PBF Energy Inc

Latest PBF Energy Inc News and Updates

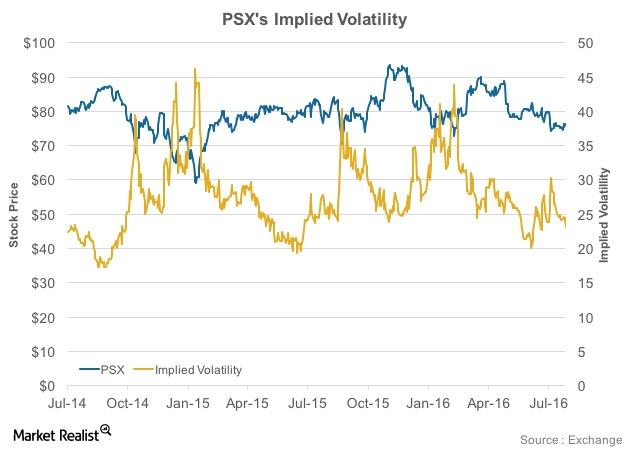

How PSX’s Implied Volatility Trended Post-Earnings

Phillips 66 (PSX) posted its earnings on July 29, 2016. On the day, PSX’s implied volatility fell by 5% to 23.2 compared to the previous day.

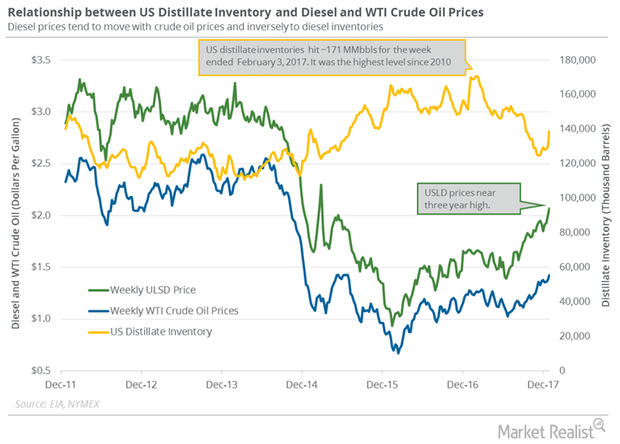

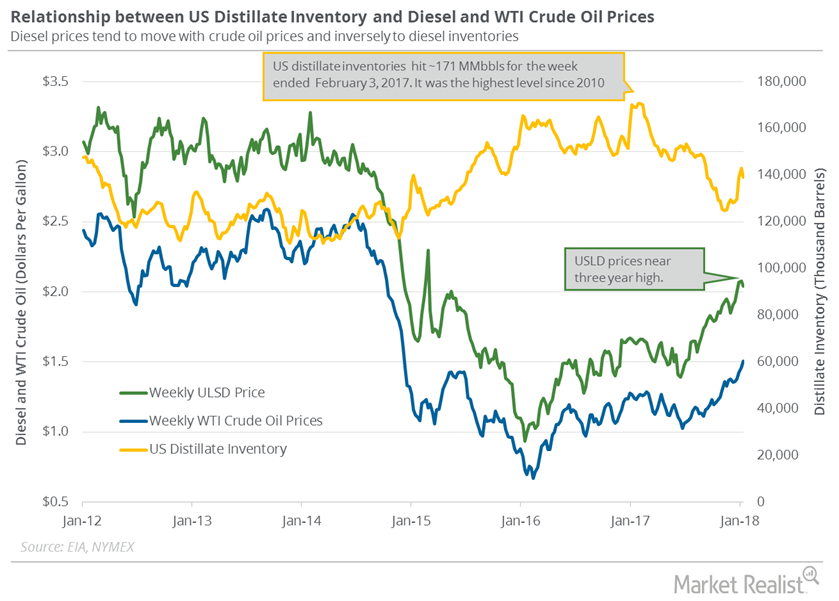

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

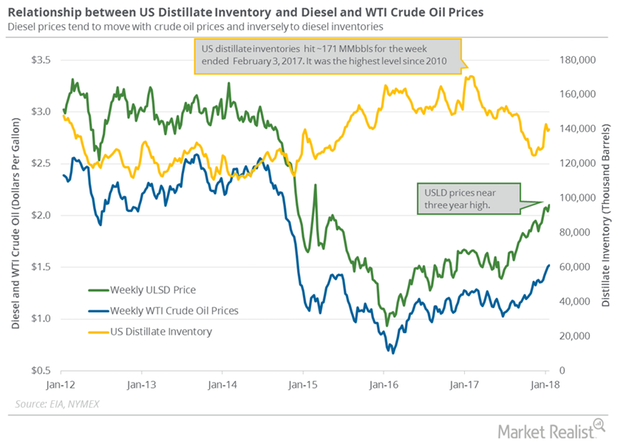

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

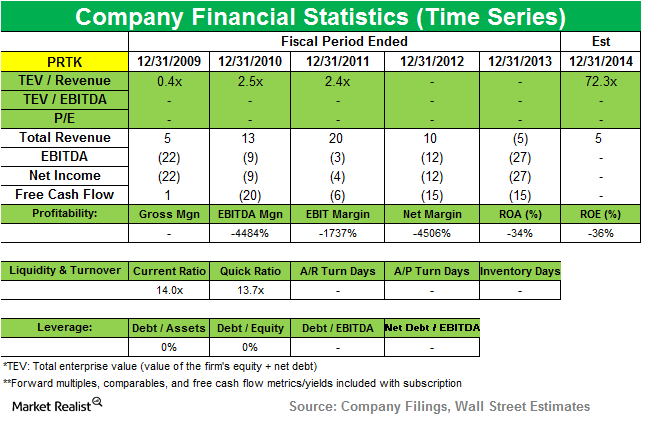

Baupost discloses stake in Paratek Pharmaceuticals

Seth Klarman’s The Baupost Group added a 12.04% stake in Paratek Pharmaceuticals, Inc. (PRTK), according to a 13G filing in December.

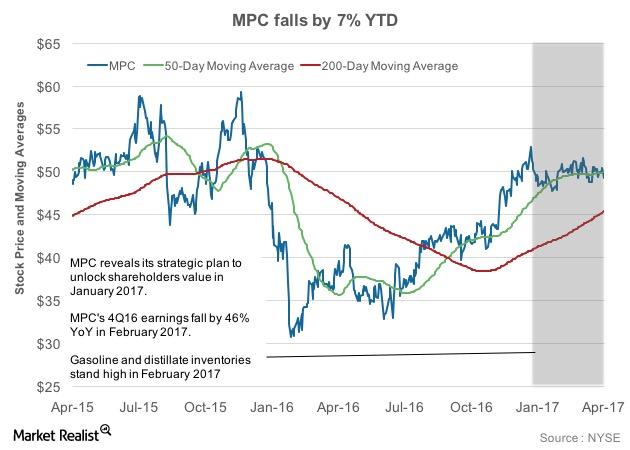

Marathon Petroleum Stock: Performance ahead of the 1Q17 Earnings

Marathon Petroleum stock has plunged 7% year-to-date. Due to its falling price in 1Q17, the stock has broken below its 50-day moving average.

How Will Marathon Petroleum’s Refining Earnings Fare in 3Q16?

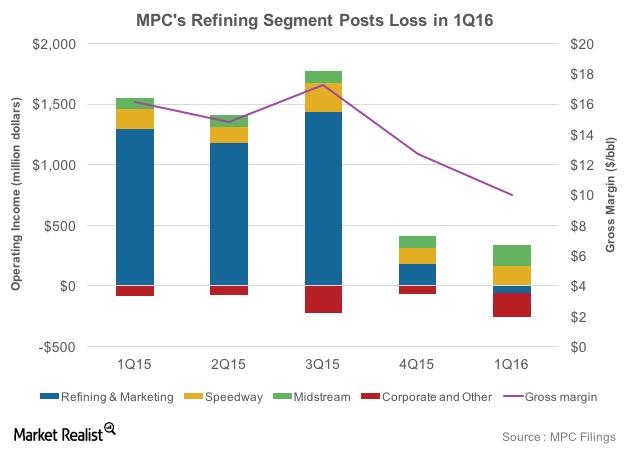

According to MPC, a dollar-per-barrel change in the blended LLS 6-3-2-1 crack spread affects its annual net income by $450 million.

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

Valero Stock Rises 12% before IMO 2020

Valero Energy (VLO) stock has risen 11.6% sequentially. The stock has risen due to stronger refining conditions in the current quarter.

Refining Crack Spread Overview: All You Ever Wanted to Know

The crack spread is a major component that drives refiners’ valuation. In this article, we’ll look at the metric’s different aspects.

Best Oil Refining Stocks: MPC, VLO, PSX, HFC, PBF, and DK

Oil refining and marketing stocks have been on investors’ radar. Valero Energy (VLO) and Phillips 66 (PSX) have risen 29.0% and 29.7%, respectively, YTD.

Why Is Delek Stock Falling?

Analysts expect Delek’s EPS to fall by 38% YoY and 45% quarter-over-quarter to $0.84 in the second quarter of 2019.

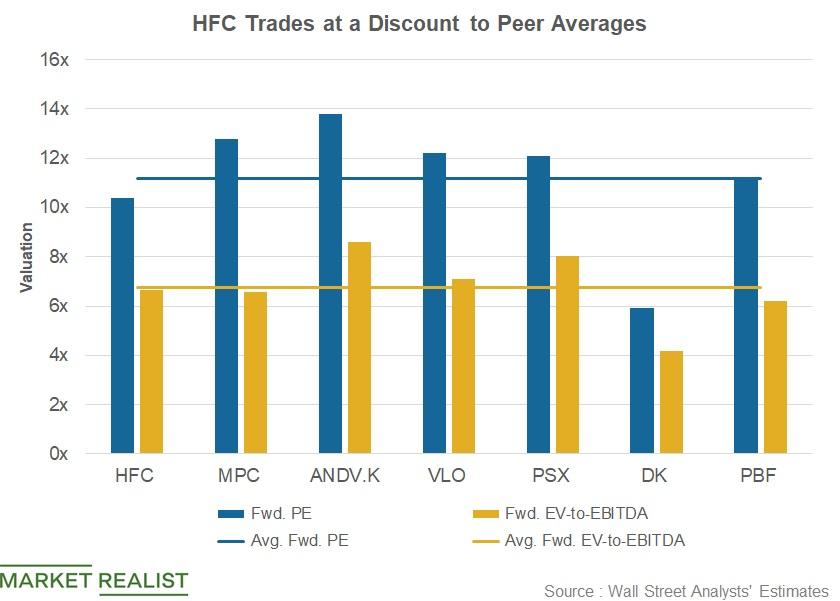

Comparing HollyFrontier’s Valuation with Peers’

HollyFrontier’s (HFC) forward PE ratio is 10.4x, below peers’ average of 11.2x. Marathon Petroleum’s (MPC), Andeavor’s (ANDV), and Phillips 66’s (PSX) forward PE ratios are higher than the average, at 12.8x, 13.8x, and 12.1x, respectively.

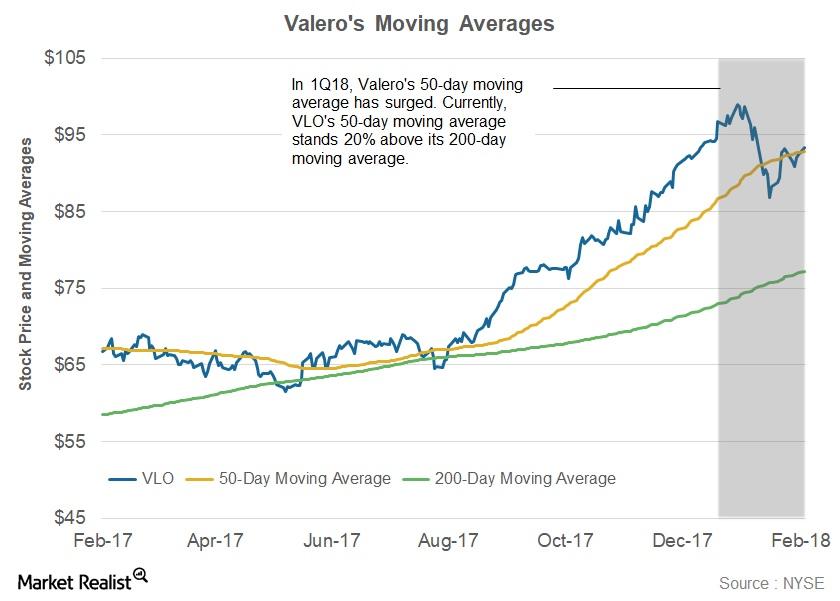

What Does Valero’s Moving Average Suggest?

In 1Q18, VLO’s 50-day moving average remained above its 200-day moving average.

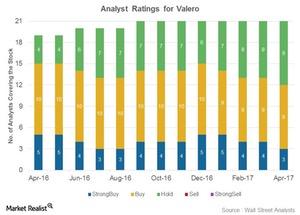

Analysts’ Views on Valero

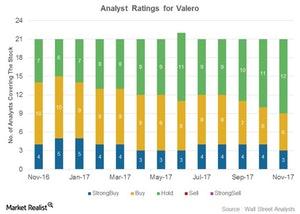

Analysts’ ratings for Valero Previously, we looked at analysts’ expectations for Valero Energy’s (VLO) dividend payment next quarter. In this part, we’ll look at analysts’ ratings for Valero. As shown in the chart above, nine (or 43%) of the 21 analysts covering VLO have rated it a “buy.” The remaining 12 analysts have rated Valero a “hold,” and […]

These Energy Stocks Rose the Most Last Week

Oil field services stock CARBO Ceramics (CRR) was the biggest gainer among the energy sector stocks last week.

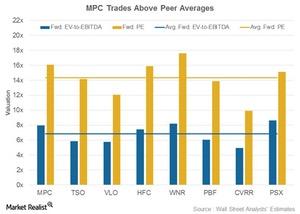

Why MPC’s Valuation Commands a Premium over the Peer Average

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value.

Where Do Analysts Ratings for Tesoro Stand Pre-Earnings?

In this series, we’ve examined Tesoro’s (TSO) 1Q17 estimates, refining margin outlook, and stock performance ahead of its earnings release expected on May 8, 2017.

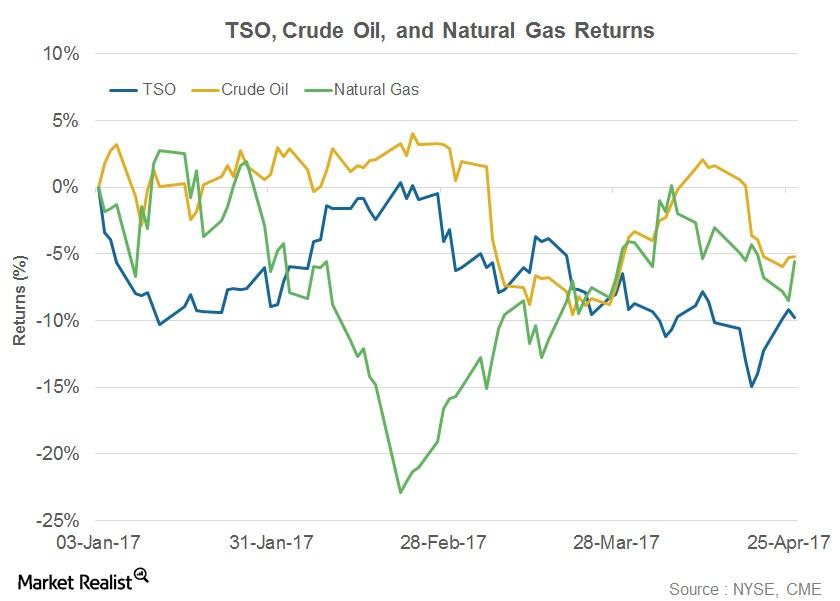

How Did Tesoro’s Stock Perform Pre-1Q17 Earnings?

Since January 3, 2017, TSO stock has fallen 9.8%. Comparatively, crude oil prices have fallen 5.2%, and natural gas prices have fallen 5.6% year-to-date.

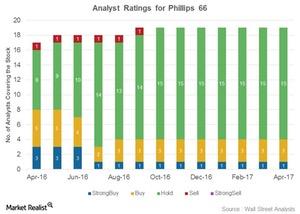

How Are Analysts Rating Phillips 66 before Its 1Q17 Earnings?

Phillips 66 has been rated by 19 analysts. Of those, four (or 21.0%) have given it a “buy” or “strong buy” rating.

Are Valero’s Analyst Ratings Weaker or Stronger before the 1Q Results?

Of the 21 analysts covering Valero Energy (VLO), 12 (57%) analysts have assigned “buy” or “strong buy” ratings, while nine (43%) have assigned “hold” ratings.

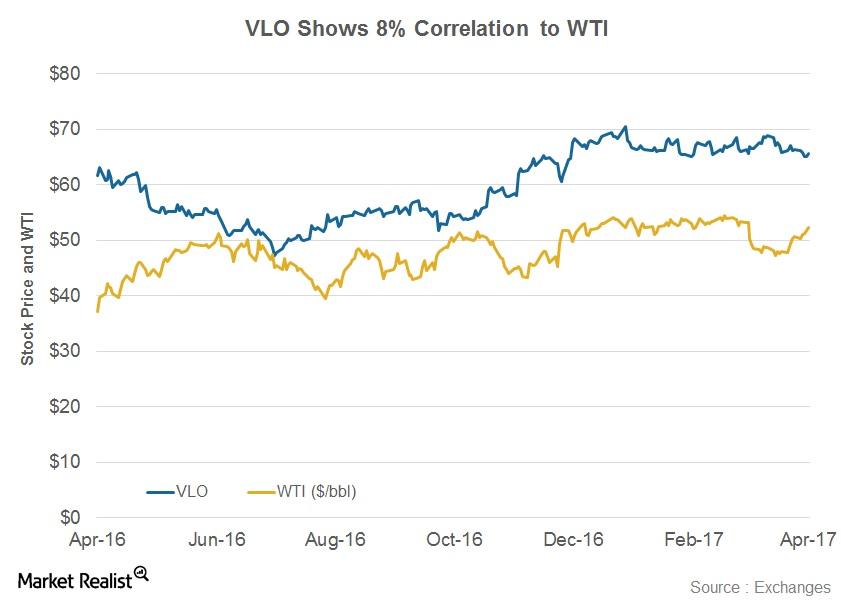

What Is the Relationship between VLO and WTI?

The correlation coefficient between VLO and WTI stands at 0.08.

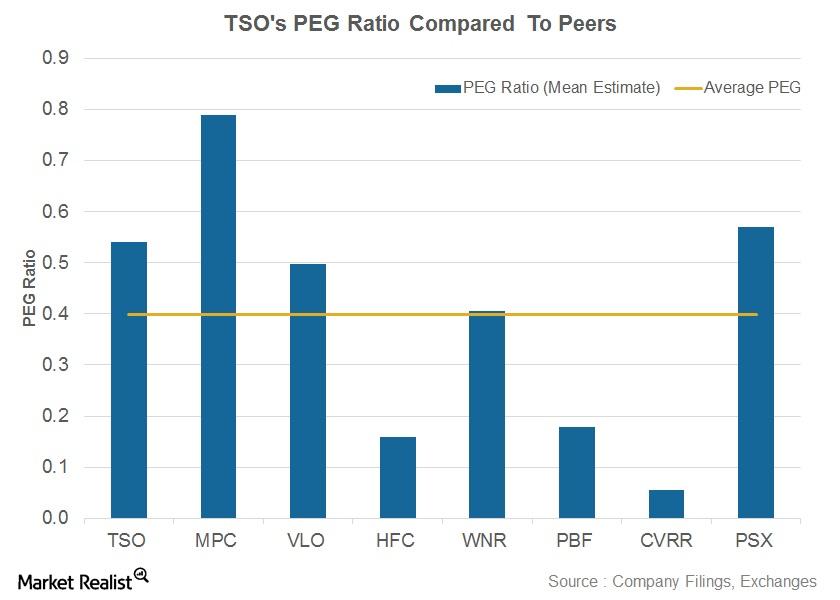

How Does Tesoro’s PEG Compare to Its Peers’?

In this article, we’ll compare Tesoro’s (TSO) PEG ratio (price-to-earnings to blended growth rate) to those of its peers. We’ve considered the mean estimate of PEG.

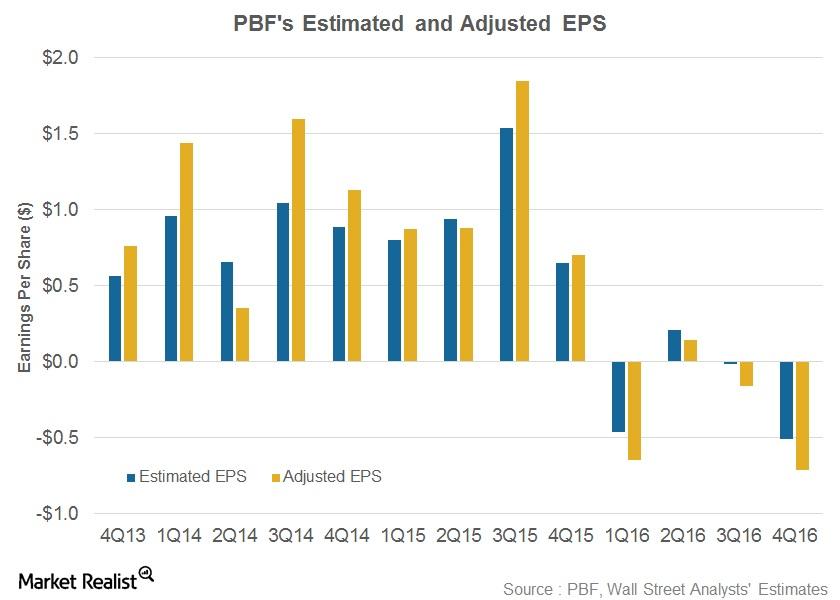

PBF Energy’s 4Q16 Results: Earnings Take a Nosedive

PBF Energy (PBF) released its 4Q16 results on February 16, 2017. The earnings results weren’t very encouraging for this petroleum refiner.

What’s the Correlation between Valero Stock and WTI?

The correlation coefficient of Valero (VLO) and WTI stands at 0.15. The correlation value for Valero’s stock and oil price show that they have a positive but feeble correlation.

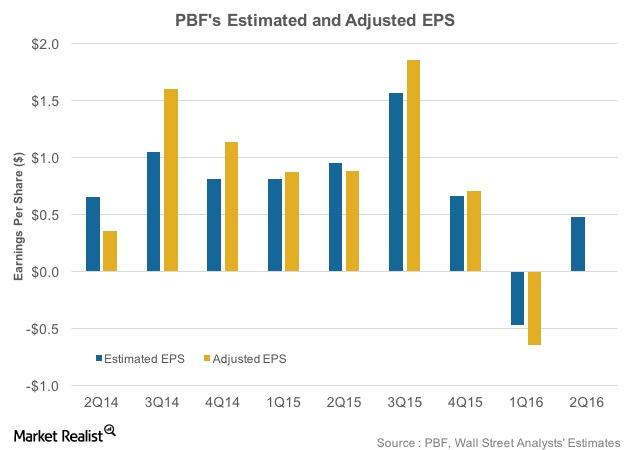

What Do Analysts Expect from PBF Energy’s 2Q16 Earnings?

In 1Q16, PBF Energy’s revenues surpassed Wall Street analyst estimates by 12%. PBF’s 1Q16 adjusted EPS was -$0.65, as compared to the estimated -$0.47.

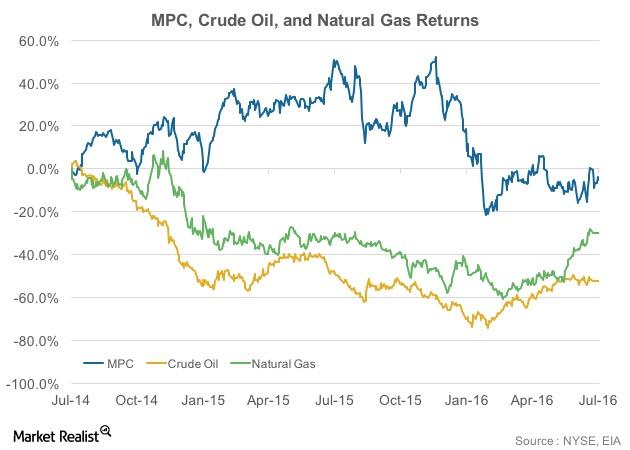

How Has Marathon Petroleum Stock Performed Pre-Earnings?

Between July 2014 and November 2015, Marathon Petroleum (MPC) stock rose 51%. But after that, the stock fell until early 2016.

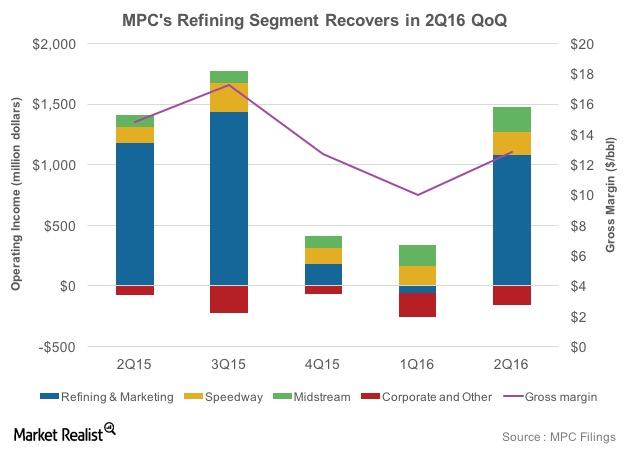

How Will Marathon Petroleum’s Refining Earnings Shape Up in 2Q16?

Marathon Petroleum’s (MPC) refining segment’s operating income plunged to -$62 million in 1Q16 due to a fall in its gross refining and marketing margin.

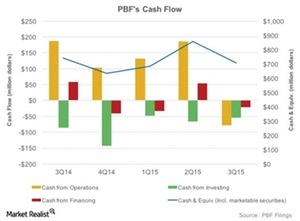

PBF’s Cash Flow Is Volatile amid Changes in Working Capital

PBF Energy has seen a fall in cash balances from 3Q14 to 3Q15. PBF’s cash balance in 3Q15 stood at $707 million, showing a 5% fall over 3Q14.