US Gasoline Inventories Add More Pain to Crude Oil Futures

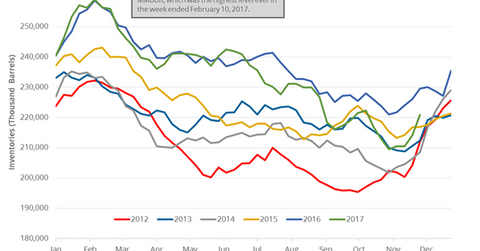

According to the EIA, US gasoline inventories rose by 6,780,000 barrels to 220.8 MMbbls (million barrels) on November 24–December 1, 2017.

Dec. 7 2017, Published 9:39 a.m. ET

US gasoline inventories

According to the EIA, US gasoline inventories rose by 6,780,000 barrels to 220.8 MMbbls (million barrels) on November 24–December 1, 2017. Inventories rose 3% week-over-week but fell by 8.6 MMbbls or 3.7% from a year ago.

Market surveys expected that US gasoline inventories would have risen by 1,741,000 barrels on November 24–December 1, 2017. A massive rise in gasoline inventories weighed on gasoline (UGA) and crude oil (SCO) (USL) prices on December 6, 2017. US gasoline futures fell 3.3% to $1.66 per gallon on the same day.

US gasoline production and demand

US gasoline production fell by 464,000 bpd (barrels per day) or 4.5% to 9.7 MMbpd (million barrels per day) on November 24–December 1, 2017, according to the EIA. The production also fell by 155,000 bpd or 1.5% from the same period in 2016.

US gasoline demand rose by 171,000 bpd or 2% to 8.8 MMbpd on November 24–December 1, 2017. Gasoline demand also rose by 138,000 bpd or 1.6% from the same period in 2016. The rise in gasoline demand is positive for gasoline and oil (UWT) prices.

Higher gasoline (UGA) prices have a positive impact on refining companies (CRAK) like Holly Frontier (HFC), Phillips 66 (PSX), and PBF Energy (PBF).

Similarly, higher oil (DWT) prices have a positive impact on oil producers (IYE) (FENY) like EOG Resources (EOG), Callon Petroleum (CPE), Parsley Energy (PE), and Matador Resources (MTDR).

Impact

US gasoline inventories rose for the fourth straight week. They’re 2.3% above their five-year average for the week ending December 1, 2017. It’s bearish for gasoline and oil (USO) prices.

Next, we’ll discuss why US distillate inventories are bearish for oil prices.