OPEC’s Crude Oil Production and Exports Impact Crude Oil Prices

The EIA estimates that OPEC’s crude oil production fell by 150,000 bpd to 32.77 MMbpd (million barrels per day) in August 2017—compared to July 2017.

Sept. 19 2017, Published 10:32 a.m. ET

OPEC’s crude oil production

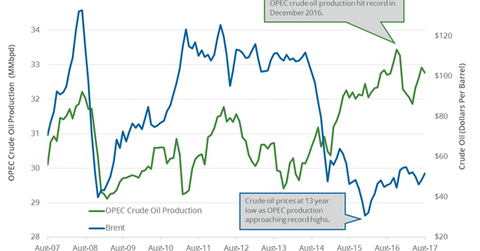

According to the EIA (U.S. Energy Information Administration), OPEC’s crude oil production fell by 150,000 bpd (barrels per day) to 32.77 MMbpd (million barrels per day) in August 2017—compared to July 2017. Production fell 0.5% month-over-month but rose by 61,000 bpd or 0.2% year-over-year.

OPEC’s crude oil production fell in August 2017 due to the production cut deal and supply outage in Libya. Any fall in OPEC’s crude oil production is bullish for crude oil (FXN) (ERY) (ERX) prices.

Higher crude oil prices are positive for oil and gas producers like Contango Oil & Gas (MCF), Bill Barrett (BBG), Hess (HES), and Bonanza Creek Energy (BCEI).

OPEC’s crude oil exports

A Reuters survey estimates that OPEC’s crude oil exports fell by 920,000 bpd to 25.19 MMbpd in August 2017—compared to July. Saudi Arabia is OPEC’s largest crude oil producer and exporter. It’s expected to cut crude oil exports to worldwide customers by 520,000 bpd in September 2017 and 350,000 bpd in October 2017. As a result, OPEC’s crude oil exports could fall in September 2017 and October 2017. Any fall in OPEC’s crude oil exports is bullish for crude oil (FENY) (IXC) (IYE) prices.

OPEC’s crude oil production estimates

The EIA estimates that OPEC’s crude oil production averaged 31.66 MMbpd in 2015 and 32.69 MMbpd 2016. It’s expected to average 32.48 MMbpd in 2017 and 32.99 MMbpd 2018.

OPEC and the production cut deal

On September 10, Saudi Arabia’s energy minister discussed a possible extension of the production cut deal beyond March 2018 with Venezuela and Kazakhstan. Russia could also support extending the production cut deal.

Impact

A fall in OPEC’s crude oil production and exports would benefit crude oil (IXC) (IYE) prices. However, OPEC’s crude oil production is expected to rise in 2018.

So, a possible production cut deal extension beyond March 2018 would help crude oil (SCO) (BNO) prices.

In the next part of this series, we’ll see how Iran’s crude oil production could impact crude oil prices.