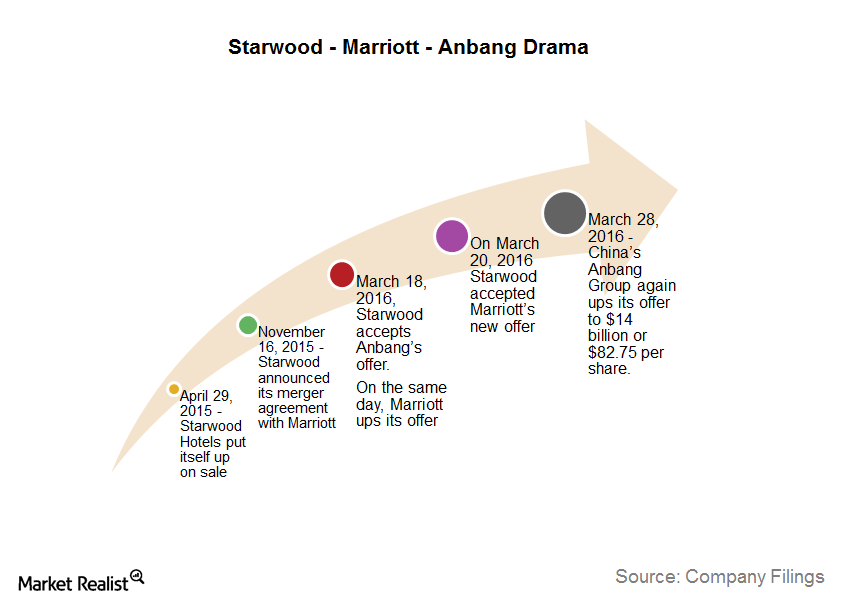

The Starwood Sale: The Story to Date

In this series, we will discuss why Starwood (HOT) decided to put itself up for sale, how a merger with Starwood would benefit either Marriott or Anbang, and who could probably win this takeover tussle.

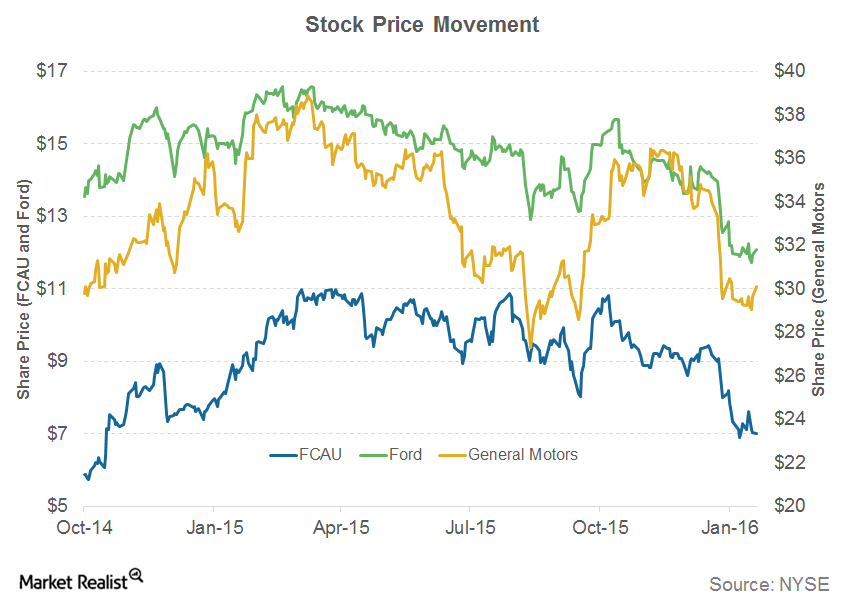

Must-Read Guide on Fiat Chrysler’s 4Q15 Earnings and Conference

Fiat Chrysler Automobiles (FCAU) released its 4Q15 earnings on January 27, 2016.

Understanding the Hotel Industry Valuation Multiple

The forward EV-to-EBITDA multiple for the hotel industry currently stands at 9. It has declined from 13.1, which was recorded at the beginning of 2015.

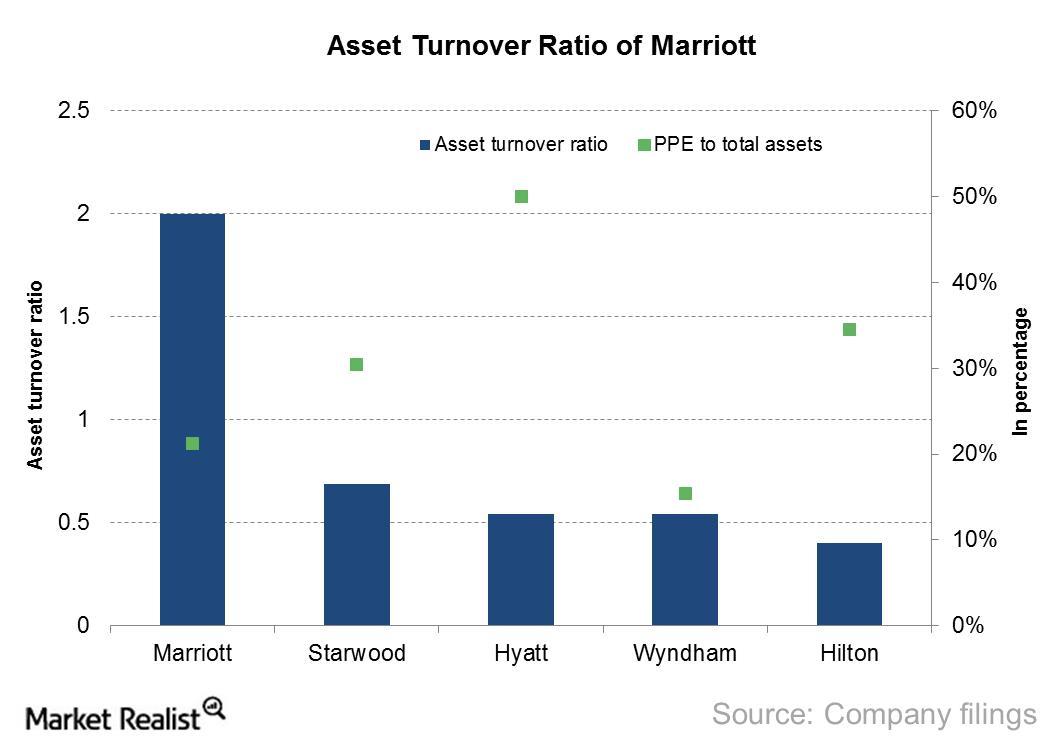

What You Ought to Know about Marriott International’s Asset Utilization

Marriott has one of the lowest asset bases among its industry peers, having reduced its PPE-to-total-assets ratio from 24% in 2012 to 21.2% in 2014.

Marriott International’s Expansion in the Franchise Model Is Bearing Fruit

Marriott’s operating margin increased from 5.9% in 2010 to 8.4% in 2014. Its operating income grew from $695 million in 2010 to $1,159 million in 2014.

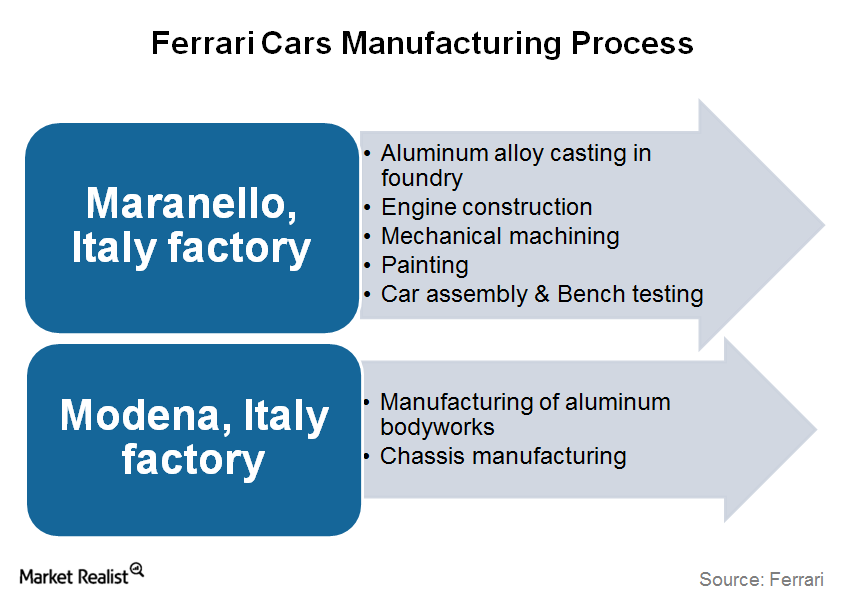

How Ferrari Manufactures Its Luxury Cars

Ferrari (RACE) owns two manufacturing units in Italy: one in Maranello and one in Modena.

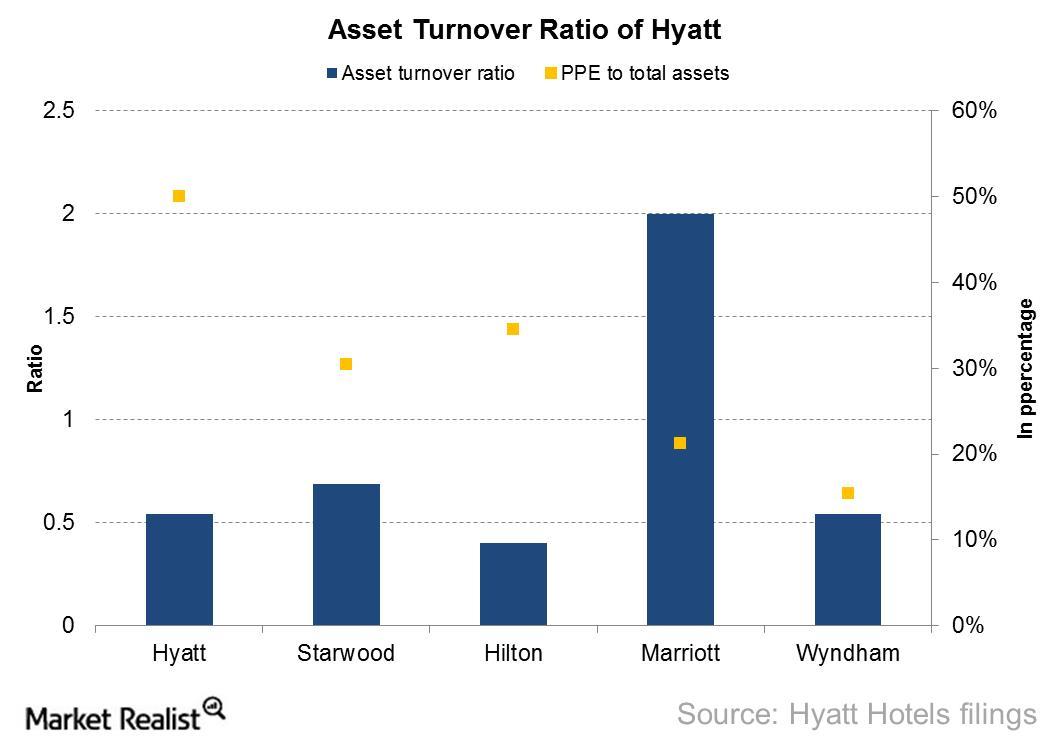

Asset Utilization by Hyatt Hotels

Hyatt had the lowest return on assets (or ROA) ratio among its peers at 4.6% for fiscal 2014 due to lower profits generated from its assets.

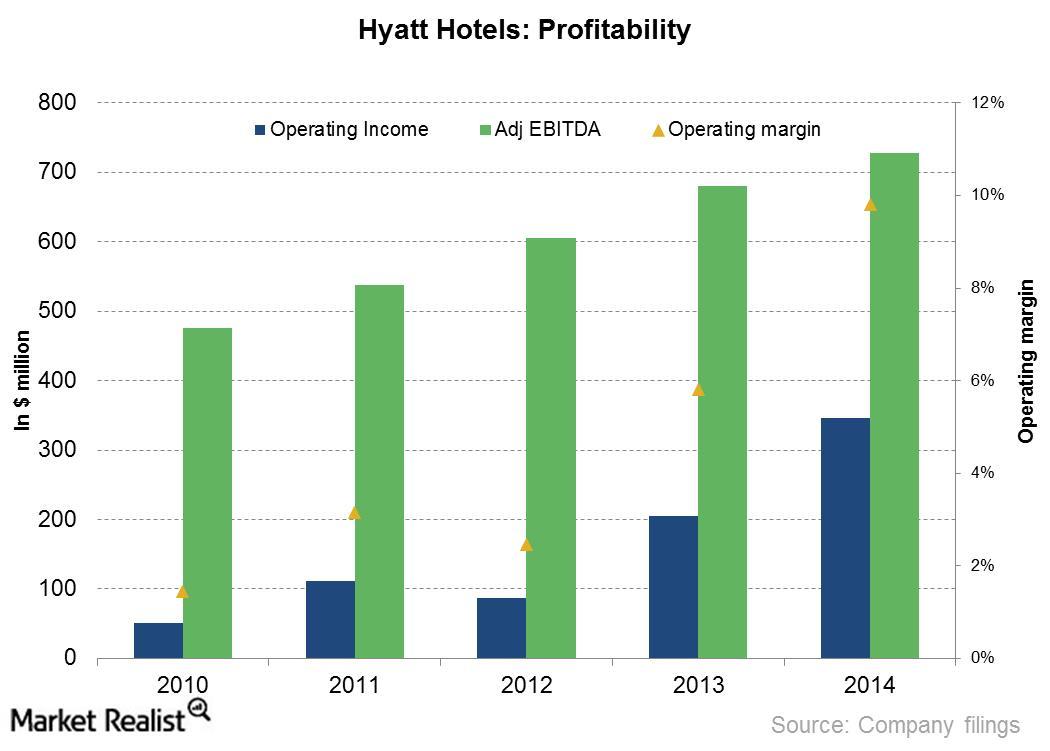

Profitability Margins Grew for Hyatt Hotels

Operating margins for Hyatt Hotel (H) increased from 1.4% in 2010 to 6.3% in 2014. The growth in margins was largely driven by steady growth in revenue and declining expenses from the owned and leased hotels segment.

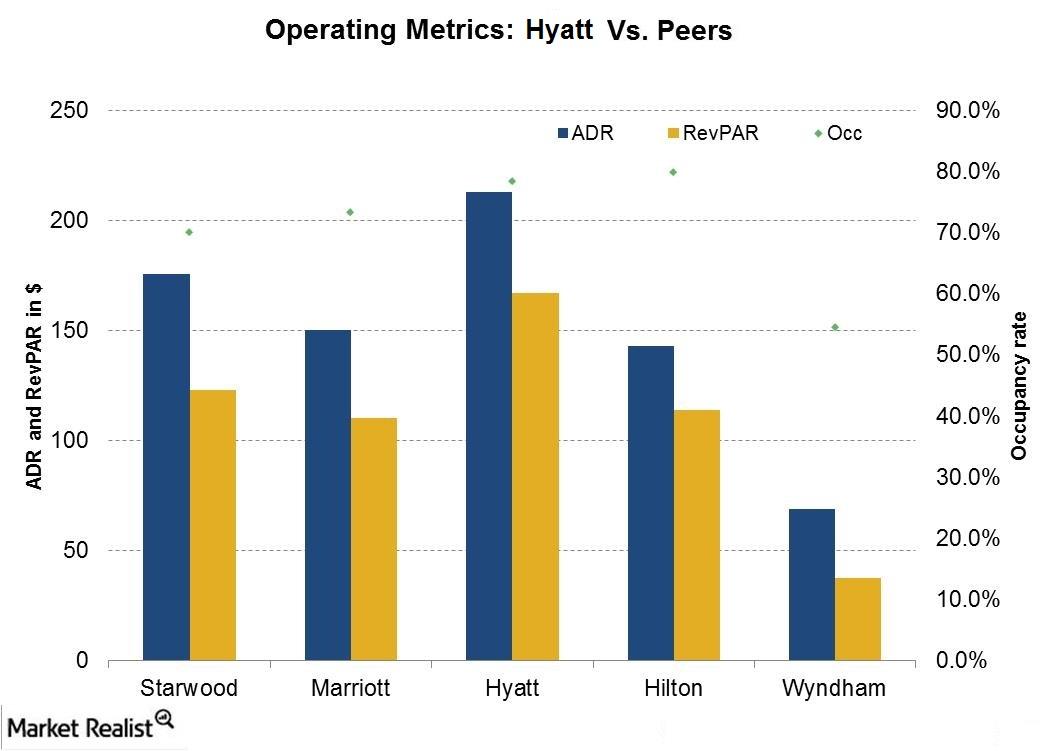

Why Hyatt Has the Highest ADR and Occupancy Rate Among Its Peers

At 76.2%, Hyatt Hotels (H) had one of the highest occupancy rates among its peers for its owned and leased hotels in 2014.