Indian Equities and Funds Fall after the August Monetary Policy

Indian equities fell on August 9, the day of the monetary policy announcement. Benchmark equity indices like the S&P BSE Sensex and the Nifty 50 fell 0.4%.

Aug. 11 2016, Updated 9:06 a.m. ET

Equities fall

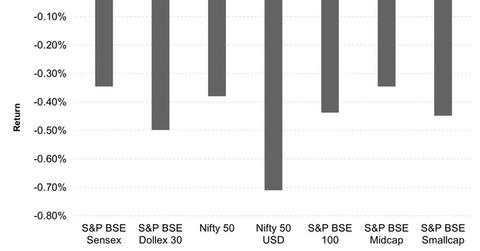

Indian equities fell on August 9, the day of the monetary policy announcement. Investors booked profits accumulated in the previous three days due to the GST (Goods and Services Tax) Constitutional Amendment bill being passed in Parliament. Benchmark equity indices like the S&P BSE Sensex and the Nifty 50 fell 0.4% each for the day. Their US dollar equivalents, the S&P BSE Dollex 30 and the Nifty 50 USD fell 0.5% and 0.7%, respectively, at closing on the day of the policy announcement.

The S&P BSE 100 covers a broader segment of the market. It has 100 stocks—compared to the S&P BSE Sensex’s 30. It fell 0.4% for the day. The impact on mid and small-cap stocks was similar to the broad market. Mid-cap stocks, represented by the S&P BSE Midcap Index, fell 0.3% for the day, while small-cap stocks, represented by the S&P BSE Smallcap Index, fell 0.4%.

Investors should note that except for the Dollex 30 and Nifty 50 USD, returns are in Indian rupee terms.

The reaction of Indian ADRs listed on US exchanges

All but a few ADRs (American depositary receipts) listed on US exchanges fell on August 9. Vedanta (VEDL) fell the most—it fell 3% for the day. Dr. Reddy’s Laboratories (RDY) and Wipro (WIT) were the other major decliners. They fell 1.8% and 0.7%, respectively. Banks emerged as gainers. ICICI Bank (IBN) rose 0.1%, while HDFC Bank (HDB) rose 0.2%. However, the biggest gainer was Infosys (INFY)—it rose 0.5% for the day.

India-focused funds

All India-focused mutual funds posted negative returns on August 9. The Wasatch Emerging India Fund (WAINX) lost the most—it fell 0.6% for the day. The Franklin India Growth Fund – Class A (FINGX) fell the least—it fell 0.1%. Among India-focused ETFs, the WisdomTree India Earnings ETF (EPI) and the iShares MSCI India (INDA) rose marginally, while the PowerShares India ETF (PIN) fell.