TransDigm Group Inc

Latest TransDigm Group Inc News and Updates

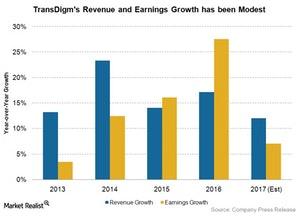

Consumer Chilton Investment Company buys stake in TransDigm in 4Q13

Chilton started a new position in aerospace engineering company TransDigm Group Inc. (TDG) that accounts for 0.76% of the fund’s fourth quarter portfolio.

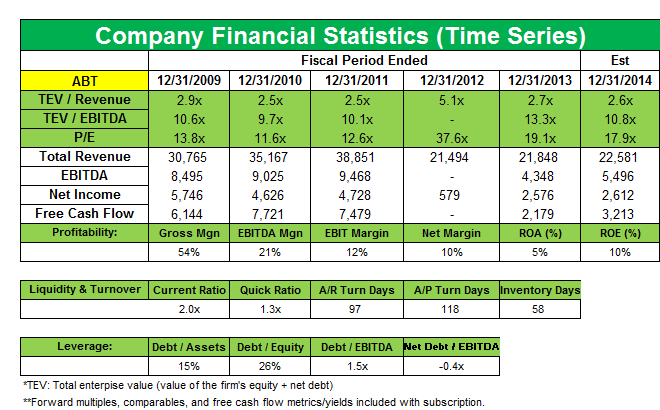

Chilton opens a new position in Abbott Laboratories in 4Q13

Abbott Laboratories (ABT) is a brand new position that accounts for 1.19% of Chilton’s fourth quarter 2013 portfolio.

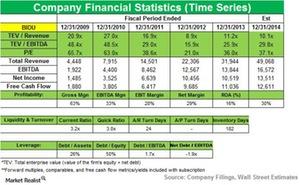

Maverick Capital lowers position in Baidu, Inc.

Maverick Capital lowered its position in Baidu, Inc. in 3Q14. The position accounts for 0.36% of the fund’s total portfolio in the third quarter.

How TransDigm Group Reinforces Switching Costs

TransDigm Group Inc. (TDG US) is a leading designer and manufacturer of engineered aircraft components for commercial and military aircraft.

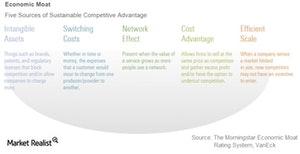

Why Switching Costs Help Build Powerful Moats

Many successful companies build customer loyalty by offering high-quality products and/or services. Some also have the unique advantage of integrating their products….

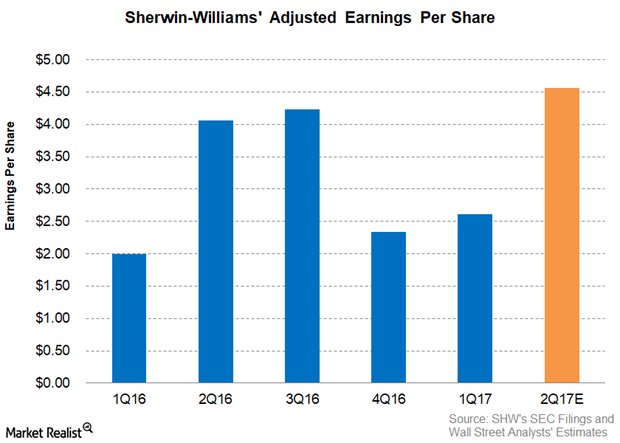

Analysts Expect Sherwin-Williams’ 2Q17 Adjusted EPS to Rise

Analysts expect Sherwin-Williams (SHW) to post adjusted EPS (earnings per share) of $4.56 in 2Q17—an increase of 12.2% on a year-over-year basis.