British American Tobacco PLC

Latest British American Tobacco PLC News and Updates

Vuse Is in the News—Who Owns the First FDA-Authorized Vape Company?

Vaping has had a bad rap, but Vuse is defying the odds amid FDA authorization. Who owns the vaping company?

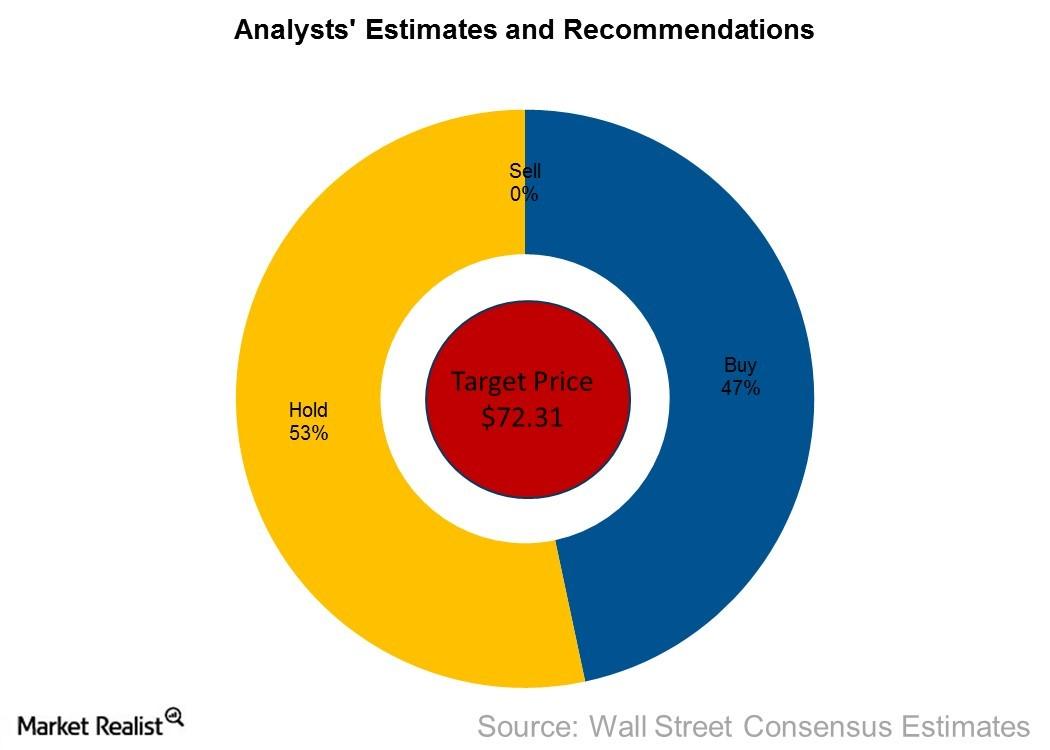

What Are Analysts Recommending for Altria?

The FDA’s (Food and Drug Administration) recent announcement could have compelled analysts to lower their 12-month target price for Altria Group (MO).

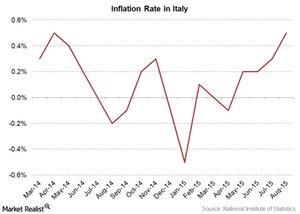

Italy’s Inflation Rate Rose in August: EWI Fell 0.40%

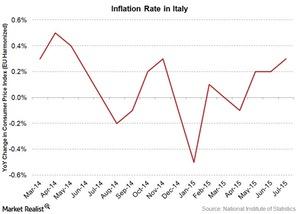

According to the August 31 release by the ISTAT, the EU’s harmonized inflation rate in Italy rose to an impressive 0.50% in August on a YoY (year-over-year) basis.

Altria Acquires 35% Stake in Juul Labs

Today, Altria Group (MO) announced a $12.8 billion investment in Juul Labs for a stake of 35% in the e-cigarette company.

Can We Expect an Upside Potential in Altria Stock?

As of September 17, Altria Group (MO) stock was trading at $62.44, which represents a 7.9% rise since July 26.

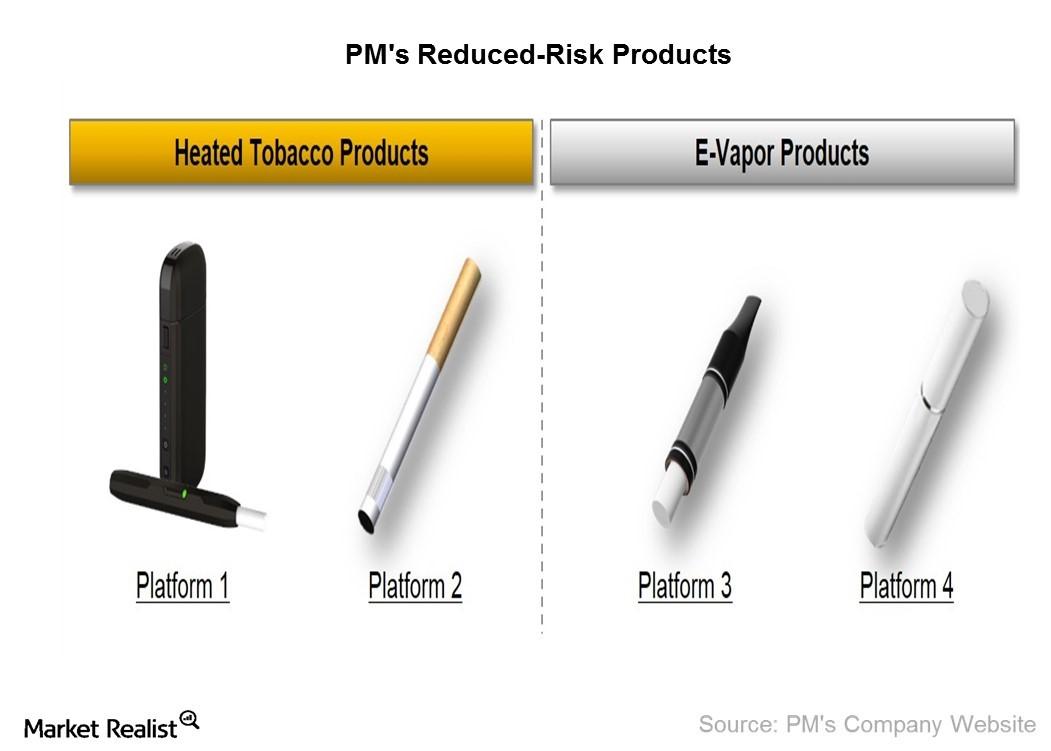

Why Philip Morris’s iQOS Sales in Japan Are Promising

According to the WHO, under the current regulatory regimes, the percentage of the cigarette smoking population is expected to fall from 22% to 19% by 2025.

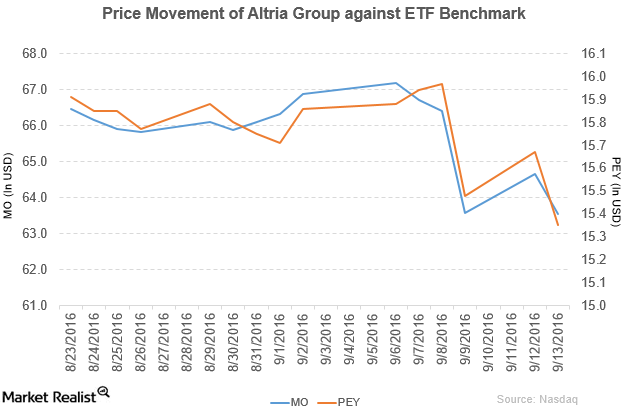

Citigroup Has Rated Altria Group a ‘Buy’

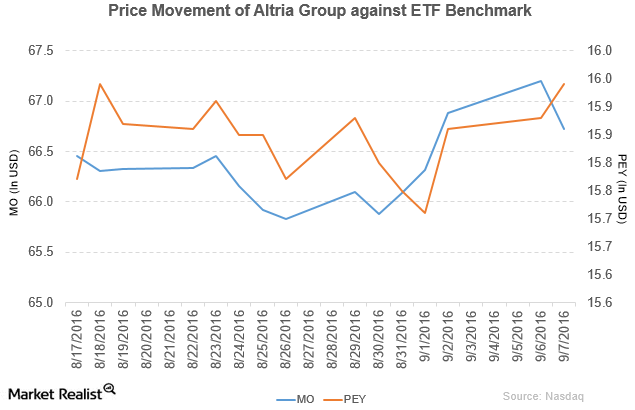

Altria Group (MO) has a market cap of $129.7 billion. It fell 1.7% to close at $63.55 per share on September 13, 2016.

Altria Group Reaffirms Its 2016 Projections

Altria Group (MO) has a market cap of $130.4 billion. It fell by 0.71% to close at $66.72 per share on September 7, 2016.

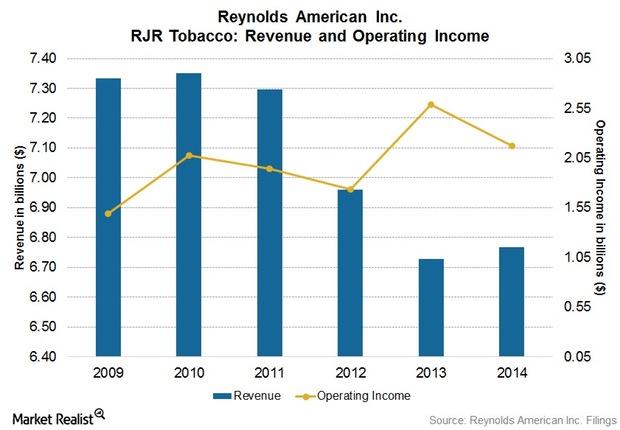

Reynolds American’s Largest Operating Segment: R. J. Reynolds Tobacco

R. J. Reynolds is Reynolds American’s largest operating segment. Its brands include the two best-selling cigarettes in the US, Camel and Pall Mall.

Obstacles to Altria Group’s Growth: Weaknesses and Threats

Altria’s business faces threats of high scrutiny, taxation, and regulation. Prohibitions on cigarette sales and smoking bans in public places affect sales.

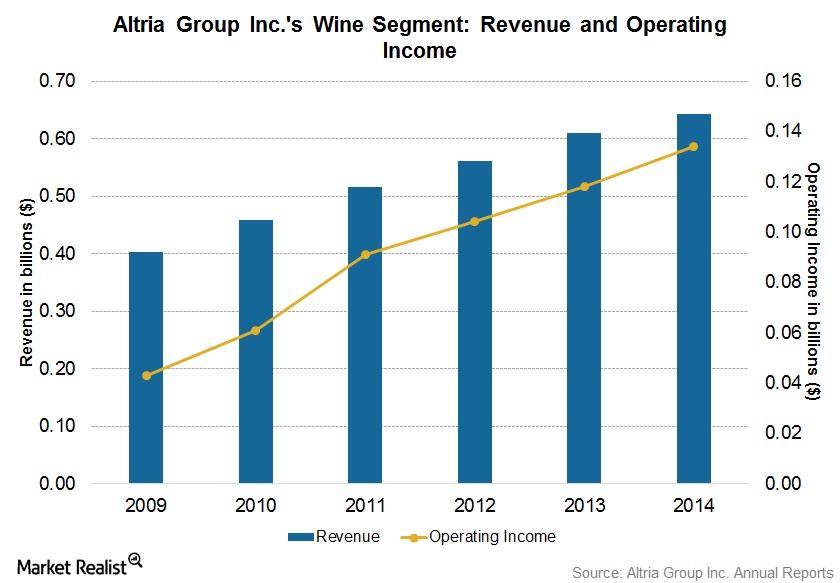

Understanding Altria’s Wine Business Segment

Altria’s subsidiary Ste. Michelle is a leading producer of Washington state wines. It owns wineries and distributes wines in several regions and countries.

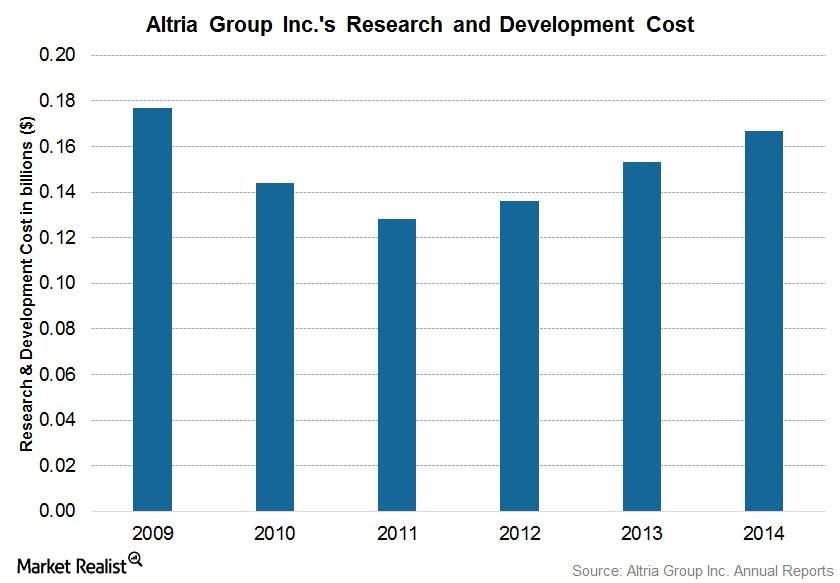

Altria’s Heritage of Innovation and Investments in R&D

Altria’s R&D expenses for fiscal 2014 were $0.2 billion, or 0.9% of net sales. Its R&D expenses upped by 9.2% in 2014, reflecting a trend toward innovation.

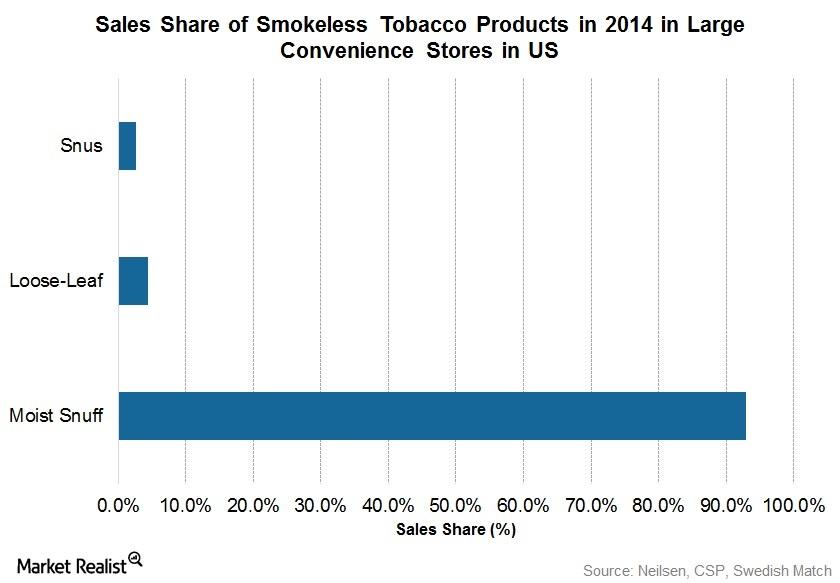

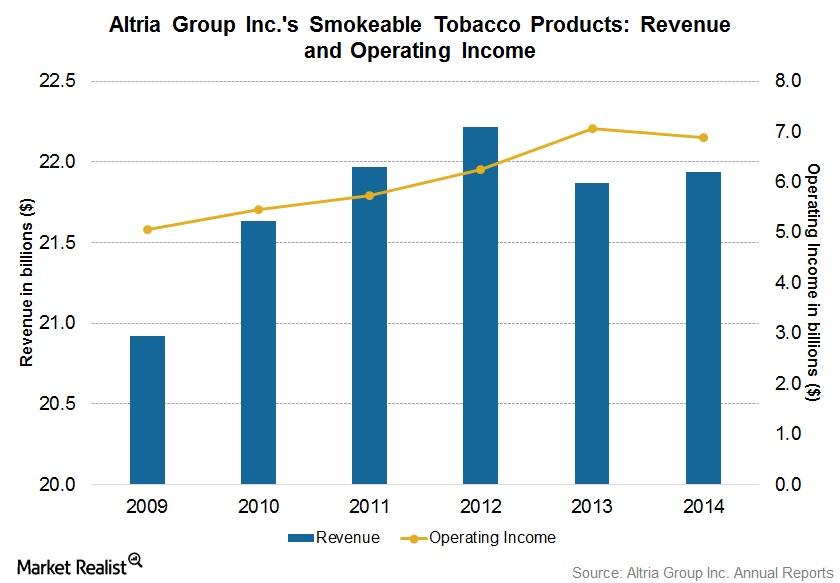

Altria Group’s Smokeable Tobacco Product Segment

MO’s tobacco business segment consists of smokeable and smokeless tobacco products. The company’s smokeable tobacco companies include PM USA and Middleton.

Philip Morris’s Growth Hurdles Ahead: Weaknesses and Threats

Philip Morris faces an exceptional level of scrutiny, taxation, and regulation. Global health consciousness and ongoing litigation also pose a threat.

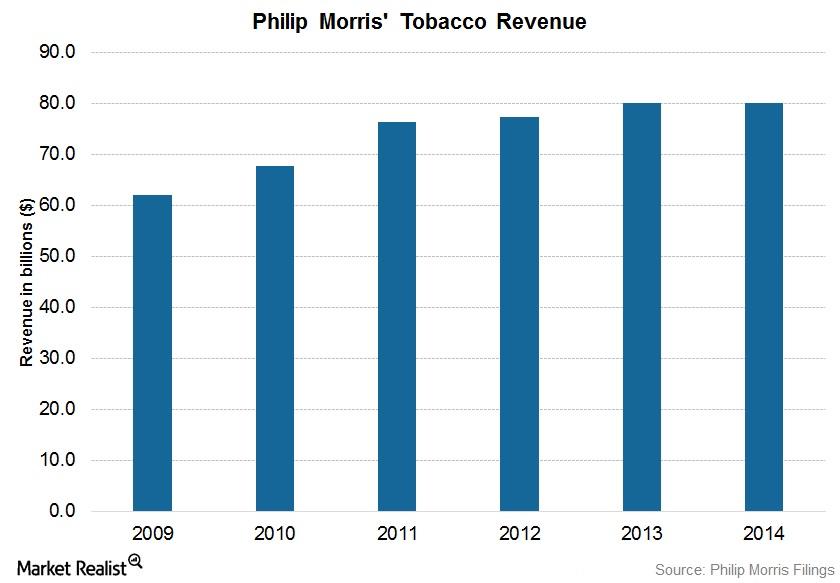

Introducing Philip Morris International

Incorporated in Virginia in 1987, Philip Morris is a leading tobacco company whose revenue in 2014 was ~$80 billion—$29.8 billion after excise taxes.

Italy’s Inflation Rate Rose to 0.3% in July, yet EWI Fell 0.88%

The ECB’s (European Central Bank) monetary stimulus package seems to be working well for most Eurozone economies, especially Italy.