US Crude Oil Inventories: Lower than the Market’s Expectation

The EIA reported that US crude oil inventories fell by 6.4 MMbbls (million barrels) to 509.9 MMbbls on May 19–26, 2017.

Nov. 20 2020, Updated 1:24 p.m. ET

Crude oil prices

July US crude oil (DIG) (XOP) (XLE) futures contracts fell 2.9% to $47.9 per barrel in electronic trade at 6:35 AM EST on June 2, 2017. Prices are near a four-week low. Crude oil prices fell ~8.5% despite OPEC’s successful meeting.

ETFs that track oil futures like the United States Oil ETF (USO) and the ProShares Ultra Bloomberg Crude Oil ETF (UCO) have fallen 5.4% and 10.6%, respectively, since OPEC’s meeting. Oil producers like PDC Energy (PDCE), Carrizo Oil & Gas (CRZO), and Comstock Resources (CRK) have fallen 6.7%, 10%, and 20.7%, respectively, since OPEC’s meeting. The S&P 500 (SPY) (SPX-INDEX) hit a record on June 1, 2017, despite underperforming in the energy sector in 2017.

EIA’s crude oil inventories

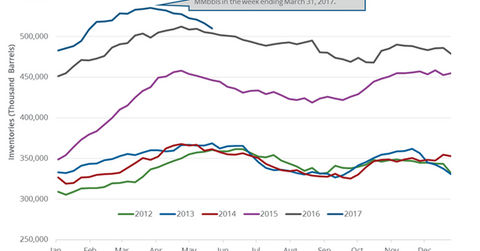

The EIA (U.S. Energy Information Administration) released its weekly crude oil report on June 1, 2017. It reported that US crude oil inventories fell by 6.4 MMbbls (million barrels) to 509.9 MMbbls on May 19–26, 2017. US crude oil inventories fell almost three times more than the market’s expectation. It supported oil (BNO) (SCO) (PXI) prices on June 1, 2017.

Impact of US crude oil inventories

Inventories fell by ~25 MMbbls in the last eight weeks. US crude oil futures rose 2.4% in the last four weeks. Read Analyzing Saudi Arabia’s Crude Oil Export Plans and Are OECD and US Crude Oil Inventories Seeing a Change in Momentum? to learn more.

US crude oil inventories fell due to the fall in US crude oil imports by 309,000 bpd to 7.985 MMbpd on May 19–26, 2017. The rise in crude oil refinery demand by 229,000 bpd to 17.5 MMbpd for the same period also caused inventories to fall. The expectation of slowing inventories in the coming months could support oil prices.

We’ll take a look at US crude oil output in the next part of the series.