Are Yield Opportunities Flourishing in Emerging Market Bonds?

Emerging market (or EM) bonds (PCY) offer diversified exposure with higher yields compared to their developed market equivalents (IHY).

Nov. 11 2016, Published 10:02 a.m. ET

Yield opportunities in emerging markets bonds

TOM BUTCHER: Fran, what do you see as the current opportunities in emerging markets debt?

FRAN RODILOSSO: I think investors have a variety of opportunities to look at within the emerging markets debt space. It represents a diversified set of asset classes, and for investors today I would consider 1) local currency sovereign debt, 2) hard currency sovereign debt, and 3) hard currency corporate debt.

With EM local debt, the opportunities are best summarized by yields on average of 6% (Source: J.P. Morgan GBI-EM Global Core Index as of 9/30/2016) or greater, but the scope of this opportunity depends on your view on global growth, commodity prices, on rates and credit markets in general. By investing in local EM markets, you will get exposure to EM currencies, and this generally reflects a positive view on global growth, and commodities prices, but perhaps not such a positive a view on the U.S. dollar. This is one way to play the opportunities and to get extra yield, given this environment where we have $12 trillion in negative-yielding debt and virtually no yield opportunities in developed markets sovereign debt.

Market Realist – Exposure to emerging market bonds

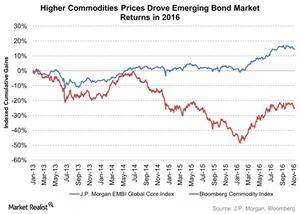

Emerging market (or EM) bonds (PCY) offer diversified exposure with higher yields compared to their developed market equivalents (IHY). Emerging market bonds have shown strong performance in 2016, driven by higher commodity prices and better fundamentals.

The chart above shows the performance of the J.P. Morgan EMBI Global Core Index (EMB) against the Bloomberg Commodity Index. The J.P. Morgan EMBI Global Core Index serves as a benchmark index for emerging market bonds.

JPMorgan Chase offers various other indexes to gain exposure to emerging market bonds, including the J.P. Morgan GBI-EM Global Diversified Index for local currency sovereign bonds, the J.P. Morgan EMBI Global Diversified Index for hard currency sovereign bonds, and the J.P. Morgan CEMBI Broad Diversified Index for hard currency corporate bonds.

Benefits of EM local currency sovereign debt

EM local currency sovereign debt, which is a government bond denominated in the domestic currency of an emerging market issuer, provides—on average—better and higher yields than its developed markets counterparts. The credit quality of these bonds is also strengthening.

EM local currency sovereign debt carries the usual risks of bond investing, including credit risk, currency inflation, and interest rate risk. Besides these risks, these bonds carry additional EM country risk.

To compensate for the additional risk, these bonds offer attractive and higher yields to investors compared to developed market sovereign debt, despite having a comparable credit quality.

With their attractive risk-to-reward profiles, larger credit spreads, and exposures to the economic growth of emerging countries, these bonds provide investors with diversification benefits.

In the next article, we’ll discuss how local currency debt is outperforming other EM bonds.