MetLife Inc

Latest MetLife Inc News and Updates

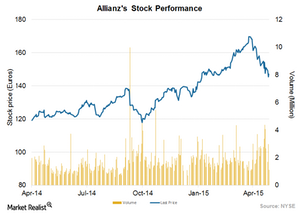

Allianz Reports 11% Revenue Growth Backed by Insurance Business

Allianz Group offer property casualty insurance, life and health insurance, and asset management products and services in over 70 countries. The company’s major operations are in Europe.

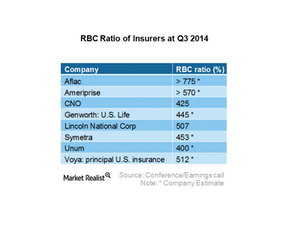

How insurers manage their capital requirements

A company managing higher risk products must maintain a higher level of minimum capital compared to a company with a relatively lower level of risk.

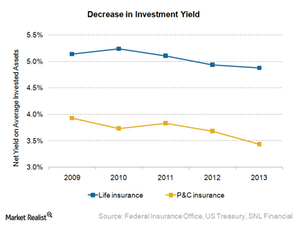

How investment income drives profit

The impact of interest rate movements is lower in the P&C segment, as their products can be repriced annually to keep in line with interest rate movements.

How key drivers impact insurance sales

For P&C insurers such as AIG and ACE, various mandatory requirements may drive sales of vehicle, workers’ compensation, and homeowners insurance.

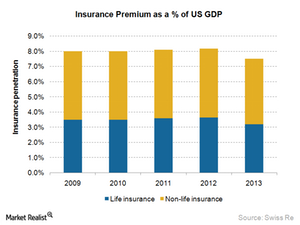

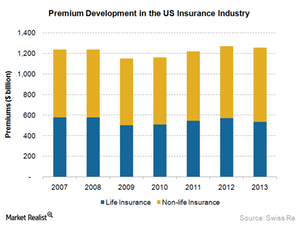

The US insurance industry: Largest in the world

Insurance premiums have grown at a modest pace after a dip in 2009 due to the financial crisis, which the industry was able to navigate.

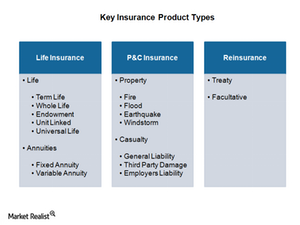

Life insurance, P&C insurance, and reinsurance

P&C products have commoditized characteristics, resulting in sharp competition in the market and business cycles. AIG and ACE are key players in this space.

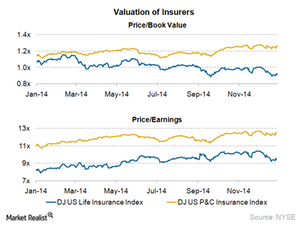

How valuation of insurance companies works

Financial market movements not only impact income from invested assets, but also the value of assets carried at fair value on an insurer’s balance sheet.

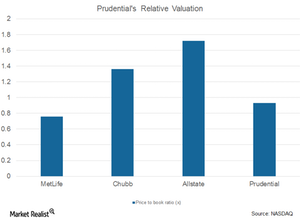

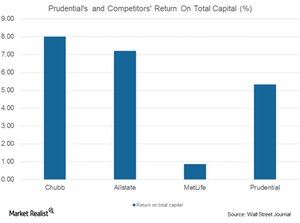

Prudential’s Discounted Valuations in 2Q17

Wall Street analysts recommended a one-year price target of $116.07 per share on Prudential Financial (PRU), reflecting an increase of ~14.1% from the current price.

Understanding Prudential’s Group Insurance and Individual Life Earnings

In 2Q17, on the basis of annualized new business premiums, sales in Prudential’s Individual Life business stood at $153 million, reflecting a marginal decline of ~3.8% year-over-year.

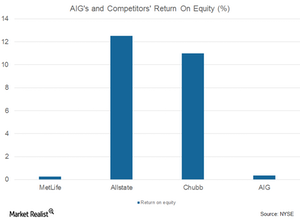

Analyzing AIG’s Life and Personal Insurance Business

AIG’s pretax operating income for personal insurance stood at $330 million in 2Q17. In 2Q16, it stood at $152 million.

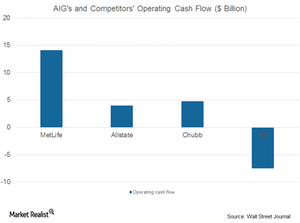

Why AIG’s Net Income Fell on a Year-over-Year Basis

AIG is expected to post earnings per share of $1.22 in 3Q17, an ~20.3% decline from its 2Q17 earnings. AIG is expected to report revenues of ~$11.8 billion in 3Q17.

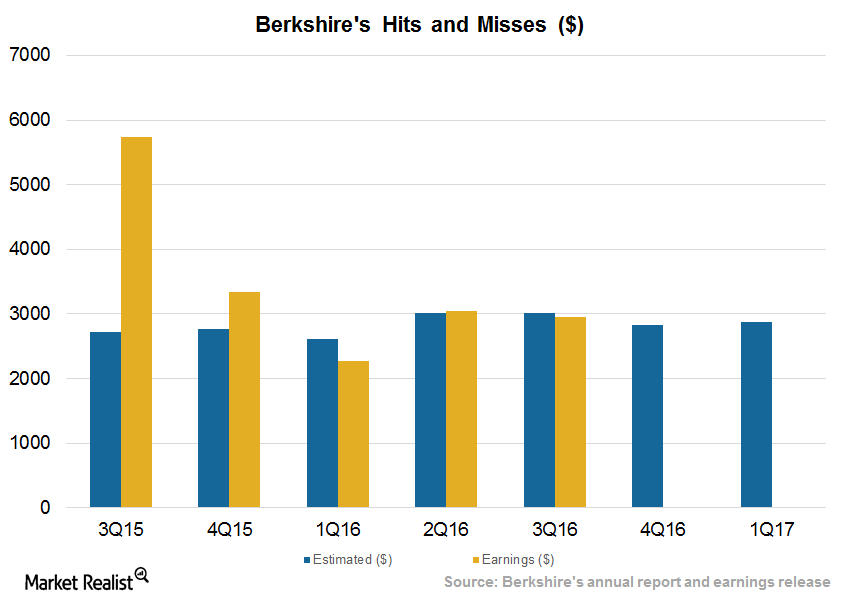

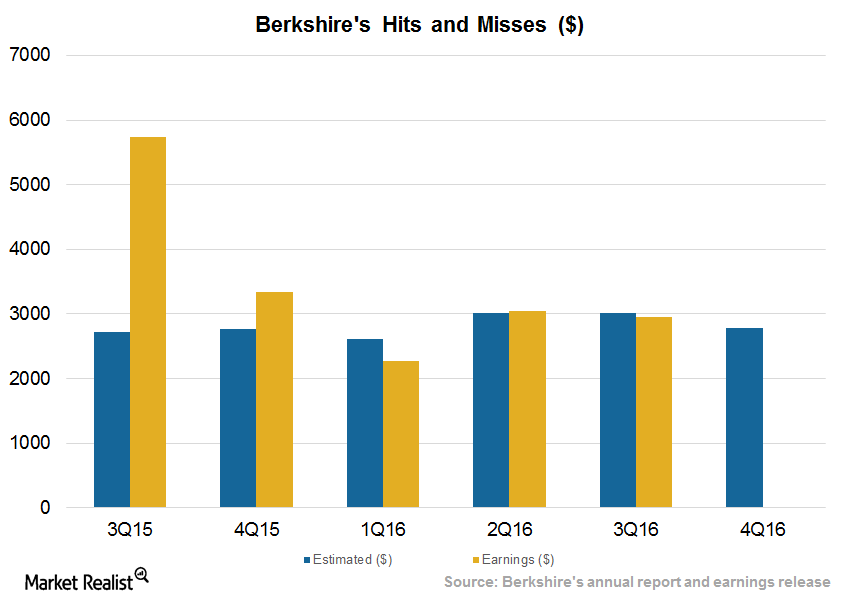

What to Expect from Berkshire Hathaway’s Earnings

Berkshire Hathaway (BRK-B) is expected to post EPS (earnings per share) of $2,829 per share in 4Q16 and $2,880 in 1Q17.

Buffett’s Berkshire Misses Estimates amid Volatile Environment

Berkshire Hathaway reported its third quarter earnings on November 5, 2016. The company missed analysts’ operating earnings per share estimates of $3,022 with reported EPS of $2,951.

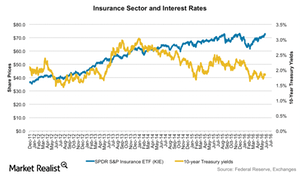

How Does a Rate Hike Impact Insurance Stocks?

Interest rates are a key performance driver for life insurance companies, affecting their margins, hedging costs, and product sales.

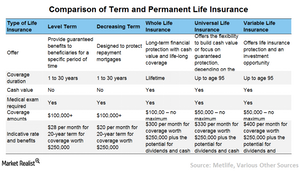

How to Pick a Life Insurance Policy

Term life insurance provides guaranteed benefits to beneficiaries for a specific period of time in case of the sudden death of the insured person.

What Are the Different Types of Life Insurance Policies?

Life insurance (PRU) (MET) policies come in various forms that cater to people in different age groups and with different financial goals.

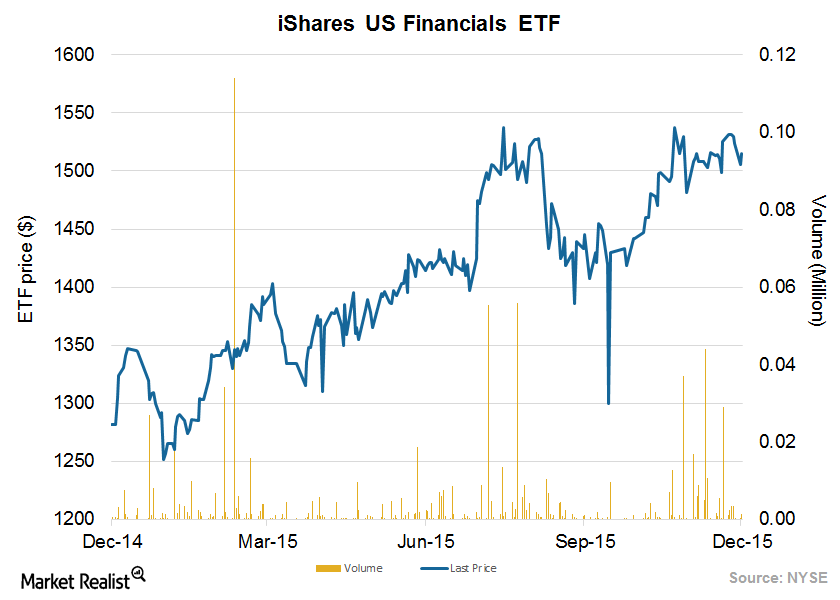

Rising Interest Rates, Banks, and Insurance Companies

Banking stocks are expected to benefit from higher interest rates, but not immediately. Also, rising interest rates would be countered by higher existing liquidity.

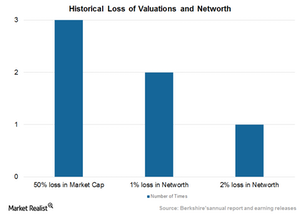

Warren Buffet’s 50-Year Vision for Berkshire Hathaway

Berkshire Hathaway has doubled its earnings and balance sheet potential since the financial crisis of 2007.

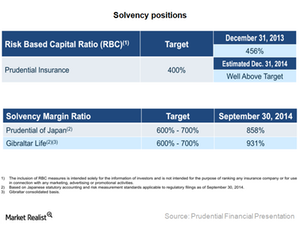

Prudential Financial Enjoys Strong Solvency Ratios

Prudential has comfortable solvency positions in its subsidiaries. In the US, Prudential Insurance’s solvency ratio was well above the target ratio of 400%.

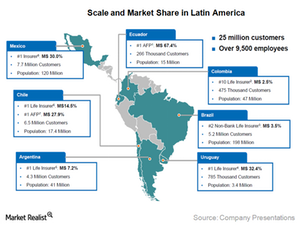

MetLife is the largest player in Latin America

MetLife plans to grow its retail and group business in Latin America, capitalizing on the growing middle class, affluent class, and corporate needs.

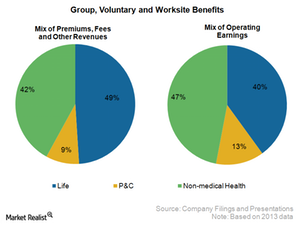

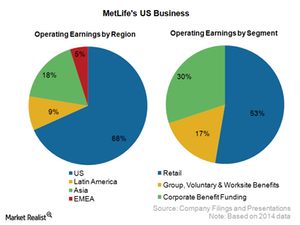

MetLife is a key player in the US group insurance business

MetLife is the market leader in the Large market with ~30% of the market share, while its market share is slightly above 5% in the Middle market.

MetLife is a leading player in the US insurance industry

MetLife intends to grow its retail business and expects low single-digit growth in the long term.

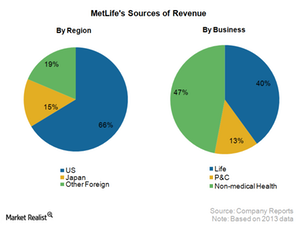

MetLife – A globally diversified insurance company

MetLife is a market leader in the US and the largest life insurer in Mexico and Chile. It is among the leading players in Japan, Korea, and Poland.