US Dollar Could Impact Natural Gas Prices

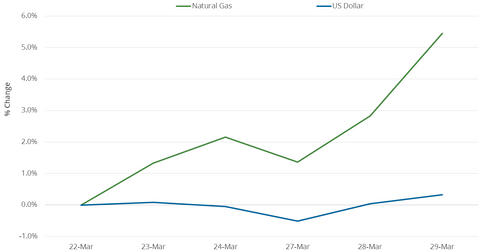

Between March 22 and March 29, 2017, natural gas (GASX) (FCG) (GASL) May futures rose 5.4%. The US dollar rose 0.3% during that period.

March 30 2017, Updated 11:06 a.m. ET

Natural gas and the US dollar in the short term

Between March 22 and March 29, 2017, natural gas (GASX) (FCG) (GASL) May futures rose 5.4%. The US dollar (UUP) (UDN) (USDU) rose 0.3% during that period.

In the past five trading sessions, natural gas futures and the US dollar moved in opposite directions one out of five times. The correlation between the two over the past five trading sessions was 81.7%. The high positive correlation doesn’t indicate an inverse quantitative relationship between them during that short period.

When the dollar falls, it makes commodities cheaper for importing countries, which boosts prices. However, US natural gas wasn’t exported in large quantities outside North America in the past. Historically, there hasn’t been a strong relationship between natural gas and the dollar.

In February 2016, the US started exporting natural gas in liquefied form from the lower 48 states to outside North America. Currently, natural gas exports to Mexico and Canada through pipelines account for a significant portion of US natural gas exports.

Natural gas and the US dollar in the long term

On March 3, 2016, natural gas futures closed at $1.64 per million British thermal units—a 17-year low. Since then, natural gas active futures have risen ~93.6%, while the US dollar has risen 2.5%. During that period, the US dollar and natural gas prices moved in opposite directions based on their closing prices in 146 of 271 trading sessions.

The correlation was -9.3% during that period, which shows the lack of a relationship between the two over a longer period. Other factors, such as weather, were likely driving movements in natural gas during that time.

Natural gas and President Trump

The Trump Administration’s aggressive energy policies could lead to higher natural gas production. The policies could actually boost natural gas exports. President Trump’s policies could also mean the return of coal as a source of fuel for power generators, which would make even more gas available for exports.

As US natural gas becomes a more international commodity, prices could develop a relationship with the US dollar that’s similar to the relationship between crude oil and the US dollar.

The Fed hiked the benchmark interest rate on March 15, 2017, which could strengthen the US dollar. However, due to various factors discussed above, natural gas could escape the impact of a stronger dollar.

The natural gas impact on ETFs

Remember, natural gas prices impact ETFs like the Direxion Daily S&P Oil & Gas Exploration & Production Bear 3x ETF (DRIP), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), the PowerShares DWA Energy Momentum ETF (PXI), the Vanguard Energy ETF (VDE), and the Fidelity MSCI Energy ETF (FENY).

In the next part of this series, we’ll look at natural gas prices and the forward curve.