US Gasoline Futures Hit 2-Year High despite Inventory Rise

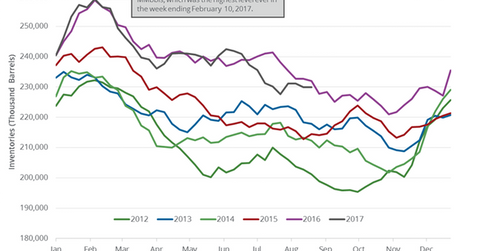

US gasoline inventories The U.S. Energy Information Administration reported that US gasoline inventories rose 35,000 barrels to 229.9 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell 2.1 MMbbls, or 0.9%, from the same period in 2016. For the third time in five weeks, inventories rose. A market survey estimated that US gasoline […]

Sept. 10 2017, Updated 1:15 p.m. ET

US gasoline inventories

The U.S. Energy Information Administration reported that US gasoline inventories rose 35,000 barrels to 229.9 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell 2.1 MMbbls, or 0.9%, from the same period in 2016. For the third time in five weeks, inventories rose.

A market survey estimated that US gasoline inventories may have fallen by 989,000 barrels between August 18 adn 25, 2017. US gasoline (UGA) futures rose on August 30, 2017, due to the Hurricane Harvey. Reaching a two-year high, futures rose 5.6% to $1.88 per gallon on August 30, 2017. Higher gasoline prices benefit refiners such as Valero (VLO), Tesoro (TSO), and Phillips 66 (PSX), as well as crude oil (DIG) (RYE) (SCO) prices, which support oil and gas producers such as SM Energy (SM), Goodrich Petroleum (GDP), and Sanchez Energy (SN).

US gasoline production, imports, and demand

US gasoline production rose by 36,000 bpd (barrels per day), or 0.3%, to 10.6 MMbpd (million barrels per day) between August 18 and 25, 2017. Production rose 581,000 bpd, or 5.8%, from the same period in 2016. US gasoline imports rose by 284,000 bpd to 839,000 bpd between August 18 and 25, 2017. Imports rose 7,000 bpd, or 0.8%, from the same period in 2016. US gasoline demand rose by 217,000 bpd to 9.8 MMbpd between August 18 and 25, 2017, its highest level ever. Demand rose 335,000 bpd, or 3.5%, from the same period in 2016.

Impact of gasoline inventories

Citigroup estimates that gasoline production could drop more than 2 MMbpd due to Hurricane Harvey, which could reduce gasoline inventories. US gasoline inventories are within their five-year range. Lower inventories and high gasoline could support gasoline prices, and high gasoline prices could support crude oil (ERY) (ERX) (IEZ) prices. In the next part, we’ll analyze US distillate inventories.