BTC iShares J.P. Morgan USD Emerging Markets Bond ETF

Latest BTC iShares J.P. Morgan USD Emerging Markets Bond ETF News and Updates

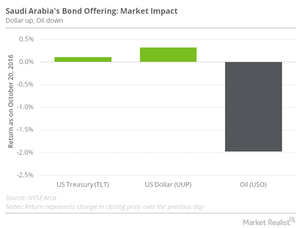

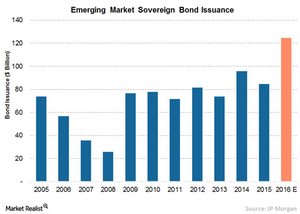

Saudi Arabia Enters International Bond Market, Raises $17.5 Billion

On October 20, the government of Saudi Arabia raised about $17.5 billion in an international bond issuance, marking the emerging market’s first foray into the international bond market.

Investment Opportunities in This Environment

VanEck CEO, Jan Van Eck, joins me today to discuss his macroeconomic outlook and also to talk about investment opportunities that he finds most interesting in the current environment.

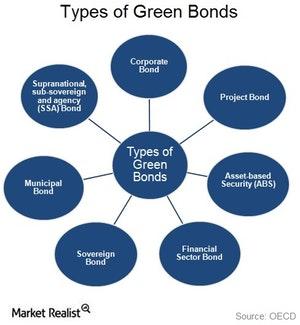

The Role of Emerging Markets in Global Green Bond Issuance

Over the last ten years, the green bonds (GRNB) universe has expanded and diversified, holding 600 bonds from 24 countries in 23 currencies.

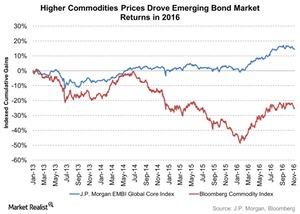

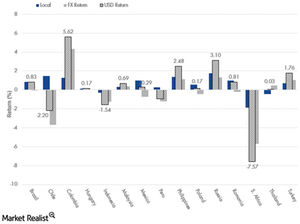

How Did Emerging Market Debt Perform in 2016?

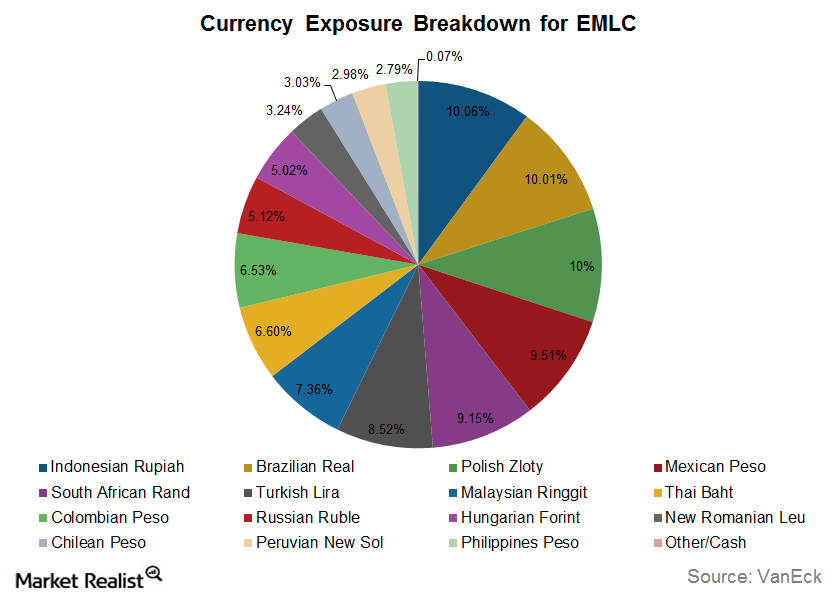

In the emerging market bond space (PCY) (EMLC), high-yield bonds and local currency bonds outperformed hard currency sovereign bonds.

When The Net Asset Value Of A Bond ETF Differs From Market Price

The Intraday Indicative Value gives us a more real-time value than the bond ETF’s NAV. It’s considered an implied value of an ETF.

Why Does Fixed Income Look Promising?

Under the current uncertain economic circumstances, investors searching for higher yield might turn to fixed income.

The Economic Costs That Come with Climate Goals

Climate-related policies and a transition to a low-carbon economy require capital, and most countries are already burdened with high debt.

Quality May Provide Attractive Risk-Adjusted Returns

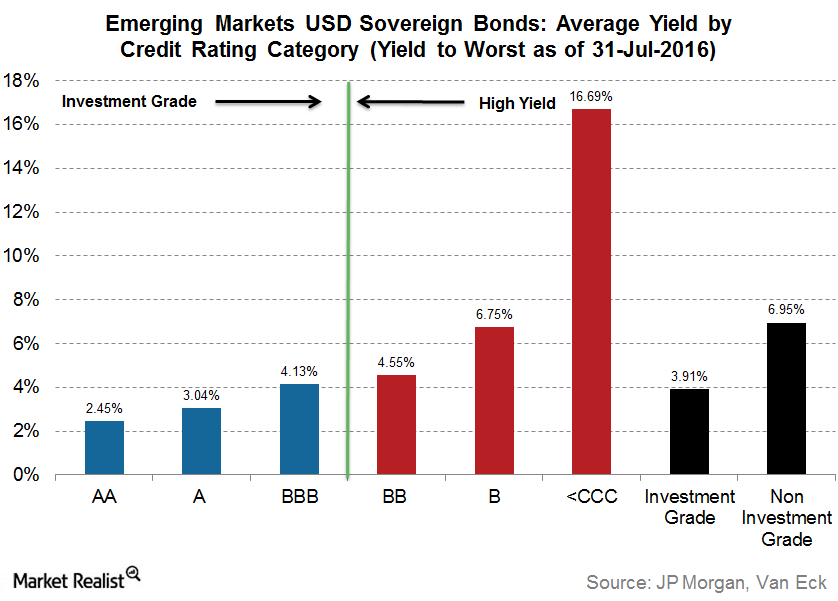

It’s useful to analyze the historical returns of credit rating categories within emerging markets bonds.Financials Fixed income ETFs: The longer the duration, the higher the loss

The higher the expense ratio, the deeper the decline in an investment’s value. Also, the higher the period of investment, the greater the impact of expense ratios due to the compounding effect.

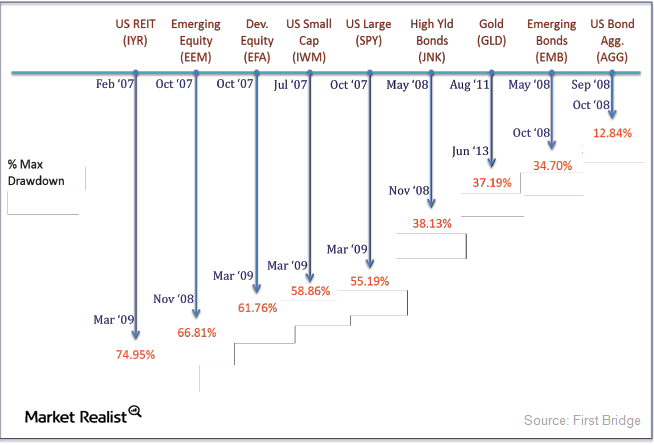

Must-know: Minimizing ETF losses by observing max drawdowns

In practice, asset owners (both retail and institutional) want to avoid significant portfolio drawdowns even if the benchmark index declines.

Why Should Investors Focus on Real Yield in Emerging Markets?

Real yields in emerging markets (or EM) have remained at compelling levels over the past few years.

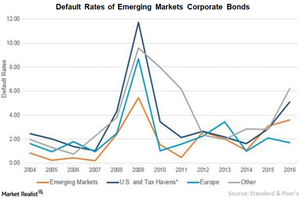

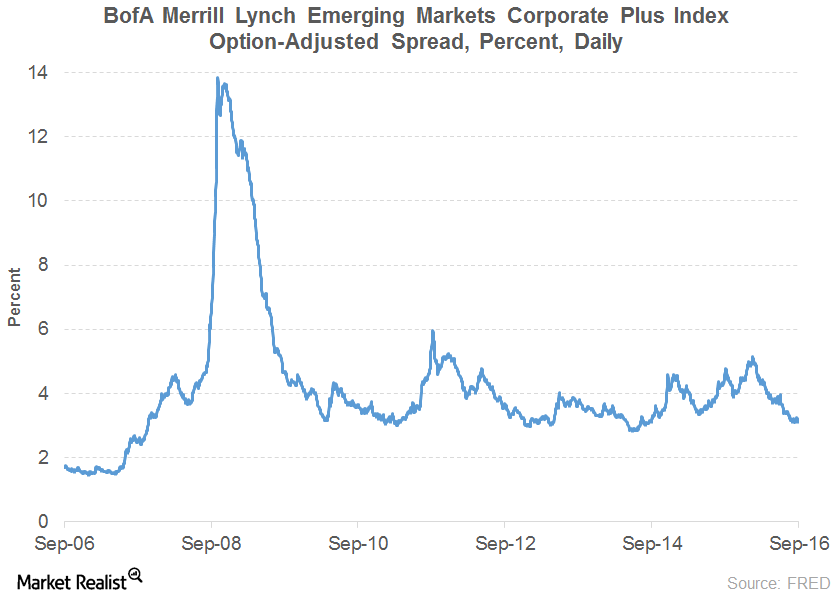

EM Corporates Offer Huge Opportunities and Better Profile

VanEck A Diverse and Growing Category The emerging markets high yield bond market has grown tremendously over the past 10 years, from $56 billion at the end of 2007 to $440 billion as of June 30, 2017.[2. Source: BofA Merrill Lynch.] In addition to growing in size, diversity within the category has also increased. Investors currently […]

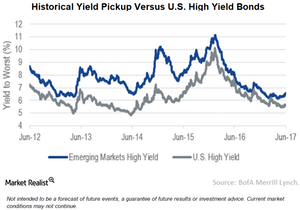

How to Benefit from Emerging Markets Corporate Debt

VanEck Higher Yield and Lower Duration Compared to U.S. high yield bonds, emerging markets high yield bonds offered a 90 bps yield pickup as of June 30, 2017.[1.U.S. high yield bonds and emerging markets high yield bonds are represented by BofA Merrill Lynch US High Yield Index and BofA Merrill Lynch Diversified HY US Emerging […]

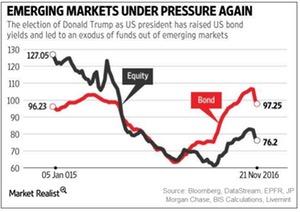

Why Was November Important for Global Financial Markets?

Trump’s unexpected presidential victory caused short-term uncertainty about markets and policies. His win reinforced a reflationary theme in global markets.

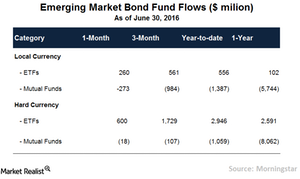

Why Emerging Market Local Currency Bonds Are Looking Attractive

Emerging market economies have bounced back in 2016, delivering strong economic growth with improved fundamentals and better capital management.

Are Yield Opportunities Flourishing in Emerging Market Bonds?

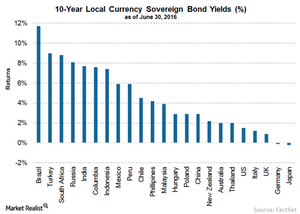

Emerging market (or EM) bonds (PCY) offer diversified exposure with higher yields compared to their developed market equivalents (IHY).

Looking to Local-Currency Emerging Market Bonds for Opportunities

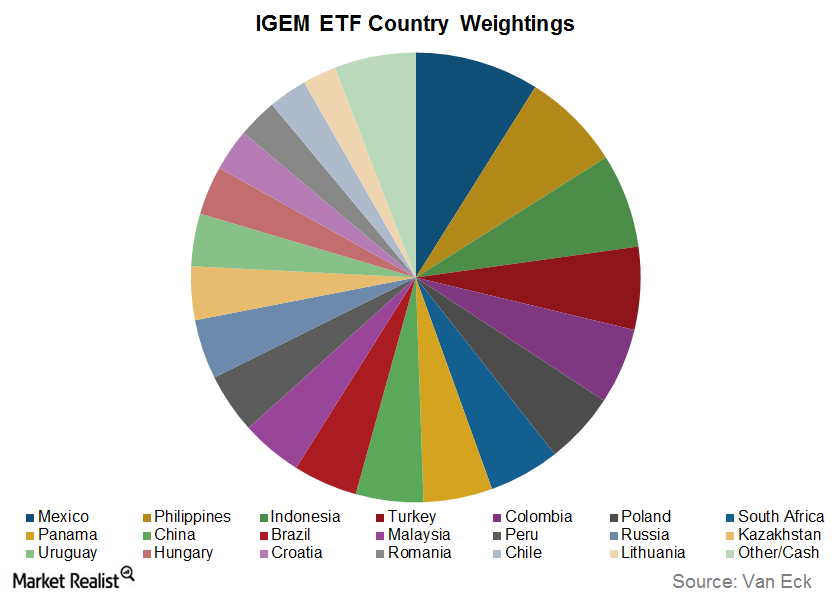

In today’s context, emerging market bonds (IGEM) look like good opportunities for investors.

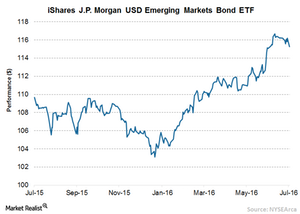

The Rally in Emerging Market Debt

Emerging markets’ nonfinancial corporate debt breached the $26 trillion mark in the first half of 2016.

Is Emerging Market Debt Immune to Rate Hikes?

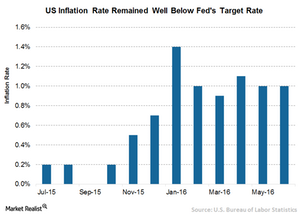

The Federal Reserve kept its key interest rate unchanged in its policy meeting this week while signaling a possible rate hike in December.

Emerging Market Debt Outperforms Other Risk Assets

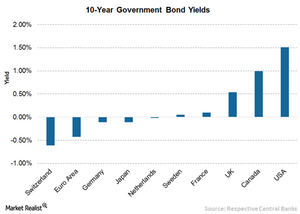

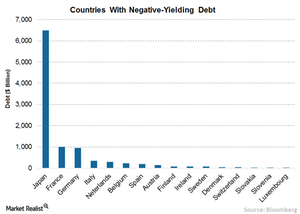

While around 30% of developed market bonds (IHY) are trading at negative yields, emerging market debts (HYEM) are offering attractive returns.

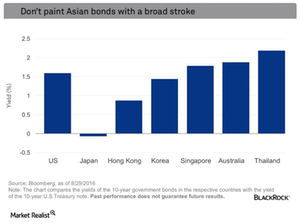

Diminishing Opportunities in Asia: What You Need to Know

The balance of countries in Asia present more interesting opportunities. To better focus our discussion, I’ll concentrate on investment grade markets.

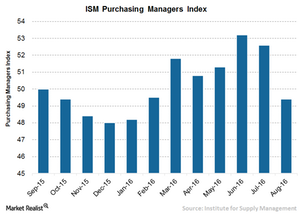

Fed’s Rate Hike Decision to Drive the Markets

In the wake of disappointing economic indicators over the past month, the Federal Reserve kept the interest rate unchanged in its policy meeting this week.

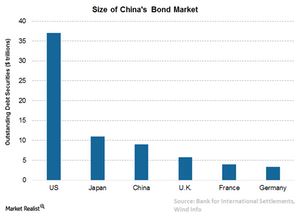

Regulatory Hurdles Affecting Chinese and Indian Bond Markets

As the intensifying search for yield goes international, Matt examines and shares his thoughts on the different Asian bond markets.

Emerging Market Bonds: Higher Yields Could Reflect Higher Risks

Emerging market bonds have been doing extremely well over the past couple of months. EM debt funds have been in the green for seven consecutive weeks.

Why Does Emerging Market Debt Still Look Attractive?

Emerging market debt (EMB) offers plenty of opportunities to investors. Markets are expected to continue their outperformance for the next few quarters.

What Are the Threats for Emerging Markets?

The major threat to emerging markets is tightening in the US. While the Fed will likely leave rates unchanged in September, a hike is possible in December.

Intense Search for Yield Leads to Emerging Market Debt

Under the current uncertain economic circumstances, investors flocked to emerging market debts in search of higher yields.

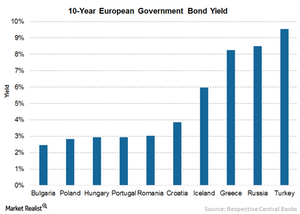

Central and Eastern Europe Have the Brexit Blues

In the long term, Eastern Europe is largely affected by the United Kingdom’s exit from the European Union because of its strong trade links.

How Negative Rates Intensify the Hunt for Yield

By early July, some $11.5 trillion in bonds were trading at negative rates, with 58% of the Barclays US Aggregate Bond Index1 trading below 1%.

Time to Look at Emerging Market Debt

Global emerging markets (“EM”) debt, both hard and local currency, rebounded strongly in June after a significant retracement in May.

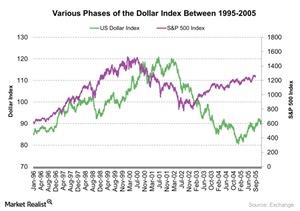

The Dollar Index and Economic Uncertainty: Is There Correlation?

The rally in the US Dollar Index can be correlated to two important events: the dot-com bubble crisis in 1999 and the Argentine debt crisis in 2001.