Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

Nov. 20 2020, Updated 1:29 p.m. ET

Crude oil futures

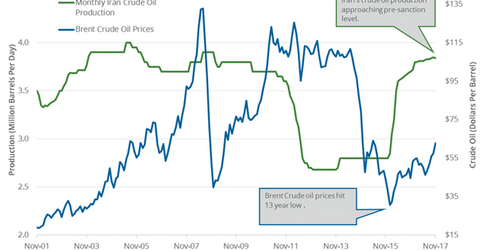

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8, 2018. Prices are near the highest level since December 2014. Brent crude (BNO) oil futures contracts rose 0.2% to $67.78 per barrel on January 8, 2018—the highest level since May 2015. Oil prices (DWT) (USO) rose due to tensions in Iran. The expectation of a fall in US crude oil inventories also supported crude oil prices. The EIA will release the crude oil inventory report on January 10, 2018.

Crude oil price performance

US crude oil prices rose 1.7% last week—the best opening week in the last five years. The massive fall in US crude oil inventories, ongoing production cuts, cold winter, and strong crude oil demand supported oil prices last week. Higher oil (DWT) prices favor funds like the Energy Select Sector SPDR Fund (XLE), which rose 0.6% to 75.4 on January 8, 2018. All of these factors could support crude oil prices this week.

Civil unrest in Iran

The anti-government protests in Iran continued for the 11th day on January 8, 2018. The protestors aren’t happy about the poor economic conditions in Iran. The protests supported US crude oil (USO) prices, which are near a three-year high. Higher oil (UWT) prices favor energy companies like Ensco (ESV) and Noble (NE). These stocks rose more than 5% on January 8, 2018.

Wall Street’s performance

The Dow Jones Industrial Average (DIA) fell 0.05% to 25,283 on January 8, 2018. However, it hit record on January 5, 2018. The NASDAQ (QQQ) rose 0.29% to 7,157.3, while the S&P 500 (SPY) rose 0.17% to 2,747.7 on January 8, 2018. Both of the indices closed at record levels on January 8, 2018.

The expectation of strong 4Q17 earnings results could be driving SPY. The utilities (XLU) (VPU), real estate (VNQ) (IYR), and energy (VDE) (XOP) sectors supported SPY the most on January 8, 2018. These sectors could support SPY this week.

In this series

In this series, we’ll discuss OPEC’s crude oil production, Cushing inventories, US crude oil rigs, and drivers for oil prices this week.