Northern Tier Energy LP Class A

Latest Northern Tier Energy LP Class A News and Updates

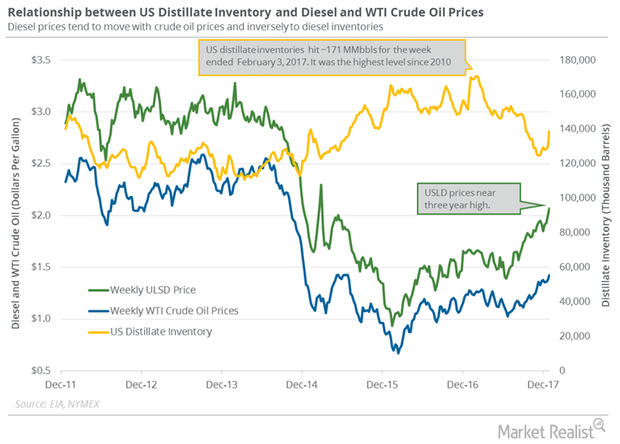

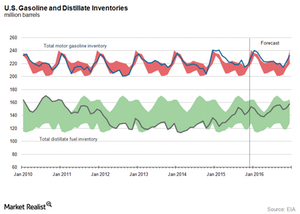

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

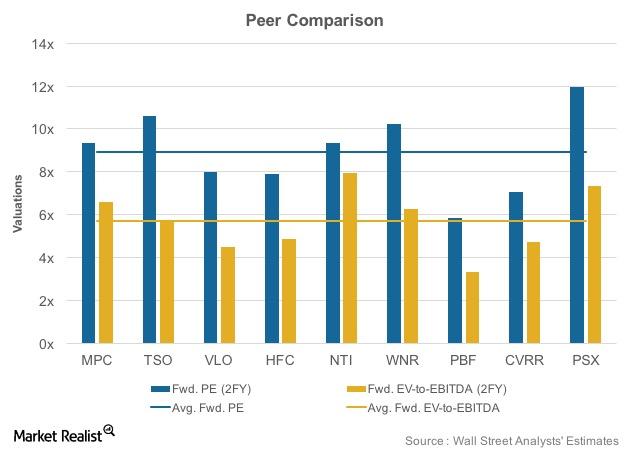

What Do Refining Stock Valuations Reveal?

With respect to the price-to-earnings ratio, larger players Marathon Petroleum (MPC), Tesoro (TSO), and Phillips 66 (PSX) trade higher than the average valuations.

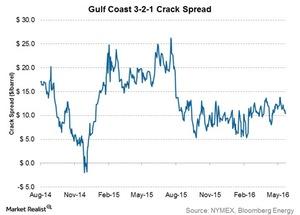

How a Fall in Crack Spreads Is Hurting Refining MLPs

The Gulf Coast 3-2-1 crack spread was $10.4 per barrel on June 16, 2016.

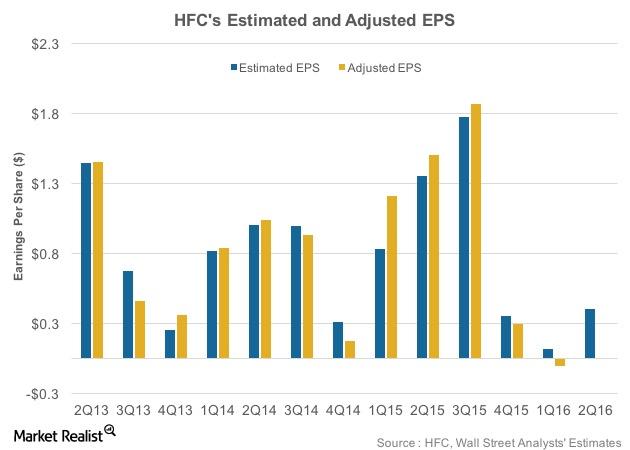

HollyFrontier’s 2Q16 Earnings Expected to Outshine Those of 1Q16

Wall Street analysts expect HollyFrontier to post EPS of $0.35, which is 76% lower than its 2Q15 adjusted EPS.

Will the Gasoline and Distillate Inventory Pressure Crude Oil Prices?

The API (American Petroleum Institute) published its weekly crude oil, gasoline, and distillate inventory report on January 12, 2016.