Will US Natural Gas Futures Start 2018 on a Positive Note?

February US natural gas (UNG) futures contracts were above their 20-day moving averages on December 29, 2017.

Jan. 2 2018, Updated 1:00 p.m. ET

Moving averages

February US natural gas (UNG) futures contracts were above their 20-day moving averages on December 29, 2017. However, February US natural gas (DGAZ) futures contracts were below their 100-day and 50-day moving averages on December 29, 2017. Prices rose 14% on December 21–29, 2017. The bullish momentum could push natural gas prices higher this week.

US natural gas (UGAZ) prices were near a four-week high. Higher gas (FCG) prices favor energy producers’ (XLE) (XOP) profitability like Cabot Oil & Gas (COG), Exco Resources (XCO), WPX Energy (WPX), and Antero Resources (AR).

Natural gas futures drivers

A larger-than-expected withdrawal in US natural gas inventories compared to the seasonal and historical averages could support natural gas prices this week. The expectation of colder-than-normal weather in January 2017 could also support natural gas (UGAZ) prices. A rise in natural gas heating demand and exports could help natural gas prices. However, any rise in natural gas production and mild weather forecasts could pressure natural gas (UNG) prices.

EIA’s forecast

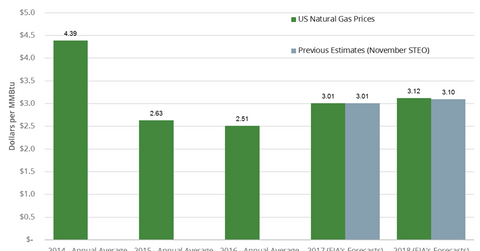

According to the EIA, US natural gas prices will average $3.12 per MMBtu in 2018. The expectation of an increase in US natural gas demand and exports will drive natural gas prices higher in 2018. US natural gas prices could average $3.1 per MMBtu in 2018, according to the World Bank.

Read Traders Tracking Key Drivers of Crude Oil Futures in 2018 for the latest updates on crude oil.