Dr Reddy Laboratories Ltd

Latest Dr Reddy Laboratories Ltd News and Updates

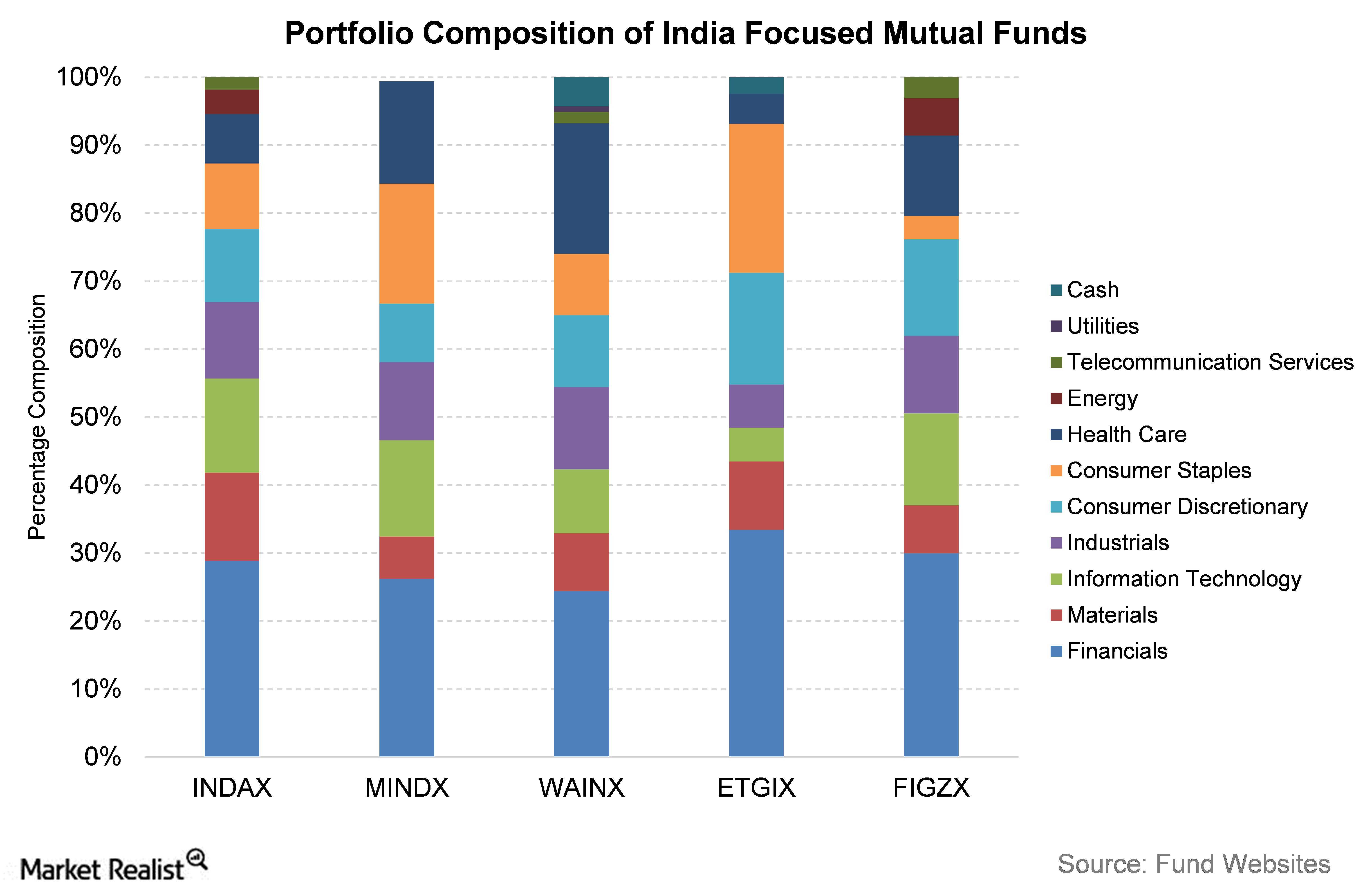

Looking ahead for Indian-Focused Funds

All five India-focused funds have their highest individual sectoral exposure to financials. As reported in the news, 2015 has been a year of global economic stress.

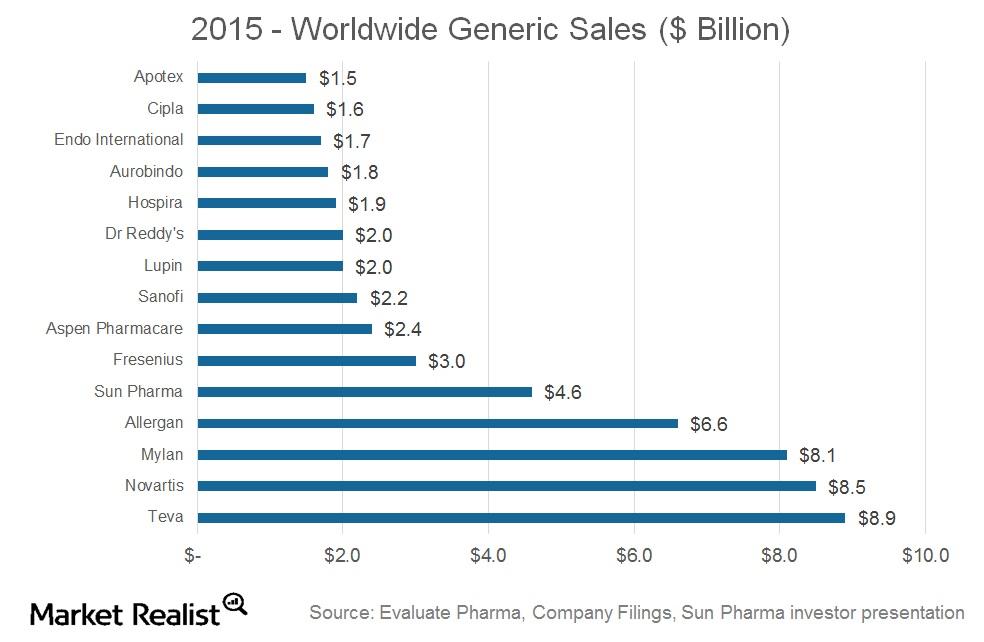

Expert Q&A: What to Know Before Investing in Generic Pharma? (Part 1)

Market Realist analysts recently conducted a Q&A with experts from VanEck on the generic pharmaceutical industry, a space that has attracted investor interest due to upside potential from brand name drugs coming off patent, cost saving pressure in the healthcare industry, and increased worldwide demand for prescription drugs (for more on these topics, please see […]

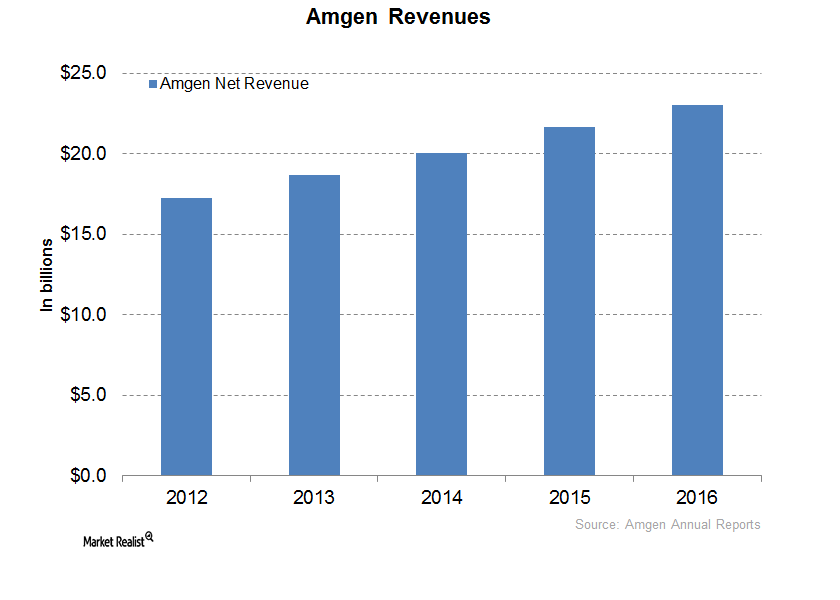

What Could Drive Amgen’s Growth in 2017?

Enbrel, Neulasta, and Epogen are among Amgen’s (AMGN) major revenue-generating drugs, each with annual sales in excess of $1 billion. Enbrel and Neulasta together accounted for ~46% of Amgen’s 2016 revenues.

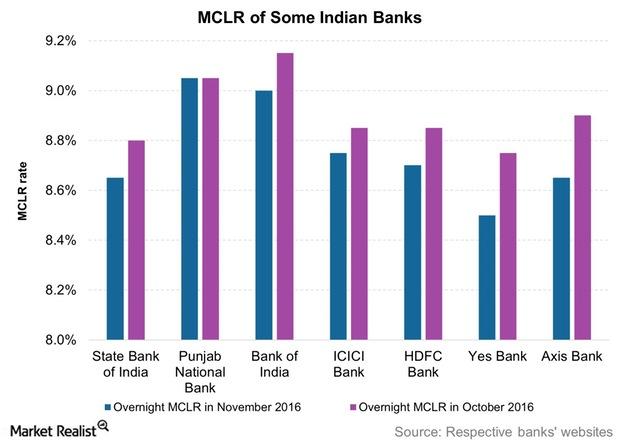

Will Demonetization in India Impact Your Loan Burden?

Banks saw a rise in term deposit accounts since the demonetization. As a result, commercial banks sharply reduced their deposit rates.

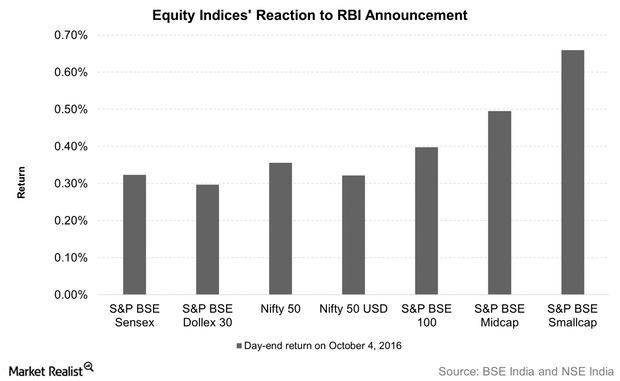

Indian Equities Rise after the RBI’s October 2016 Monetary Policy Announcement

Equities gain Indian equities rose on October 4, 2016, the day of the RBI’s (Rerserve Bank of India) latest monetary policy announcement. The central bank’s cut of its repo rate had a positive effect on equities, with bonds rising initially along with the Indian rupee. Banking and telecom stocks were among major gainers during the […]

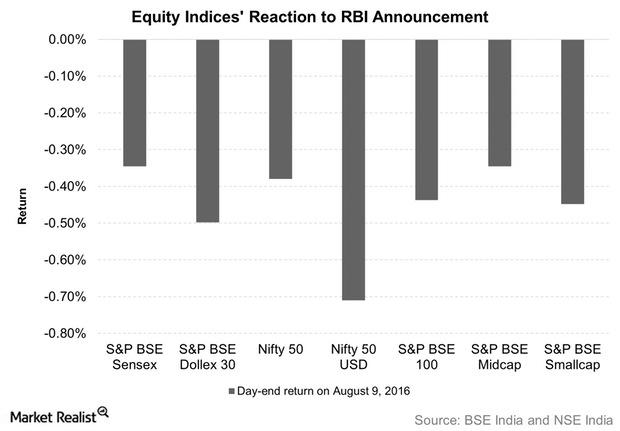

Indian Equities and Funds Fall after the August Monetary Policy

Indian equities fell on August 9, the day of the monetary policy announcement. Benchmark equity indices like the S&P BSE Sensex and the Nifty 50 fell 0.4%.

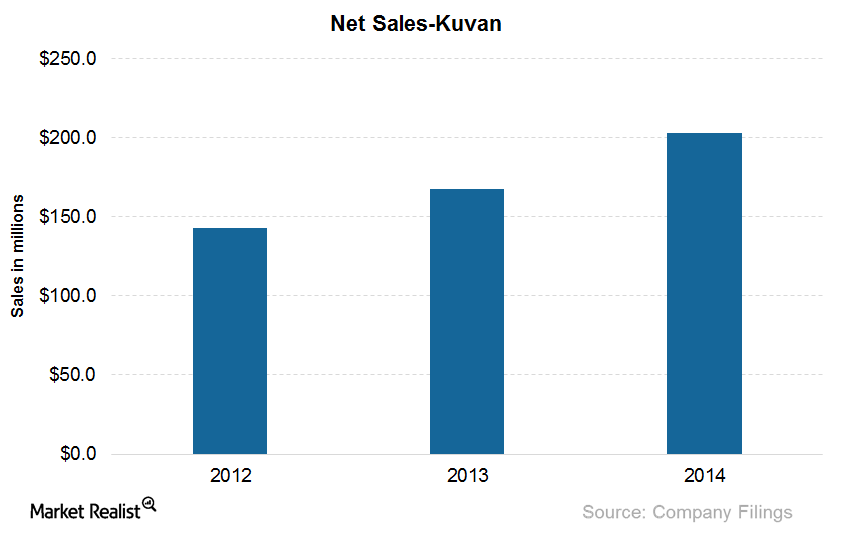

What Are BioMarin’s Products for Treating Phenylketonuria?

Kuvan, with the active ingredient sapropterin dihydrochloride, is effective in reducing blood phenylalanine levels in PKU (or phenylketonuria) patients.

The Booming Indian Stock Market: Will It Last?

Indian stocks had a strong run in the last half of 2014 through early 2015, but the ride since then hasn’t been smooth. The INDA is up only 2.6% in the one year ended June 2015.