Market Vectors® Mstar Wide Moat ETF

Latest Market Vectors® Mstar Wide Moat ETF News and Updates

Inside Norfolk Southern’s Freight in Week 28

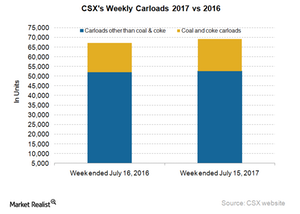

CSX’s (CSX) overall railcar traffic rose 3.1% in the 28th week of 2017 (ended July 15).

Why LSE Stock Has Outperformed over the Years

The London Stock Exchange’s high market share in growth areas such as client clearing, along with its good asset quality, suggest that the stock exchange is on solid ground.

The Ins and Outs of Moat Investing

Stock selection, a cornerstone of the moat investment philosophy, has driven much of the recent success of the Morningstar® Wide Moat Focus Index.

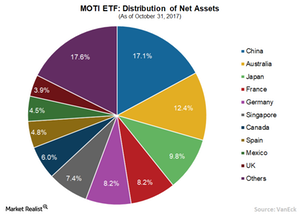

Expanding Investors’ Reach to Global Markets

Building on the success and popularity of VanEck Vectors® Morningstar Wide Moat ETF (MOAT®) and its underlying index’s approach to investing in the U.S., VanEck launched MOTI in 2015 to expand investor access to Morningstar’s core equity research in the international arena.

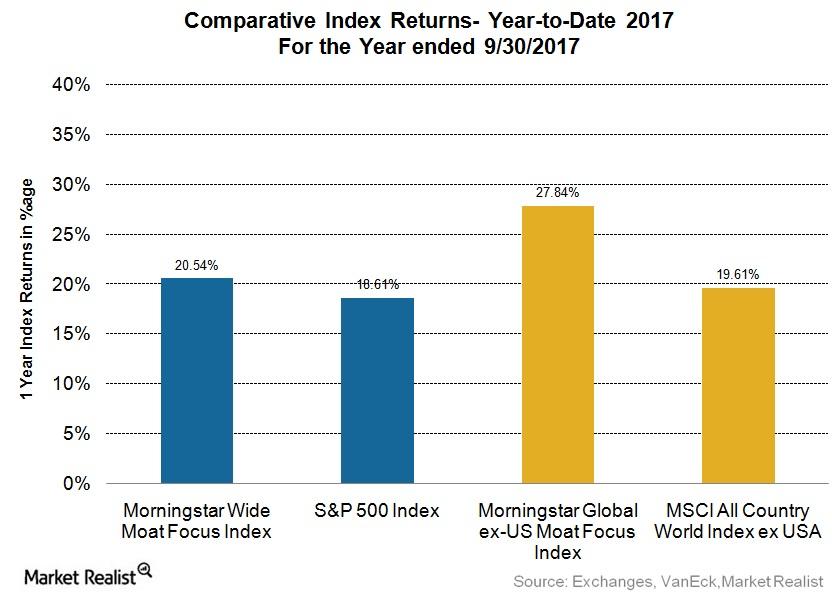

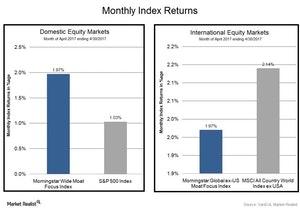

How Moat Indexes Performed in September

The US Moat Index has been performing fairly well this year. As of September 30, 2017, it has outperformed, rising 20.5% over the S&P 500 Index’s (SPY) (SPX-INDEX) rise of 18.6% YTD.

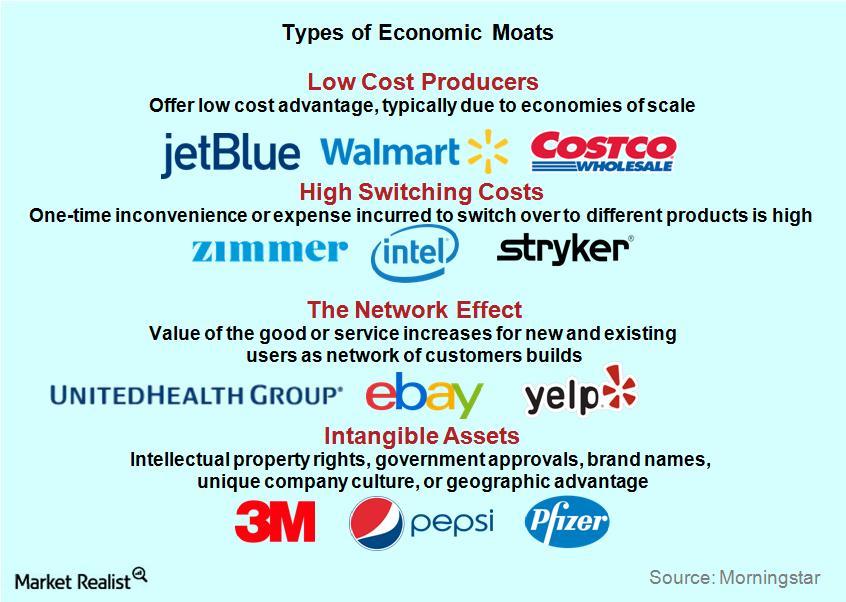

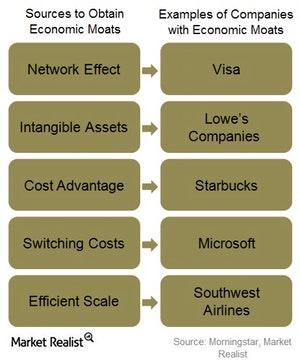

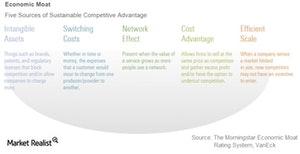

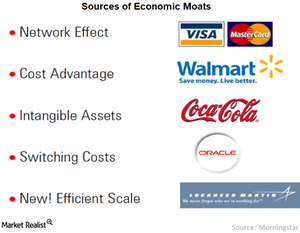

The Idea behind Economic Moats

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. she

Why the US Moat Index Beat the S&P 500 Index in July

Domestic moat companies, as represented by the Morningstar® Wide Moat Focus IndexSM (MWMFTR, or “U.S. Moat Index”), once again posted strong results in July.

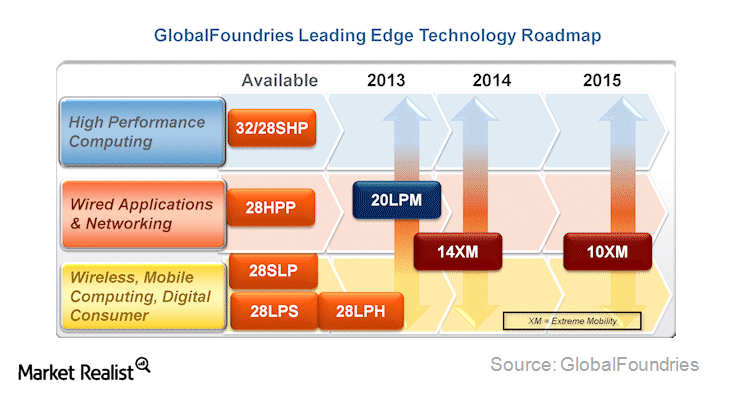

Why IBM sold its semiconductor division to Globalfoundries

In its 3Q14 results, IBM (IBM) announced the sale of its semiconductor operations to Globalfoundries. IBM will pay Globalfoundries $1.5 billion over next three years.

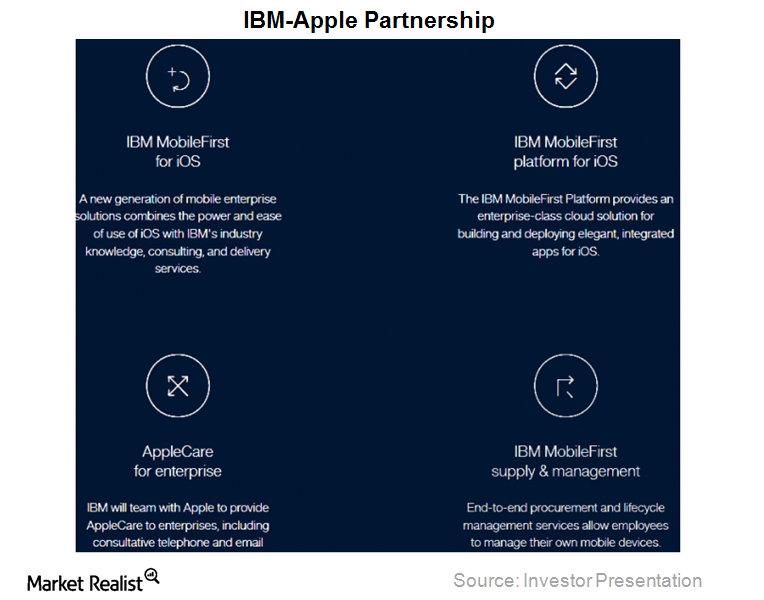

Why IBM announced a partnership with Apple

In July 2014, IBM Corp. (IBM) announced its partnership with Apple Inc. (AAPL). IBM wants to make a space for itself in the enterprise mobility space.

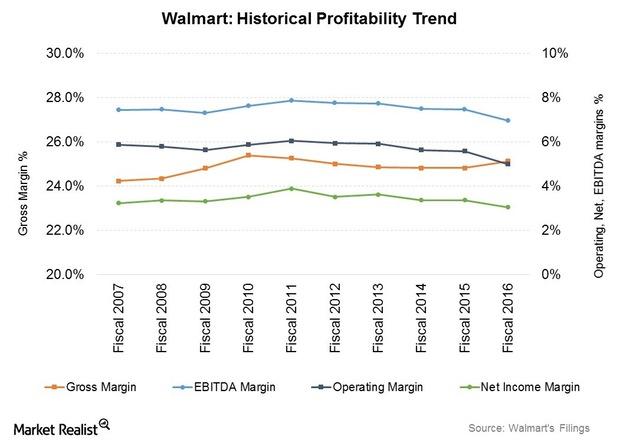

How Walmart Is Looking to Offset Future Operating Cost Headwinds

Wage costs are expected to be a headwind for Walmart. On February 20, Walmart made the second round of wage increases for over 1.2 million staff.

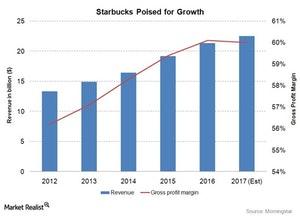

How Starbucks Obtained a Wide Economic Moat Rating

Cost Advantage in Action: Four Case Studies of Moat Companies To demonstrate the power of cost advantages in creating economic moats, we highlight four moat companies: U.S. based Starbucks and Compass Mineral, and international moat companies: Kao (Japan) and Ramsay Health Care (Australia). Starbucks Corp (SBUX US) boasts a “wide economic moat” rating from Morningstar from […]

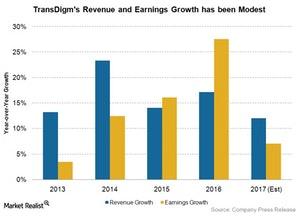

How TransDigm Group Reinforces Switching Costs

TransDigm Group Inc. (TDG US) is a leading designer and manufacturer of engineered aircraft components for commercial and military aircraft.

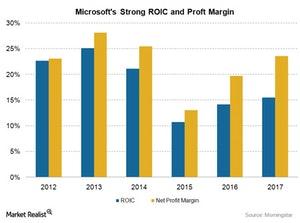

How Microsoft Earned a Wide Economic Moat Rating

The technology industry is the most competitive industry, making it crucial for companies in this industry to have a competitive edge for survival.

Why Switching Costs Help Build Powerful Moats

Many successful companies build customer loyalty by offering high-quality products and/or services. Some also have the unique advantage of integrating their products….

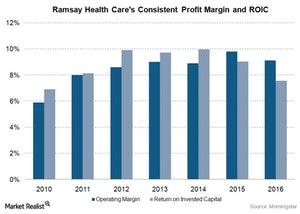

How Ramsay Health Care Became a Cost Leader

Ramsay Health Care is a market leader in private healthcare in Australia, treating almost 3 million patients each year.

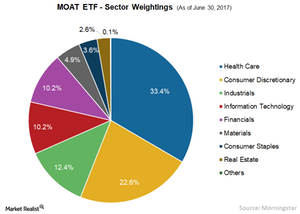

How to Take Exposure to Moat Stocks

The VanEck Vectors Morningstar Wide Moat ETF (MOAT) tracks the price and yield performance of the Morningstar Wide Moat Focus Index.

How to Identify Economic Moats

In this series, we’ll discuss how intangible assets can create long-term competitive advantages for companies.

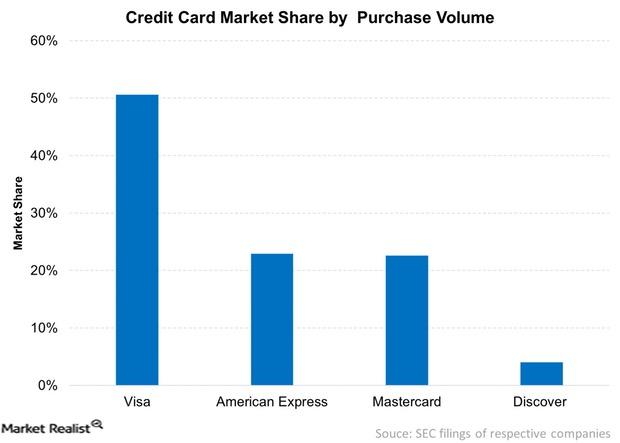

How Visa Created a Network Effect

Visa (V) boasts a significant advantage in terms of its worldwide acceptance. This availability lent to the network effect’s being the source of the company’s moat.

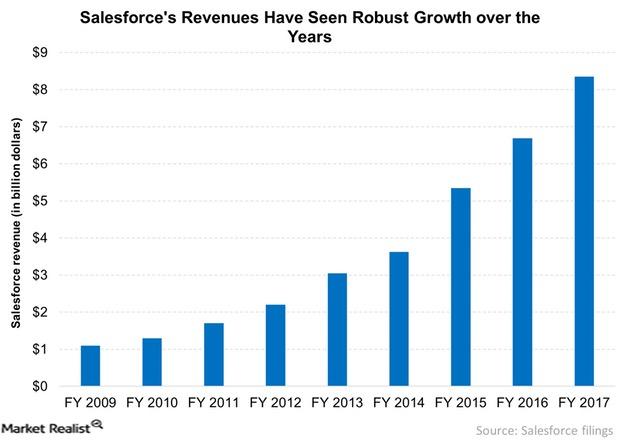

How Salesforce Gained Its Moat

Salesforce.com is a leader in the customer relationship management industry. The company has built its moat on the back of its network effect and strong brand.

How Does Moat Investing Provide a Competitive Advantage?

Morningstar helps investors choose companies with economic moats. “Economic moats” refers to companies’ ability to obtain an advantage over competitors.

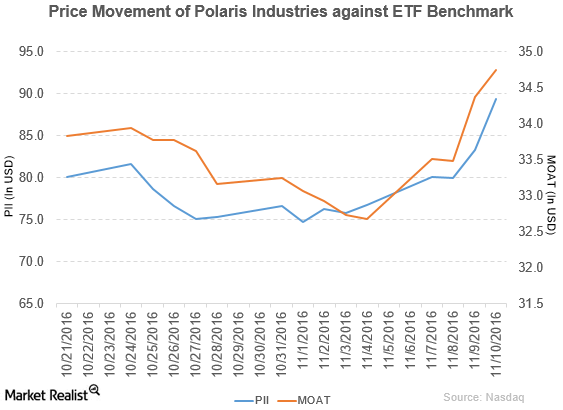

Polaris Industries Acquired Transamerican Auto Parts for $665 Million

Polaris Industries (PII) reported 3Q16 sales of ~$1.2 billion, which represents a fall of 18.5% from its ~$1.5 billion in sales in 3Q15.

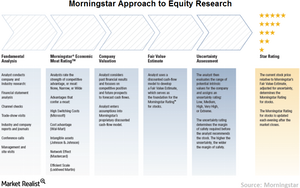

Morningstar: Using Economic Moat to Assess Stocks

The concept of economic moat is the basis of Morningstar’s assessment of a company’s (KO)(ORCL) long-term investment potential.

Analyzing Morningstar’s Economic Moat Rating

Morningstar first began rating companies in 2002 according to the strength and longevity of their competitive advantages.