Why Oil Traders Are Tracking US Gasoline Inventories

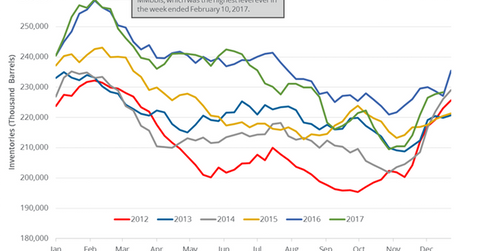

US gasoline inventories rose by 0.5 MMbbls (million barrels) or 0.3% to 228.3 MMbbls from December 15 to 22, 2017, per the EIA.

Dec. 29 2017, Published 3:50 p.m. ET

US gasoline inventories

US gasoline inventories rose by 0.5 MMbbls (million barrels) or 0.3% to 228.3 MMbbls from December 15 to 22, 2017, per the EIA. The inventories also increased by 1.2 MMbbls or 0.5% year-over-year. Market surveys had estimated that US gasoline inventories could have increased by 1.3 MMbbls from December 15 to 22, 2017.

US crude oil (DWT)(SCO) and gasoline futures (UGA) rose on December 28. US gasoline futures rose 0.08% to $1.79 per gallon on December 28.

Crude oil (USO) prices are at a 30-month high. Higher oil (UCO) prices favor oil producers (IYE)(IEZ) like Hess (HES), W&T Offshore (WTI), Newfield Exploration (NFX), and Goodrich Petroleum (GDP).

Likewise, higher gasoline (UGA) prices benefit US refiners (CRAK) like PBF Energy (PBF) and Northern Tier Energy (NTI).

US gasoline production and demand

US gasoline production increased by 181,000 bpd (barrels per day) to 10.3 MMbpd (million barrels per day) from December 15 to 22, per the EIA. However, production decreased by 291,000 bpd or 2.8% year-over-year.

US gasoline demand increased by 59,000 bpd to 9.5 MMbpd from December 15 to 22, 2017. Demand also increased by 207,000 bpd or 2.2% year-over-year. Any rise in gasoline demand is bullish for gasoline and oil (UCO) prices.

Impact

US gasoline inventories increased for the seventh consecutive week. Inventories rose by 18.8 MMbbls or 8.9% during this period. If this momentum continues in 2018, it will weigh on gasoline and oil (DBO) prices.

US gasoline inventories are ~3% above their five-year average for the week ending December 22, 2017. If the difference increase, it is a bearish sign for gasoline and oil (UWT) prices in 2018.

Next, we’ll cover US distillate inventories.