How Could US Tax Bill Affect Dollar and Crude Oil Prices?

The US Dollar Index advanced 0.1% to 92.8 last week. Consequently, it pressured oil prices during the week.

Dec. 4 2017, Updated 12:50 p.m. ET

US tax bill

The US Dollar Index rose 0.2% to 93.3 at 2:30 AM EST on December 4, 2017. The US dollar (UUP) advanced due to the US tax bill progress. The US Senate passed the US tax overhaul on Saturday, December 2, 2017. The US tax bill aims to reduce US corporate and household tax. This move could increase US corporate profits. Consequently, the S&P 500 (SPY) advanced in morning trade on December 4, 2017. However, the strong dollar pressured oil (UWT) (DWT) prices on the same day.

US dollar performance

The US Dollar Index advanced 0.1% to 92.8 last week. Consequently, it pressured oil prices during the week. US oil (USO) (UCO) prices fell 1% last week. Lower oil prices negatively impact oil companies (PXI) (RYE) like Anadarko Petroleum (APC), PDC Energy (PDCE), ConocoPhillips (COP), and Sanchez Energy (SN).

US dollar’s highs and lows

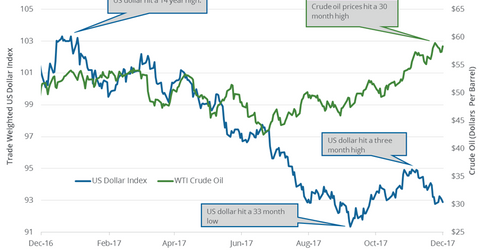

The US dollar (USDU) hit 91.3 on September 8, 2017. It was the lowest level in almost three years. But, the US dollar hit 103.8 on January 3, 2017. It was the highest level in 14 years.

US dollar and crude oil

The US dollar (UUP) and oil (SCO) prices are generally inversely related. A strong dollar pressures oil prices, while a weak dollar helps oil prices.

The US tax cut bill and a possible hike in US interest rates in December 2017 and even in 2018 would drive the US dollar higher. An expectation of an appreciating US dollar could pressure oil (USL) prices.

Next, we’ll focus on how Cushing inventories affected oil prices.