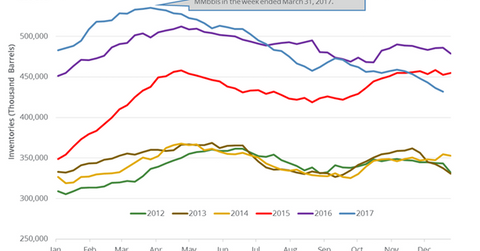

US Crude Oil Inventories Have Fallen ~10.6% in 2017

February WTI crude oil futures (DWT)(SCO) contracts rose 0.8% to $60.3 per barrel at 12:45 AM EST on December 29, 2017—the highest level since June 2015.

Dec. 29 2017, Updated 5:20 p.m. ET

Crude oil futures

February WTI crude oil futures (DWT)(SCO) contracts rose 0.8% to $60.3 per barrel at 12:45 AM EST on December 29, 2017—the highest level since June 2015. High oil prices benefit funds like the Vanguard Energy ETF (VDE) and Guggenheim S&P Equal Weight Energy (RYE).

E-mini S&P 500 (SPY) futures contracts for March delivery rose 0.07% to 2,687.75 at 12:45 AM on December 29.

US crude oil inventories

The EIA released its weekly crude oil inventory report on December 28. US crude oil inventories declined by 4.6 MMbbls (million barrels) to 431.8 MMbbls from December 15 to 22, 2017, per the EIA. Inventories declined 1% week-over-week and 54.2 MMbbls or 11.15% year-over-year.

The Wall Street Journal surveys had estimated that US crude oil inventories would have declined by 3.7 MMbbls from December 15–22, 2017. A larger-than-expected draw in US oil inventories helped oil (UCO) prices on December 28, 2017. Higher oil (USO) prices benefit energy producers (IXC) (XLE) like PDC Energy (PDCE), ConocoPhillips (COP), and Stone Energy (SGY).

Impact

US crude oil inventories declined by 103.6 MMbbls or ~19.3% from their peak. Inventories are also down 10.6% between January 2017 and December 22, 2017. Likewise, US oil prices were up ~11.8% during the same period. US crude oil inventories declined for the sixth straight week. The decline in inventories is bullish for oil (DWT) prices.

However, US oil inventories are ~37 MMbbls or 9.4% above their five-year average for the week ending December 22, 2017. It’s bearish for oil (DBO) prices. If the difference drops, it’s a bullish sign for oil (USL) prices.

Next, we’ll cover how US crude oil production impacts oil prices.