Callon Petroleum Co

Latest Callon Petroleum Co News and Updates

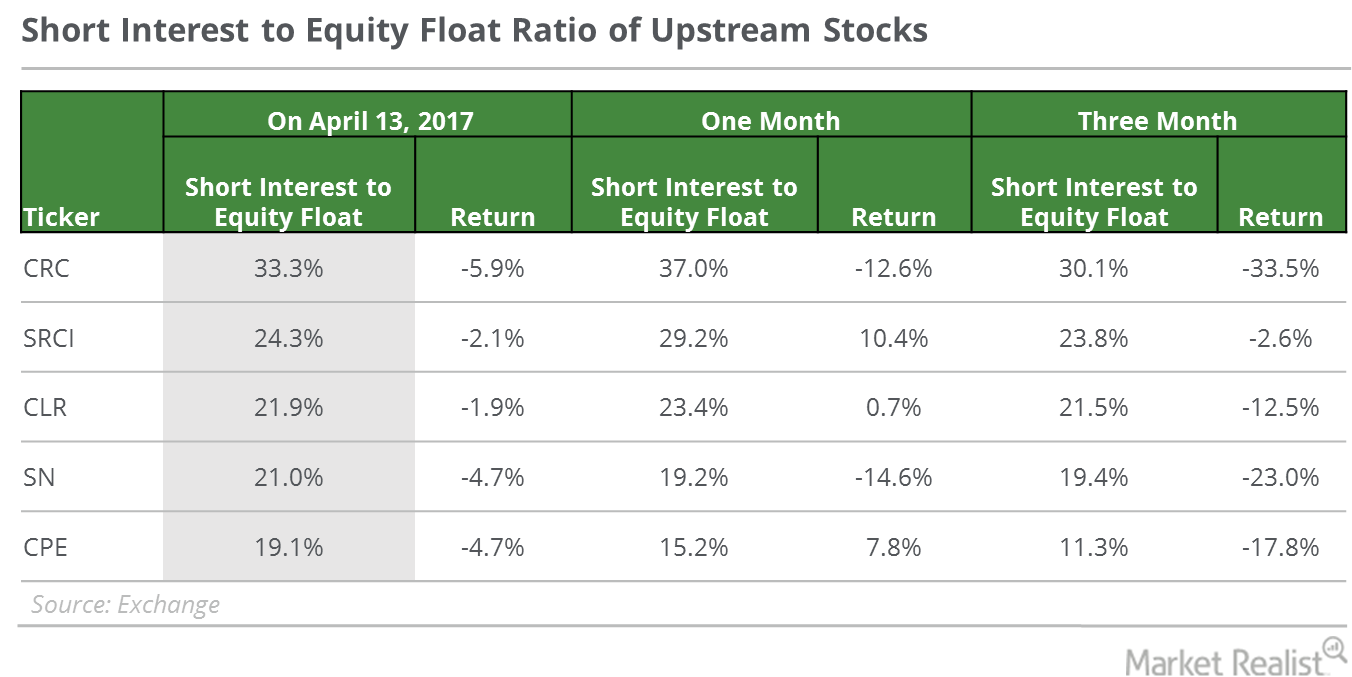

Why the Numbers Look Bearish for These Upstream Stocks

All these upstream companies have seen the short interest in their stocks rise—an potential indication of market skepticism in these companies’ abilities to profit from oil’s recent gains.

Are You Looking at the Right Oil-Weighted Stocks?

On May 16, US crude oil June futures rose 0.3% and closed at $71.49 per barrel, a more-than-three-year high.

Should Energy Investors Be Cautious with Oil-Weighted Stocks?

On March 7, US crude oil April futures fell 2.3% and closed at $61.15 per barrel. Here’s what you need to know.

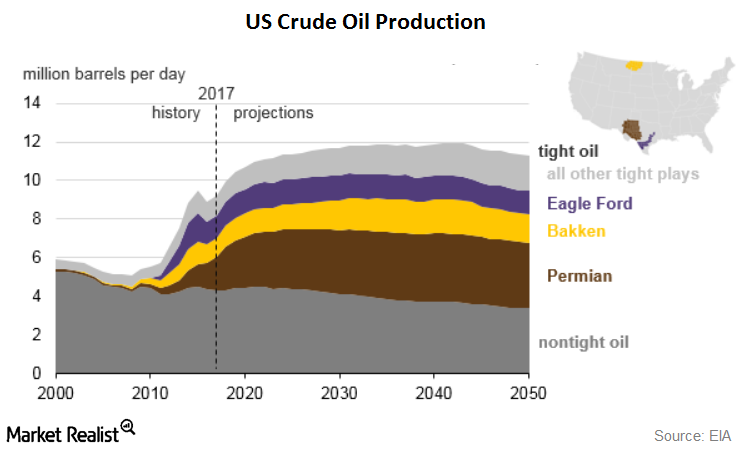

Tight Oil Contribution to Rise to 70%: Key Permian Basin Driver

In its “Annual Energy Outlook 2018,” the US Energy Information Administration (EIA) has forecast that US tight oil production will mostly increase through early 2040.

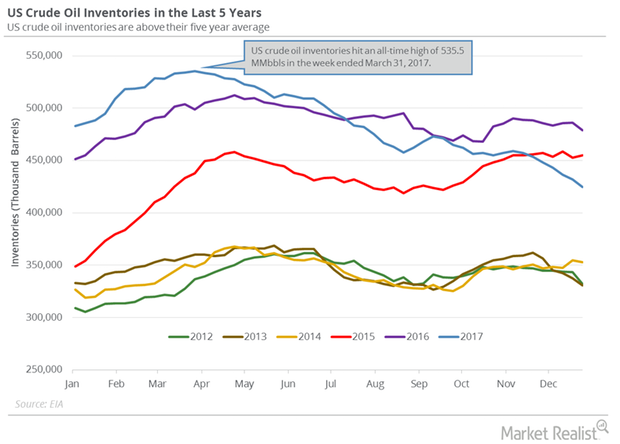

Crude Oil Inventories Fell, Refinery Utilization Hit 12-Year High

US crude oil futures contracts for February delivery fell 0.1% to $61.95 per barrel at 1:05 AM EST on January 5, 2018—the highest level since December 2014.

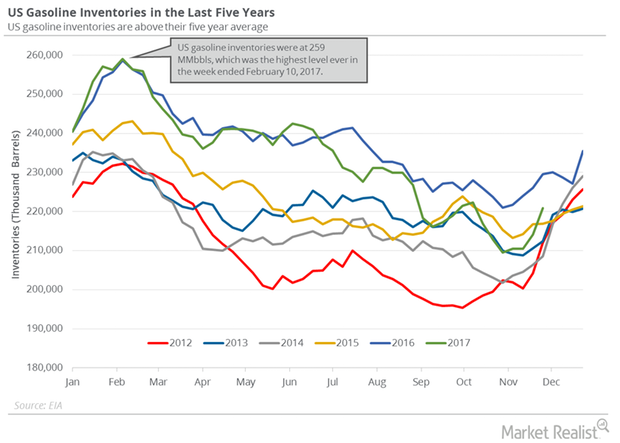

US Gasoline Inventories Add More Pain to Crude Oil Futures

According to the EIA, US gasoline inventories rose by 6,780,000 barrels to 220.8 MMbbls (million barrels) on November 24–December 1, 2017.

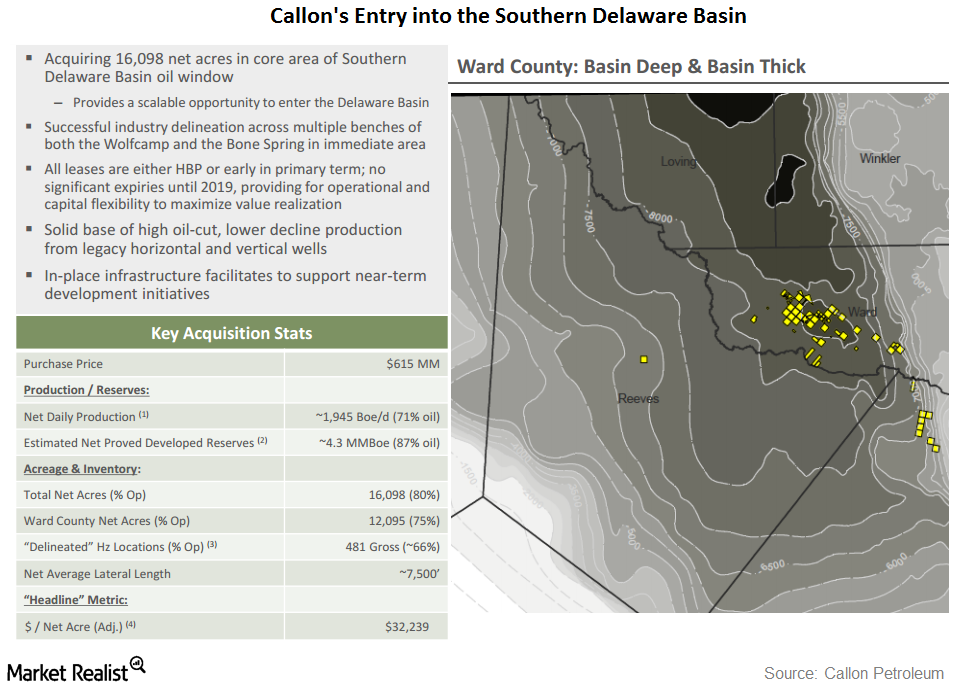

Callon Petroleum Makes Its First Delaware Basin Acquisition

On December 13, Callon Petroleum announced that it had agreed to acquire certain acreage positions and oil- and gas-producing properties from Ameredev.

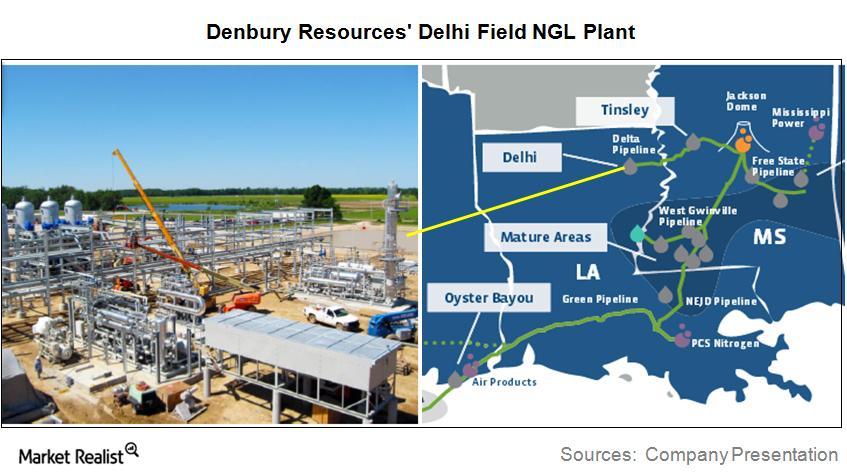

Why Denbury Resources’ Delhi Field Plant Is So Significant

Denbury Resources (DNR) is constructing an NGL (natural gas liquids) plant at its Delhi Field on the Gulf Coast.