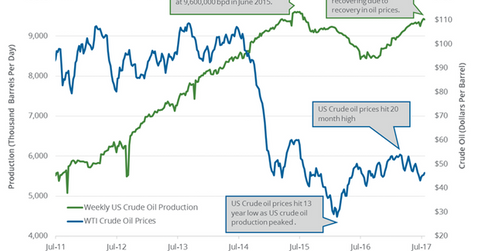

Will US Crude Oil Production Slow Down in 2018?

The EIA reported that US crude oil production fell by 19,000 bpd (barrels per day) to 9,410,000 bpd on July 14–21, 2017.

July 27 2017, Published 10:49 a.m. ET

US crude oil production

On July 26, 2017, the EIA (U.S. Energy Information Administration) released its Weekly Petroleum Status Report. It reported that US crude oil production fell by 19,000 bpd (barrels per day) to 9,410,000 bpd on July 14–21, 2017. Production fell for the first time in four weeks. However, production is near a two-year high. Production fell 0.2% week-over-week but rose 10.5% YoY (year-over-year).

The YoY rise in production would have a negative impact on crude oil (ERY) (ERX) (IEZ) prices. Prices have fallen ~15% year-to-date due to increased US output. Lower crude oil prices have a negative impact on oil and gas producers like Oasis Petroleum (OAS), ConocoPhillips (COP), Denbury Resources (DNR), and Cobalt International Energy (CIE).

Why US production fell last week?

US production fell due to production falling by 54,000 bpd to 405,000 bpd in Alaska on July 14–21, 2017. However, production rose in the lower 48 states of the US by 35,000 bpd to 9,005,000 bpd during the same period. For details on monthly production, read How Monthly US Crude Oil Production Has Supported Crude Prices.

US crude oil production estimates

The EIA estimates that US crude oil production could average 9.3 MMbpd in 2017 and 9.9 MMbpd in 2018. Production will hit record in 2018. US crude oil production peaked at 9.6 MMbpd in 1970. US production averaged 8.9 MMbpd in 2016.

Why would US production rise in 2017 and 2018?

US crude oil production is expected to rise in 2017 and 2018 due to the following:

- President Trump’s energy plans

- improving efficiency and technological advancement

- improved drilling costs in the Permian region—the region will likely contribute 30% of US crude oil production in 2018

- production cut deal would drive oil prices higher, which would help shale oil producers drill more

- a rise in US crude oil exports

- US producers’ improving break-even and production costs