US Gasoline Inventories: Will Crude Oil’s Rally Be Short-Lived?

US gasoline inventories rose for the fourth straight week. The inventories are 8.5 MMbbls or 4% higher than the five-year average.

Nov. 20 2020, Updated 4:40 p.m. ET

US gasoline inventories

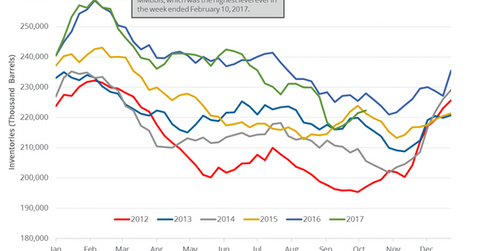

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on October 18, 2017. It estimates that US gasoline inventories rose by 0.9 MMbbls (million barrels) to 222.3 MMbbls on October 6–13, 2017. US gasoline inventories are at the highest level since September 1, 2017. The inventories rose 0.4% week-over-week. However, they have fallen by 5.6 MMbbls or 2.5% year-over-year.

Market surveys projected that US gasoline inventories would have risen by 0.3 MMbbls on October 6–13, 2017. Crude oil (OIL) (USO) (UCO) and gasoline (UGA) futures rose on October 18, 2017, despite the larger-than-expected rise in gasoline inventories. US gasoline futures rose 0.8% to $1.64 per gallon on October 18, 2017.

Volatility in crude oil (DBO) (UWT) prices impacts oil producers (VDE) (XOP) (IXC) like PDC Energy (PDCE), Contango Oil & Gas (MCF), and WPX Energy (WPX).

Likewise, moves in gasoline prices impact US refining (CRAK) companies like Alon USA Energy (ALJ), Tesoro (TSO), Valero (VLO), and CVR Energy (CVI).

US gasoline production and demand

According to the EIA, US gasoline production rose by 290,000 bpd (barrels per day) to 10,031,000 bpd on October 6–13, 2017. Production rose 3% week-over-week and by 533,000 bpd or 5.6% from the same period in 2016.

US gasoline demand fell by 344,000 bpd or 3.6% to 9,136,000 bpd on October 6–13, 2017. Demand fell 3.6% week-over-week but rose by 338,000 bpd or 3.8% from the same period in 2016. It could have been the bullish number that supported gasoline prices on the date of the data release, as we discussed above.

Impact of gasoline inventories

US gasoline inventories rose for the fourth straight week. The inventories are 8.5 MMbbls or 4% higher than the five-year average. High gasoline inventories could pressure gasoline prices. Lower gasoline prices could even pressure crude oil prices.

Read What Dennis Gartman Thinks about Crude Oil Prices and Which Geopolitical Tensions Could Drive Crude Oil Prices? to learn more.