How TransDigm Group Reinforces Switching Costs

TransDigm Group Inc. (TDG US) is a leading designer and manufacturer of engineered aircraft components for commercial and military aircraft.

Sept. 25 2017, Updated 2:06 p.m. ET

VanEck

TransDigm Group Inc. (TDG US) is a leading designer and manufacturer of engineered aircraft components for commercial and military aircraft. TransDigm’s “wide economic moat” rating is based on both switching costs and intangible assets. The company’s intangible assets are derived from the intellectual property underlying its products, and switching costs are associated with TransDigm parts, their inclusion in plane design, and the need for FAA certification of these parts. Morningstar writes, “…the low overall dollar value of the company’s parts, versus the high cost of failure for aircraft, reinforces these switching costs.”

Market Realist

How TransDigm obtained its moat

The Ohio-based TransDigm Group (TDG) is in the business of designing, producing, and supplying aircraft components in the United States. The company’s wide economic moat rating is because of its intellectual property rights to its products, which are produced according to strict Federal Aviation Administration (or FAA) certifications. Switching costs play a significant role for TransDigm’s moat. Due to the FAA certification on the company’s designs and parts, switching costs are very high for other aerospace manufacturers.

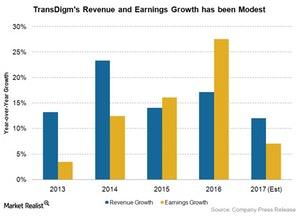

TransDigm has consistently maintained its revenue and earnings growth over the past five years, as you can see from the chart above. Revenue has grown at a compound annual growth rate (or CAGR) of 13.2% over the last five years. Meanwhile, earnings per share (or EPS) have grown at a CAGR of 11.3%. On a year-over-year basis, Wall Street expects TransDigm’s revenue to rise 12.05% and EPS to rise 7.05% for fiscal 2017. The factors responsible for TransDigm’s modest growth are its acquisition strategy, cost control implementation, productivity improvements, leveraged balance sheet, and competitive advantage.

TransDigm’s moat includes its pricing power for its highly specialized and designed products, which can’t be replaced easily. Intangible assets like intellectual property rights, patents, and FAA certification for most of its designs make it difficult to create alternate parts. This difficulty creates higher switching costs and high barriers to entry, in turn creating a competitive advantage for the company. It’s evident from the chart below that the company’s return on invested capital (or ROIC) and net profit margin have been consistent over the last five years. For the third quarter, which ended in June 2017, the company’s ROIC was 13.6% and its net margin was 18.6%.

To further enhance its competitive edge, TransDigm acquired a manufacturer of highly engineered aircraft components, Breeze-Eastern, last year. Breeze-Eastern holds a significant amount of proprietary products in its portfolio, which range from helicopter rescue hoists and cargo winches to military weapons-handling systems. This portfolio creates a competitive advantage for TransDigm.

TransDigm has always maintained a record of outpacing competitors. Nevertheless, if economic conditions start to take a toll on the aerospace industry, the company should be careful about sustaining its competitive advantage or economic moat (MOAT). TransDigm’s competitors in the industry include the Boeing Company (BA), United Technologies Corporation (UTX), and Lockheed Martin Corporation (LMT).