Will US Gasoline Demand Impact Gasoline and Crude Oil Futures?

The EIA estimates that weekly US gasoline demand rose 107,000 bpd (barrels per day), or 1.1%, to 9.6 MMbpd between August 11 and August 18.

Aug. 31 2017, Updated 7:39 a.m. ET

US gasoline demand

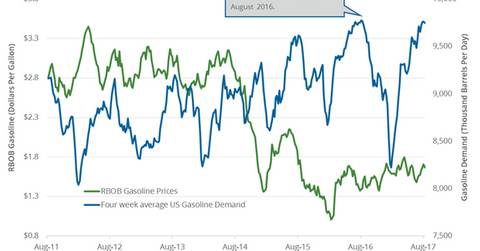

The EIA (US Energy Information Administration) estimates that weekly US gasoline demand rose 107,000 bpd (barrels per day), or 1.1%, to 9.6 MMbpd (million barrels per day) between August 11 and August 18. Weekly gasoline demand fell 30,000 bpd, or 0.3%, from the same period in 2016.

The four-week average US gasoline demand fell 48,000 bpd (barrels per day), or 0.5%, to 9.6 MMbpd (million barrels per day) between August 11 and August 18. The four-week average gasoline demand fell and 38,000 bpd, or 0.4%, from the same period in 2016.

Lower gasoline demand is bearish for gasoline (UGA) and crude oil (UWT) (DWT) prices. Lower crude oil (RYE) (VDE) prices tend to have a negative impact on oil producers like Denbury Resources (DNR), Carrizo Oil & Gas (CRZO), and Cobalt International Energy (CIE).

US gasoline demand peaks and lows

US gasoline demand hit 9.8 MMbpd in July 2017—the highest level ever. By contrast, gasoline demand was at 8.0 MMbpd in January 2017—the lowest level since February 2014.

The EIA has estimated that US gasoline consumption averaged 9.3 MMbpd in 2016—a record high. US gasoline consumption is expected to average 9.3 MMbpd in 2017 and 9.4 MMbpd in 2018. US gasoline consumption could hit an all-time high in 2018.

Gasoline demand and Tropical Storm Harvey

US gasoline demand is nearing a record level. However, Tropical Storm Harvey could impact gasoline production. Lower production and near-record demand have already pushed gasoline prices to a two-year high.

Higher gasoline prices will likely have a positive impact on refiners like Phillips 66 (PSX), Western Refining (WNR), and Marathon Petroleum (MPC). Higher gasoline prices will also likely have a positive impact on crude oil (XLE) (XOP) prices and producers.

In the next and final part of this series, we’ll look at some crude oil price forecasts.