BTC iShares Core U.S. Aggregate Bond ETF

Latest BTC iShares Core U.S. Aggregate Bond ETF News and Updates

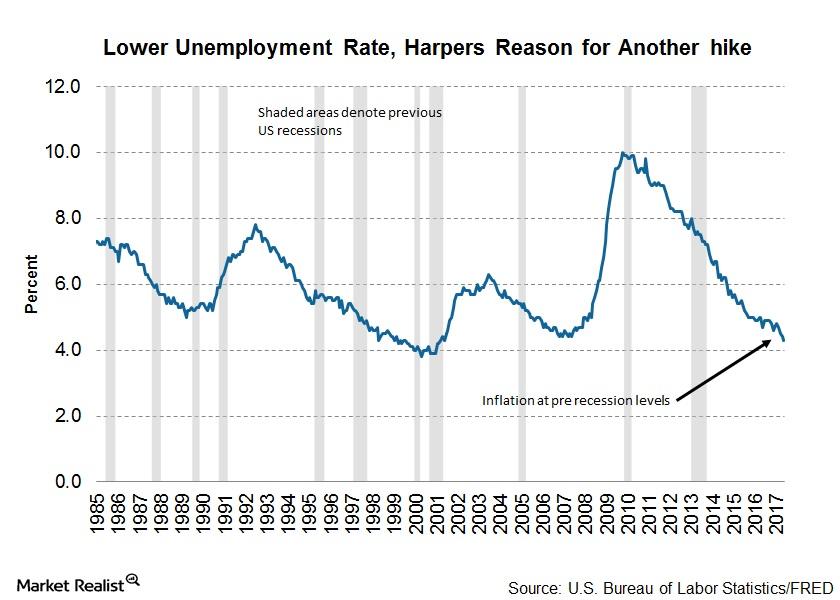

Why Philadelphia’s Fed President Supports Another Rate Hike

In a recent interview with The Financial Times, the hawkish president of the Philadelphia Federal Reserve said that the Fed’s balance sheet’s unwinding could begin in September 2017.

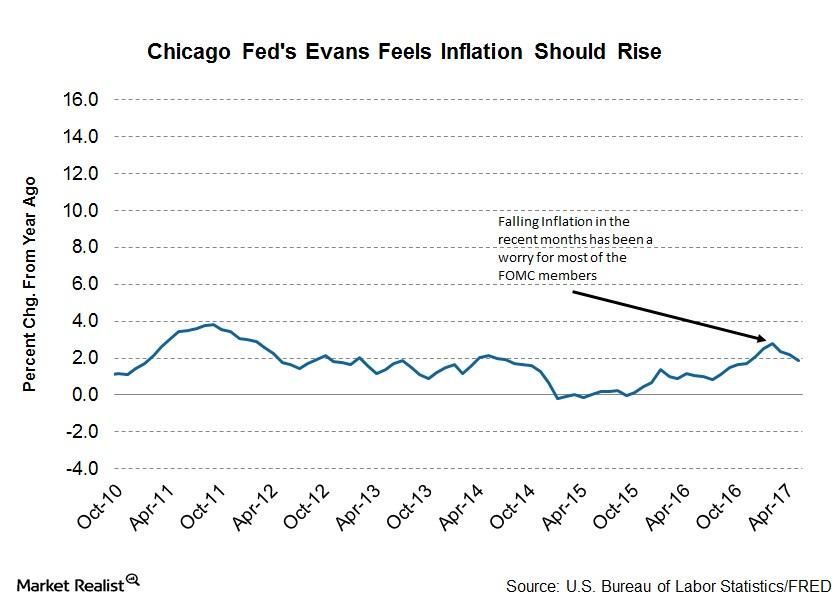

Why Chicago’s Evans Sees Moderate Risks to Financial Stability

Chicago’s Federal Reserve president, Charles L. Evans, recently spoke at a Money Marketeers of New York University event about monetary policy challenges in a new inflation environment.

St. Louis’s Bullard Thinks Rebalancing Will Take 5 Years

At the Illinois Bankers Association’s annual conference in Nashville, organized on June 23, 2017, St. Louis’s Federal Reserve president, James Bullard, sounded dovish about the US economy.

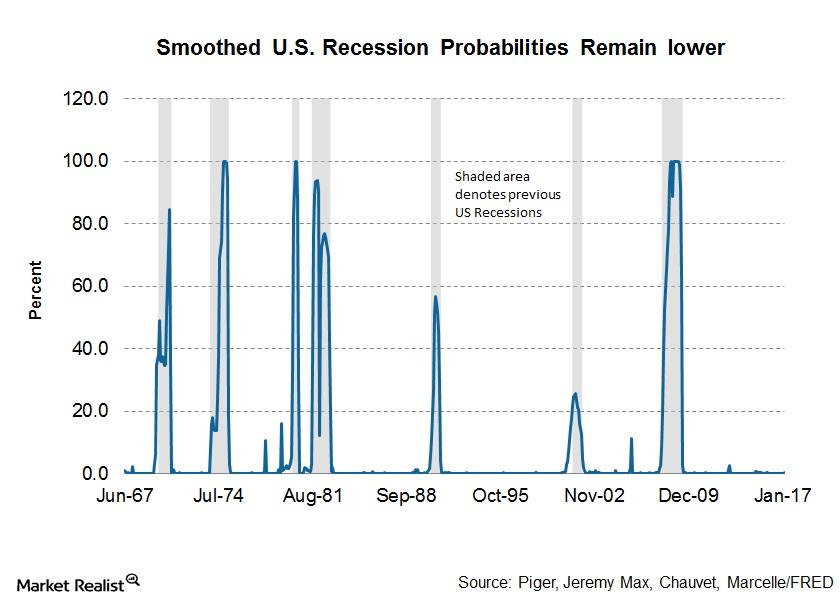

Why Cleveland’s Fed President Worries about Another Recession

Loretta J. Mester, the president and CEO of the Cleveland Federal Reserve, spoke at the 2017 Policy Summit on Housing, Human Capital, and Inequality held on June 23, 2017.

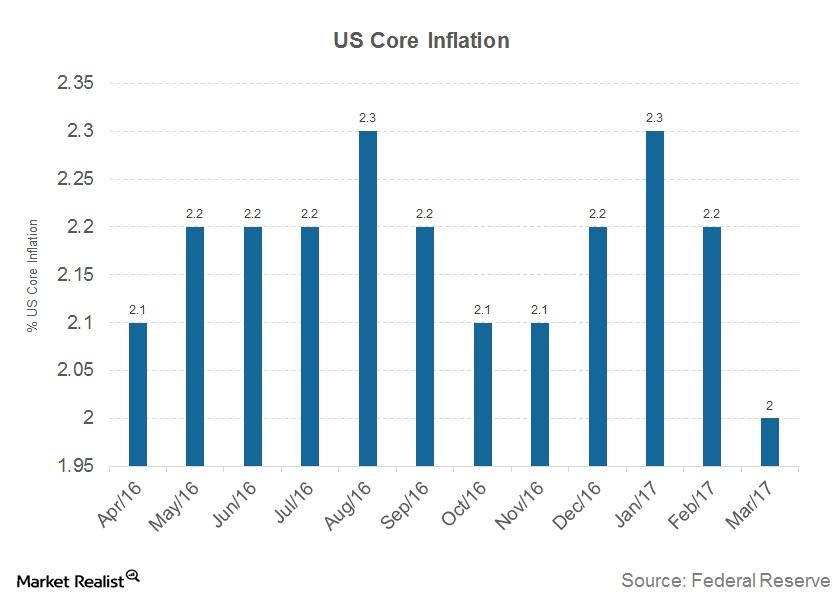

Why Charles Evans Thinks It’s Important to Reach Inflation Goals

Charles L. Evans, president of the Federal Reserve Bank of Chicago, said it’s extremely important that the Fed reach its inflation (VTIP) goal.

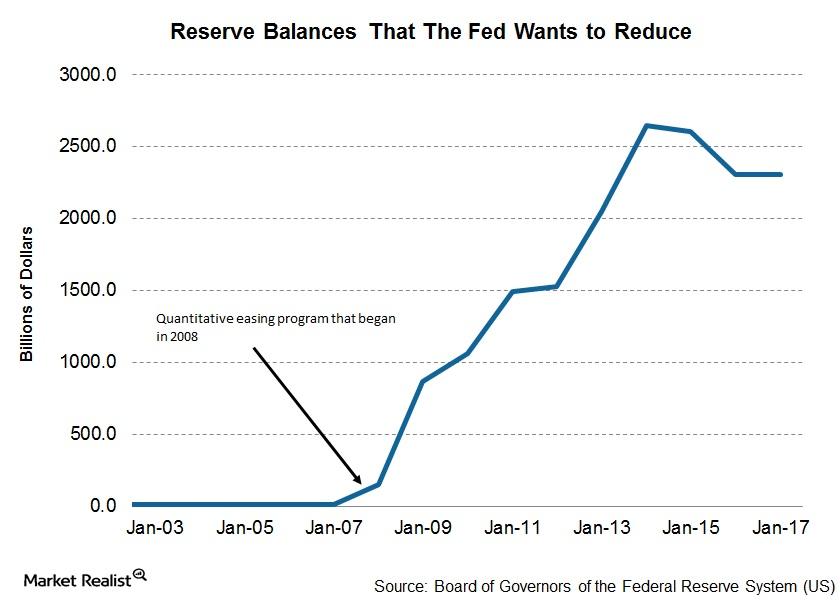

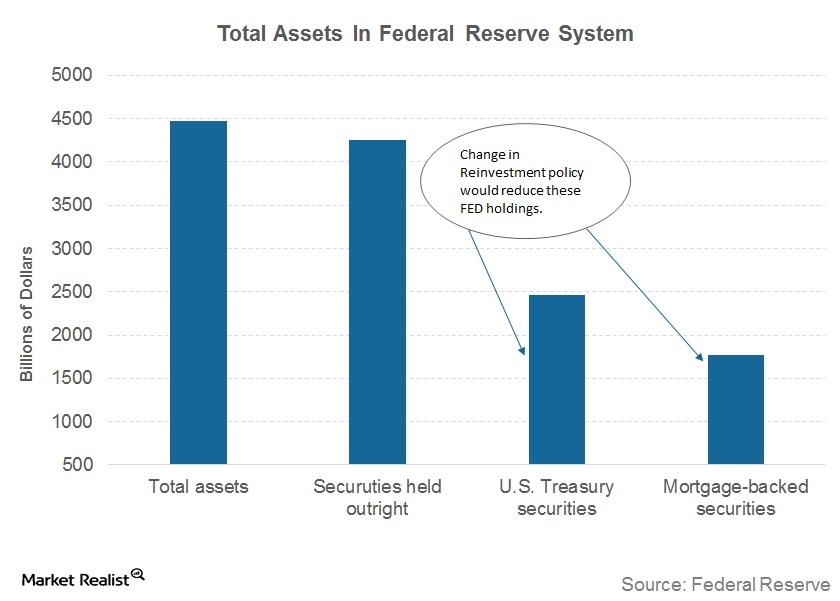

Inside the Fed’s Balance Sheet (The Biggest in the World)

The Fed has started the rate normalization process only recently and has a long way to go before the rates come back to pre-Lehman-collapse levels.

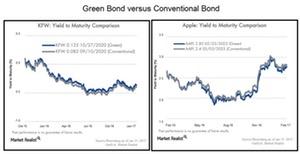

Green Bonds and Conventional Bonds: What’s the Difference?

There isn’t much difference between a conventional bond and a green bond (GRNB), also known as a climate bond. Both have similar risk-return profiles.

Why Richard Bernstein Sees Risk in ‘Safe’ Investments

Richard Bernstein believes that investors’ flocking to fixed-income products and shunning equities has increased their risk.

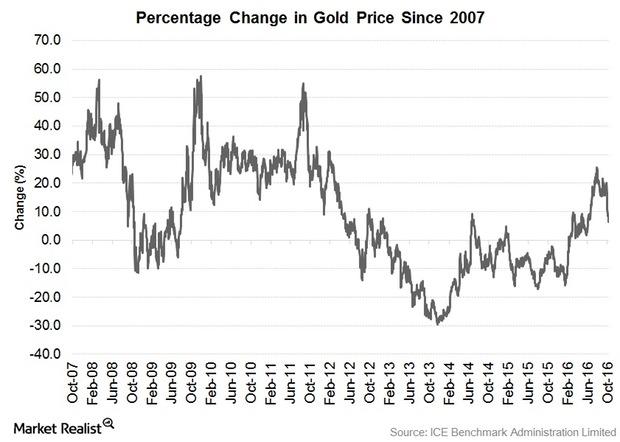

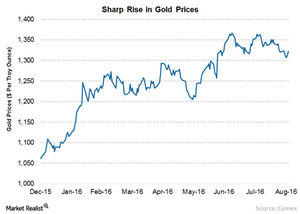

Gold and Gold Miners: Analyzing Recent Performance

Gold bullion ended September at $1,315.75 per ounce for a 0.5% gain while gold stocks experienced more positive returns. The NYSE Arca Gold Miners Index[1. NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold] (GDMNTR) posted a 3.8% gain, while […]

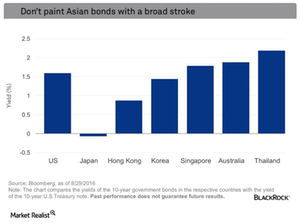

Diminishing Opportunities in Asia: What You Need to Know

The balance of countries in Asia present more interesting opportunities. To better focus our discussion, I’ll concentrate on investment grade markets.

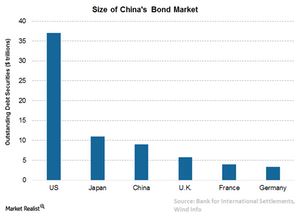

Regulatory Hurdles Affecting Chinese and Indian Bond Markets

As the intensifying search for yield goes international, Matt examines and shares his thoughts on the different Asian bond markets.

Why Caution Holds the Key

The UK has taken over other countries as the most sought-after bond market destination, especially after the Brexit vote.

How Might Yields React to a Dot-Com Bubble Situation?

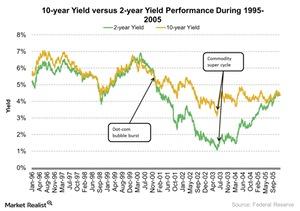

During the 1999–2002 dot-com bubble crisis, the US 2-Year Treasury yield fell by 74%. It made a high of 6.9% in May 2000 and a low of 1.8% in September 2002.

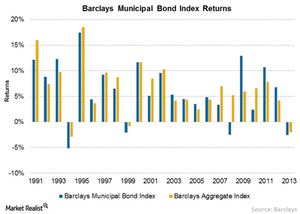

Yield Is the Workhorse of Municipal Bond Returns

Over the years, average returns from municipal bonds (CMF) are in line with the broader index. They outperformed in some years and underperformed in others.

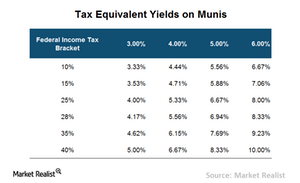

Are Municipal Bonds Really for Me?

Municipal bonds (MUB) have provided an excellent return in the past year. The returns are even better if we account for their tax benefits.

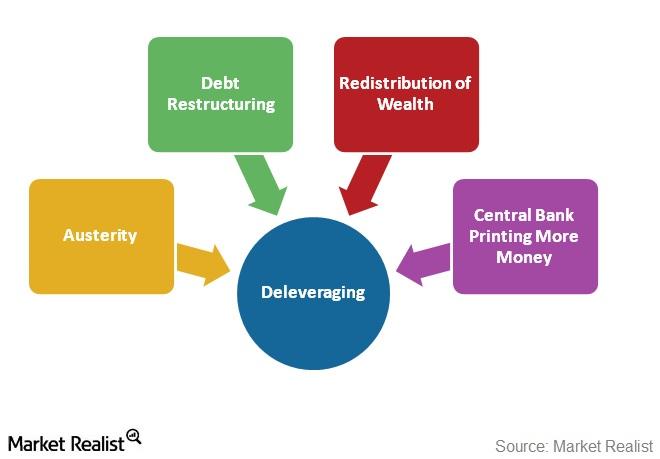

4 Ways an Economy Can Deleverage: Ray Dalio Explains

In his “Economic Principles at Work” template, Ray Dalio identifies four ways any world (ACWI)(VTI)(VEU) economy can deleverage. Find out why this matters.

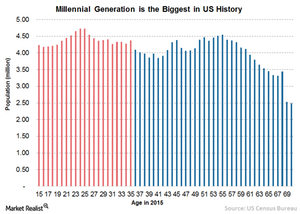

Why Millennials Are Often Called ‘the Unluckiest Generation’

A population of 80 million strong in the U.S., millennials – those born between 1980 and 1999 – are breaking with tradition.

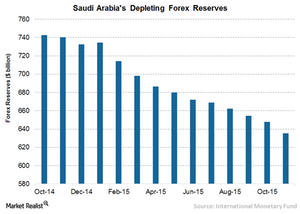

Saudi Arabia Is Depleting Its Foreign Exchange Reserves

It’s been more than a year since Saudi Arabia has had a new king, and what an eventful year for the country under his leadership!

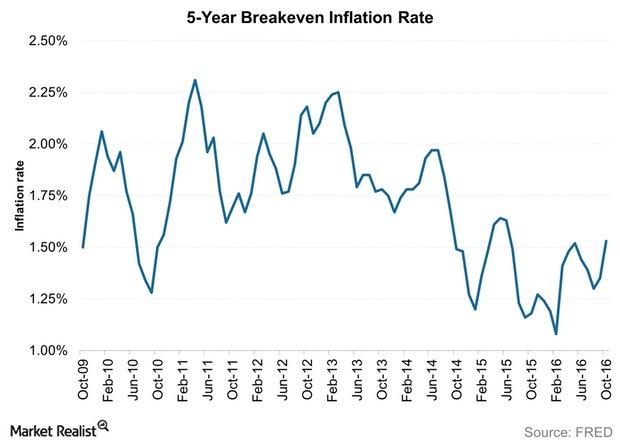

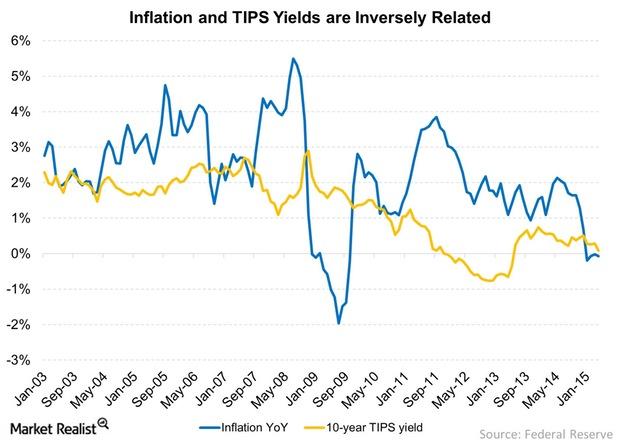

The Impact of Rising Interest Rates on TIPS

With interest rates likely to go up by the end of the year, TIPS with shorter maturities look more attractive.

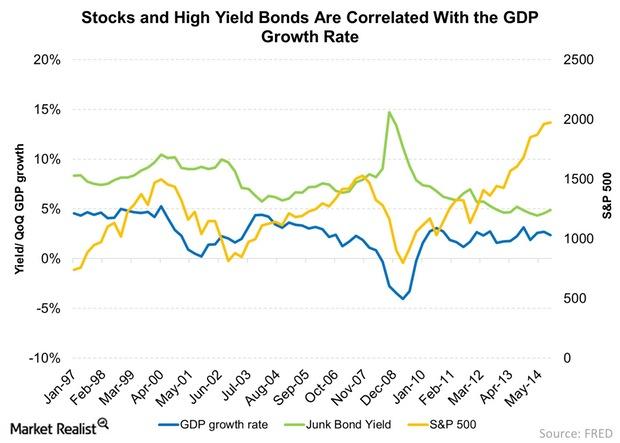

Why Corporate Bonds Correlate to Stocks

Corporate bonds, especially high yield corporate bonds, correlate to equities and hence, so they don’t provide great diversification benefits.

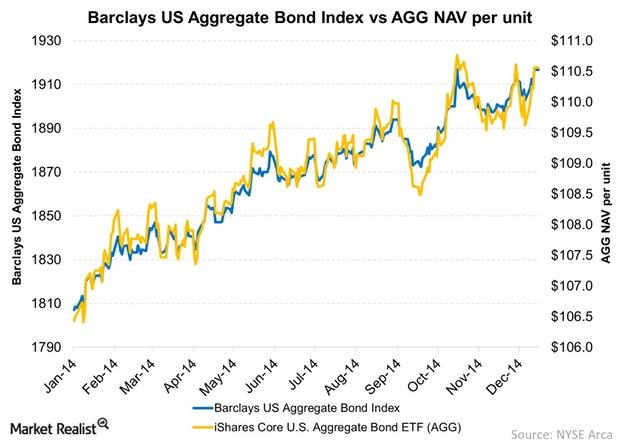

Calculating A Bond ETF’s Underlying Value

The calculation of a bond ETF’s underlying value is going to be less precise than a stock ETF’s underlying value.Healthcare Key differences between investment-grade and high-yield investments

Corporate debt is divided into investment-grade and high-yield on the basis of the credit risk associated with the issuer. Credit rating agencies issue ratings to corporations and debt issuance on the basis of associated credit risk.