Vedanta Ltd

Latest Vedanta Ltd News and Updates

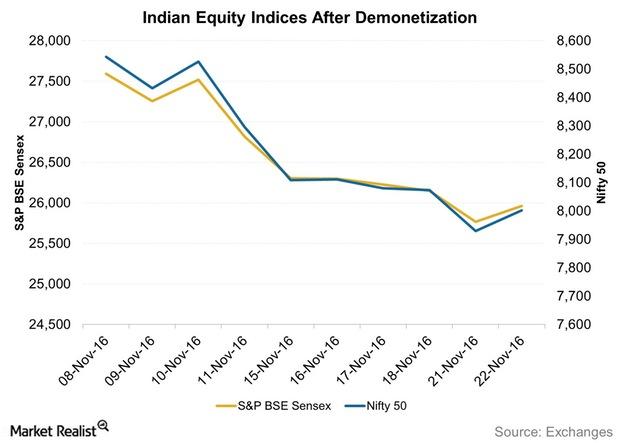

India’s Financial Markets Fell Due to Demonetization

The two benchmark equity indices—the Nifty 50 and the S&P BSE Sensex—fell each trading day since the demonetization except for November 10 and November 22.

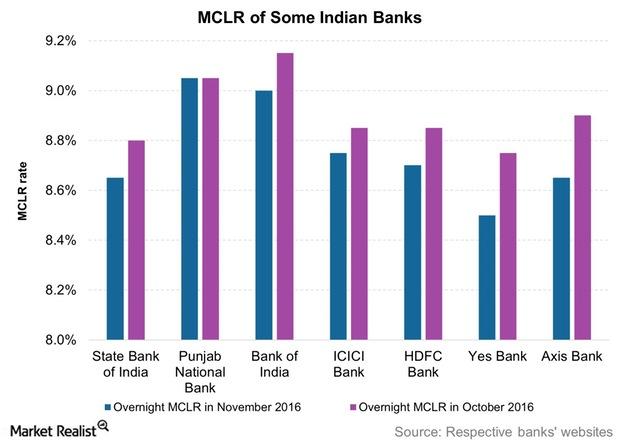

Will Demonetization in India Impact Your Loan Burden?

Banks saw a rise in term deposit accounts since the demonetization. As a result, commercial banks sharply reduced their deposit rates.

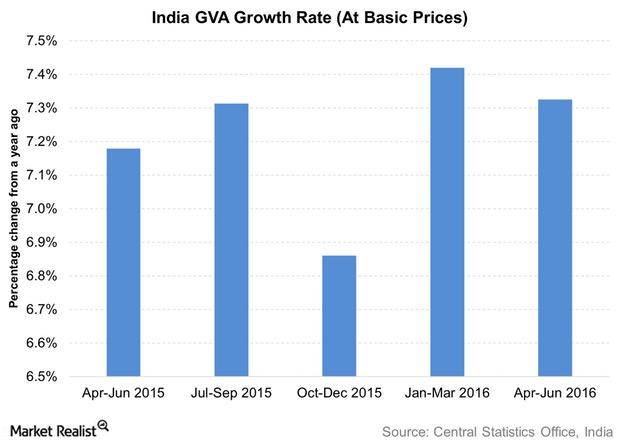

How Could Demonetization Impact the Indian Economy?

The demonetization of the 500 rupee note and the 1,000 rupee note will likely hit the Indian economy hard in the short term.

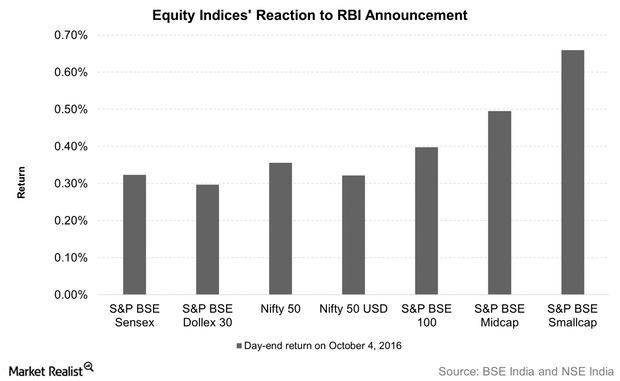

Indian Equities Rise after the RBI’s October 2016 Monetary Policy Announcement

Equities gain Indian equities rose on October 4, 2016, the day of the RBI’s (Rerserve Bank of India) latest monetary policy announcement. The central bank’s cut of its repo rate had a positive effect on equities, with bonds rising initially along with the Indian rupee. Banking and telecom stocks were among major gainers during the […]

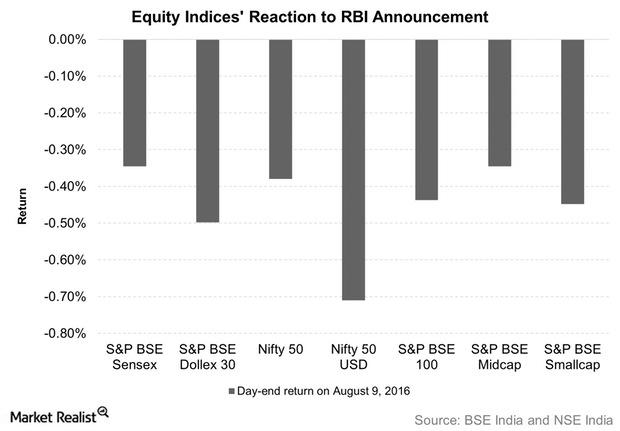

Indian Equities and Funds Fall after the August Monetary Policy

Indian equities fell on August 9, the day of the monetary policy announcement. Benchmark equity indices like the S&P BSE Sensex and the Nifty 50 fell 0.4%.