Will Weather Surprise Natural Gas Bulls?

November natural gas (UGAZ)(DGAZ) futures contracts fell 1.13% to $2.96 per MMBtu (million British thermal units) in NYMEX electronic trading at 2:05 AM EST on October 16.

Oct. 17 2017, Updated 8:38 a.m. ET

Natural gas prices

November natural gas (UGAZ)(DGAZ) futures contracts fell 1.13% to $2.96 per MMBtu (million British thermal units) in NYMEX electronic trading at 2:05 AM EST this morning.

December E-Mini S&P 500 (SPY) futures contracts rose 0.04% to 2,554 in electronic trading at 2:05 AM.

US natural gas futures are near a two-week high. But prices are down 17.6% YTD (year-to-date) due to rise in US natural gas production and mild weather. Volatility in natural gas prices impacts natural gas exploration and production companies (RYE)(VDE) like Rex Energy (REXX), Exco Resources (XCO), and EQT (EQT).

Weather forecasts

The US Energy Information Administration (or EIA) published its STEO (“Short-Term Energy Outlook”) report on October 11. It forecasts that winter in 2017 will be colder than 2016. The US winter season usually runs from October to March.

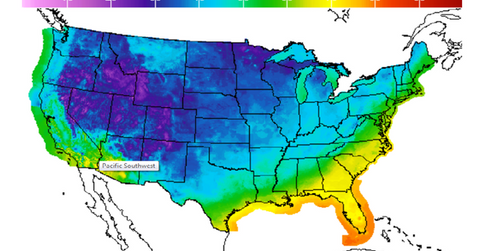

The National Oceanic and Atmospheric Administration (or NOAA) forecasts that temperatures this winter will be 13% colder than the previous winter across the United States. Consequently, US natural gas (UNG)(BOIL) futures rose 3.47% to $2.98 per MMBtu on October 12, 2017.

However, the latest forecasts suggest that weather is expected to be mild for the next few weeks in the United States. According to the EIA, nearly 50% of US households use natural gas for heating and cooling. Mild temperatures could lead to a drop in natural gas demand. Weak demand could pressure US natural gas (FCG)(GASL) prices.

Changes in weather impact demand, inventories, and natural gas prices.