Sheldon Krieger

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sheldon Krieger

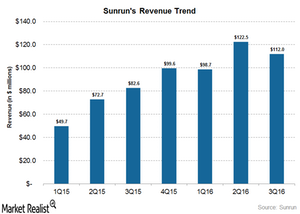

Why Did Sunrun Miss Analysts’ 3Q16 Revenue Estimates?

For 3Q16, Sunrun’s (RUN) consolidated revenue came in at ~$112 million against analysts’ expectations of $135 million.

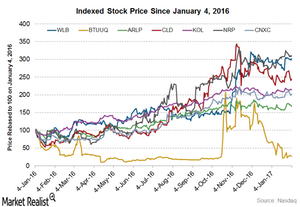

What Could Drive Arch Coal Stock in 2017?

Although the majority of coal (KOL) stocks began 2016 on a weak note, they outperformed the broader market in 2016.

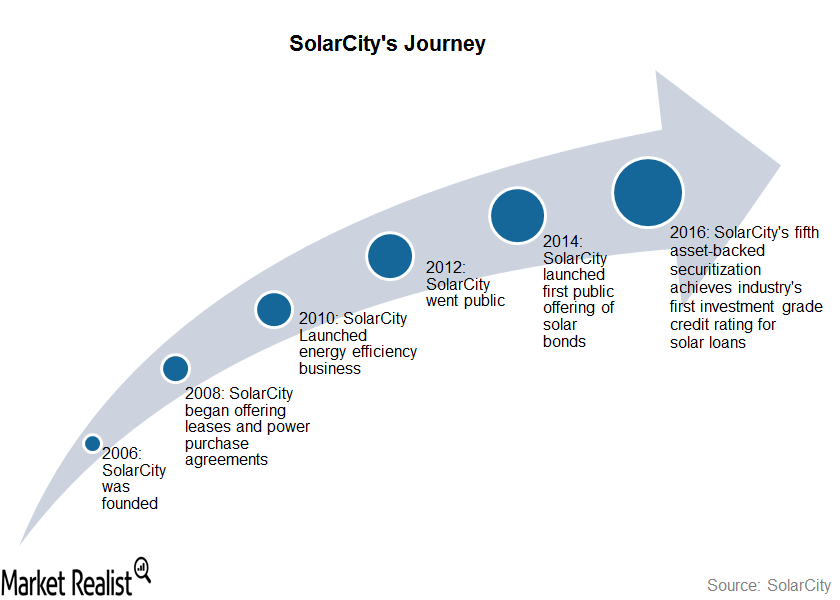

SolarCity: A Quick Trip down Memory Lane

SolarCity was founded in 2006 with the initial focused on selling, financing, and installing solar energy systems for residential and commercial customers.

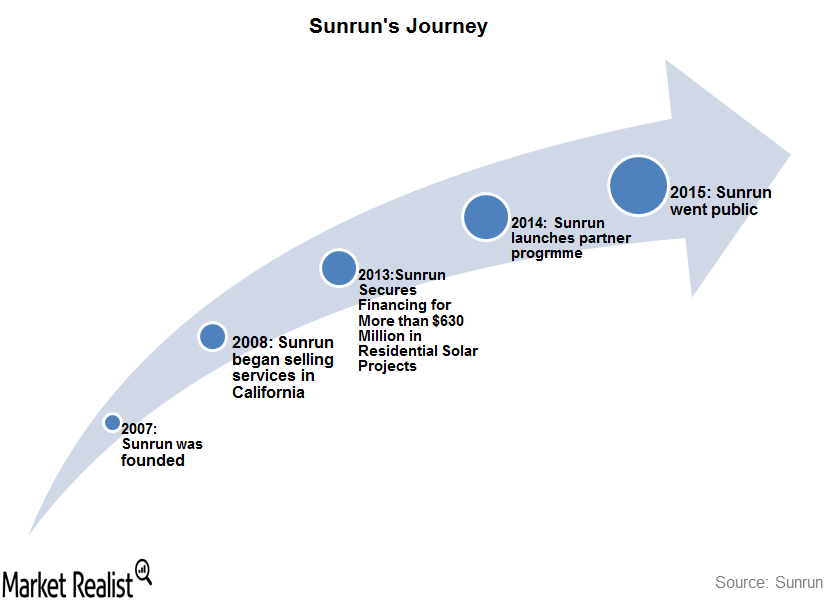

Sunrun: The Beginning of a Residential Solar Major

Sunrun was co-founded in 2007 as a startup by Ed Fenster and Lynn Jurich, with an aim to create worldwide use of solar energy. It began offering solar services in 2008.

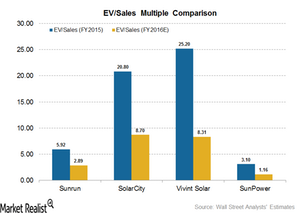

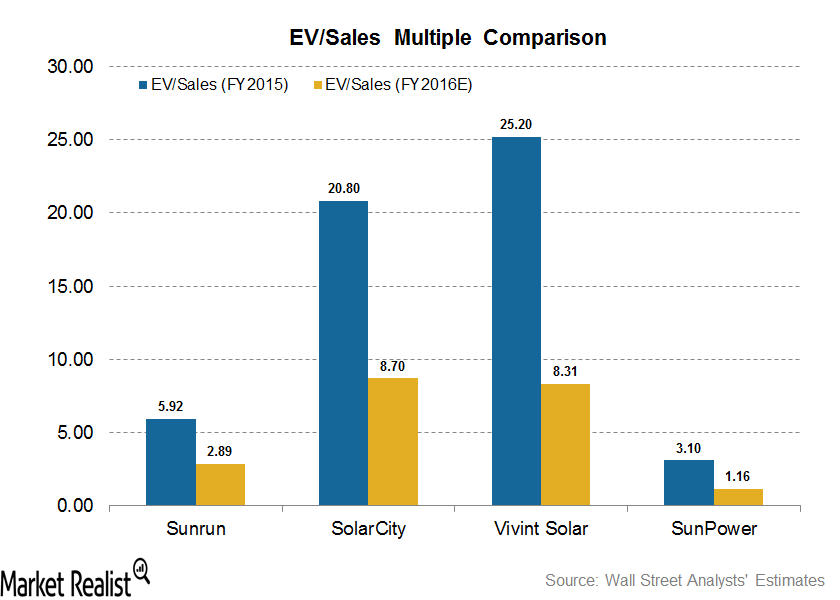

Understanding SolarCity’s Valuation Compared to Peers: Who’s Trading at a Discount?

Among the downstream solar companies, SolarCity (SCTY) has the highest EV-to-sales value of 8.70x, which is closely followed by Vivint Solar at 8.31x.

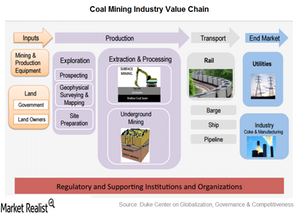

Analyzing the Coal Mining Industry Value Chain

Coal (KOL) mining is a capital-intensive industry. A wide variety of auxiliary industries both help and depend on the coal mining sector across its value chain.

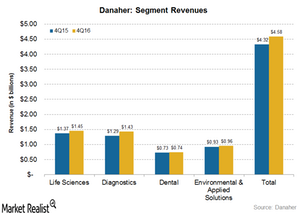

How Did Danaher’s Operating Segments Fare in 4Q16?

Currently, Danaher (DHR) reports its revenue under four operating segments: Life Sciences, Diagnostics, Dental, and Environmental & Applied Solutions.

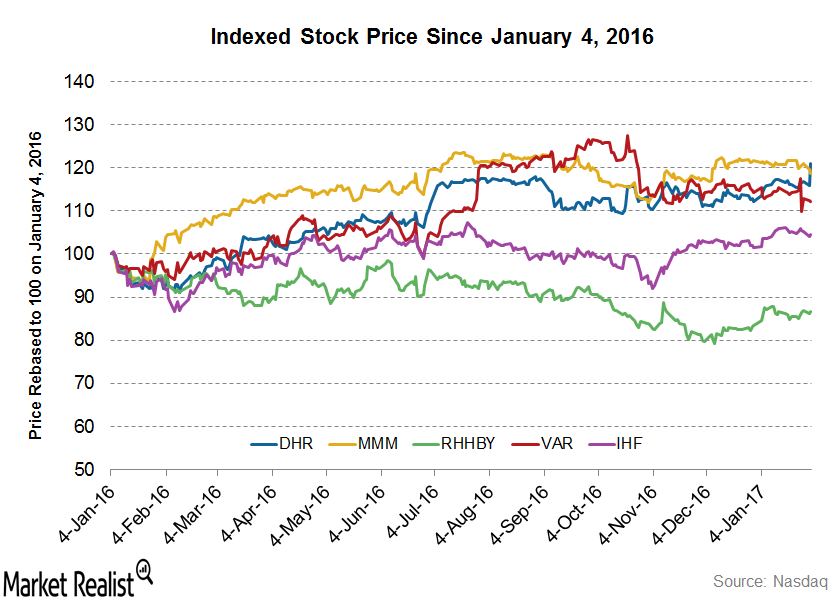

Why Danaher Stock Rose after Its 4Q16 Results

Danaher Corporation (DHR) announced its 4Q16 and 2016 earnings results before the market opened on January 31, 2017. Let’s take a look.

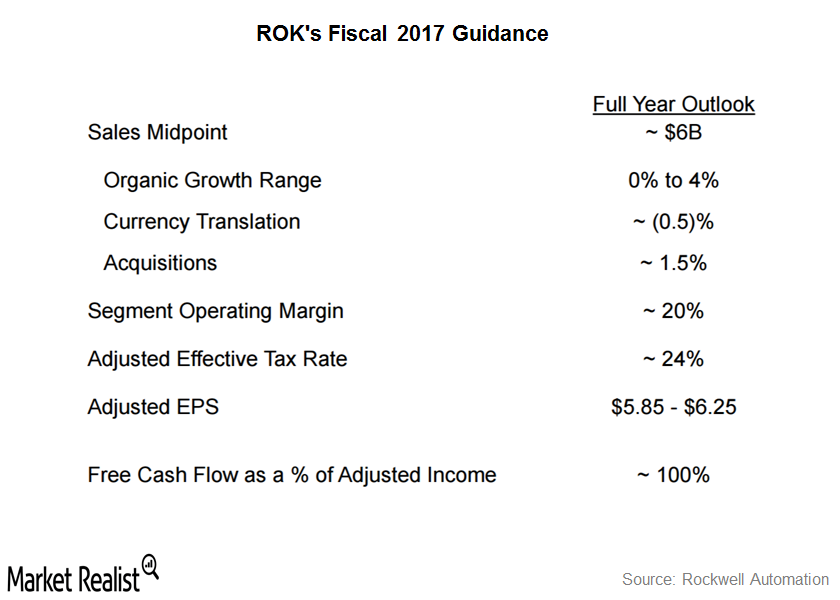

Rockwell Automation’s Fiscal 2017 Guidance: A Closer Look

ROK maintains that oil prices have recovered since early 2016 and that most of its business in the heavy industries end market is expected to stabilize.

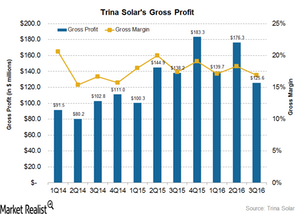

How Did Trina Solar’s Costs Affect Its Gross Margin in 3Q16?

In 3Q16, Trina Solar (TSL) reported a gross profit of $125.6 million compared to $176.3 million in 2Q16. On a YoY basis, the company’s gross profit fell nearly 9.0%.

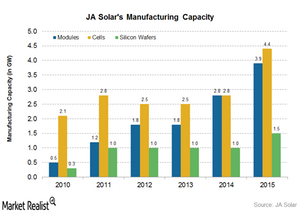

A Look at JA Solar’s Business Strategy

JA Solar’s (JASO) future success largely depends on the ability to expand its manufacturing capacity and output.

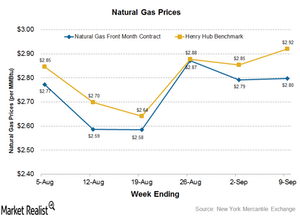

Cleaner Natural Gas Production Continuing to Hurt Coal Miners

Henry Hub benchmark natural gas prices came in at $2.92 per MMBtu for the week ended September 9, 2016, compared to $2.85 per MMBtu for the previous week.

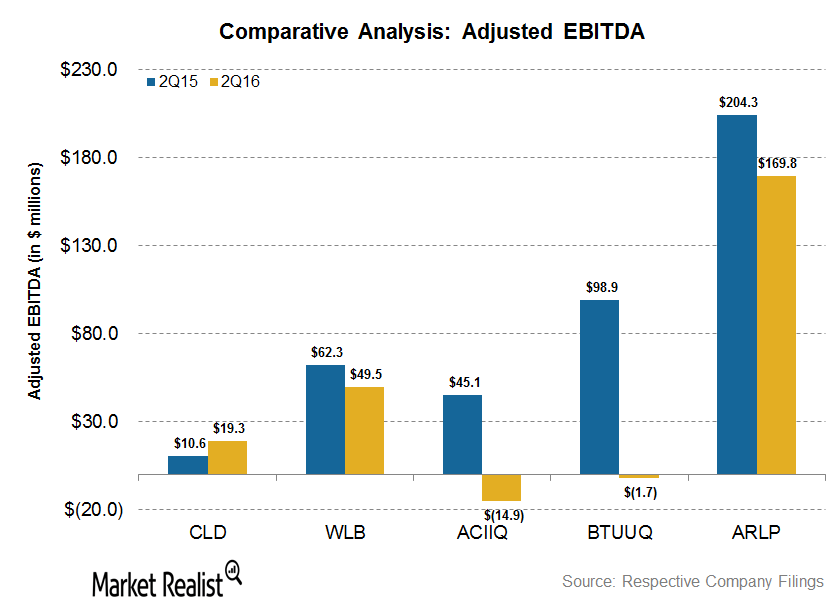

Cloud Peak Energy Topped EBITDA Margin Growth in 2Q16

Cloud Peak Energy reported positive growth in its 2Q16 EBITDA margins. Cloud Peak Energy’s EBITDA margins came in at 11.1% in 2Q16.

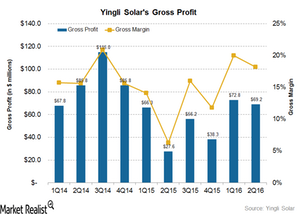

How Yingli Solar’s Costs Affected Its Gross Margin in 2Q16

Yingli Solar’s (YGE) total operating expenses in 2Q16 were about $45.4 million, compared to $43.9 million in 1Q16 and $56.3 million in 2Q15.

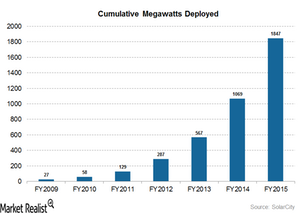

Understanding SolarCity’s Business Strategy

Business expansion is crucial for companies like SolarCity, which intends to expand its presence via partnerships with homebuilders and industry leaders.

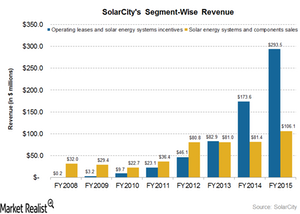

How Does SolarCity Make Money?

SolarCity’s business is divided into two segments: Operating Leases and Solar Energy Systems Incentives and Solar Energy Systems and Component Sales.

Is Vivint Solar Trading at a Discount Compared to Its Peers?

One out of four analysts covering Vivint Solar (VSLR) has rated the stock a “buy,” two analysts rated the stock a “hold,” and one analyst recommends a “sell” for the stock.

How Vivint Solar’s Customers Benefited from Solar Tax Credits

ITCs (investment tax credits) are a dollar-for-dollar reduction on an income tax bill. It is applicable to both residential and commercial deployment of solar systems.

How Does Vivint Solar Make Money?

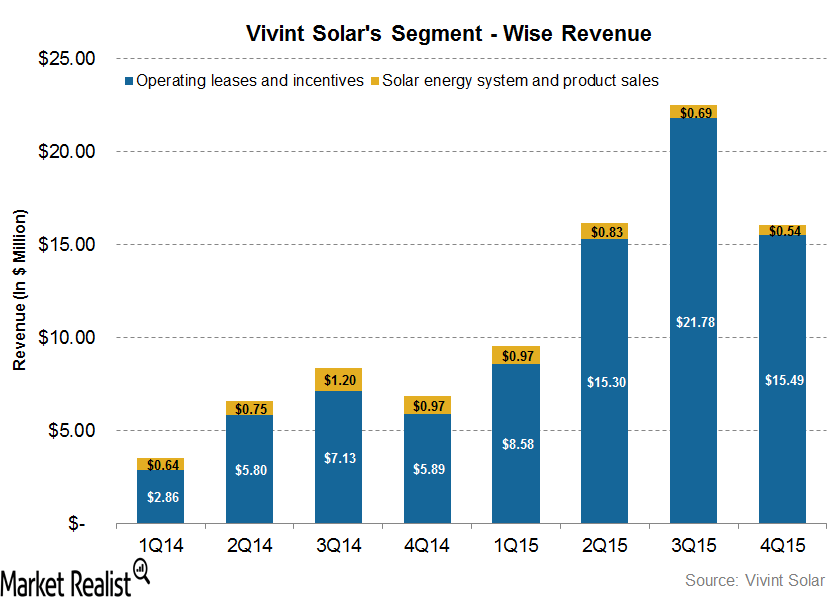

Vivint Solar’s business model is divided into two revenue segments: Operating Leases and Incentives and Solar Energy Systems and Product Sales.

Analyzing Key Elements of Sunrun’s Business Strategy

Unlike its peers, Sunrun is building an open platform of services and tools to provide a differentiated customer experience and, at the same time, gaining a wide customer base.

Need to Know: Sunrun’s Major Acquisitions

In February 2014, Sunrun (RUN) acquired the residential business of REC Solar, AEE Solar, and SnapNrack from Mainstream Energy Corporation for $78.8 million.

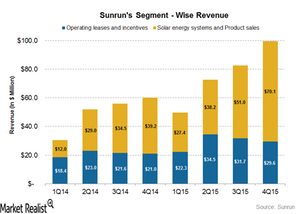

How Does Sunrun Make Money?

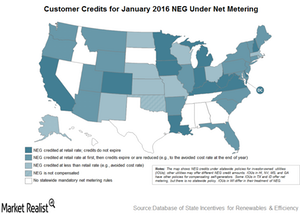

Extension of ITCs for investments in solar energy has been key for the rapid expansion of downstream solar companies like Sunrun, Vivint Solar (VSLR), SolarCity (SCTY), and SunPower (SPWR).

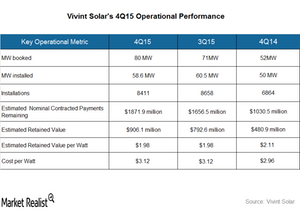

Behind Vivint Solar’s Key Operational Metrics

Vivint Solar’s estimated nominal contracted payments remaining increased by $251.4 million during 4Q15, compared to $214 million during 3Q15.

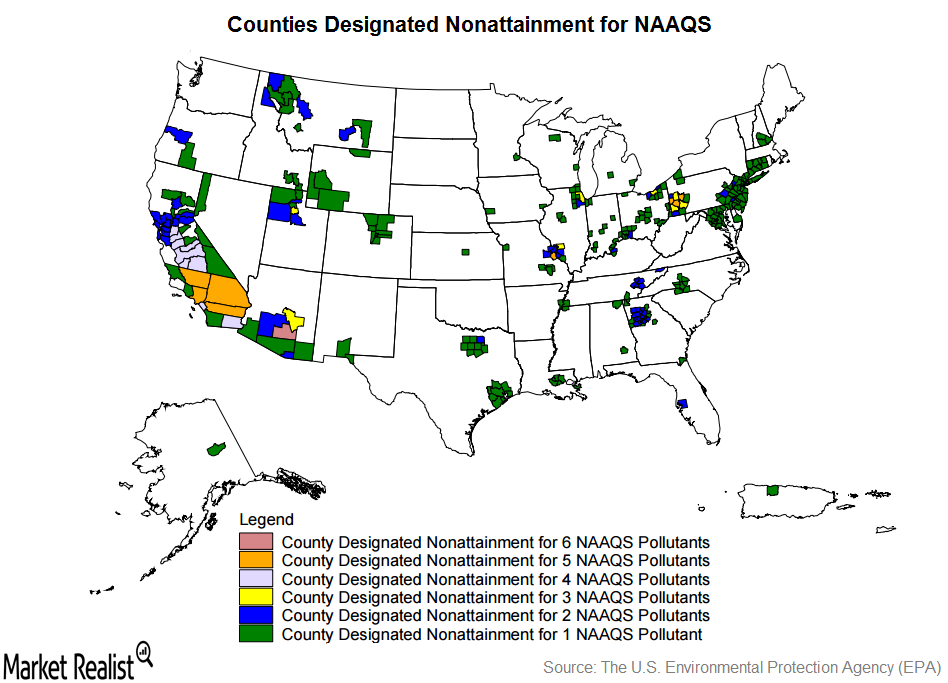

How Developments in the Clean Air Act Will Impact Coal Mining

The Clean Air Act is a national air pollution control policy that regulates the emission of hazardous pollutants from stationary and mobile sources in the United States.

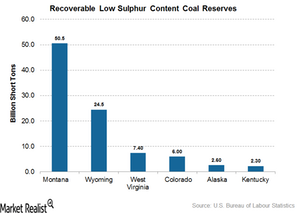

Where Are the Low Sulphur Content Coal Mines in the US?

According to the EIA, low sulphur content coal is defined as having less than 0.60 pounds of sulphur per million British thermal units.

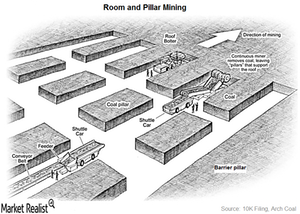

How Is Coal Mined in the US?

According to the World Coal Association, there are two main underground mining methods in the US.

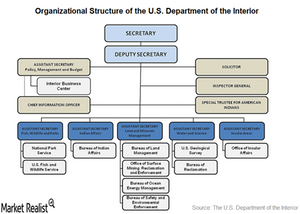

How Does the Land Ownership Pattern in the US Affect Miners?

Land ownership in the US can be broadly divided into the following categories: federally owned land, state-owned land, privately owned land, and Native American land.

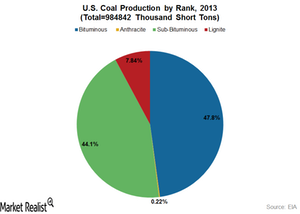

What Are the Different Types of Coal?

Coal types differ from each other as a result of the difference in their organic matter content and maturity.