Comcast Corp

Latest Comcast Corp News and Updates

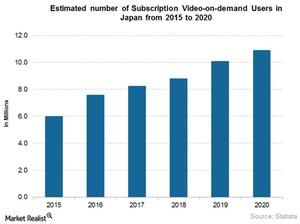

How Is Netflix Performing in Japan?

Netflix considers Japan to be a brand-sensitive market. Once it establishes its brand, it expects its connection with the Japanese audience to be long term.

Why Is Hulu Shying Away from International Markets?

Hulu CEO Mike Hopkins said at an industry conference in Cannes, France, that Hulu was not looking to expand into international markets any time soon.

Verizon Sees Demand for Skinny Bundles

Verizon launched its Custom TV service in April. A skinny bundle service, it gives more choices to customers, allowing them to select their TV channels

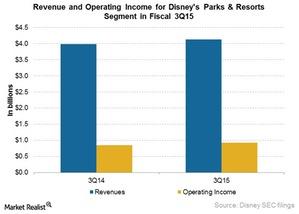

Disney’s Parks and Resorts: Shanghai Disneyland’s Capex Rising

Disney is incurring significant pre-opening expenses for Shanghai Disneyland (FXI), which will be unveiled in spring next year.

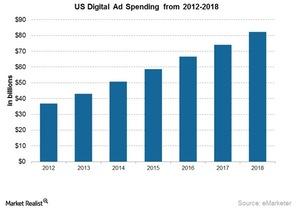

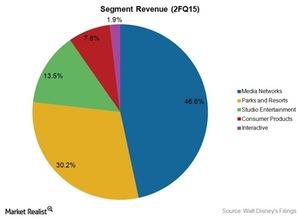

A Look at Disney’s Advertising Revenues

The Walt Disney Company’s (DIS) advertising revenues made up 37% of its Media Networks segment’s total revenues of $5.7 billion in fiscal 3Q15.

Disney’s ESPN: Revenues under Competitive Pressure

ESPN is a part of Disney’s Media Networks segment. Affiliate fees are major component of this segment and are under pressure due to subscriber loss.

AT&T’s All in One Plan Offerings

Since the merger, AT&T has extended bundled video and wireless offerings, such as its All in One Plan, which is being offered to DIRECTV and AT&T customers.

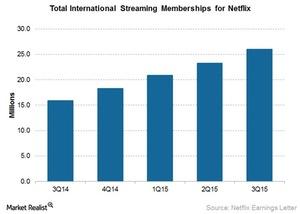

The Must-Know Business Trends Affecting Netflix

Netflix is grabbing eyeballs with its original content and taking advantage of an audience prone to hyper-consumption or binge viewing.

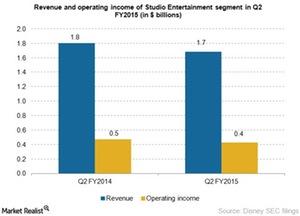

A Look at Disney’s Studio Entertainment Segment

Disney’s Studio Entertainment segment had revenues of $1.7 billion in 2Q15, down 6% from 2Q14. The segment had operating income of $0.4 billion, a 10% fall from 2Q14.

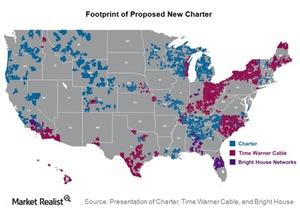

New Charter’s Footprint: Better Position to Reach Customers

New Charter is the proposed merged entity. The company will include networks of some of the largest cable operators in the US.

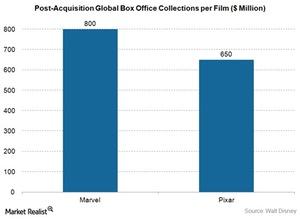

The Walt Disney Company Discusses Acquisitions and Strategy

At a May 13 MoffettNathanson event, Walt Disney’s (DIS) senior vice president of investor relations, Lowell Singer, discussed the company’s acquisitions.

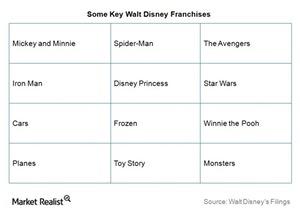

The Walt Disney Company Weighs In on Its Intellectual Properties

In the MoffettNathanson Media & Communications Summit on May 13, the company highlighted its intellectual properties portfolio.

Disney Monetizes Frozen in Multiple Segments in 2Q15

An integrated business model helps Walt Disney (DIS) utilize value created by its intellectual properties such as Frozen across its different segments.

Gigabit Pro: Comcast Internet Offering Delivers up to 2 Gbps

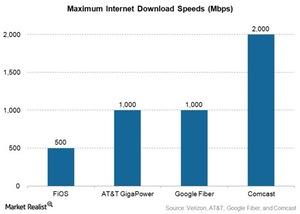

The Gigabit Pro service can provide much faster speeds than those offered by Verizon (VZ) FiOS, AT&T GigaPower, and Google Fiber.

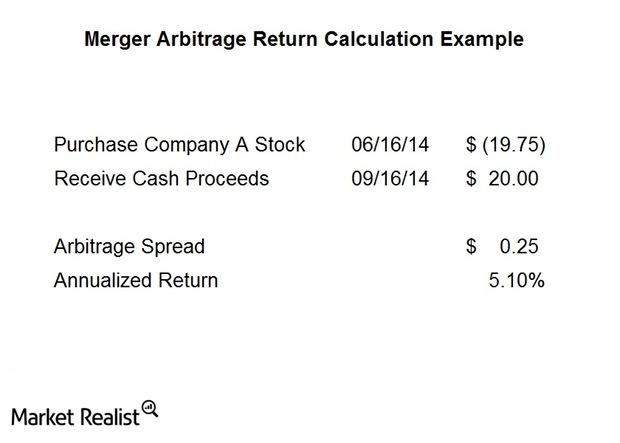

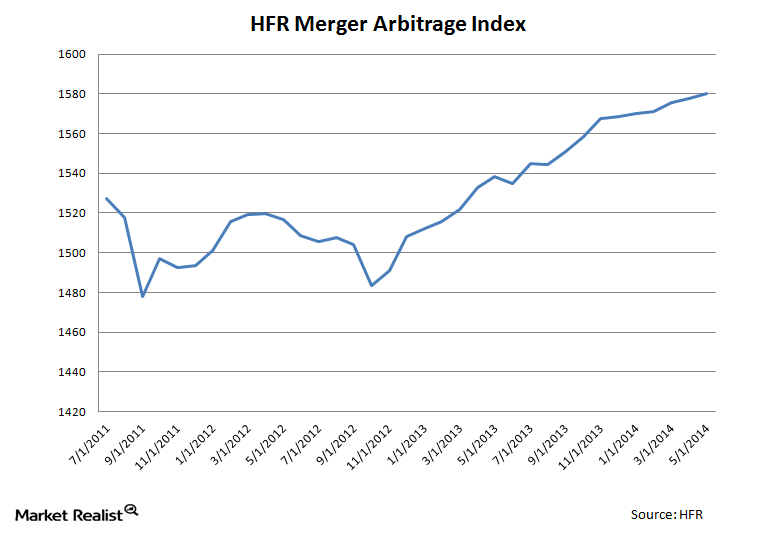

Identifying and analyzing a typical cash merger arbitrage spread

What are the components of a risk arbitrage spread? There are a number of factors that figure into a trade. Let’s look at a typical cash deal first.

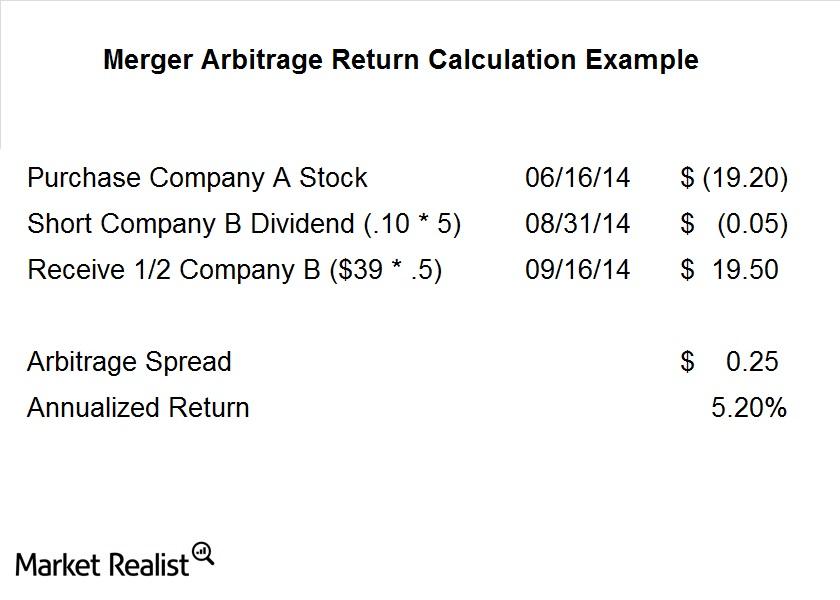

Merger arbitrage must-knows: A typical stock merger spread

Not all deals are cash deals, however. Often companies will issue stock in lieu of giving cash for a deal. This adds a layer of complication to the process and also some risk factors we need to consider.

The Kraft–Heinz Merger and Material Adverse Change, Part 3

Other important merger spreads include the deal between Time Warner Cable and Comcast as well as the merger between Pharmacyclics and AbbVie.

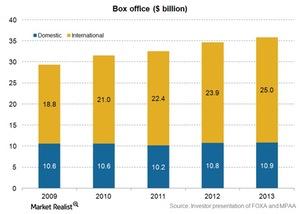

How do the largest studios make money in motion pictures?

The largest studios are owned by conglomerates like 21st Century Fox (FOXA) whose studio had the largest 2014 domestic box office market share.

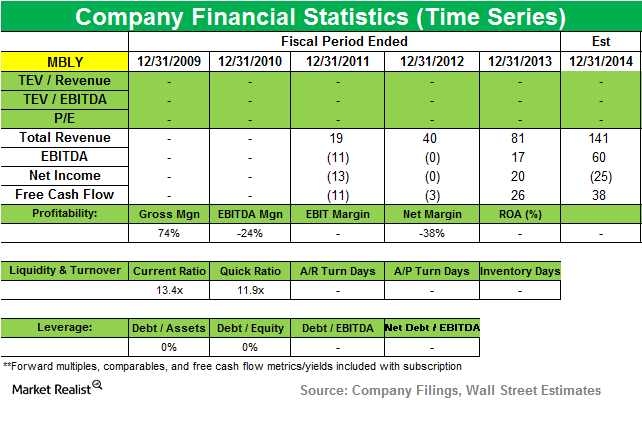

Tiger Global starts new position in Mobileye

Mobileye, the Israel-based vehicle safety technology company, earned gross proceeds from its initial public offering of $1.023 billion.

Must-know: Tiger Global Management’s holdings in 3Q14

Tiger Global Management’s holdings included 48 stocks during the third quarter. The size of the fund’s US long portfolio fell slightly from $7.8 billion to $7.5 billion.

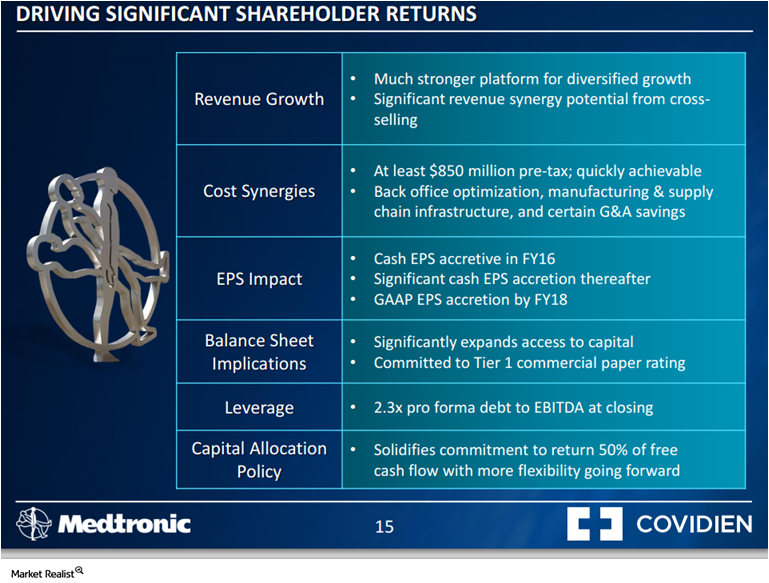

Understanding the rationale for the Covidien-Medtronic transaction

On June 15, 2014, Medtronic (MDT) and Covidien (COV) reached an agreement to merge via a scheme of arrangement. The two companies more or less offer complementary goods.

Merger arbitrage must-knows: A key guide for investors

Merger arbitrage, otherwise known as “risk arbitrage,” is an investment strategy that primarily focuses on mergers and capturing the spreads on announced deals.

An investor’s guide to cyclical and counter-cyclical industries

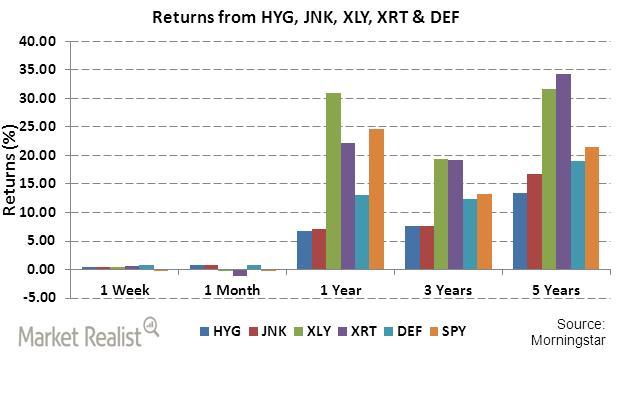

XLY and XRT have performed better in terms of absolute returns over longer periods of three and five years

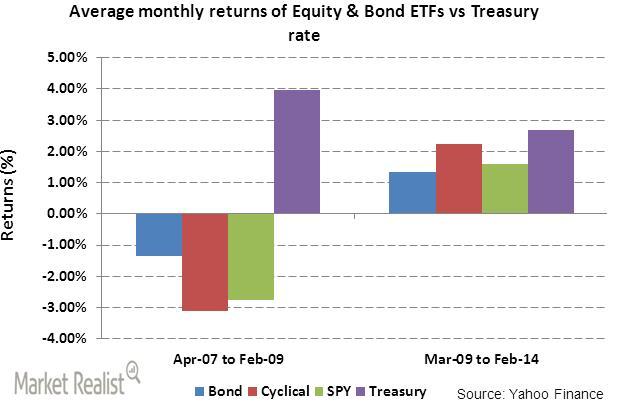

High yield bond ETFs’ performance compared to cyclical industry ETFs

During economic uncertainty, investors want steady, guaranteed returns from the Treasury instead of quick returns from price movements in equity ETFs.Technology & Communications A guide to Disney’s Consumer Products and Interactive Media segment

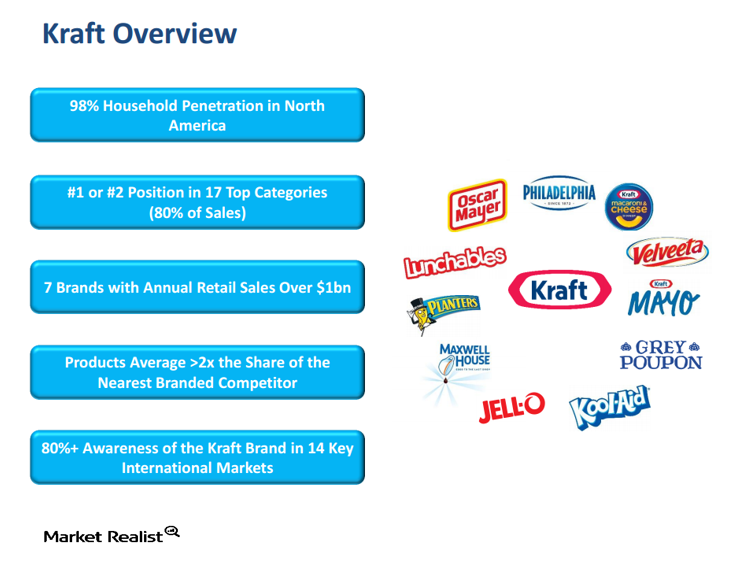

The businesses in the Consumer Products segment generate royalty revenue by licensing characters from its film, television, and other properties to third parties.

Why Disney’s Parks and Resorts business is a valuable growth driver

In 2013, Parks and Resorts revenues increased 9%, to $14.1 billion, and segment operating income increased 17%, to $2.2 billion

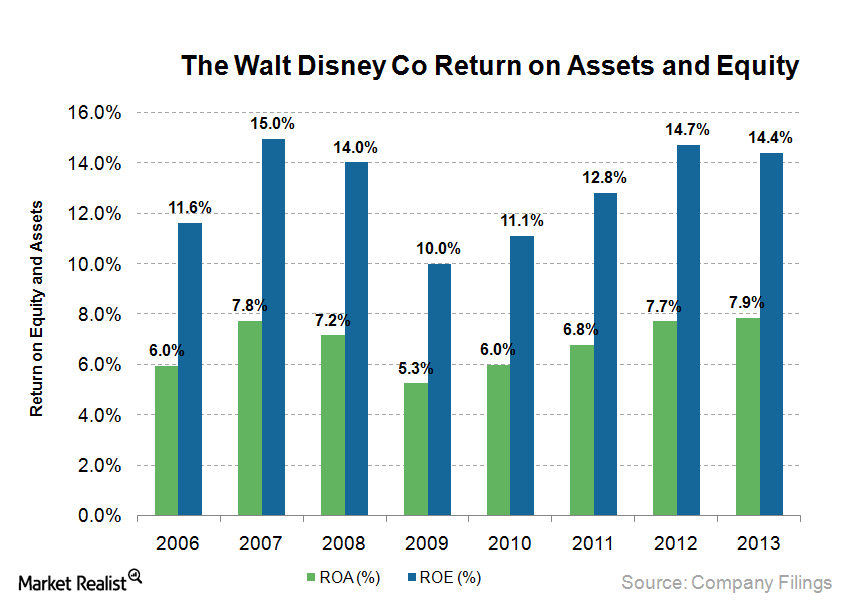

Exploring revenue and profitability drivers at Disney

For the fiscal year ended September 28, 2013, the company reported record results, with an 8% increase in diluted EPS, to $3.38 compared to $3.13 in the prior year.