Weather Impacts the US Natural Gas Market

January US natural gas (DGAZ) (UNG) futures contracts fell 1.4% to $3.01 per MMBtu in electronic trading at 1:05 AM EST on November 24, 2017.

Nov. 24 2017, Updated 9:15 a.m. ET

Natural gas prices

January US natural gas (DGAZ) (UNG) futures contracts fell 1.4% to $3.01 per MMBtu (million British thermal units) in electronic trading at 1:05 AM EST on November 24, 2017.

December US natural gas (FCG) (BOIL) futures contracts fell 1.7% to $2.91 per MMBtu during the same period. These contracts will expire on November 28, 2017. The E-Mini S&P 500 (SPY) futures contracts for December 2017 delivery rose 0.11% to 2,597.25 in electronic trading at 1:05 AM EST on November 24, 2017.

US natural gas futures are near a one-month low. They have fallen almost 7% in the last three months. Lower gas prices have a negative impact on natural gas producers’ (IEZ) (RYE) profitability like Exco Resources (XCO), Chevron (CVX), Cabot Oil & Gas (COG), and Antero Resources (AR).

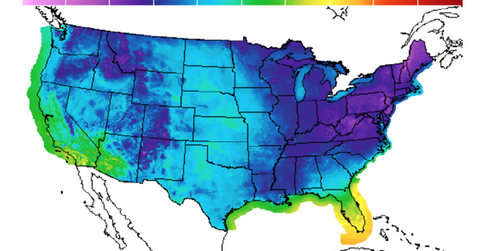

Weather forecasts

The weather is expected to be mild in the western and southern parts of the US next week. The northwestern parts might experience cooler-than-normal temperatures next week. The east and central parts of the US might experience cold weather next week. Overall, the weather is expected to be moderate. Almost 50% of US households use natural gas for heating and cooling. Moderate temperatures could lead to a decline in natural gas demand. Any fall in demand is bearish for natural gas (UGAZ) (GASL) prices.

The National Weather Service predicts that the temperatures in the US will be warmer than average this winter (2017–2018). However, NOAA thinks that the temperatures will be 13% colder than last winter across the US.

In the next part, we’ll discuss US natural gas inventories.