Xtrackers Harvest CSI 300 China A-Shares ETF

Latest Xtrackers Harvest CSI 300 China A-Shares ETF News and Updates

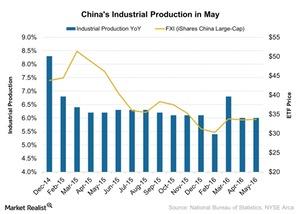

China’s Industrial Production Rises: Is Investor Confidence Back?

On a year-over-year basis, China’s industrial production increased to 6.0% in May 2016. That’s the same pace as April.

IMF Provides a Positive Assessment of China’s Economy

In a press conference on June 14 on its annual Article Four Staff Report, the IMF provided a positive assessment of China’s economy.

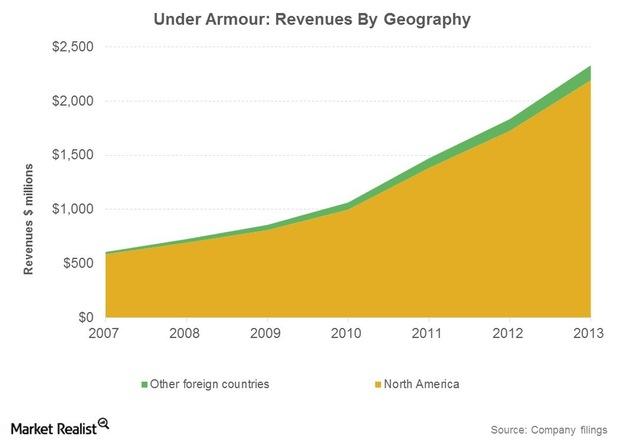

Can Under Armour’s Growth Model Cope With These Threats?

Key threats to the company include higher labor costs and greater regulation. After the Bangladesh factory tragedy, stricter regulations can be expected.

Why Druckenmiller Is Optimistic about Chinese Consumer Stocks

Druckenmiller’s firm bought 710,200 shares of Alibaba (BABA) in 2Q17. The holding accounted for nearly 5.4% of the firm’s portfolio in 2Q17.

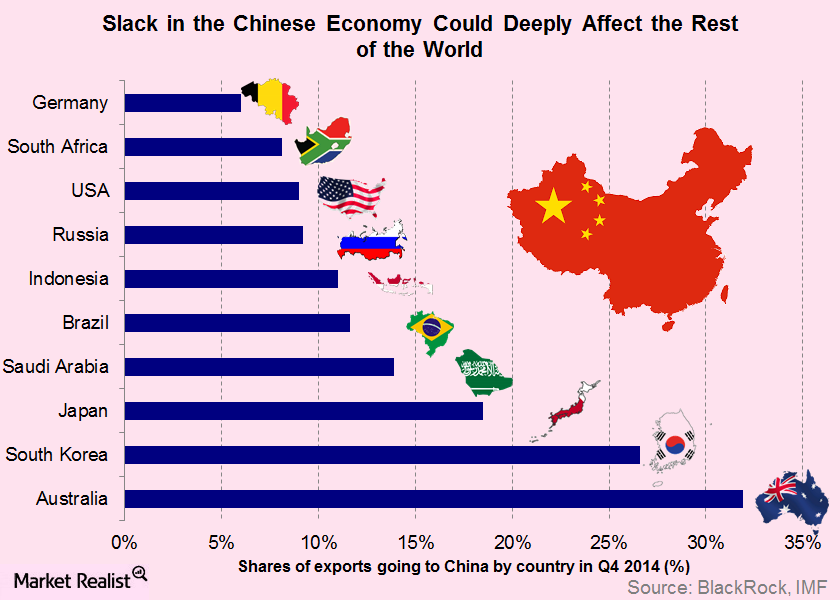

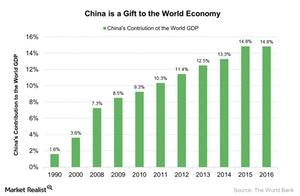

Why China Matters in the Long Run

China matters in the long run—and not just for investors in the country’s equity markets. Slack in the Chinese economy could affect the global economy (FAM) in a big way.

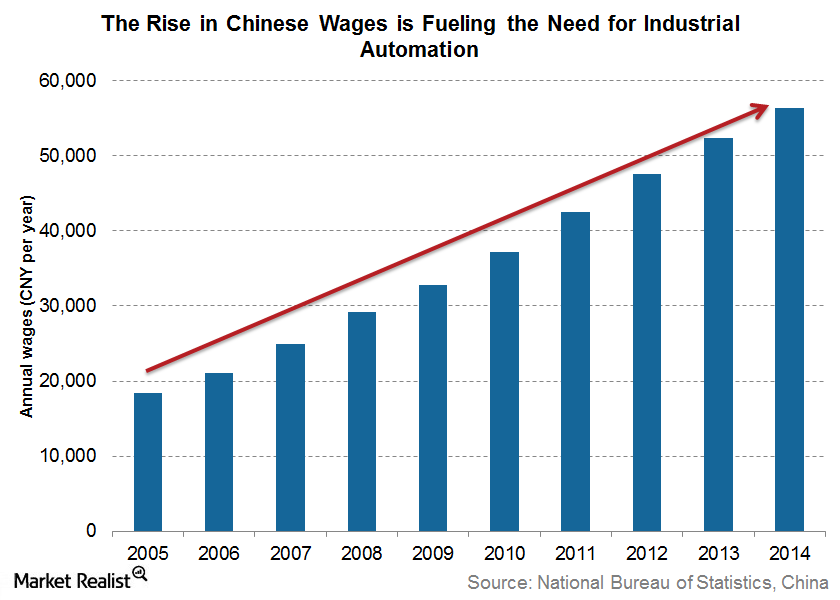

From Men to Machines: China’s Robotic Revolution

A quiet revolution is taking place in China. Few people will have heard of Shenzhen Everwin Precision Technology but this company is making history.

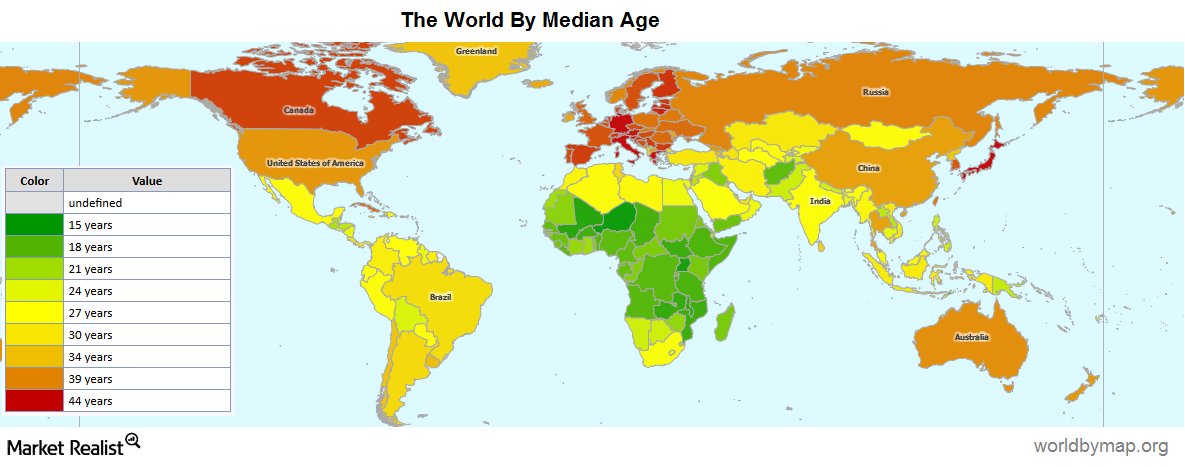

How Demographics Are the Key to India’s Growth

Demographics are the key to India’s growth story. India’s strength in numbers is one of its biggest advantages over the rest of the world.

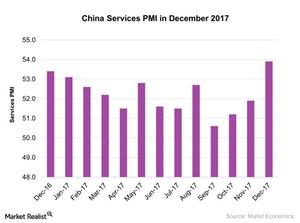

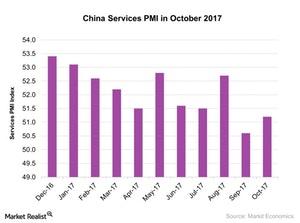

China’s Services PMI Rose: Is the Economy Back on Track?

China’s final Markit services PMI stood at 53.9 in December compared to 51.9 in November 2017. It beat the preliminary market estimation of 51.8.

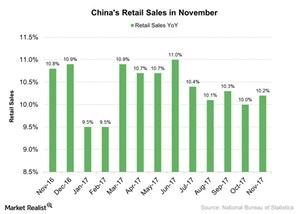

Why China’s Retail Sales Strengthened in November 2017

On a year-over-year basis, China’s retail sales strengthened in November 2017, according to a report by the National Bureau of Statistics of China.

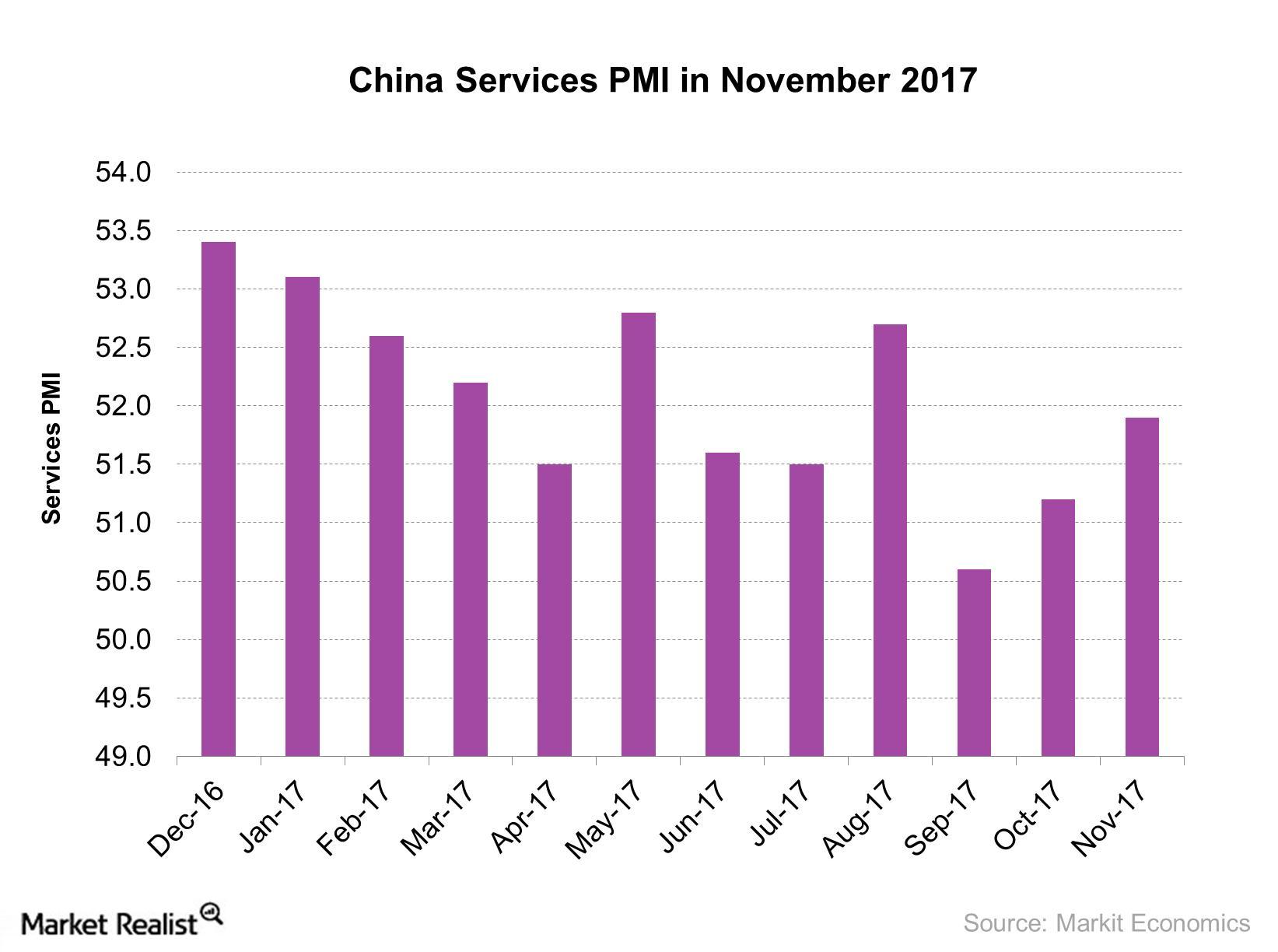

Why China’s Service Sector Activity Rose in November

China’s service sector in November According to data provided by Markit Economics, China’s service PMI (purchasing managers’ index) stood at 51.9 in November, compared with 51.2 in October 2017. It beat the preliminary market estimate of 51.5. China’s November service PMI updates are as follows: production output and volume improved new business orders improved employment in […]

Key Economic Indicator Data Released Last Week

In this series, we’ll analyze major emerging nations’ manufacturing and service PMIs (purchasing managers’ indexes).

James Gorman Says China ‘Is a Gift to the World Economic Growth’

James Gorman, chair and CEO of Morgan Stanley (MS), shared his view on China (FXI) (YINN) in an interview with CNBC.

China’s Retail Sales Fell Last Week: Will That Affect Growth?

According to a report provided by the National Bureau of Statistics of China, on a yearly basis, China’s retail sales rose 10% in October compared to a 10.3% rise in September 2017.

China’s Services PMI Improved: Is the Economy Back on Track?

According to data provided by Markit Economics, the Caixin China Services PMI (purchasing managers’ index) improved in October 2017 from its 21-month low in September.

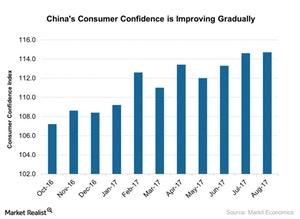

Does China’s Consumer Confidence Signal Better Conditions?

According to a report provided by the National Bureau of Statistics of China, the consumer confidence index for China stood at 114.7 in August 2017 compared to 114.6 in July.

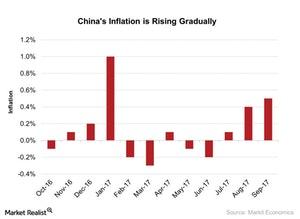

China’s Inflation Is Improving: Are Consumers More Selective?

According to a report provided by the National Bureau of Statistics of China, China’s inflation index improved 0.50% in September 2017 compared to a 0.40% rise in August 2017.

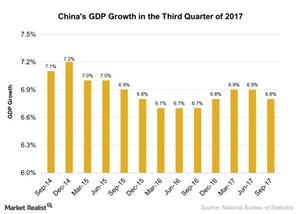

China’s GDP at 6.8% in 3Q17: What’s Affecting Economic Growth?

China’s GDP grew at an annualized rate of 6.8% in 3Q17 and met the market expectation. The economy expanded at an annualized rate of 6.9% in the first two quarters of 2017.

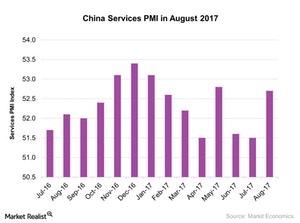

Why China’s Services PMI Rose in August 2017

According to a report by Markit Economics, China’s Caixin services PMI rose to 52.7 in August 2017 as compared to 51.5 in July.

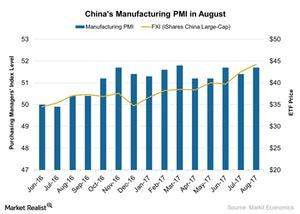

China’s Manufacturing PMI Indicated Stronger Business Climate

China’s manufacturing activity improved sharply in August 2017.

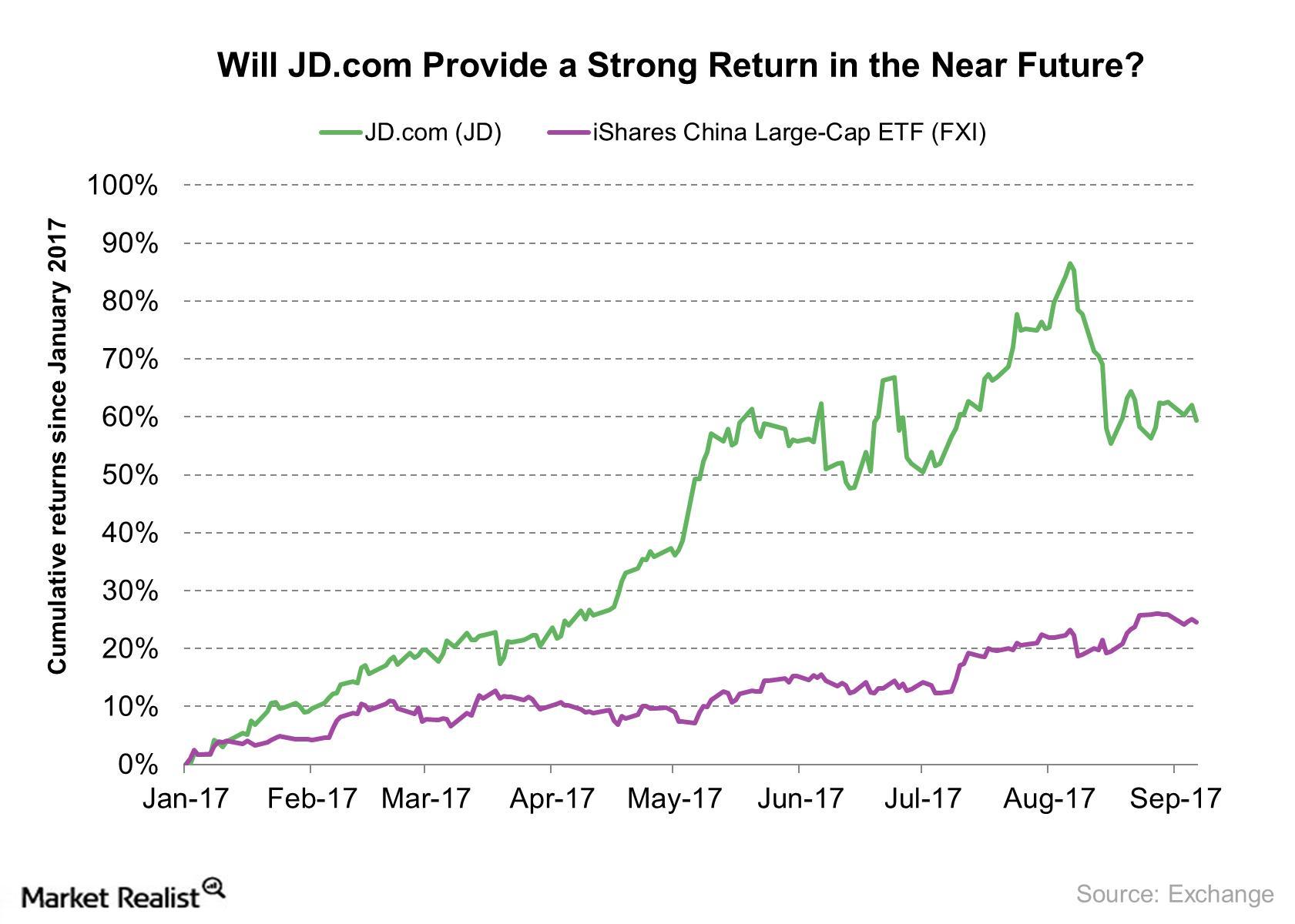

Goldman Sachs Increased JD.com’s Target Price to $56

Goldman Sachs (GS) has a positive outlook on JD.com (JD).

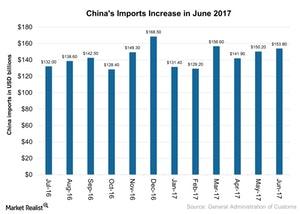

Did China’s Imports Rise on Its Structural Shift in June 2017?

China’s (FXI) imports rose to $153.8 billion in June 2017, a 17.2% rise year-over-year (or YoY) and a 2% rise month-over-month.

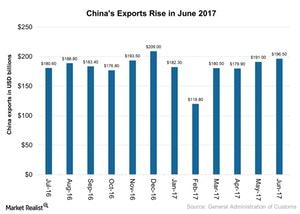

Chinese Exports Rose in June 2017 on Improving Global Demand

Chinese (FXI) exports stood at $196.6 billion in June 2017, a rise of 11.3% year-over-year basis and a rise of 8.7% month-over-month.

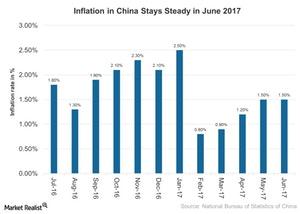

Will China Continue to a See Steady Rise in Inflation in 2017?

Inflation in China was on a steady rise in June 2017, in line with the market’s expectation. China’s (MCHI) consumer prices rose 1.5% year-over-year in June 2017.

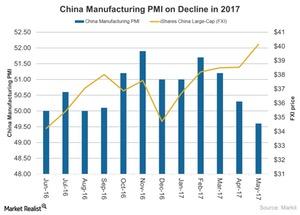

A Look at China’s Manufacturing Activity in 2017

China’s (FXI) economic activity slowed down in May 2017 as the country’s manufacturing activity touched its 11-month low.

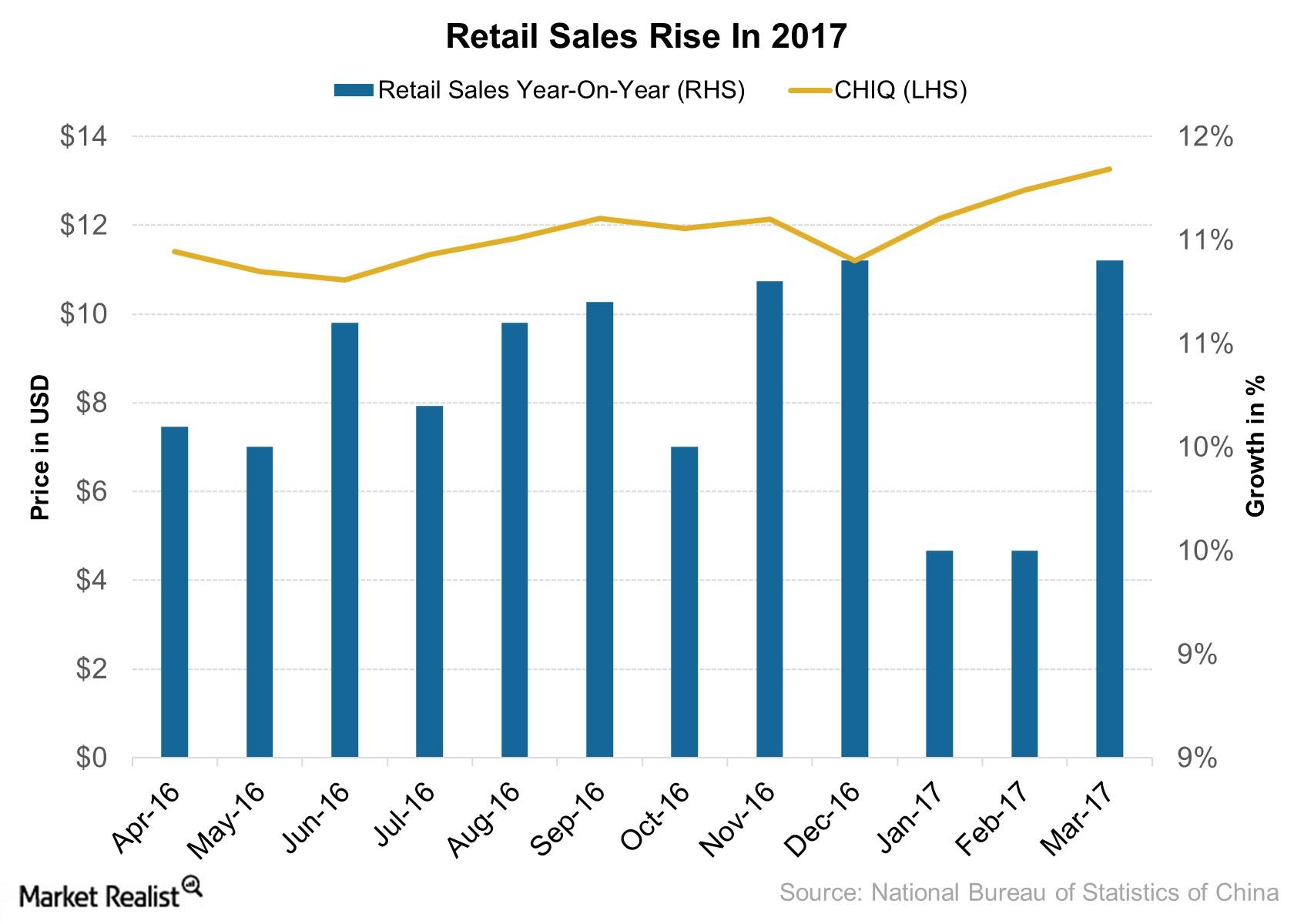

China’s Retail Sales Improved in March 2017

Retail sales of consumer goods totaled 8.5 trillion yuan (~$1.3 trillion) in 1Q17, according to the National Bureau of Statistics.

What China’s Weakening Services PMI Indicates for the Economy

Caixin China’s services PMI (purchasing managers’ index) stood at 52.2 in March 2017 compared to 52.6 in February.

China’s Manufacturing PMI Improved: How It Could Drive Investor Sentiment

China’s final manufacturing PMI (purchasing managers’ index) stood at 51.8 in March 2017 compared to 51.6 in February, beating market expectations of 51.6.

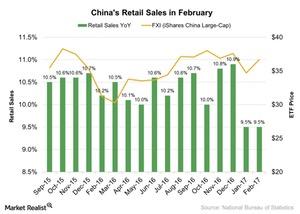

How Did China’s Retail Sales Look in February?

On a year-over-year basis, China’s retail sales were weaker in February 2017, according to the National Bureau of Statistics of China. The data were released on March 13, 2017.

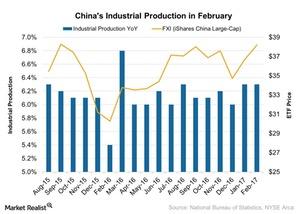

Will China’s Improved Industrial Production Impact Manufacturing?

According to the National Bureau of Statistics of China, on a year-over-year (or YoY) basis, the country’s industrial production rose 6.3% in February 2017.

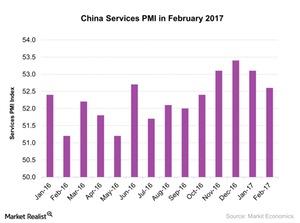

China Services PMI Could Indicate a Weaker Path for Its Economy

According to a report by Markit Economics, the Caixin China services PMI (purchasing managers’ index), released on March 2, 2017, stood at 52.6 in February 2017.

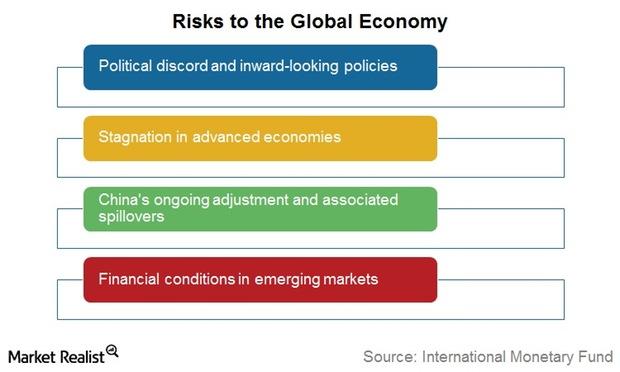

Behind the Risks Affecting Global Economic Growth

The IMF cited the “fraying consensus about the benefits of cross-border economic integration” visible in the UK’s Brexit vote as a slowdown factor.

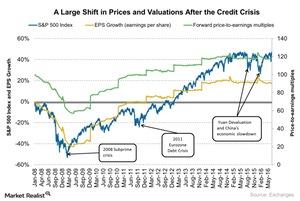

In Retrospect: How the 2008 Crisis Affected SPY’s Valuation

When the 2008 credit crisis affected the S&P 500 Index (SPY), we saw a large shift in valuations and the index level.

What’s Needed to Ensure Long-Term Economic Growth?

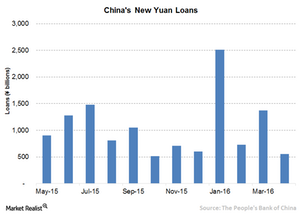

China is consistently propping up domestic demand backed by strong credit growth. The impacts of Chinese stimulus measures are starting to show results.

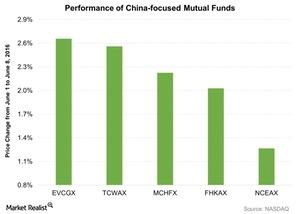

SSE Composite Index Rose ahead of Long Weekend

The SSE Composite Index rose slightly by 0.4% to 2,927.16 from June 1 to June 8, 2016, as the market prepared for the long weekend.

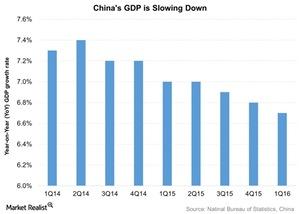

When China Sneezes, the World Catches a Cold!

China is the world’s second-largest economy. Its economy started going downhill due to sluggish global demand. This impacted its trading partners.