US Gasoline Demand: Are the Crude Oil Bears Taking Control?

Weekly US gasoline demand rose by 81,000 bpd to 9.5 MMbpd on September 15–22, 2017. Gasoline demand rose by 642,000 bpd or 7.2% YoY.

Oct. 4 2017, Published 12:46 p.m. ET

US gasoline demand

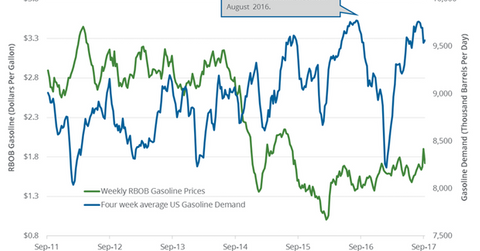

According to the EIA’s (U.S. Energy Information Administration) estimates, monthly US gasoline demand fell by 193,000 bpd (barrels per day) to 9.5 MMbpd (million barrels per day) in July 2017—compared to the previous month. US gasoline demand fell 2% month-over-month and by 5,000 bpd or 0.1% YoY (year-over-year).

US gasoline demand fell for the first time in four months. Any fall in gasoline demand is bearish for gasoline (UGA) and crude oil (SCO) (USL) prices.

Moves in gasoline prices impact US refining companies (CRAK) like Holly Frontier (HFC), PBF Energy (PBF), and Valero (VLO). Likewise, volatility in crude oil prices impacts oil producers (XLE) (PXI) like Carrizo Oil & Gas (CRZO) and PDC Energy (PDCE).

Weekly US gasoline demand

Weekly US gasoline demand rose by 81,000 bpd to 9.5 MMbpd on September 15–22, 2017. Gasoline demand rose by 642,000 bpd or 7.2% YoY. Any rise in gasoline demand is bullish for gasoline (UGA) and crude oil (UCO) (USO) prices.

US gasoline consumption estimates

US gasoline consumption will average 9.33 MMbpd in 2017 and 9.37 MMbpd in 2018, according to the EIA. Consumption averaged a record 9.33 MMbpd in 2016.

Impact

US gasoline consumption is expected hit an annual record in 2018. Record gasoline demand will have a positive impact on gasoline prices. High gasoline prices are also bullish for crude oil (UWT) (DWT) prices.

In the next part of this series, we’ll discuss how geopolitical tensions impact crude oil prices.