Market Vectors® Intl Hi-Yld Bd ETF

Latest Market Vectors® Intl Hi-Yld Bd ETF News and Updates

Why Should Investors Focus on Real Yield in Emerging Markets?

Real yields in emerging markets (or EM) have remained at compelling levels over the past few years.

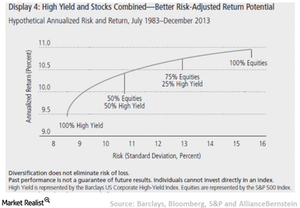

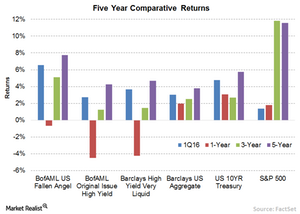

How High-Yield Bonds Can Help Reduce Risk

AB A Place at the Asset-Allocation Table For investors seeking to control volatility in their equity portfolios while still maintaining return potential, high-yield bonds could represent an effective solution. A typical approach to moderating equity volatility is to reallocate assets to the greater stability of investment-grade bonds, or even cash. But this can exact a […]

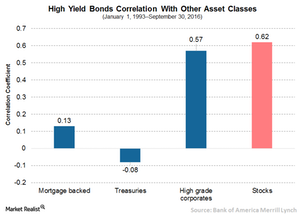

How High-Yield Bonds Are Connected to Other Asset Classes

AB Looks Are Deceiving But even though high-yield bonds look like other bonds, they don’t necessarily act like other bonds. This insight can have important implications for how investors consider them in an overall portfolio context. High-yield performance patterns, for example, don’t track those of other fixed-income sectors very closely over the long term. Looking […]

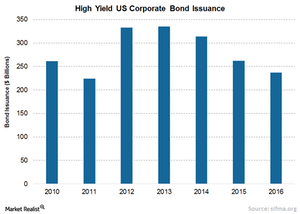

Why High Yield Bonds Are Attractive

In this series, we’ll discuss the many advantages of high yield bonds, their correlation with other asset classes, the rise of global high yield markets, and why high yield bonds should command a place in a portfolio.

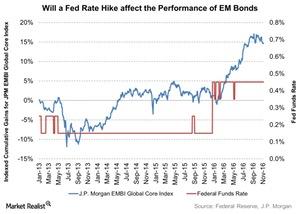

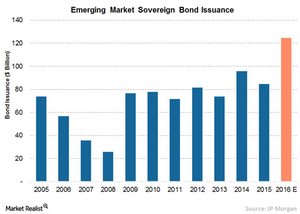

Can a Rate Hike Affect the Performances of Emerging Market Bonds?

In her speech at the Jackson Hole Economic Symposium, Fed chair Janet Yellen expressed optimism about another rate hike in the United States.

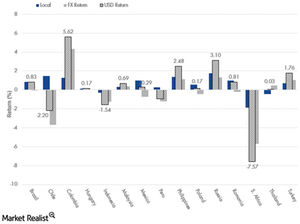

Are Yield Opportunities Flourishing in Emerging Market Bonds?

Emerging market (or EM) bonds (PCY) offer diversified exposure with higher yields compared to their developed market equivalents (IHY).

Is Emerging Market Debt Immune to Rate Hikes?

The Federal Reserve kept its key interest rate unchanged in its policy meeting this week while signaling a possible rate hike in December.

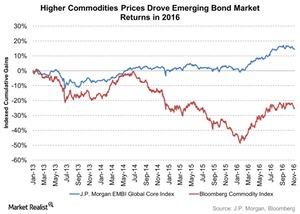

Emerging Market Debt Outperforms Other Risk Assets

While around 30% of developed market bonds (IHY) are trading at negative yields, emerging market debts (HYEM) are offering attractive returns.

Interest Rate Outlooks Don’t Affect All Asset Classes: Here’s Why

Historically, it seems that fallen angels generally perform well across interest rate environments.