McCormick & Company Inc

Latest McCormick & Company Inc News and Updates

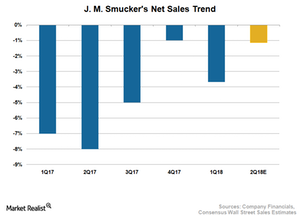

Behind J.M. Smucker’s Waning Sales

J.M. Smucker (SJM) has continued to disappoint on the sales front this year, having posted declines in sales for the past several quarters.

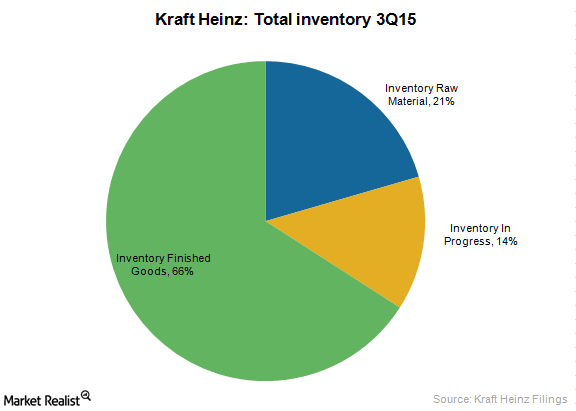

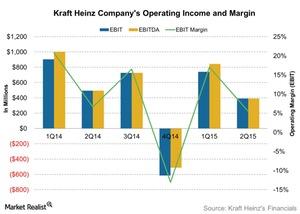

Sizing up Kraft Heinz’s SKU Rationalization Technique to Manage Inventory

Heinz has been using an inventory management technique, SKU rationalization to focus on profitable growth, which helps improve sales and profitability.

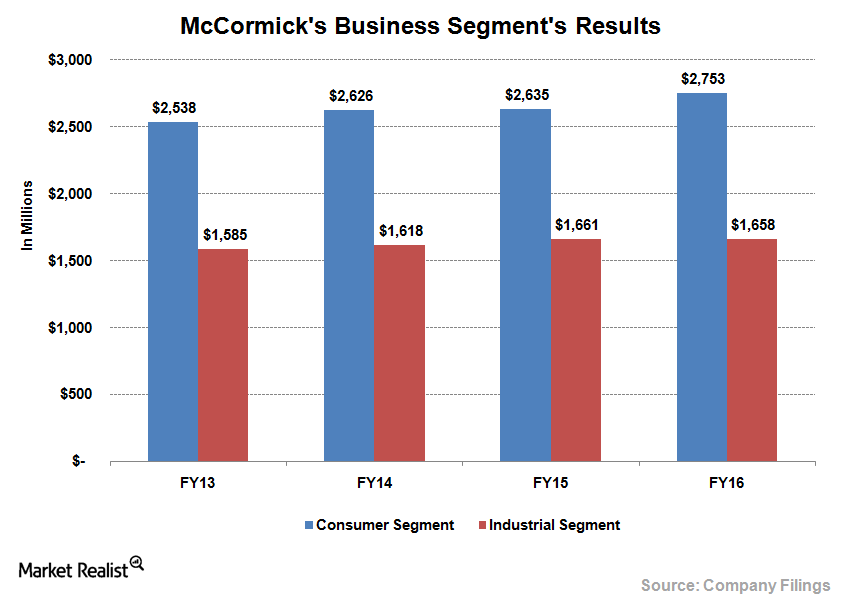

What Drove McCormick’s Flavor Solutions Segment?

McCormick’s (MKC) flavor solutions segment’s sales increased 1.0% on a year-over-year basis to $0.54 billion.

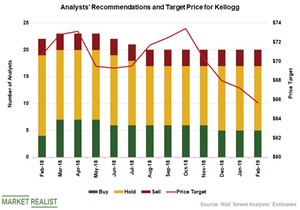

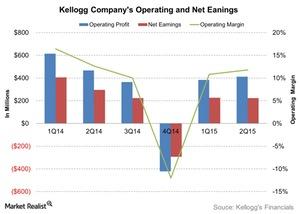

Kellogg Stock: Analysts’ Recommendations

Analysts continue to suggest a “hold” rating on Kellogg (K) stock. Analysts’ target price shows a downward trend.

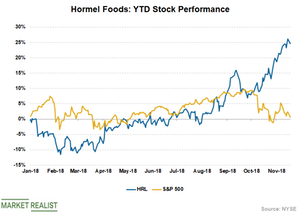

What’s Backing the Uptrend in Hormel Foods Stock?

Hormel Foods (HRL) is another company in the consumer staples industry that has outperformed the broader markets so far this year.

Could McCormick’s Improving Fundamentals Boost Its Stock?

McCormick (MKC) has seen double-digit sales and earnings growth over the past couple of quarters.

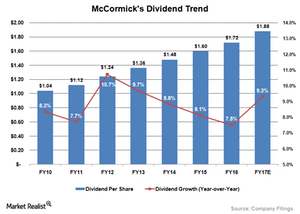

A Look at McCormick’s Strong Dividend History

In the past three fiscal years, McCormick has returned more than $1.0 billion to its shareholders in the form of dividends and share buybacks.

A Look at McCormick’s Strategic Initiatives

McCormick’s (MKC) strategic acquisitions have been one of the key components of the company’s sales and margin growth.

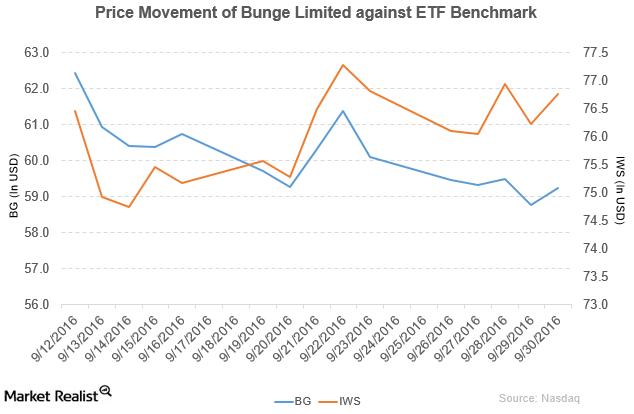

Bunge to Partner with Oleo-Fats

Bunge (BG) has a market cap of $8.3 billion. It rose 0.80% to close at $59.23 per share on September 30, 2016.

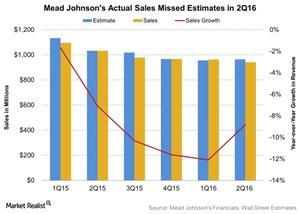

What Hurt Mead Johnson Nutrition’s Revenue in 2Q16?

In 2Q16, Mead Johnson (MJN) reported a drop in revenue of ~9% to $942 million, compared to revenue of ~$1.0 billion in 2Q15.

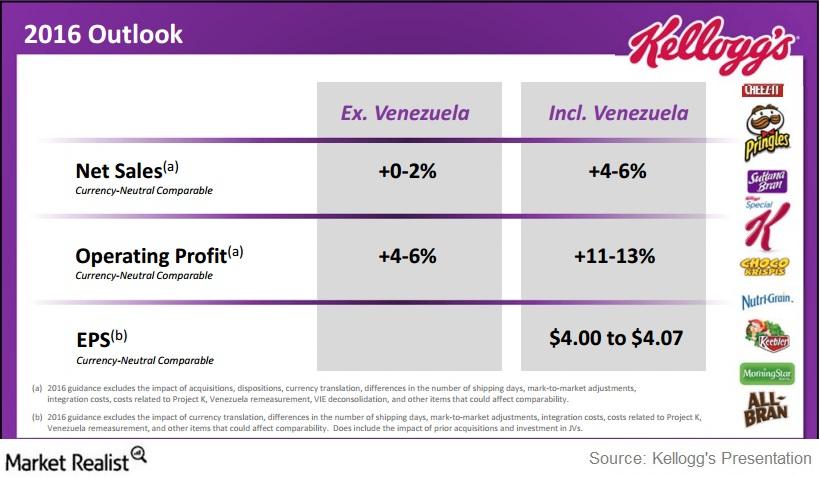

What’s Kellogg’s Updated Guidance for Fiscal 2016?

Kellogg (K) updated its fiscal 2016 guidance for currency-neutral comparable net sales, operating profit, and earnings per share.

How Much Did Kellogg Return to Shareholders?

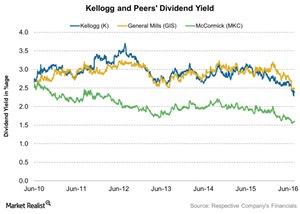

Kellogg announced a quarterly dividend of $0.50 per share on its common stock—paid on June 15 to shareowners of record at the close of business on June 1.

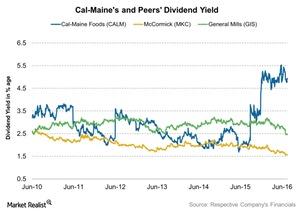

How Much Did Cal-Maine Return to Shareholders in Fiscal 2016?

Cal-Maine Foods has a dividend yield of 4.0% as of July 18, 2016. Management raised the dividend at a CAGR (compound annual growth rate) of 15.3% over five years.

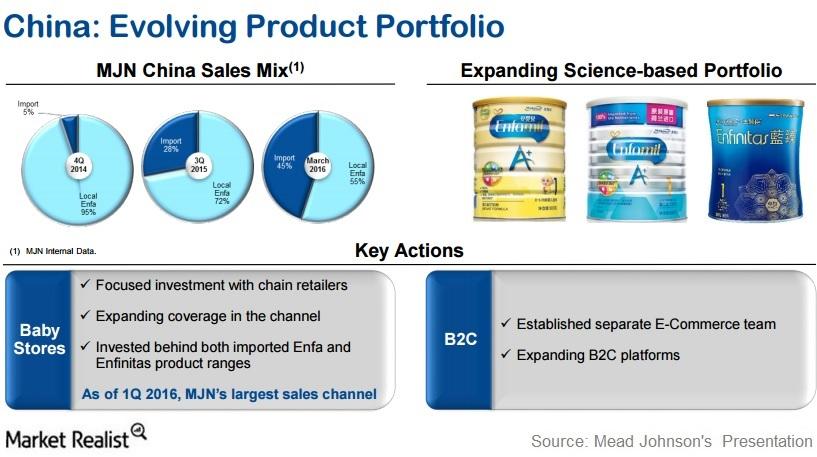

How Is Mead Johnson Improving Its Product Portfolio in China?

China accounts for around one-third of Mead Johnson’s global business.

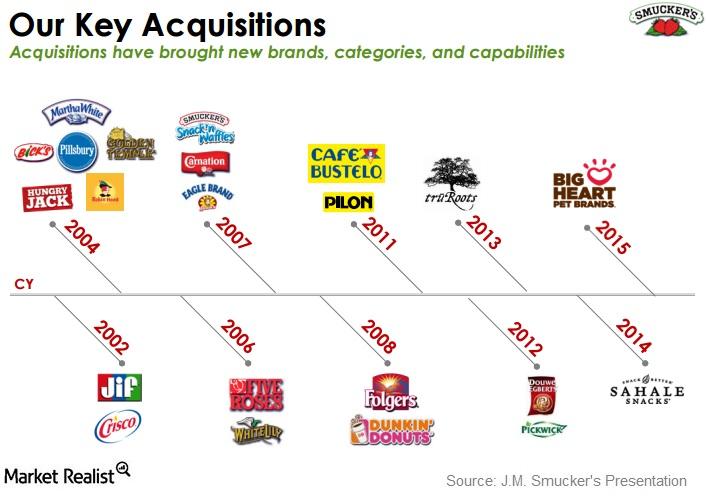

How Did Acquisitions and Innovations Lead J.M. Smucker’s Revenue?

The J.M. Smucker Company has made some key acquisitions since 2002. These acquisitions have brought in new brands, categories, and capabilities.

What Are Wall Street Analysts’ Recommendations for ConAgra?

The average broker target price for ConAgra has risen slightly to $50.60 from $50.27. This 5% higher than ConAgra’s closing price of $47.91 on June 23.

What’s Kellogg’s 2020 Vision Strategy?

Kellogg plans to return its “Kashi” brand to growth in 2016. It aims to lead in plant-based nutrition and win with “food forward” consumers.

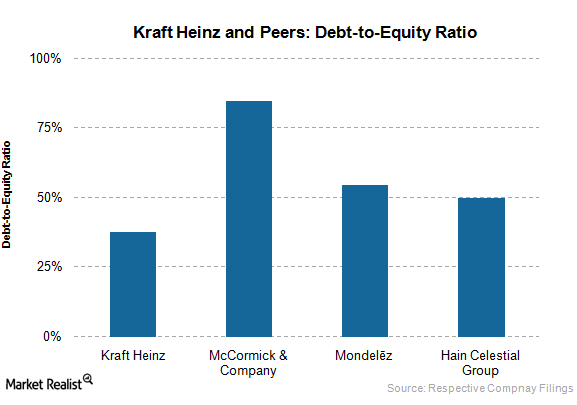

Evaluating Kraft Heinz’s Financials against Its Biggest Competitors

Kraft Heinz had a coverage ratio of 0.87x at the end of 3Q15, whereas McCormick & Company and Mondelēz had coverage ratios of 10.2x and 56.1x, respectively.

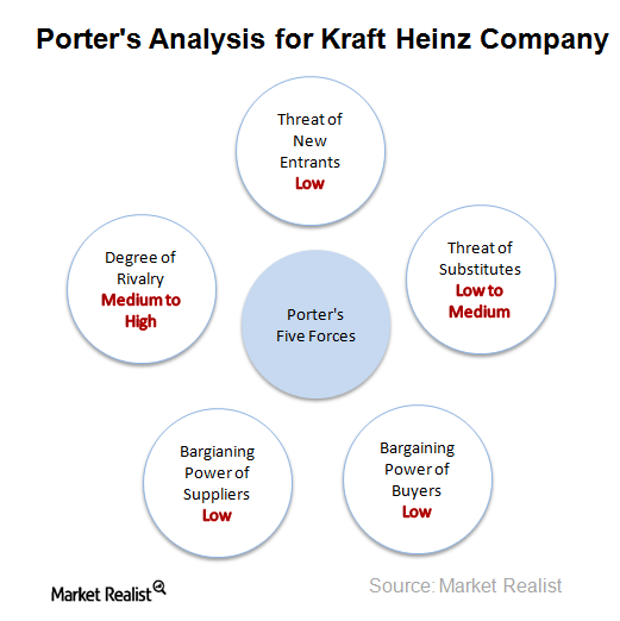

A Porter’s Five Forces Analysis of Kraft Heinz Company

Kraft Heinz faces competition from a huge number of players in the food market, but product differentiation is low between its competitors.

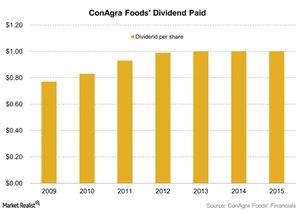

ConAgra Foods’ Dividend, Outlook, and Expectations

ConAgra Foods (CAG) has a dividend yield of 2.45% as of December 17, 2015. The company’s management raised the dividend at an average annual rate of 4.6%.

The Kraft Heinz Merger and Its Benefits

Pittsburgh-based H.J. Heinz Holding Corporation acquired Kraft Foods in October. After the merger, the company changed its name to Kraft Heinz.

Kellogg’s Acquisitions and Their Benefits

The price of Kellogg’s acquisition of Diamond Foods is expected to reach over $1.5 billion, and Kellogg could offer the company between $35 and $40 per share.

Kraft Heinz: What Happened after the Merger?

The Pittsburgh-based, privately owned ketchup maker H.J. Heinz Holding Corporation acquired Kraft Foods last month.

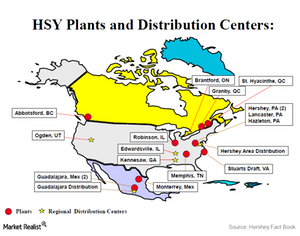

How Hershey Gained from Improving Its Supply Chain

In 2010, Hershey announced Project Next Century, which aims to streamline its global supply chain operations and create a more competitive cost structure.