Barrick Gold Corp

Latest Barrick Gold Corp News and Updates

What Will Barrick Gold’s Focus on Its 4 Priorities Achieve?

Barrick Gold (ABX) wants to achieve positive free cash flow even at a gold price of $1,000 per ounce.

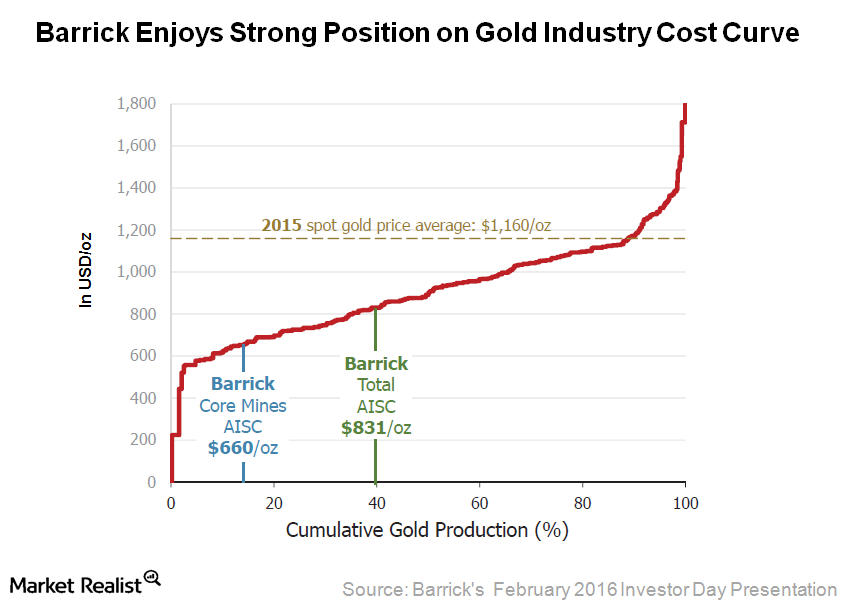

Barrick’s Focus on Costs Places It Favorably on Gold’s Cost Curve

Barrick Gold achieved all-in sustaining costs of $831 per ounce for 2015. This AISC was below the 40th percentile of the global industry cost curve.

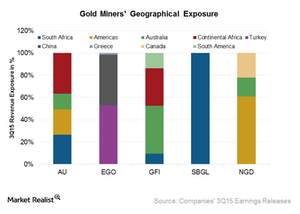

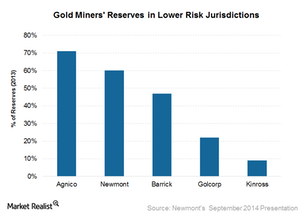

Gold Miners’ Geographic Exposure Impacts Growth Prospects

While gold miners try to limit their exposure to safe jurisdictions, it’s important to look at geographic exposure and its implications on their prospects.

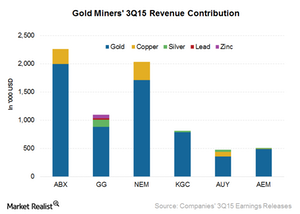

Why You Should Look Out for Gold Miners’ Commodity Exposure

It’s important to understand not only miners’ geography but also their revenue composition in terms of commodity exposure.

Gold Miners Are Cutting Down on Risky Geographical Exposure

While gold miners (GDX) are trying hard to limit their exposure to safe jurisdictions, it’s important to look at their geographic exposure and the implications it could have on their future prospects.

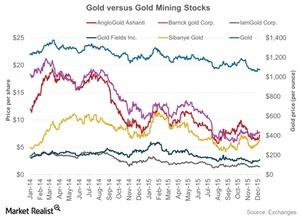

How the Gold Price Is Influencing Pure Gold Miners

In the precious metals mining industry, there are some stocks that to an extent follow the price and market sentiment of the precious metals.

What Can You Learn from the Recent Gold Price Swings?

After getting a good start to the year—driven by strong demand from Asia, the Greek crisis, and the Swiss currency cap removal—gold prices started pulling back in April.

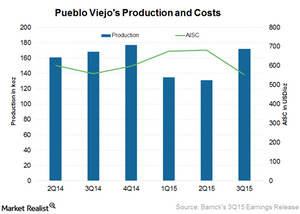

Barrick: What Will Drive Increased Recoveries for Pueblo Viejo?

The Pueblo Viejo mine is a joint venture between Barrick Gold Corporation (ABX) at 60% and Goldcorp (GG) at 40%.

Must-Read Notes on Barrick Gold’s 3Q15 Earnings and Conference

Barrick Gold (ABX) reported its 3Q15 results on October 28 after market hours and held its conference call the next day. Its results beat market expectations.

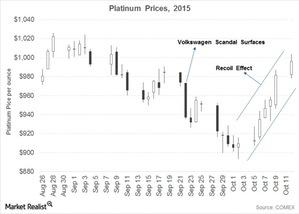

Analyzing the Coiled Spring Effect in Platinum Prices

After the VW scandal, platinum prices jumped to an almost two-week high, again entering the $1,000 territory after hitting a low of $893.4 on October 2.

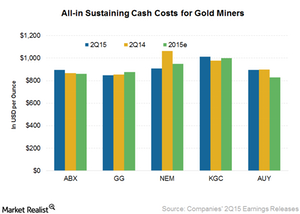

Comp: How Are Gold Miners Progressing on the Cost-Cutting Front?

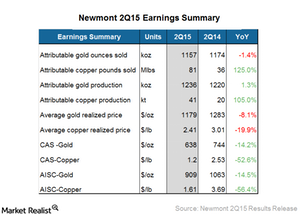

For 2Q15, Newmont has been the most successful YoY in cost cutting. It had a reduction of 14.50%—mainly due to a rise in productivity and efficiency improvements.

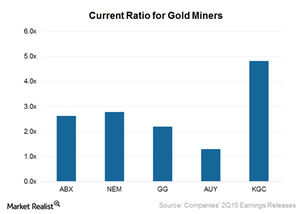

Comp: Importance of Looking at Gold Miners’ Liquidity Profile

In a weaker commodity price environment, a company’s short-term liquidity might come under more pressure. It could be forced to take drastic measures.

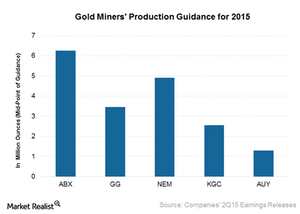

Comp: Which Gold Miners Expect Production Growth Going Forward?

Yamana Gold (AUY) expects higher gold production in the second half of the year compared to the first half of the year. It’s expected to be more than 15% higher.

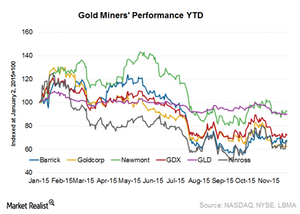

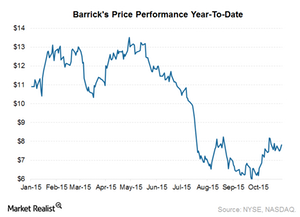

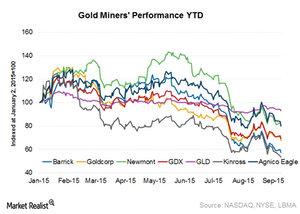

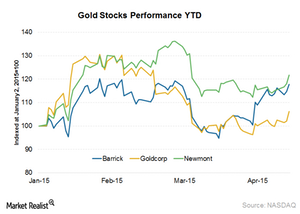

Comparative Analysis: How Have Gold Miners Performed This Year?

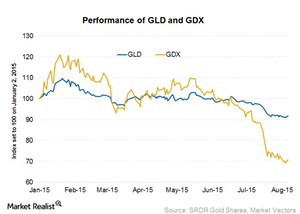

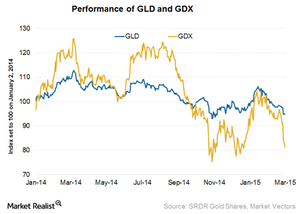

Gold prices, as tracked by the SPDR Gold Trust (GLD), have significantly outperformed the VanEck Vectors Gold Miners Index (GDX) since 2008.

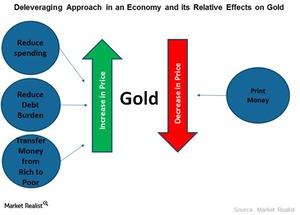

Reviewing an Economy and Its Effect on Gold Prices

Deleveraging can affect gold and other bullion prices, as well as exchange-traded funds such as the iShares Gold Trust ETF (IAU) and the iShares Silver Trust ETF (SLV).

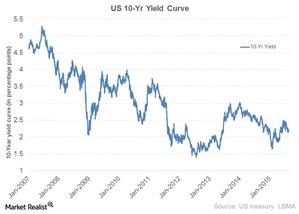

Broad Commodities Market Sell-Off: Impact on Gold

The benchmark US ten-year note yield fell by eight basis points, or 0.08%, to 1.96% as of Monday, August 24. Recent buying ended a bearish period in gold.

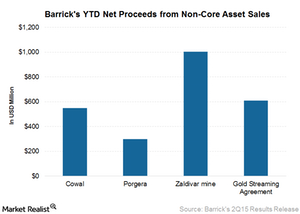

Barrick Gold in 2Q15: The Benefits of Asset Monetization

So far, Barrick has achieved 90% of its 2015 debt reduction target of $3 billion, mainly thanks to asset monetization.

Current Gold Prices Push Barrick Gold to Go for a Leaner Look

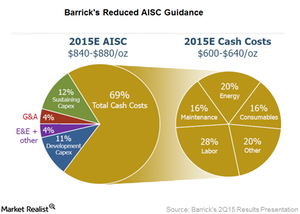

Barrick Gold (ABX) is focused on reducing operating expenses. The company’s all-in sustaining costs to produce gold in 2Q15 totaled $895 per ounce. In 1Q15, costs came in at $927 per ounce.

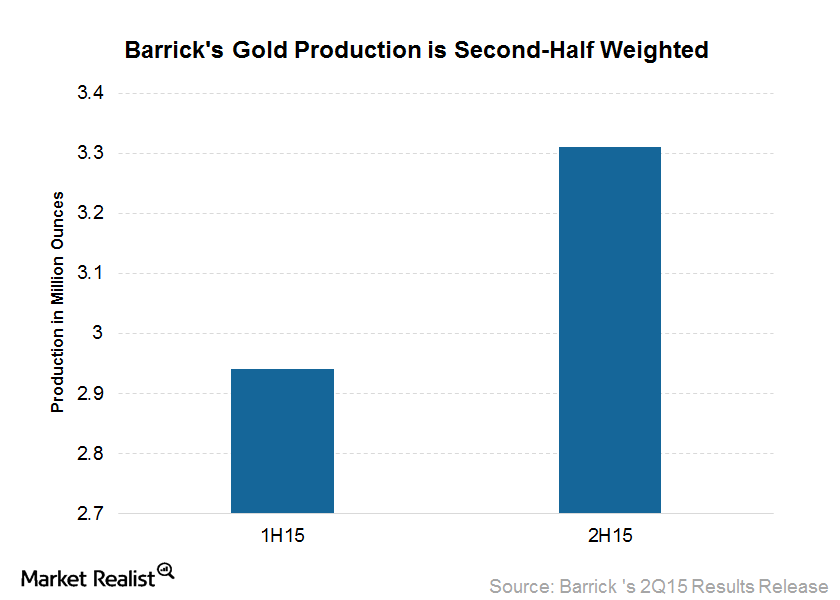

Barrick Gold Weights 2015 Production toward the 2nd Half

Barrick has reduced its 2015 gold production guidance to 6.1 million to 6.4 million ounces from 6.2 million to 6.6 million ounces.

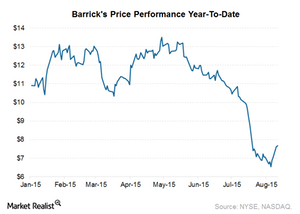

Investors Are Excited about Barrick Gold’s 2Q15 Results, but Why?

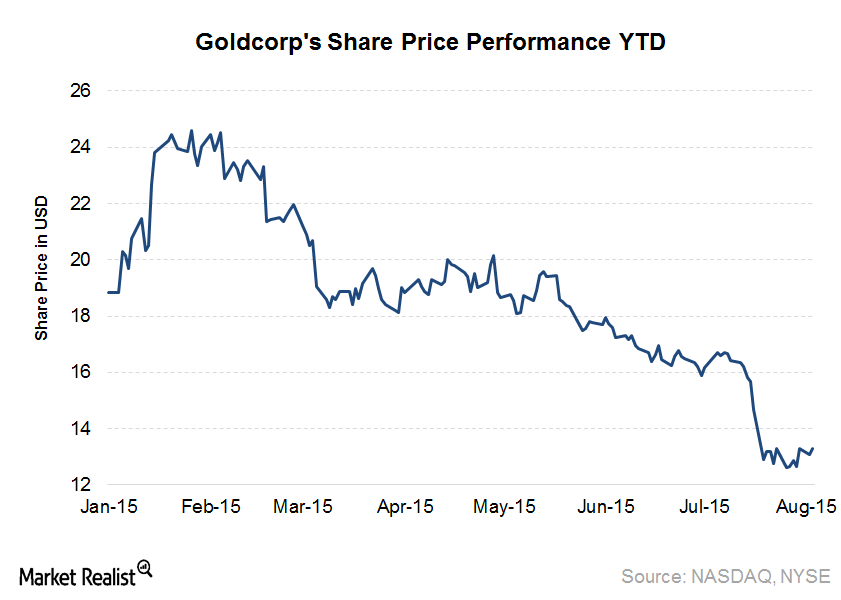

In this series, we’ll analyze Barrick Gold’s 2Q15 results. Barrick stock reacted positively to its earnings report, its improved cost guidance, and its progress toward reducing its debt.

Key Indicators Are Pointing to Gold Prices

Gold prices have been steadily falling since the last week of June. As of August 11, gold prices (GLD) have fallen by 4.40% in a month.

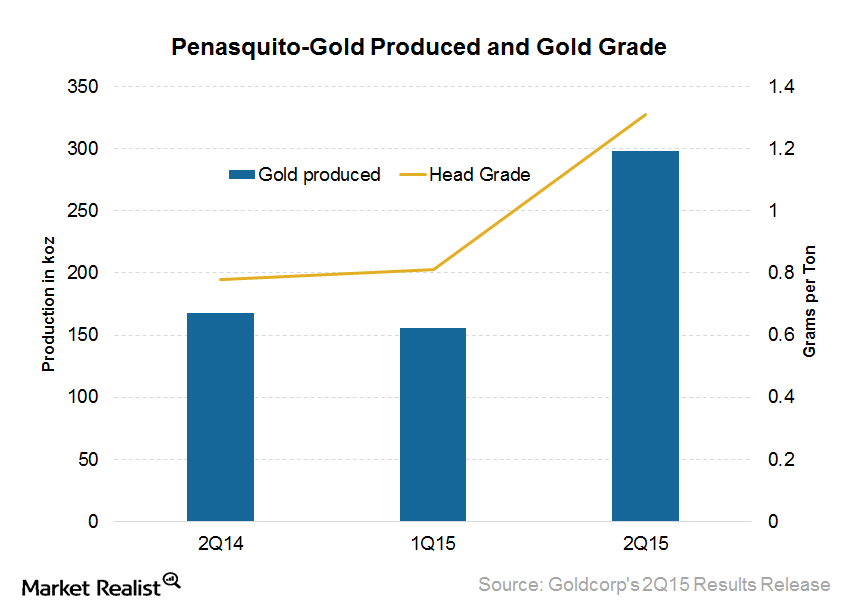

Peñasquito Helps Achieve Record Quarterly Production for Goldcorp

The Peñasquito mine contains gold, silver, lead, and zinc. It achieved its first commercial production in 2010, on schedule and on budget.

Do Falling Gold Prices Mean More Mergers Are in the Cards?

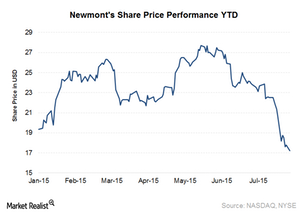

Gold touched its lowest level on July 24. Its price fell to $1,073.70. Miner ETFs have suffered more than gold prices themselves.

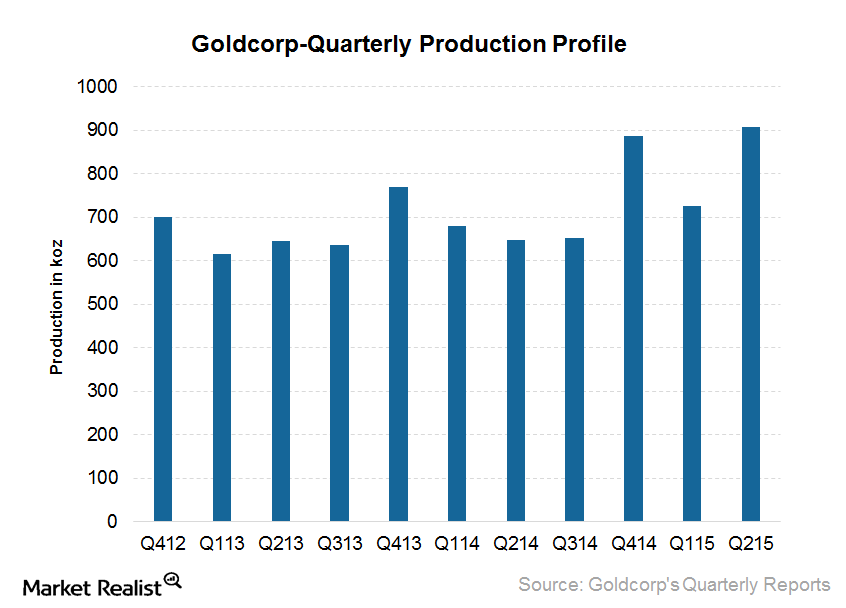

Goldcorp’s Production Growth Starts to Deliver in 2Q15

In 2Q15, Goldcorp achieved record gold production of 908,000 ounces. The Peñasquito mine in Mexico posted a record 298,000 ounces—33% of total gold production.

How Goldcorp Beat Estimates in Its 2Q15 Earnings

Goldcorp announced its 2Q15 results on July 30. The company’s gold production showed very strong growth at 25.3% quarter-over-quarter.

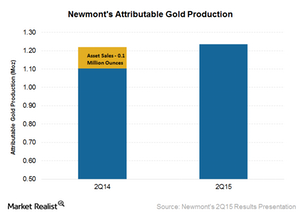

Newmont Reports Strong Gold Production in 2Q15

Newmont Mining’s (NEM) attributable gold production for 2Q15 was 1.24 million ounces. This is higher by 0.2 million ounces compared to the same quarter last year.

Newmont Mining Reports Solid 2Q15 Results

Newmont Mining (NEM) announced its 2Q15 results on July 22. It reported adjusted EPS of $0.26 and adjusted EBITDA of $692 million.

Key Highlights of Newmont’s 2Q15 Earnings

In its 2Q15 earnings release, Newmont Mining (NEM) reported net income attributable to shareholders of $131 million, or $0.26 per share. This compares to $101 million, or $0.20 per share, in 2Q14.

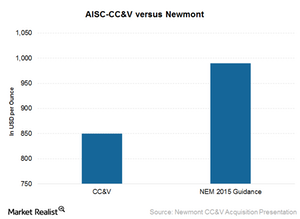

Newmont Mining’s Acquisition Makes Strategic Sense

The CC&V mine acquisition will help Newmont achieve a lower-cost profile. The mine’s cost attributable to sales and all-in sustaining costs are lower than Newmont’s current averages.

Newmont Mining Asset Optimization Efforts Encourage Analysts

Newmont Mining is the world’s second-largest gold producer. In this series, we’ll analyze various steps taken by Newmont toward asset optimization.

Key Updates Investors Should Look for in Newmont’s 1Q15 Results

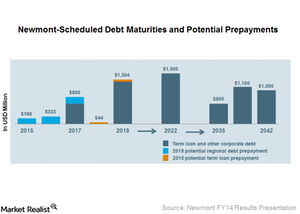

Newmont stated during its 4Q14 earnings call that it is analyzing potential opportunities to pay its liabilities in advance.

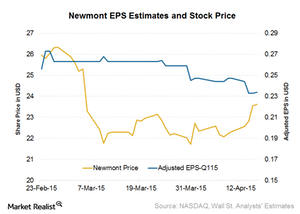

What Are Market Expectations for Newmont in 1Q15?

Analysts’ sales estimate for Newmont is $1.93 billion for 1Q15 compared to $1.80 billion in 4Q14.

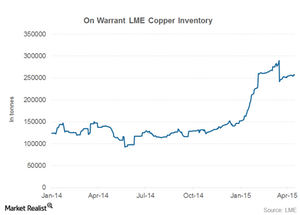

London Metal Exchange Copper Inventory Sees On-Warrant Stock Dip

A declining on-warrant copper inventory means that more metal is being booked for delivery. This is generally associated with stronger demand.

Newmont Will Release 1Q15 Results on April 24

Newmont Mining is the world’s second largest gold producer. It’s the only gold company included in the S&P 500 Index and Fortune 500.

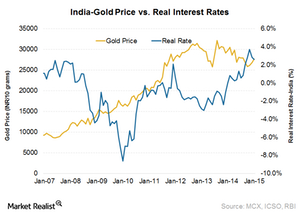

India’s rising real interest rate is negative for gold

India’s real interest rate has moved up rapidly in the last few months due to declining inflation.

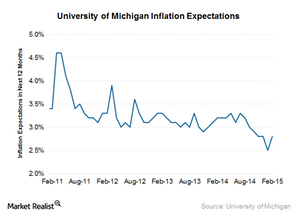

What do US inflation expectations mean?

In 2014, inflation expectations were 2.8% to 3.3%. In January 2015, expectations dropped to 2.5%, the lowest since September 2010.

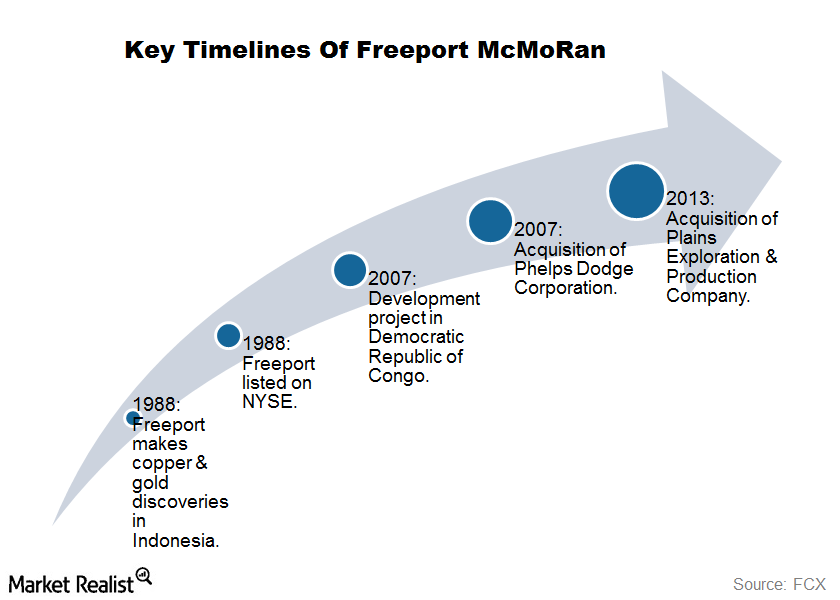

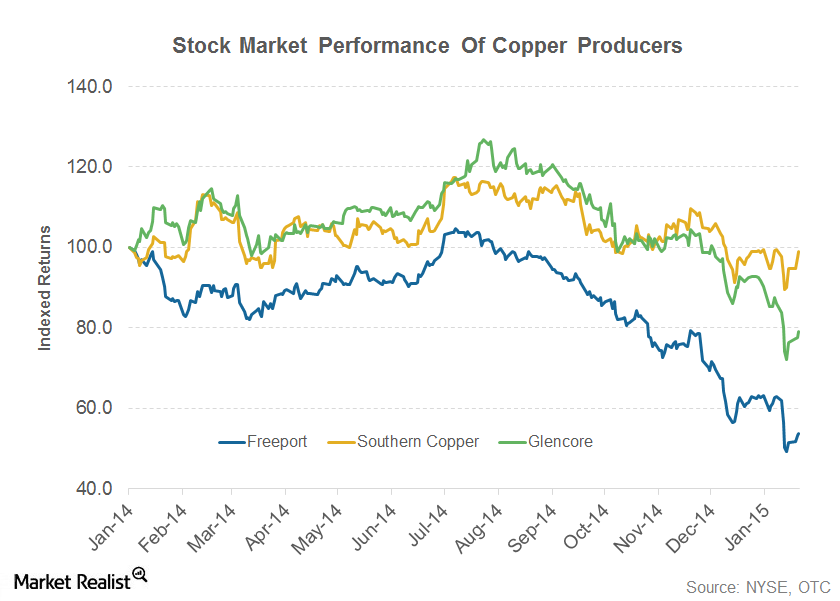

Why is Freeport’s key historical timeline important?

Freeport’s key historical timeline starts more than a century ago when Freeport Sulphur established the city of Freeport, Texas, near its sulphur mine.

Why tracking gold indicators is important for investors

In this series, we’ll look at some gold indicators investors can track to get a sense of what direction the price of gold will take.

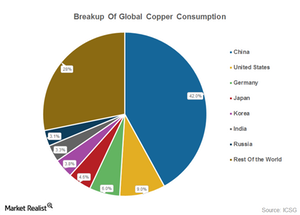

An Investor’s Guide To The Chinese Copper Industry

China overtook the US and Japan as the premier manufacturing location. China doesn’t have sufficient copper reserves, leading to the global copper trade.

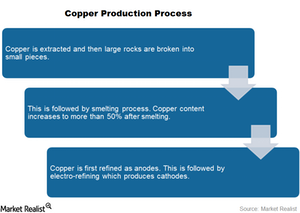

Key Facts About The Copper Value Chain

Cathodes are not used directly by copper consumers. Cathodes are melted and cast into shapes based on end usage, such as cakes, ingots, rods, and billets.

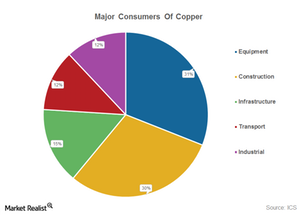

Must Know: Major Consumers Of Copper

Because of its excellent heat transfer capabilities, copper is also widely used in producing heat exchange equipment and other uses in extreme environments.

An Investor’s Guide To The Copper Industry

Mining giants Rio Tinto and BHP Billiton have diversified portfolios of iron ore, aluminum, and copper assets, with most revenues coming from iron ore.

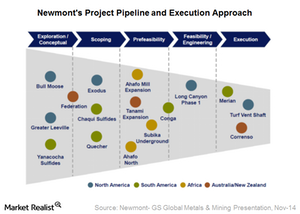

How is Newmont’s project pipeline looking?

Newmont Mining has a strong project pipeline of 16 projects across different stages of development throughout the world.

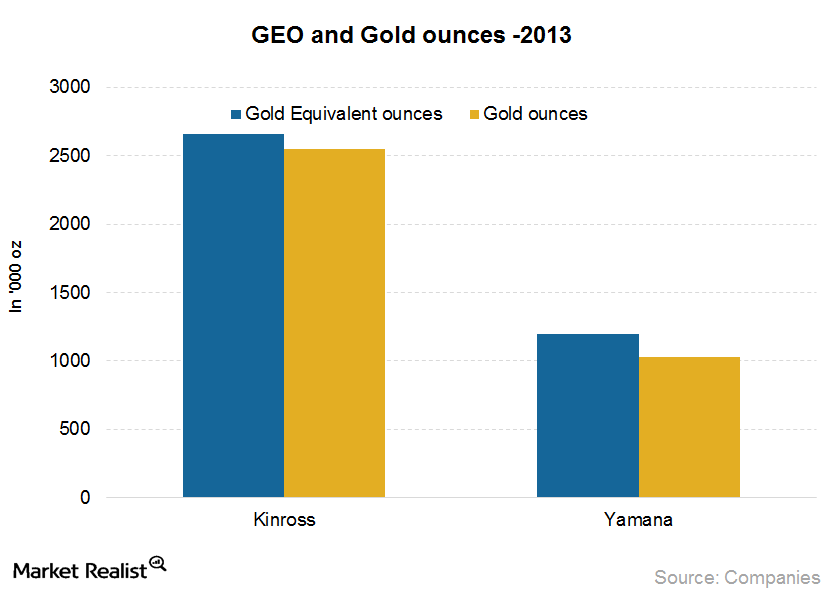

Must-read: Understanding gold companies’ gold equivalent ounces

It’s important to understand GEO or gold equivalent ounces because gold companies like Goldcorp (GG), Barrick Gold (ABX), Newmont Mining (NEM), and Kinross (KGC), measure their production and reserves in different ways. You need to make sure you’re comparing apples to apples.

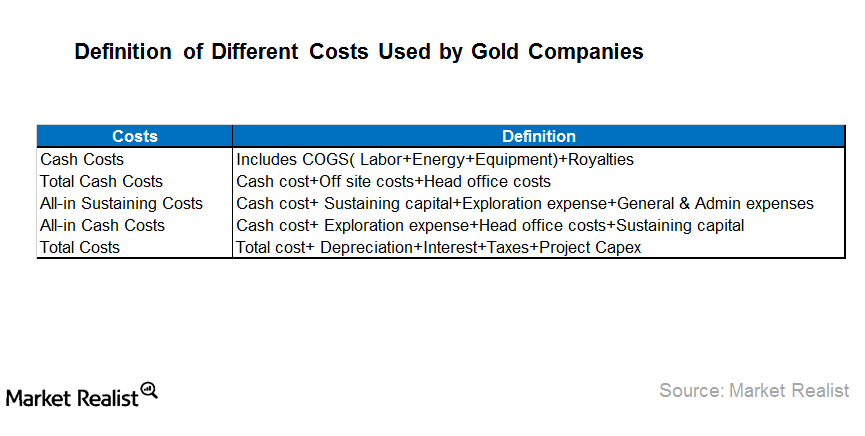

Must-know: Deciphering gold companies’ cost reporting

Gold mining companies like Goldcorp Inc. (GG), Barrick Gold Corp. (ABX), and Newmont Mining Inc. (NEM) report cash costs, total cash costs, total costs, and all-in cash costs. It can be very confusing for investors to understand exactly what’s what here.Materials Gold companies’ cash costs and all-in sustaining cash costs

In the gold industry, substantial discrepancies exist between the actual costs incurred and the costs reported by the companies. In this part, we’ll discuss different methodologies and how effective they are at representing a company’s true costs.Materials Must-know: Is gold an effective hedge against inflation?

An inflation hedge is basically an investment that’s expected to increase its value over a specific period of time. Gold might not have a linear relationship with inflation. However, it’s probably better than most of the investment alternatives available. It protects the portfolio against inflation.

Why is gold considered so special as an investment?

Gold is an unusual metal. It exists in the Earth’s crust as an element. It’s not chemically combined with other metals. Silver and copper are the only other metals naturally found in their elemental form.Materials Must-know: A guide to investing in gold

Investing in gold is complex. It’s challenging because it’s hard to predict gold prices in the future. However, there are many indicators that investors can track. The indicators help to determine the direction that gold prices will take.