Southwestern Energy Co

Latest Southwestern Energy Co News and Updates

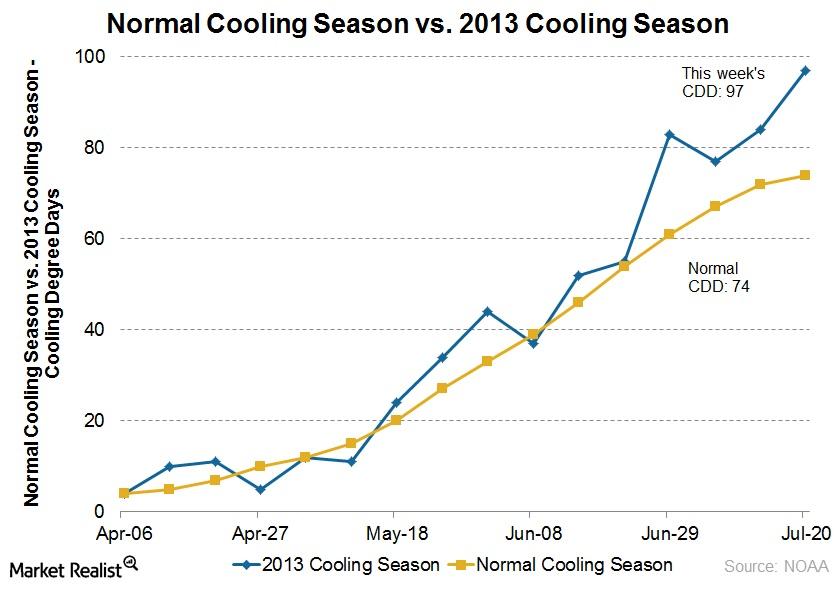

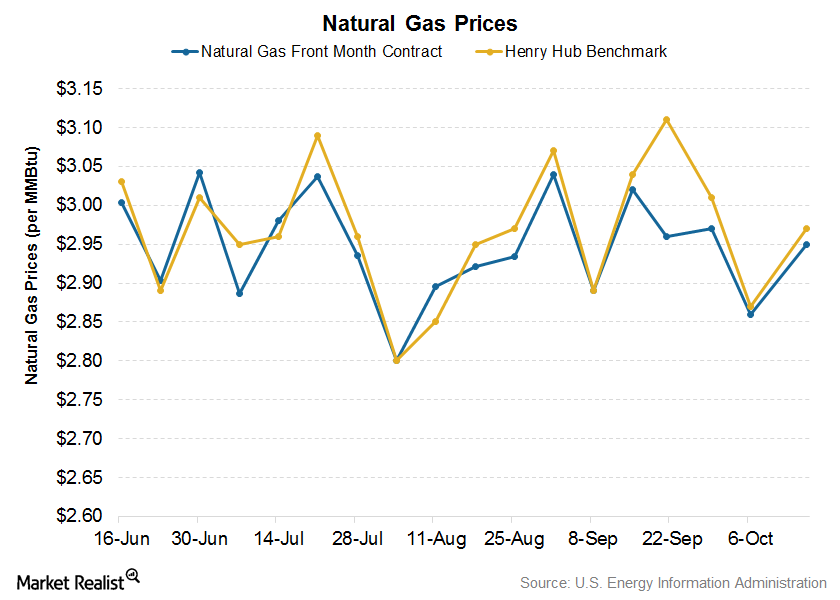

Why the summer heat wave supports natural gas prices

A heat wave that has persisted in the US has helped to lift natural gas prices.

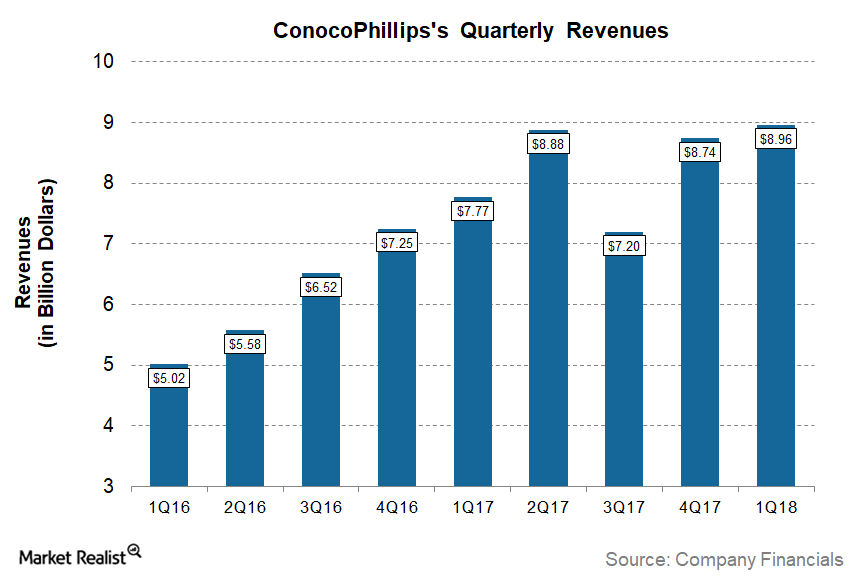

Why Did ConocoPhillips’s Revenue Grow in 1Q18?

For 1Q18, ConocoPhillips (COP) reported revenues of ~$9.0 billion—higher than analysts’ consensus of ~$8.8 billion.

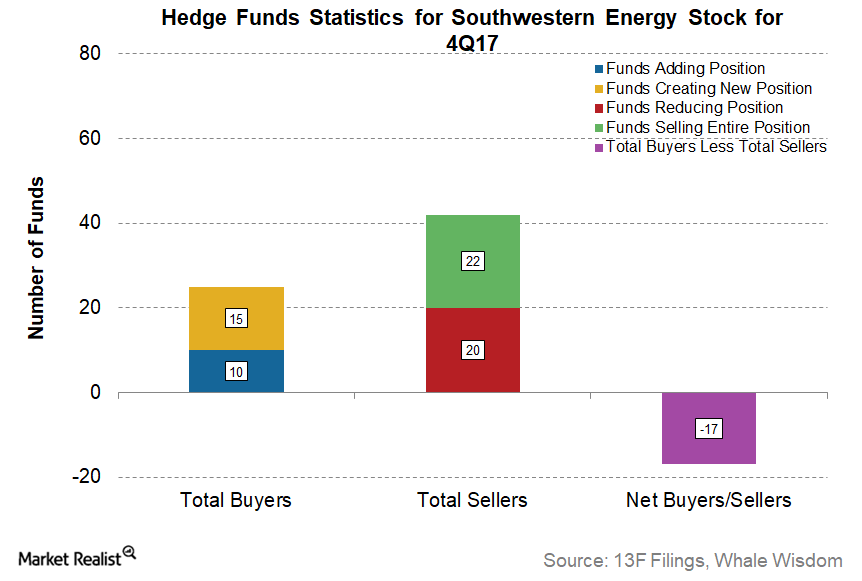

Are Hedge Funds Accumulating Southwestern Energy Stock?

In 4Q17, 25 hedge funds were buyers of Southwestern Energy (SWN) stock, and 42 hedge funds were sellers.

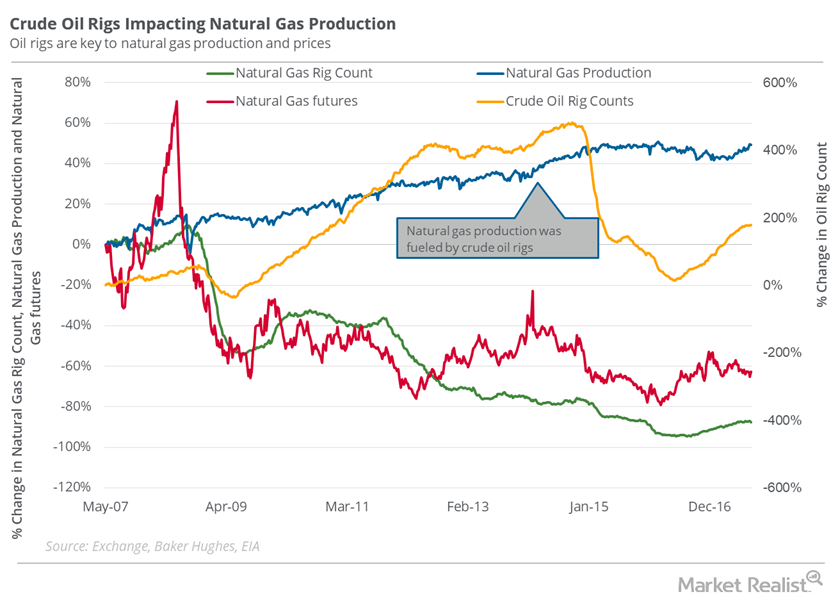

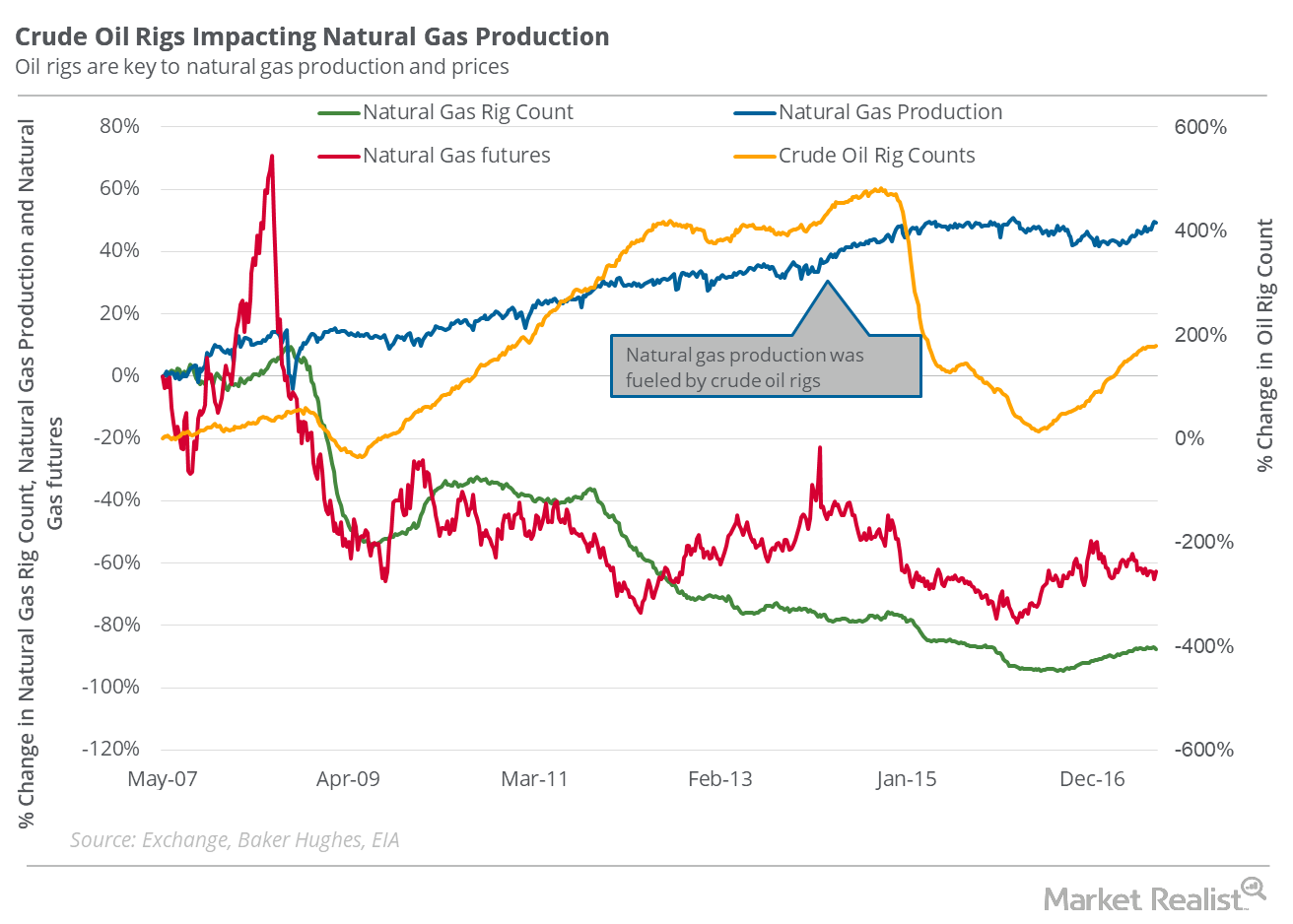

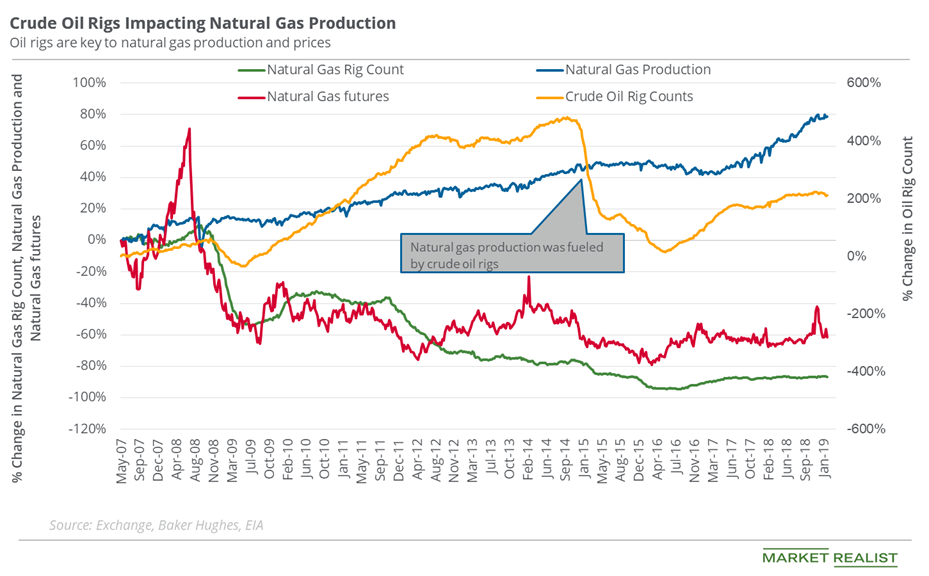

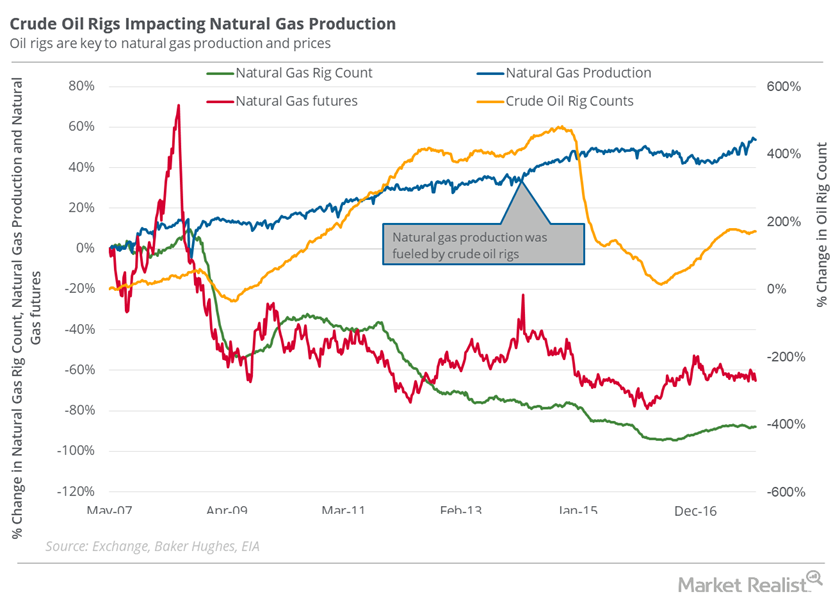

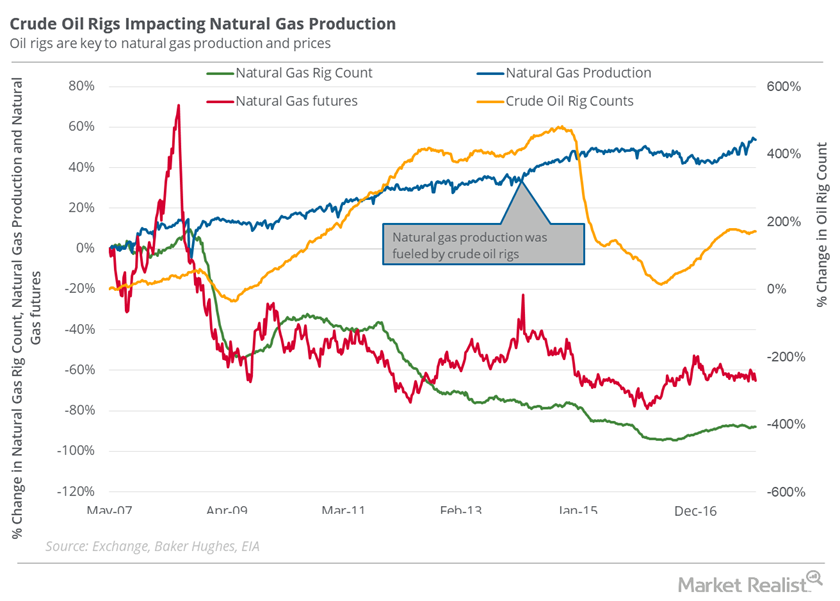

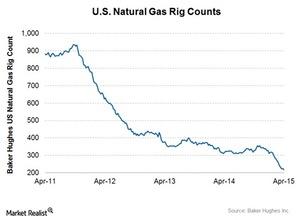

Will the Oil Rig Count Increase Natural Gas Downside Risk?

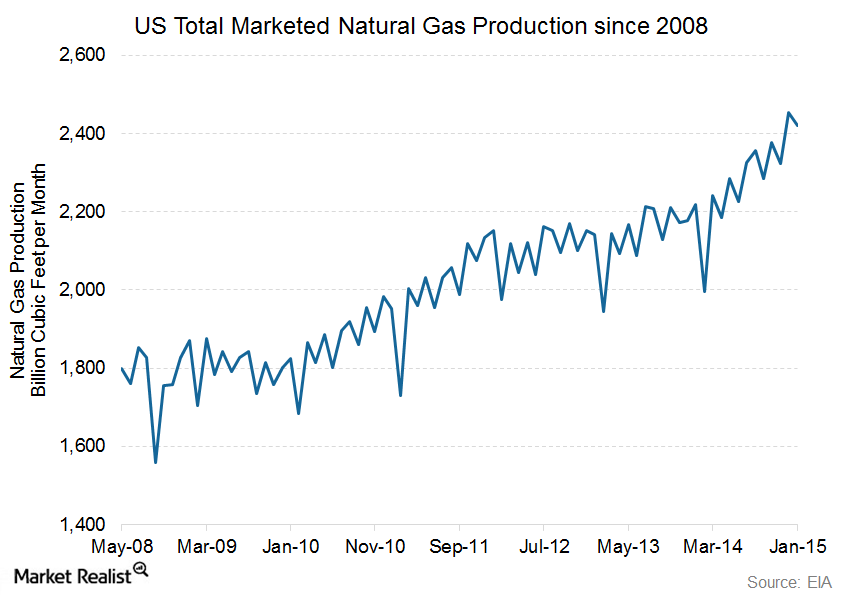

Since 2008, the natural gas rig count has fallen ~89% from its record high. But the fall was unable to stop the rise in natural gas supplies.

Behind the Natural Gas Rig Count: Will Production Rise?

The natural gas rig count rose by four to 187 in the week ended September 8, 2017. On a YoY basis, the natural gas rig count more than doubled that week.

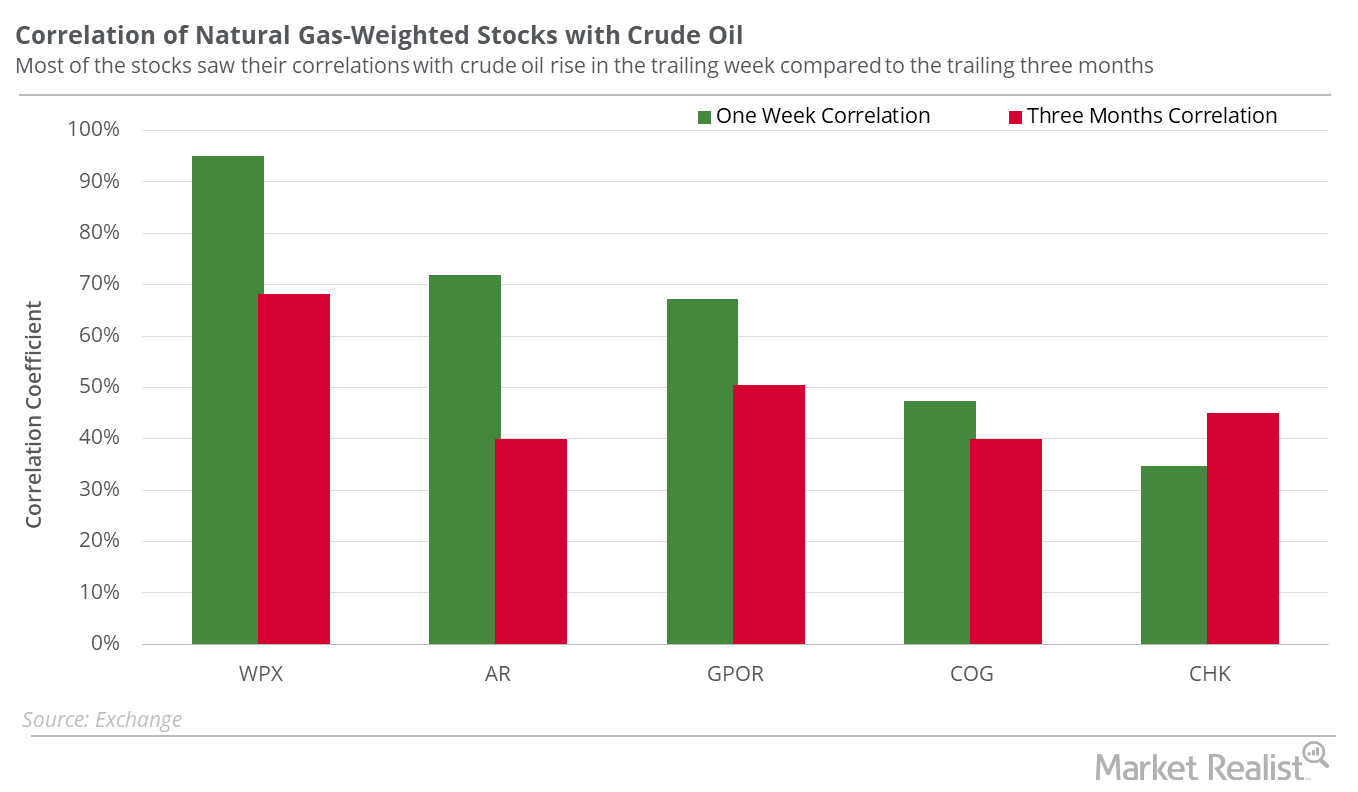

Which Natural Gas–Weighted Stocks Could Follow Oil?

WPX Energy had the lowest correlation with natural gas prices in the past five trading sessions. Southwestern Energy had among the highest correlations.

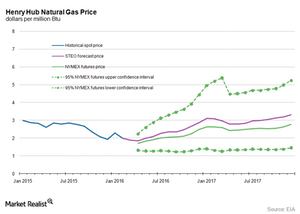

What’s the Long-Term US Natural Gas Price Forecast?

In its March Short-Term Energy Outlook report, the EIA forecast that the US natural gas supply-demand balance could average around 2.9 Bcf per day in 2016.

How Oil Rigs Impact Natural Gas Production

The natural gas rig count was at 187 last week. The natural gas rig count has fallen ~88.4% from its record level of 1,606 in 2008.

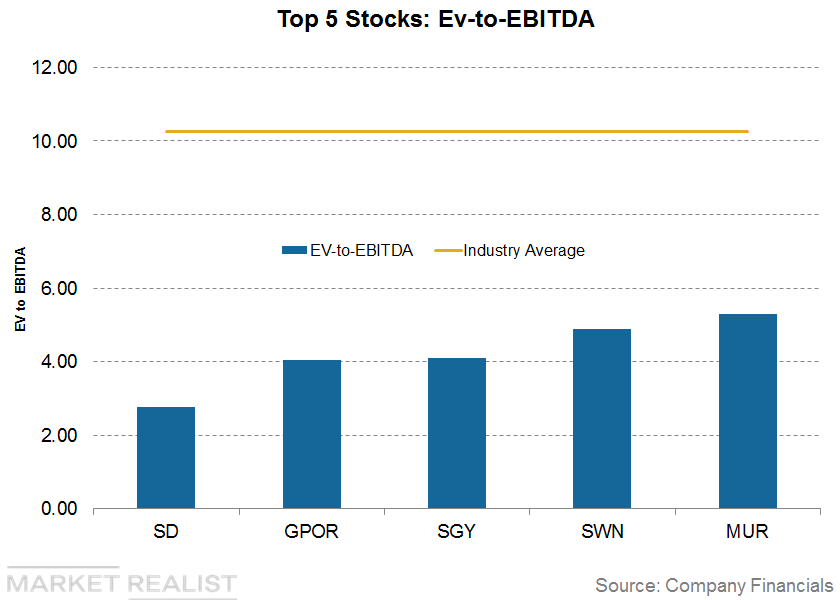

Upstream Companies with the Lowest EBITDA Multiples

As of the first quarter, Sandridge Energy’s (SD) EV-to-adjusted EBITDA ratio was ~2.77x. The company has a market capitalization of $529.83 million.

A Look at the Rig Count and Natural Gas

On December 15, 2017, the natural gas rig count was 88.6% lower than its record high in 2008.

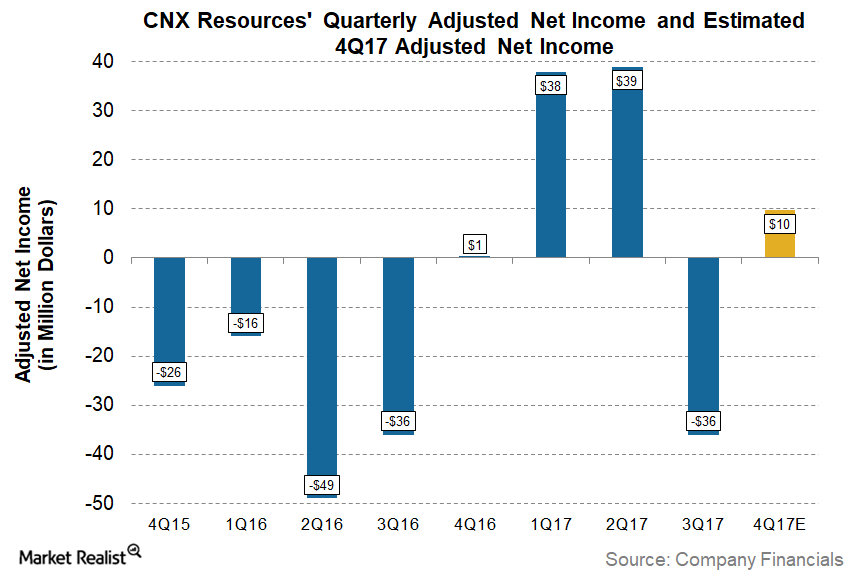

Can CNX Resources Report Higher Profits in 4Q17?

CNX Resources (CNX) is set to report its 4Q17 and 2017 earnings on February 6, 2018, before the market opens. CNX is expected to report 1,000% higher profits YoY than 4Q16.

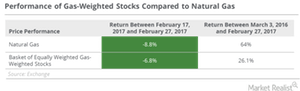

Analyzing Gas-Heavy Stocks amid Falling Natural Gas Prices

From February 17–27, 2017, natural gas futures contracts for April 2017 delivery fell 8.8%. On March 3, 2016, natural gas futures touched a 17-year low.Financials What’s the Dow Theory?

The Dow Theory was developed by Charles Dow. It identifies and signals the change in the stock market trends. It’s useful for trading and investing. The Dow Theory has six components.

Why it’s important to know the crude oil extraction process

Before learning the costs components of crude oil extraction, let’s take a look at how producers extract crude oil from the ground.Energy & Utilities Southwestern is among the largest US oil and natural gas producers

Headquartered in Houston, Texas, Southwestern Energy Corporation (SWN) is one of the largest independent natural gas and oil producers in the United States.

Will API Inventory Data Impact Energy Stocks?

Today, the API plans to release its oil inventory data for the week ended August 30. Gasoline inventories are expected to fall by 1.8 MMbbls.

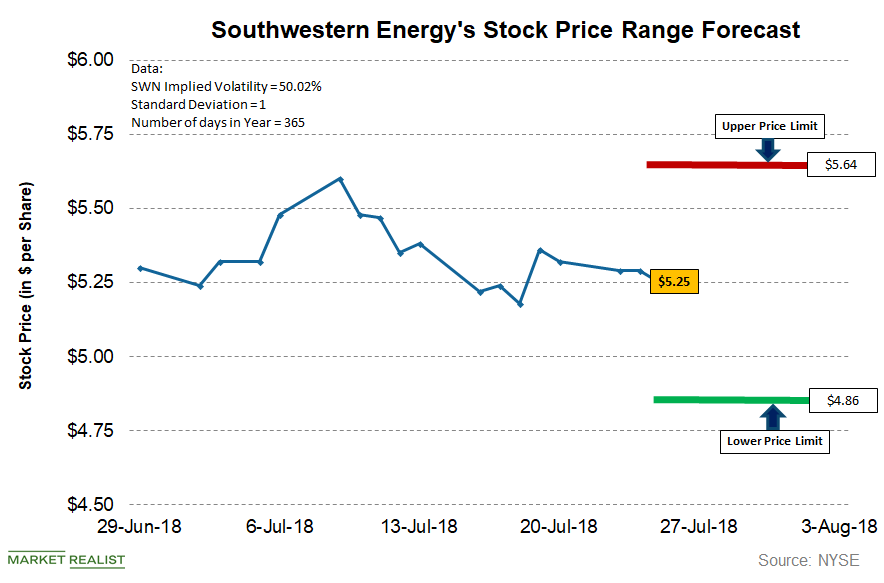

What’s the Forecast for Southwestern Energy Stock?

As of July 25, Southwestern Energy (SWN) had an implied volatility of ~50.0%, which is lower when compared with its implied volatility of ~50.9% at the end of the second quarter of 2018.

Analysts’ Price Targets for Cabot Oil & Gas’s Next 12 Months

Approximately 66.66% of analysts covering Cabot Oil & Gas (COG) recommend “buy,” and 33.33% recommend “hold.”

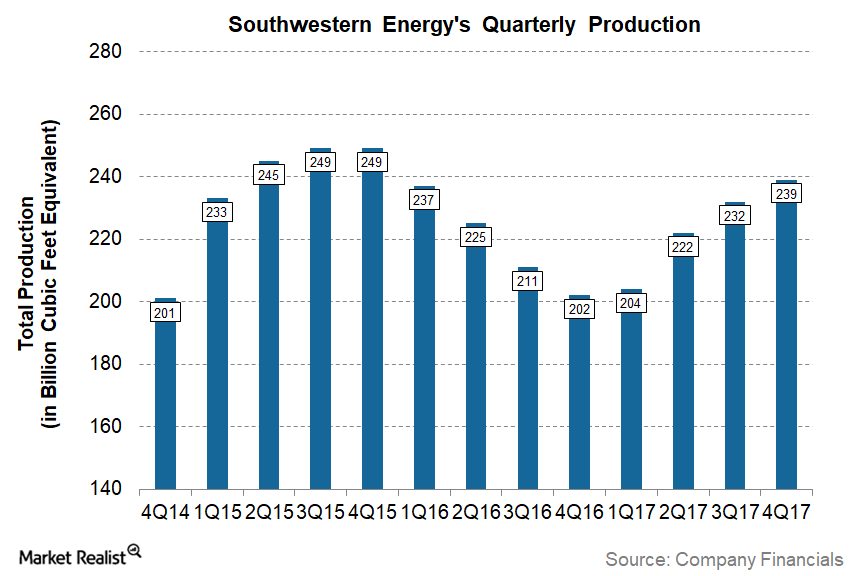

Southwestern Energy Reported Higher Production in 4Q17

Sequentially, Southwestern Energy’s 4Q17 production is ~3% higher compared to its production of 232 Bcfe in 3Q17.

Why the Oil Rig Count Could Be a Concern for Natural Gas Bulls

In the week ended December 22, the natural gas rig count was 88.5% below its record high of 1,606 in 2008.

How Weather Affects Natural Gas Prices

On October 16, the November US natural gas futures contract price was reported as $2.95 per MMBtu.

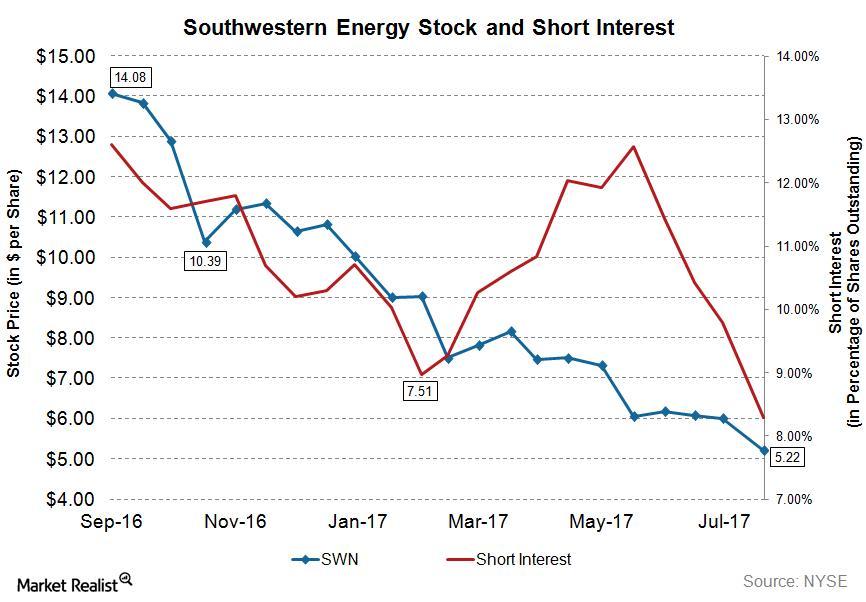

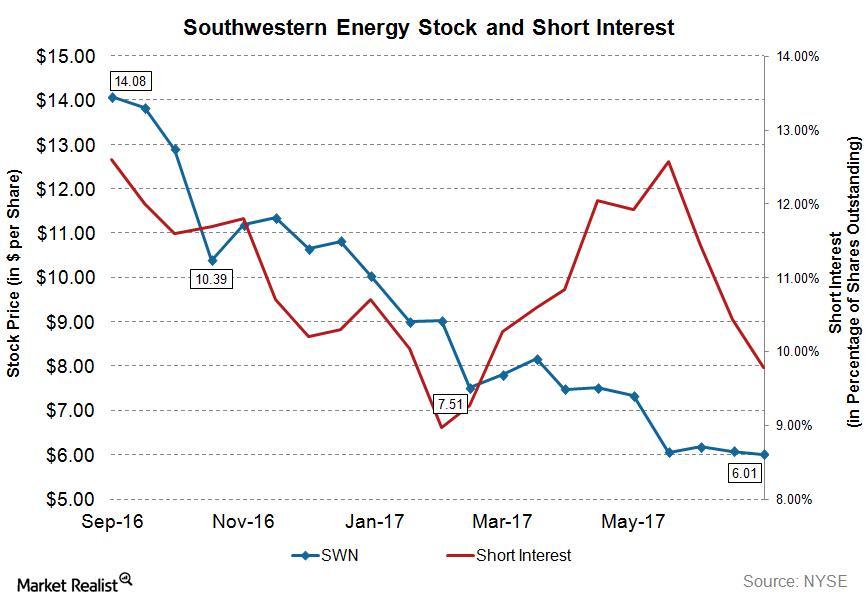

Analyzing the Short Interest in Southwestern Energy Stock

As of August 14, Southwestern Energy’s total shares shorted (or short interest) stood at ~45.89 million, while its average daily volume is ~17.44 million.

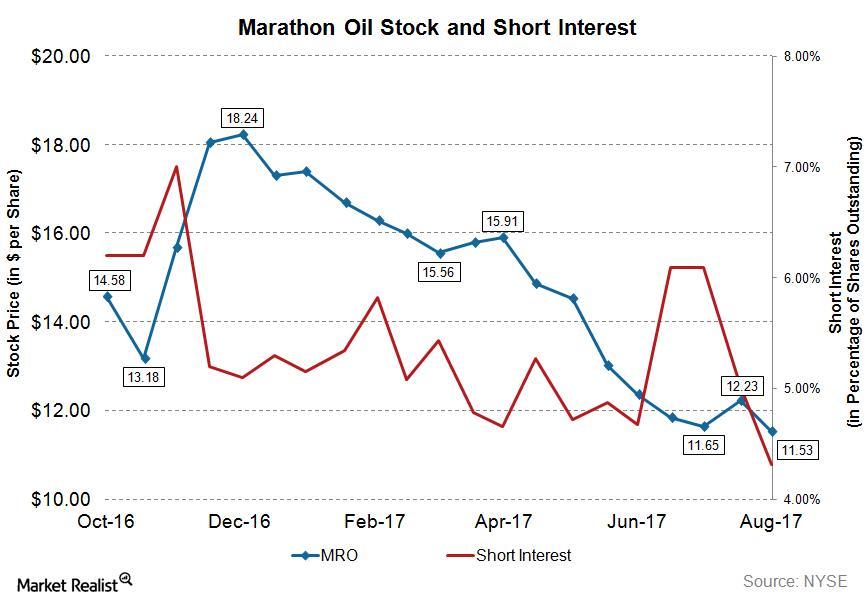

Short Interest in Marathon Oil Stock Remains at Lower Levels

As of August 14, 2017, Marathon Oil’s total shares shorted (or short interest) stood at ~36.65 million, while its average daily volume is ~15.94 million.

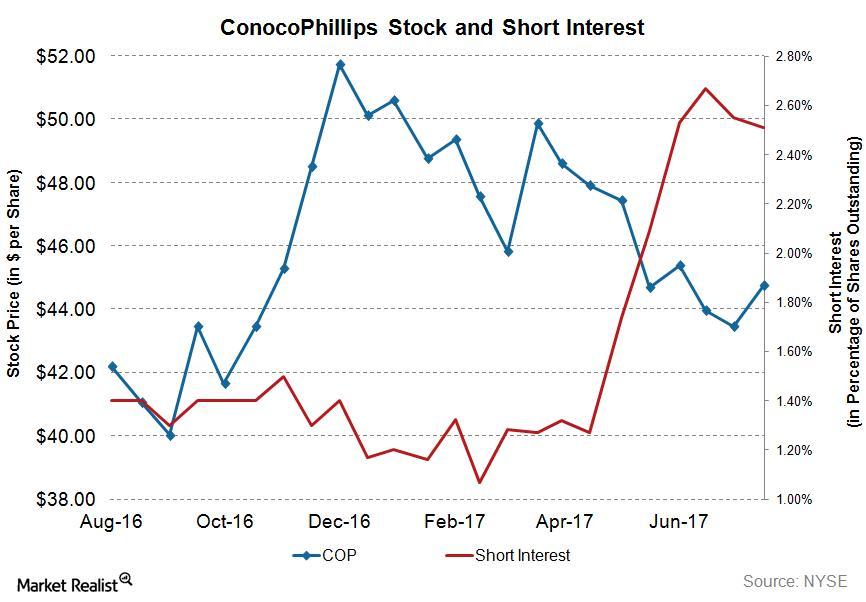

Analyzing the Short Interest in ConocoPhillips Stock

As of July 31, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) was ~31.6 million, and its average daily volume was ~8.0 million.

What’s the Short Interest in Southwestern Energy Stock?

As of July 14, 2017, Southwestern Energy’s (SWN) total shares shorted (or short interest) stood at ~49.5 million, whereas its average daily volume was ~18.4 million.

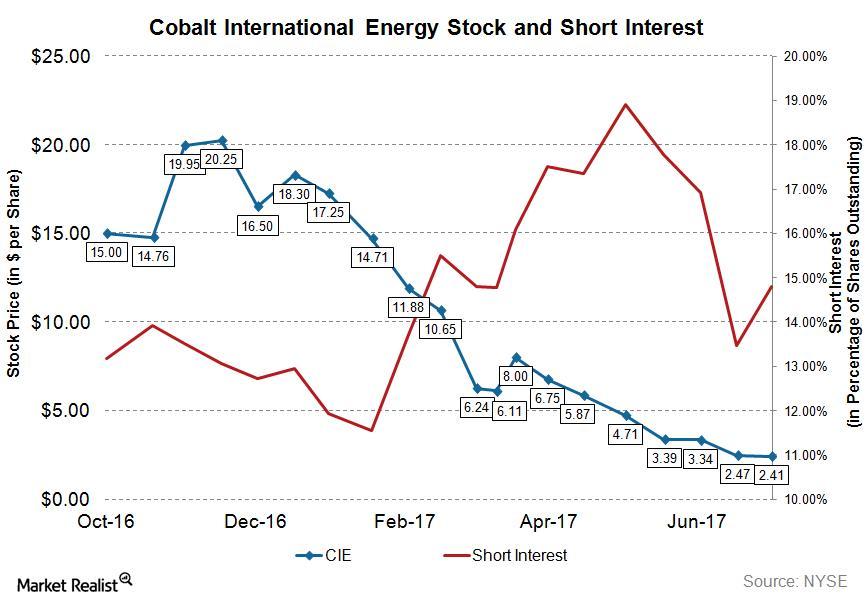

Analyzing Short Interest in Cobalt International Energy’s Stock

As of July 14, 2017, Cobalt International Energy’s (CIE) total shares shorted (or short interest) was 4.37 million, whereas its average daily volume is 1.03 million.

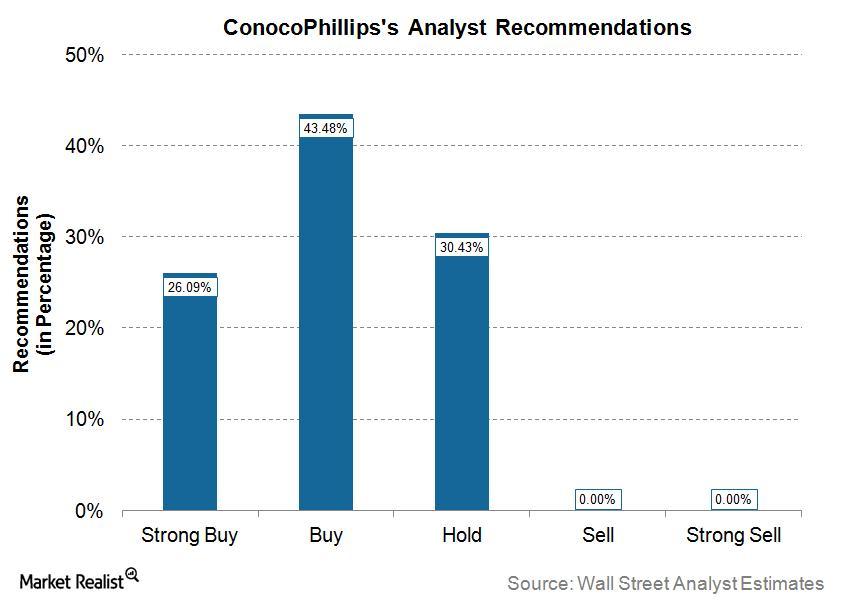

What Wall Street Analysts Are Saying about ConocoPhillips

As of July 28, 2017, 43.48% of the total Wall Street analysts covering ConocoPhillips (COP) have a “hold” recommendation on ConocoPhillips.

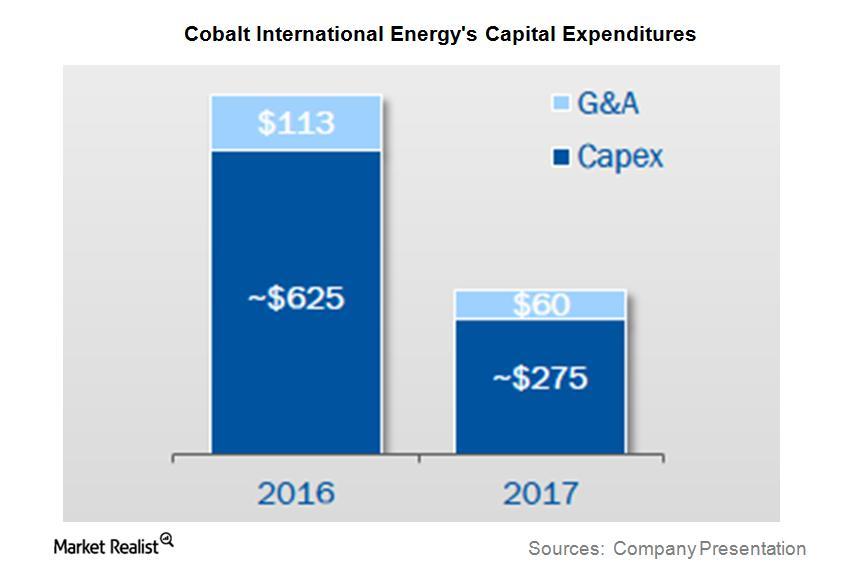

Cobalt International Energy’s Capital Expenditure Guidance

For fiscal 2017, Cobalt International Energy (CIE) plans to spend significantly lower on capex (capital expenditure), or ~56.0% less than fiscal 2016.

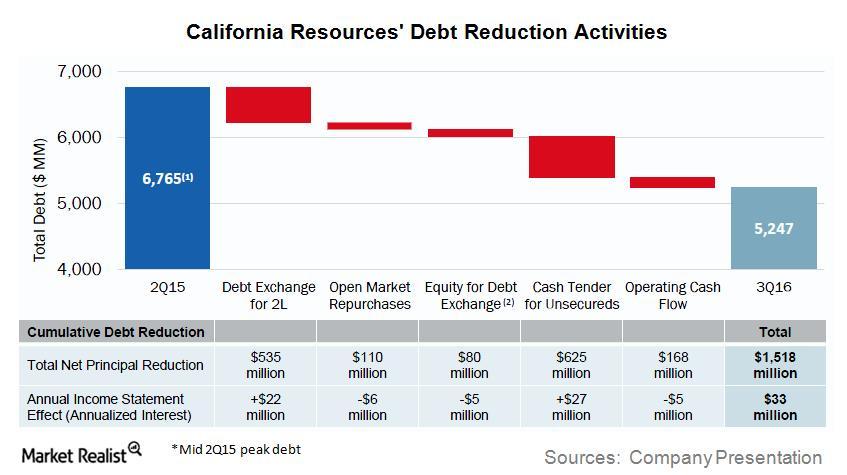

California Resources Has Taken These Steps to Reduce Its Debt

On September 30, 2016, California Resources’ (CRC) total debt stood at ~$5.3 billion. California Resources has been intently focusing on reducing its debt load.

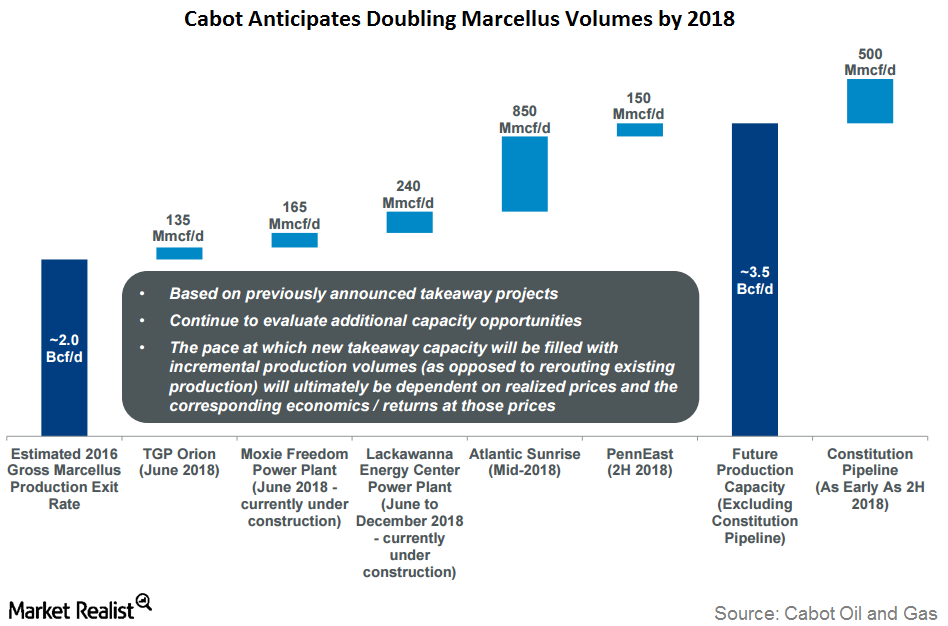

Why Cabot Awaits the Atlantic and Constitution Pipeline Projects

Cabot Oil & Gas’s stock price momentum has slowed, but its stock has recently been rising, mirroring natural gas prices.

Are Companies That Have Done Acquisitions Outperforming?

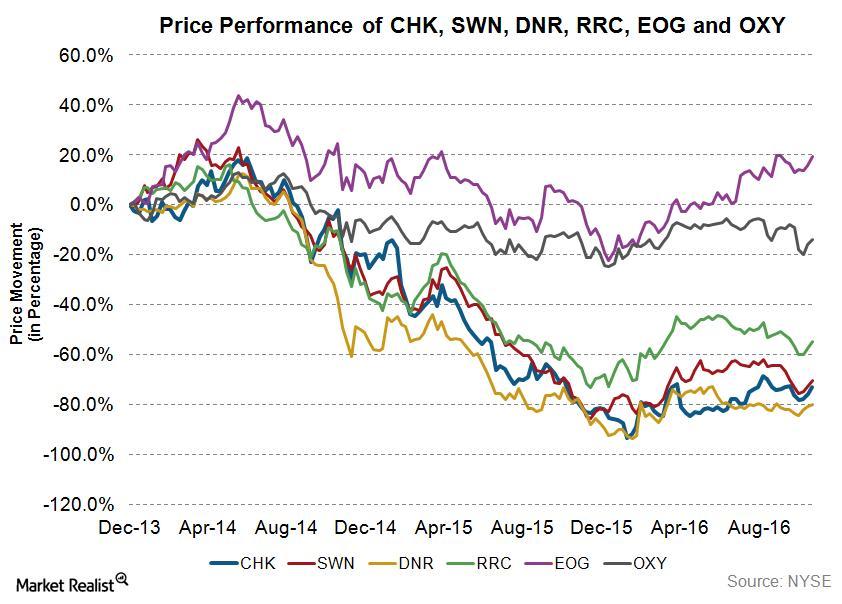

Upstream companies’ performance In the last two parts of this series, we have seen that some upstream companies, namely Range Resources (RRC), EOG Resources (EOG), and Occidental Petroleum (OXY), have taken advantage of lower crude oil (USO) and natural gas (UNG) prices through acquisitions. In this part, we’ll see if these companies are outperforming Chesapeake […]

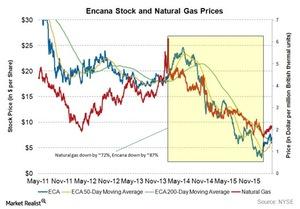

Encana: The Effect of Declining Natural Gas Prices

In this series, we’ll take a look at the effect of declining natural gas prices on Encana. We’ll also cover its May 17 Presentation for Investors on its Montney Resource Play.

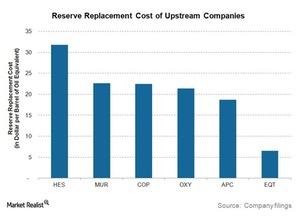

Weighing the Reserve Replacement Cost Metric of Upstream Energy Companies

The Reserve Replacement Cost metric gives us the cost incurred by an upstream company by considering the per-barrel-of-oil equivalent of a new reserve.

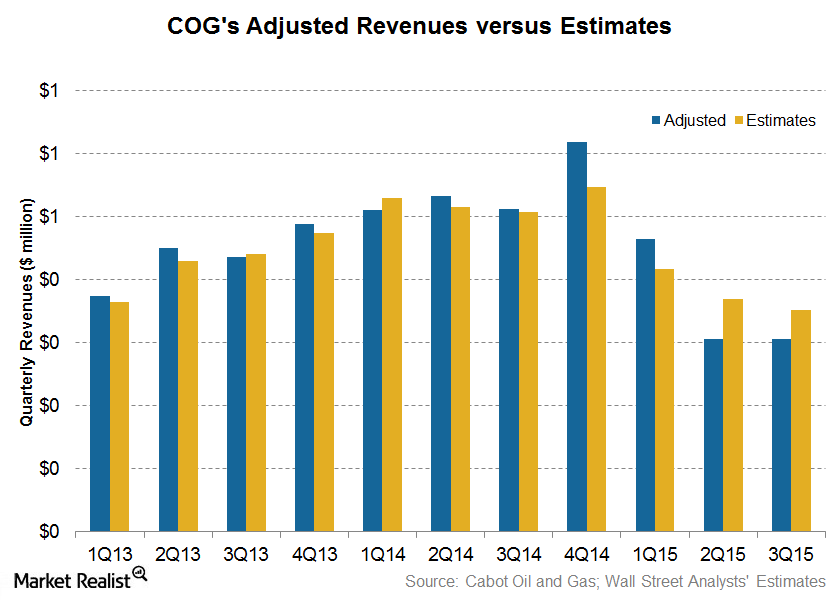

3Q15 Earnings: Cabot Oil and Gas’s Revenue Missed Estimates

Wall Street analysts’ estimate for Cabot Oil and Gas’s revenue was ~$352 million for 3Q15. The company announced adjusted revenue of ~$305 million.

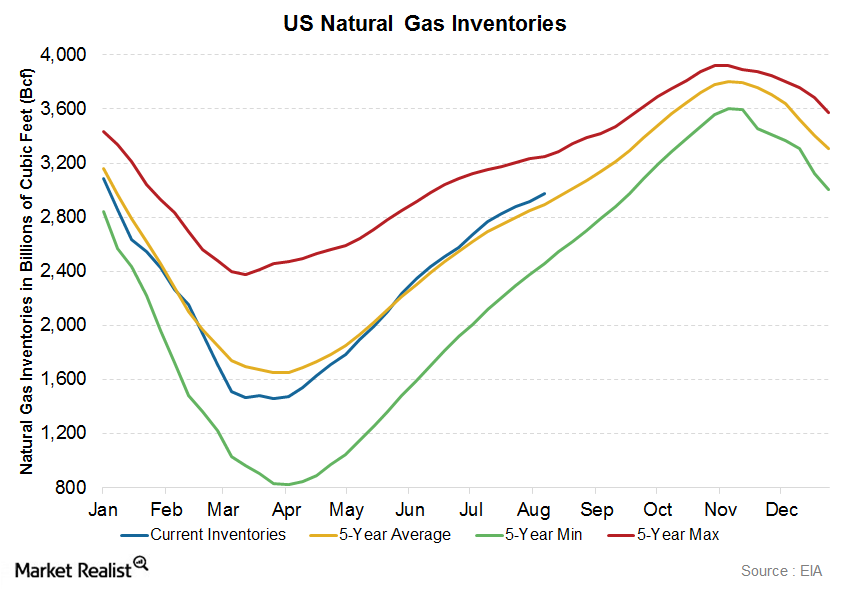

Natural Gas Inventories Beat Expectations: How Will Prices React?

On Thursday, August 13, the EIA (U.S. Energy Information Administration) published its “Natural Gas Weekly Update” for the week ended August 7.

Natural Gas Rig Count Back to Downtrend in Week Ended April 17

There were 217 natural gas rigs operating in the week ended April 17, a loss of eight from the previous week. Natural gas rig count increased by three the previous week.

EIA Reports a Slight Decline in Natural Gas Production

Continued production growth set a grim scenario for natural gas prices. High production levels are bearish for natural gas prices.

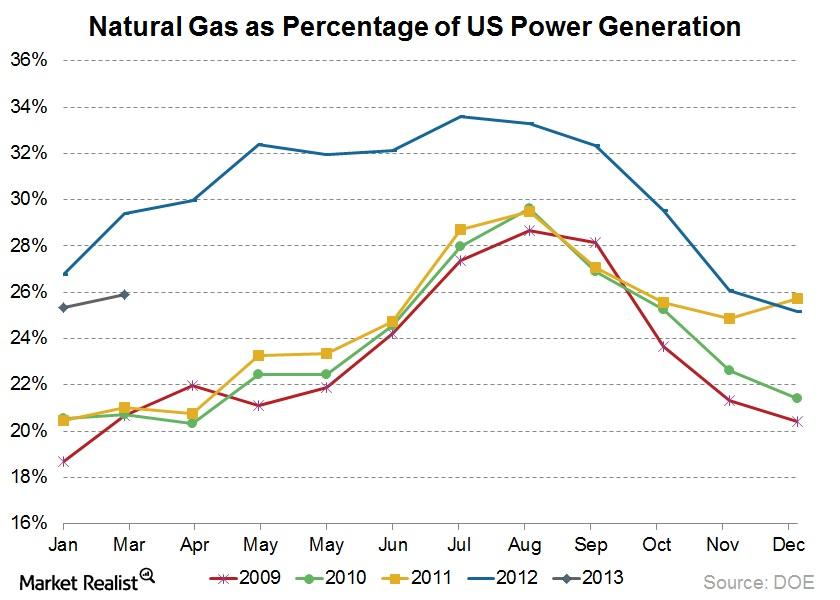

Why has natural gas gained popularity among power generators?

Natural gas has gained market share for use in power generation. Learn about the drivers of this trend and the consequences of increased natural gas use.