Transocean Ltd

Latest Transocean Ltd News and Updates

Seadrill Stock Rose 98% in Week 20

The offshore drilling industry made headlines last week, especially Seadrill (SDRL), which reached a 52-week high of $0.73.

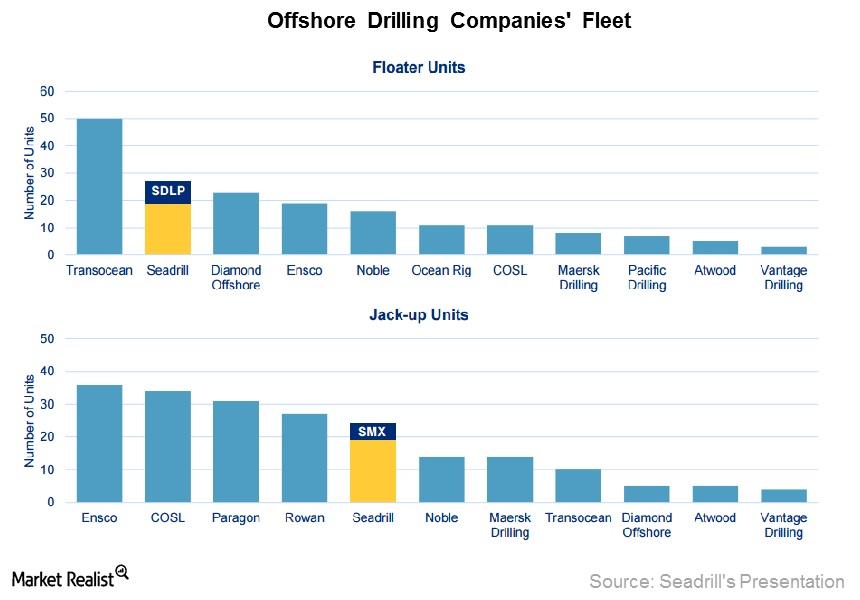

A Review of Floaters and Jack-Up Fleets for Offshore Drillers

Seadrill and Diamond Offshore have more than 20 floaters in their fleets. Ensco and Rowan Companies have more jack-ups in their fleets than peers have.

Transocean Secured New Contracts

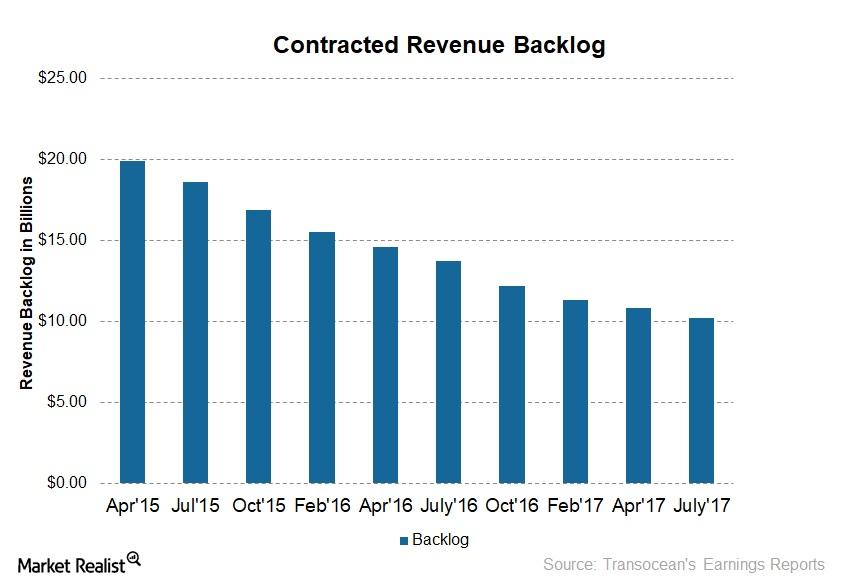

As of July 25, 2017, Transocean (RIG) had a backlog of $10.2 billion—compared to $10.8 billion in April 2017.

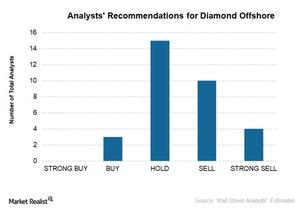

Jefferies Revises Target Prices for Diamond Offshore, Noble

Article focus In this article, we’ll discuss analysts’ target price revisions for offshore drilling companies in Week 8 of 2018 (ended February 23). Revisions in Week 8 Jefferies revised its target prices for two offshore drillers. On February 21, 2018, it reduced the target price for Transocean (RIG) to $12 from 413 and maintained a […]

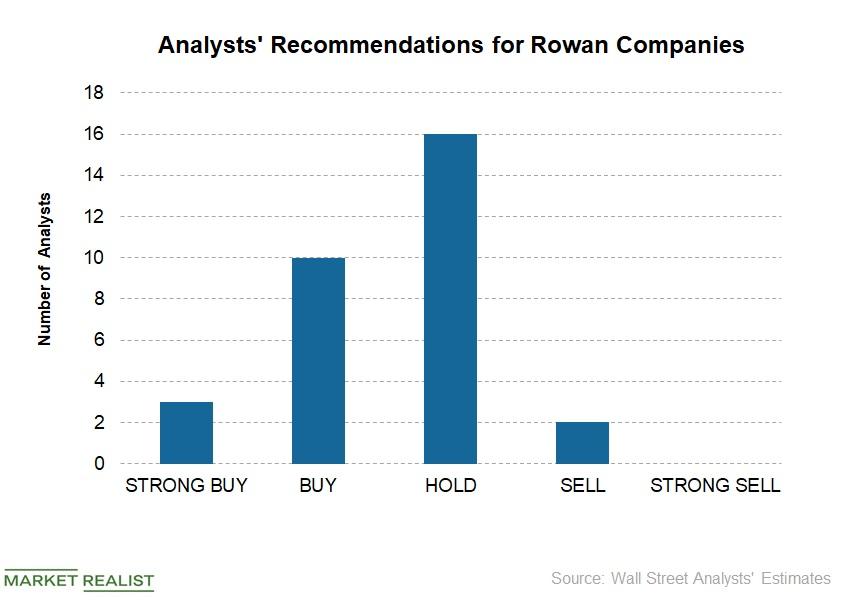

Wells Fargo Upgrades Rowan Companies to ‘Outperform’

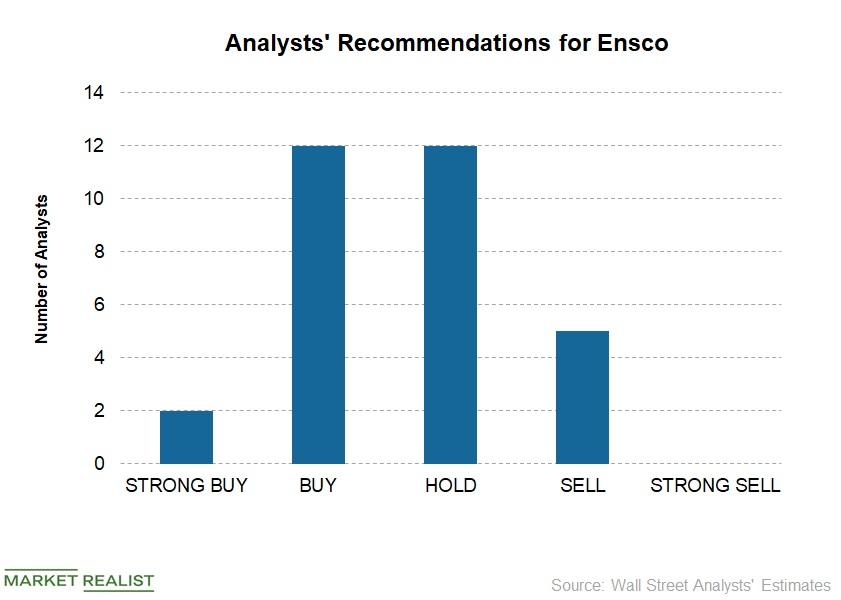

RDC’s analyst recommendations Analysts’ consensus rating for Rowan (RDC) is 2.6, which means a “hold.” Peers Transocean (RIG), Diamond Offshore (DO), Noble (NE), and Ensco (ESV) also have “hold” ratings. Of the 31 analysts covering Rowan (RDC), 39% recommend “buy” or some equivalent, 55% recommend “hold,” and 6% recommend “sell.” Among the top offshore drilling stocks […]

How US Production Is Affecting WTI Crude Oil Prices

Between February 11, 2016, and July 15, 2019, WTI crude oil prices rose 127.3%. The United States Oil Fund LP (USO) gained 53.9% in the period.

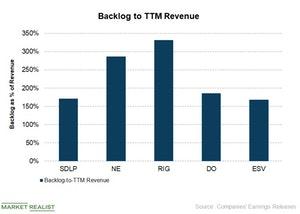

Transocean Has the Highest Backlog among Its Peers

In the last part of this series, we saw which offshore drillers had the highest and lowest falls in their backlogs. In this article, we’ll compare offshore drillers’ backlogs versus their revenues.

Jefferies Revises Ratings and Target Prices for Offshore Drillers

In Week 25, which ended June 22, Jefferies downgraded one offshore driller and revised the target prices for others.

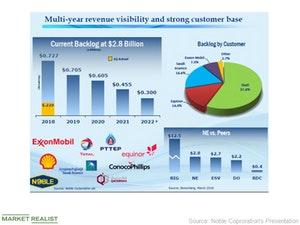

Analyzing Noble’s June Fleet Status Report

On June 7, Noble (NE) released its June fleet status report. Most of the offshore drilling companies don’t publish a monthly fleet status report.

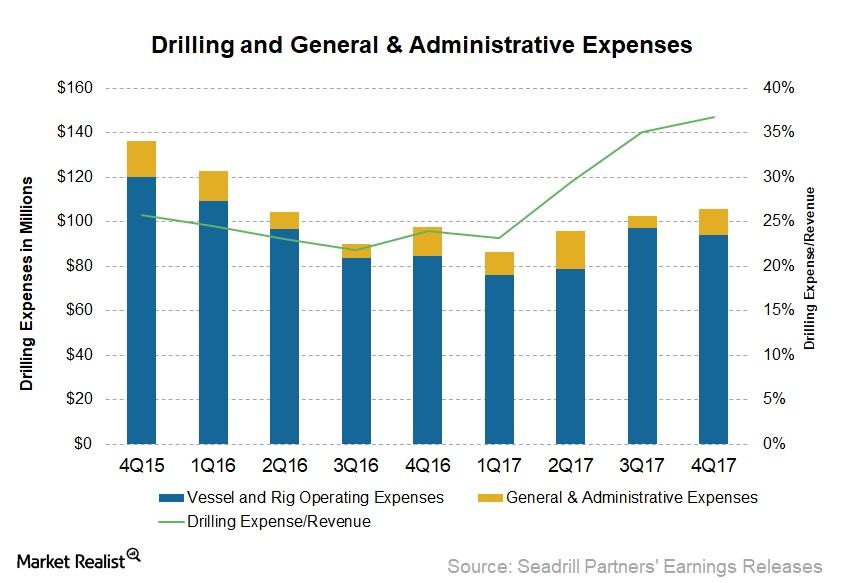

A Look at Seadrill Partners’ Cost Performance in 4Q17

Seadrill Partners’ (SDLP) vessel and rig operating expenses fell 3% to $94 million in 4Q17 compared to $96.9 million in 3Q17.

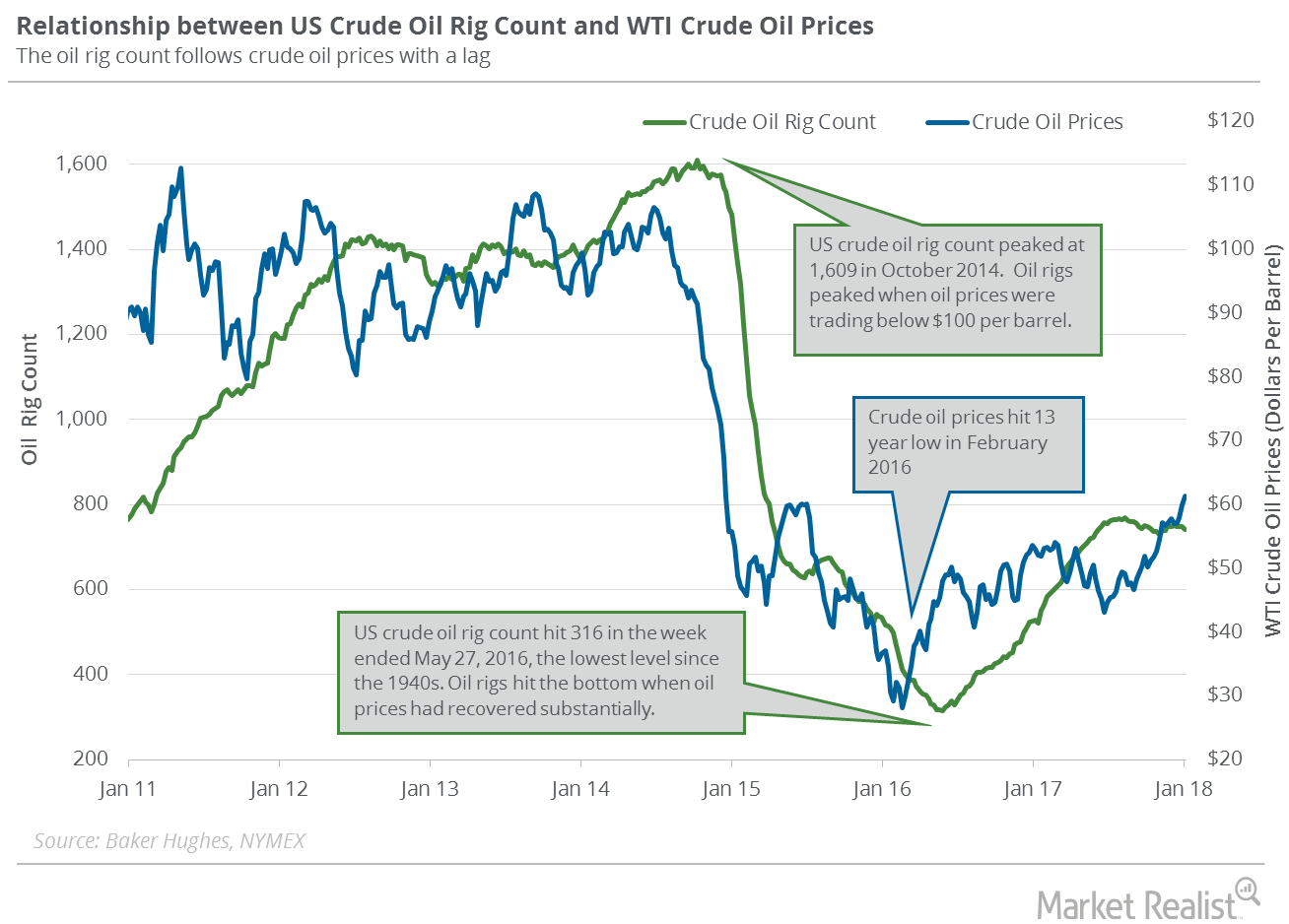

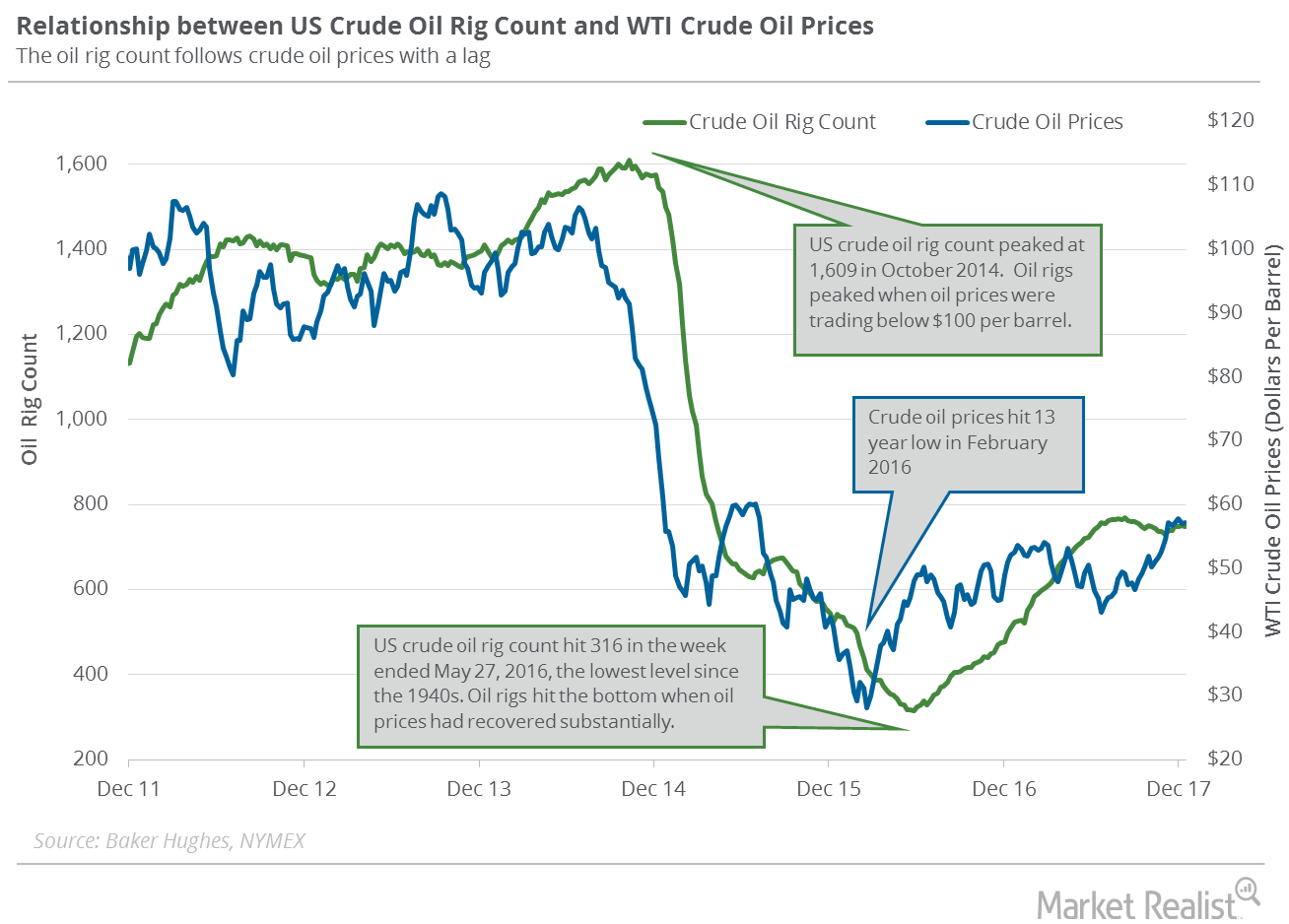

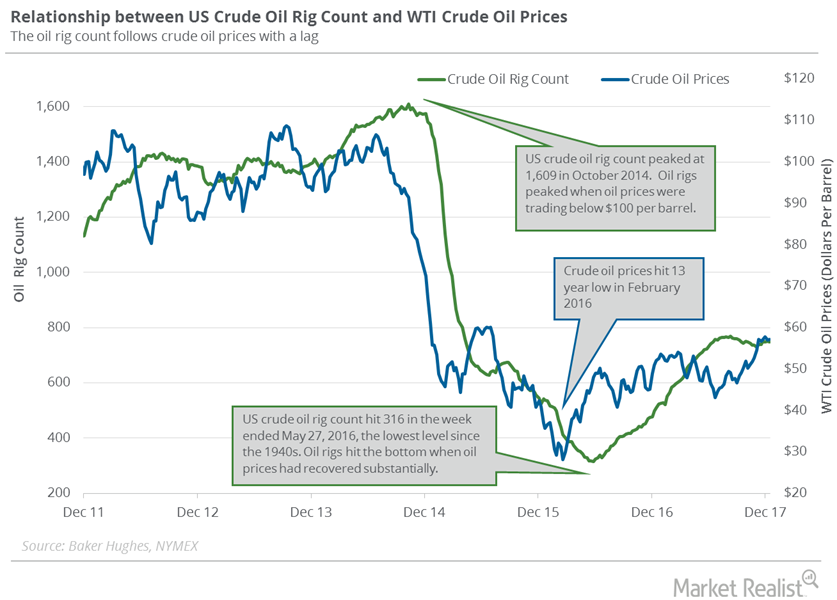

Are US Crude Oil Rigs Indicating a Slowdown in Oil Production?

On January 19, 2018, Baker Hughes released its weekly US crude oil rigs report. US crude oil rigs decreased by five to 747 on January 12–19, 2018.

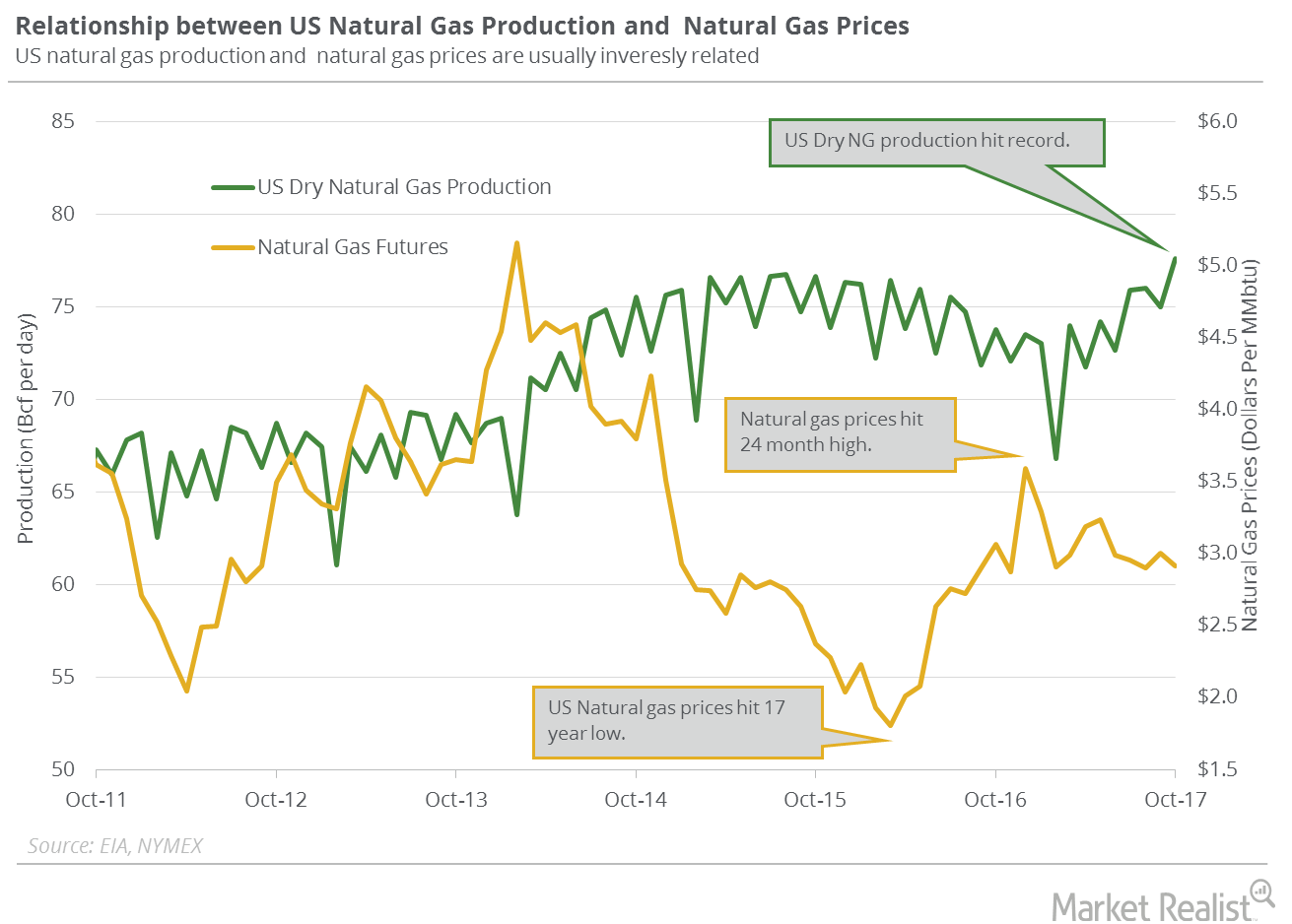

Will US Natural Gas Production Hit a Record in 2018 and 2019?

US dry natural gas production rose by 1.2 Bcf (billion cubic feet) per day or 1.6% to 74 Bcf per day on January 4–10, 2018, according to PointLogic.

US Crude Oil Rig Count: Almost Flat in the Last 5 Weeks

Baker Hughes published its US crude oil rig report on December 22, 2017. The US crude oil rig count was flat at 747 on December 15–22, 2017.

US Crude Oil Rigs Indicate Future US Crude Oil Production

Baker Hughes released its weekly US crude oil rig report on December 15, 2017. US crude oil rigs fell by four to 747 or 0.5% on December 8–15, 2017.

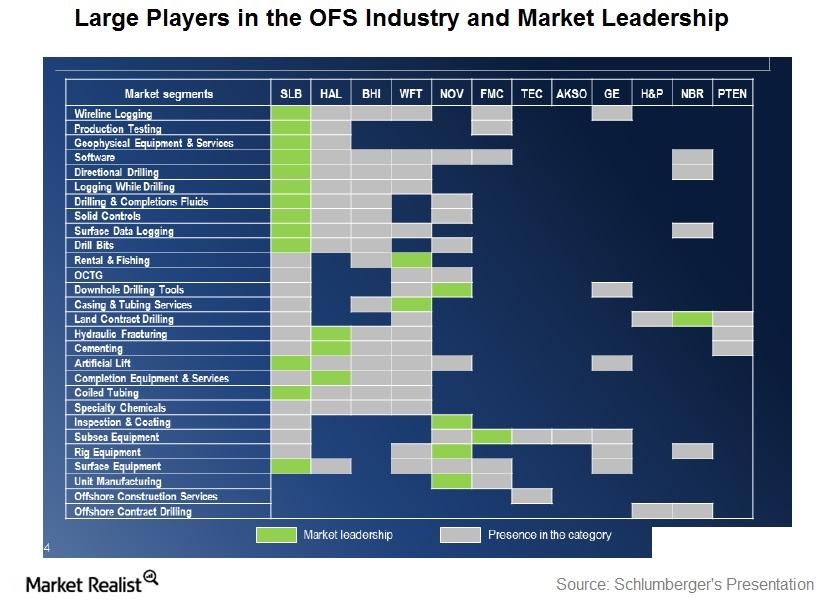

The Oilfield Services Industry: A Brief Introduction

The oilfield equipment and services industry refers to all products and services associated with the oil and gas exploration and production process, or the upstream energy industry.

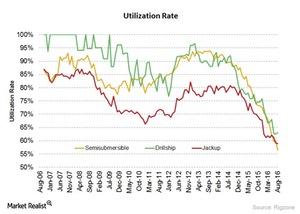

How Are Offshore Drilling Rig Utilization Rates Trending?

The rig utilization rate has drastically fallen compared to its historical rates. The utilization rate is an important indicator to gauge demand and activity in the offshore drilling industry.

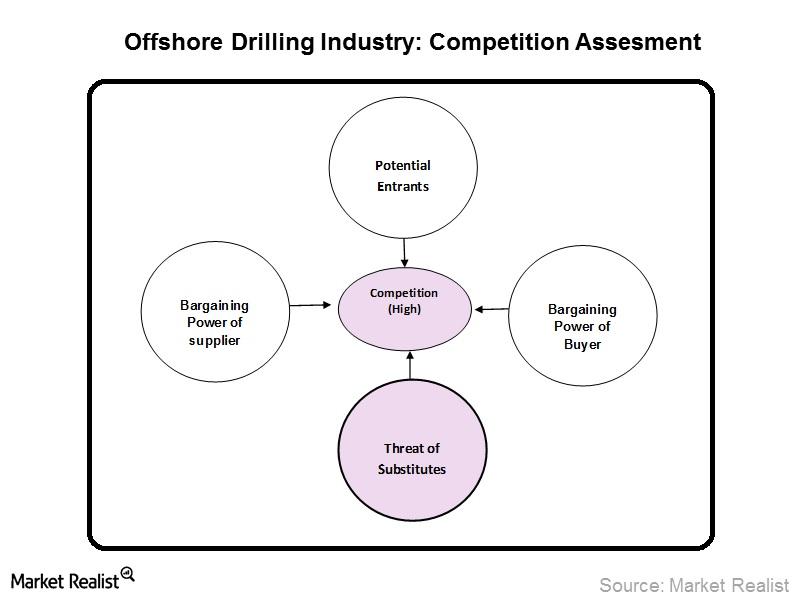

The Intense Competition in the Offshore Drilling Industry

The offshore drilling industry has a high degree of financial and operating leverage, which forces participants to engage in price competition.

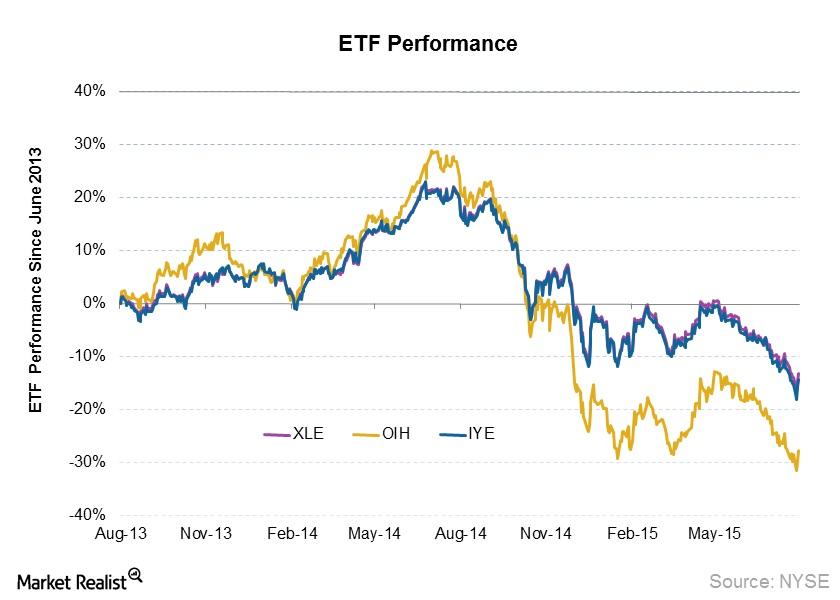

ETF Exposure in the Offshore Drilling Space

Among the biggest ETFs in the offshore drilling space, investors can choose between ETFs like OIH, XLE, and IYE for exposure to offshore drilling.

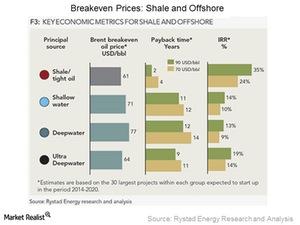

How Offshore and Onshore Drilling Perform when Oil Prices Tumble

Unconventional sources of onshore drilling have started gaining popularity in recent years, but the crude from these sources are costly to produce.

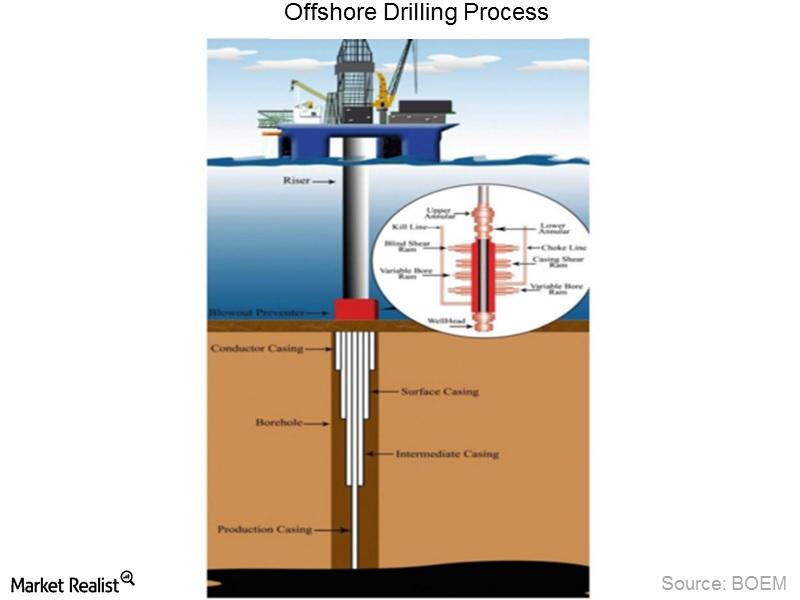

Why the Offshore Drilling Process Is so Complex and Costly

The offshore drilling process requires complex machinery and large crews. At every stage, things that can go wrong, so each stage requires special care.

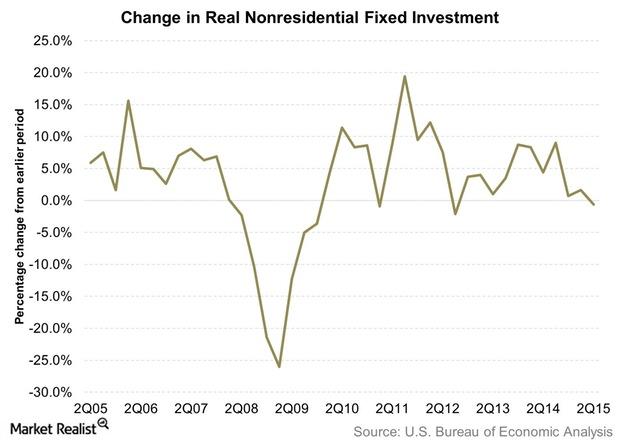

Why Is US Business Fixed Investment Subdued?

Business fixed investment represents business spending on plants, equipment, and machines. It forms an important component in the calculation of economic output.Consumer BP lost 55% shareholder value after the Deepwater Horizon incident

Deepwater Horizon was a deepwater, offshore oil drilling rig owned by Transocean (RIG) and operated by BP Plc. (BP). On April 20, 2010, while drilling at the Macondo Prospect, there was an explosion on the rig caused by a blowout that killed 11 crew members.