BTC iShares MSCI Canada ETF

Latest BTC iShares MSCI Canada ETF News and Updates

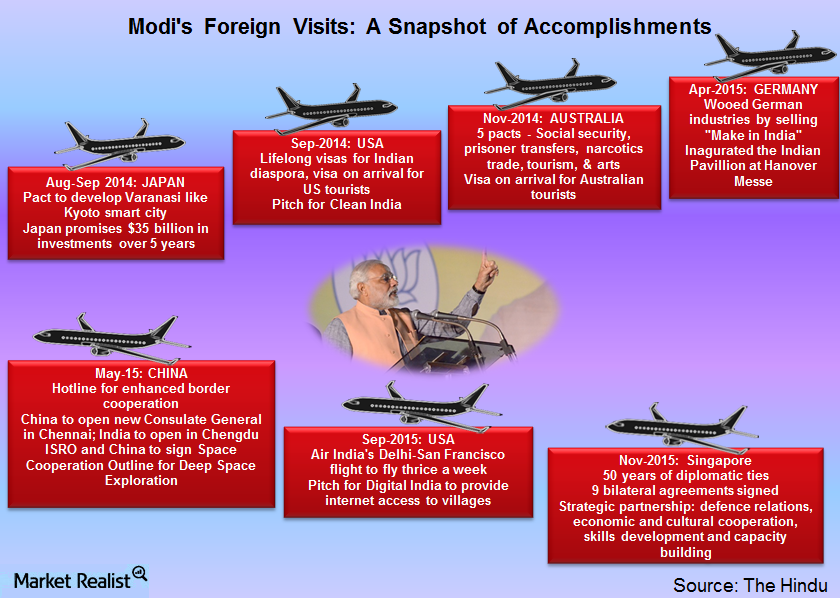

Modi’s Moment: Promises and Accomplishments

India (PIN) has strengthened its ties with Asian powerhouses (GRR) like Japan (JEQ) (EWJ) and Singapore (SGF).

How Walmart Is Gaining—and Losing—Market Share in Key Overseas Markets

Walmart’s international segment posted sales of $123.4 billion in fiscal 2016, down 9.4% YoY. In constant currency terms, the segment’s sales were up 3.2%.

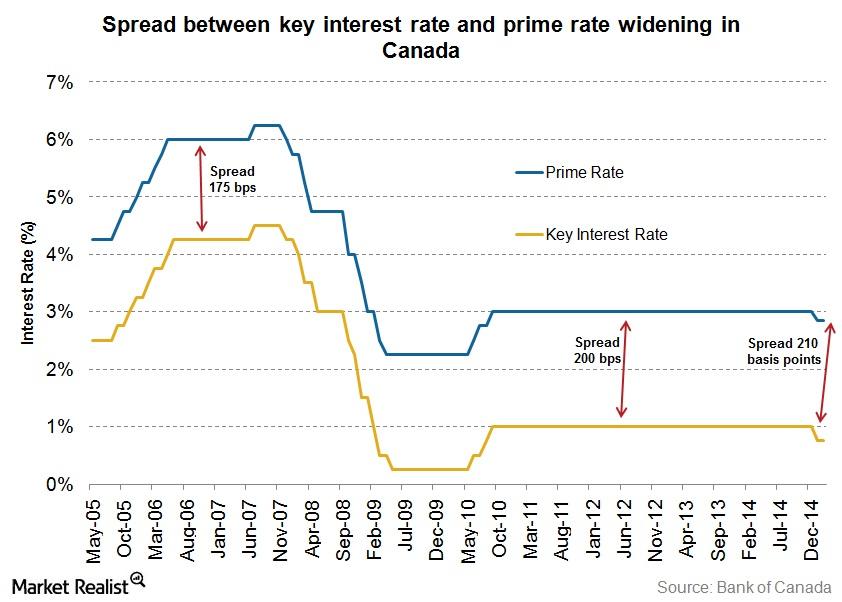

The widening spread in the Canadian prime and key interest rates

The “Big Six Banks” in Canada have only reduced their prime rates by 15 basis points. So the spread between the prime and key interest rates is now 0.1%.

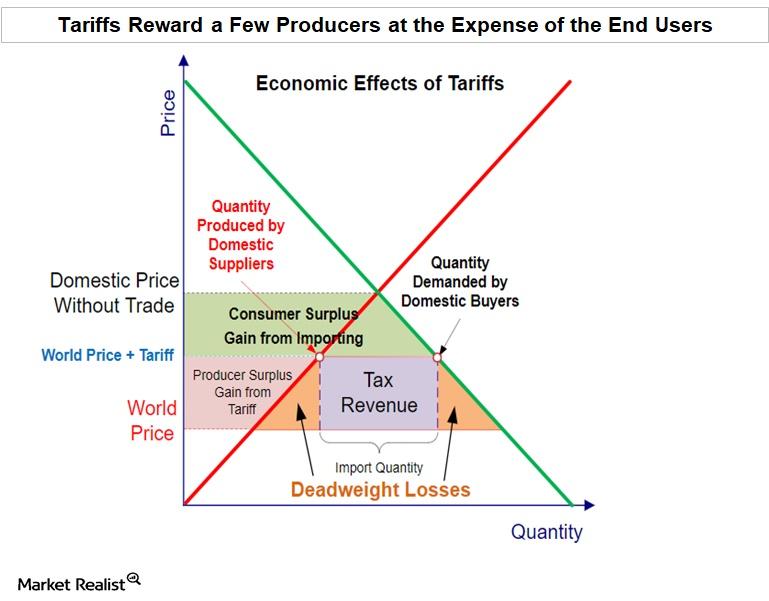

Why Economist Argue That Tariffs Are Bad for the Economy

The recently proposed import tariffs on steel and aluminum imports by US President Donald Trump are an effort to protect the interests of US manufacturers.

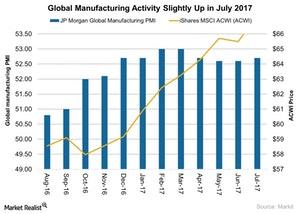

Global Manufacturing Activity Picks Up the Pace in July 2017

In this series, we’ll look at the performance of global (ACWI) manufacturing indexes and manufacturing activity in emerging markets.

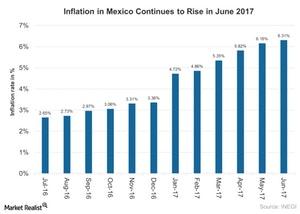

Mexican Unemployment Edged Up in June—Is the Rise Temporary?

Global (ACWI) recovery in 2017 has helped labor market conditions to improve across OECD (Organisation for Economic Co-operation and Development) nations.

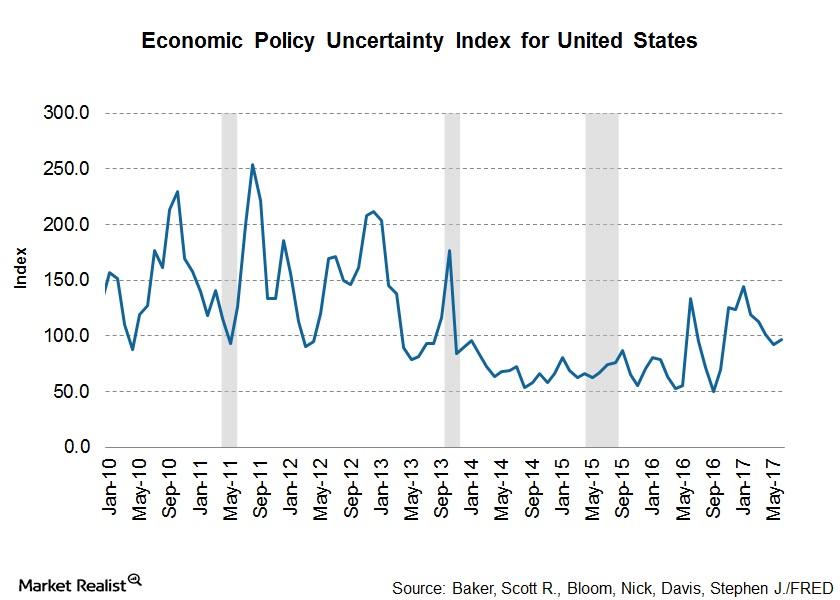

Dallas’s Kaplan Discusses the Biggest Headwind for the US Economy

Dallas’s Federal Reserve president, Robert S. Kaplan, said that the rebound in the US economy is likely to continue for the rest of 2017.

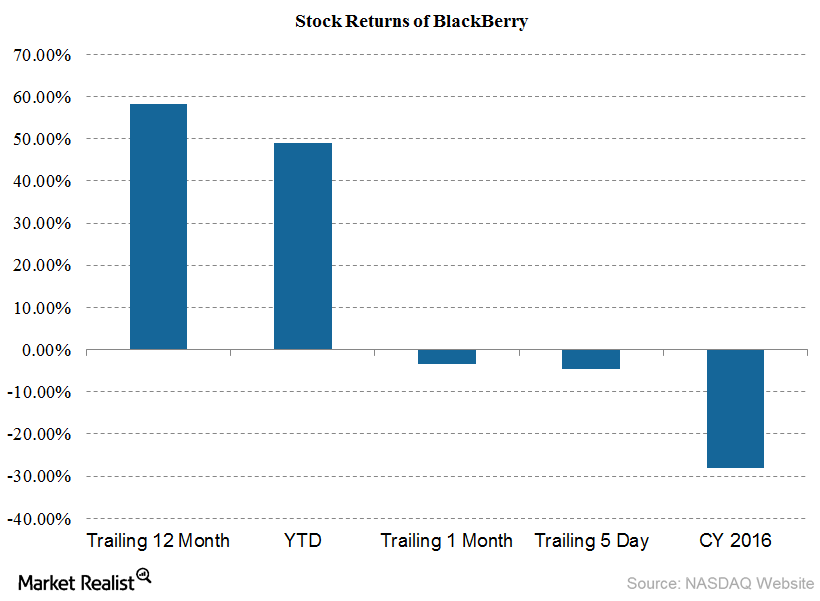

Where Is BlackBerry Trading Compared to Moving Averages in June?

Canada’s (EWC) BlackBerry (BBRY) generated returns of -3.3% in the trailing-one-month period and 58% in the trailing-12-month period.

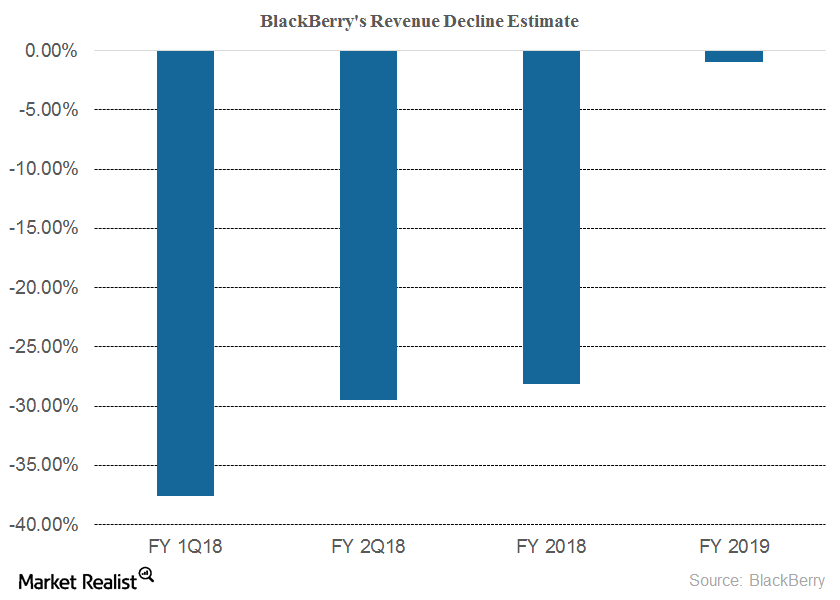

What Do Analysts Expect from BlackBerry in Fiscal 1Q18?

BlackBerry (BBRY) will announce its fiscal 1Q18 results on June 23, 2017. Analysts estimate that the company will post revenue of ~$264.51 million.

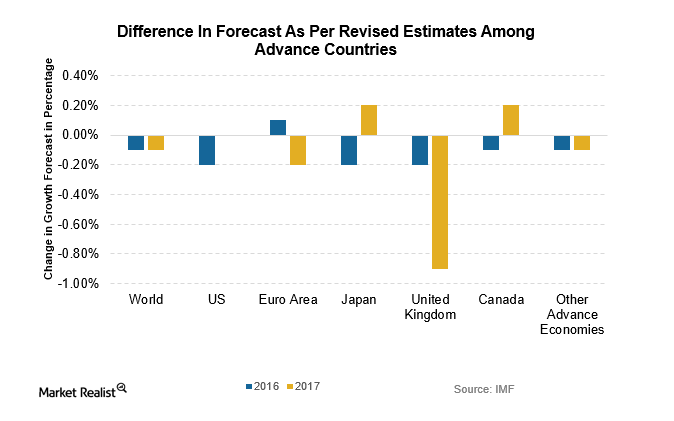

Why Were the United Kingdom’s Growth Forecasts Slashed?

Looking at the change in growth forecasts in advanced economies, the United Kingdom suffered the largest downward revision of estimates.

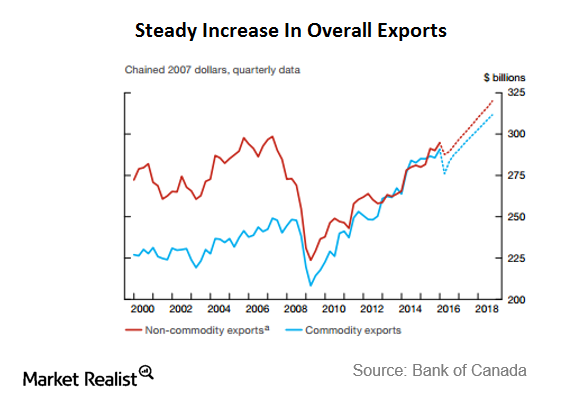

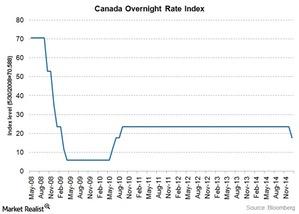

Major Takeaways from the Bank of Canada’s Monetary Policy

The Bank of Canada decided to keep the interest rates unchanged at 0.5% after the monetary policy meeting on July 13.

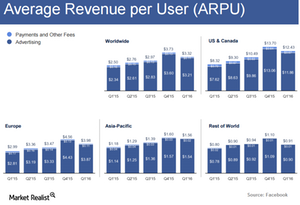

How Is Facebook’s Average Revenue per User Trending?

Average revenue per user (or ARPU) is a key metric for Internet companies, as it helps in analyzing how well a company can monetize its user base.

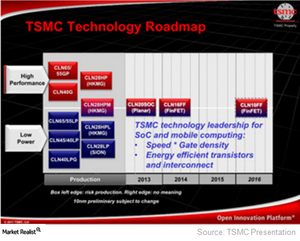

TSMC Has Accelerated Advanced Technology Development

TSMC is currently ramping up production of its 16nm technology. It expects to complete it by the end of fiscal 2Q16.

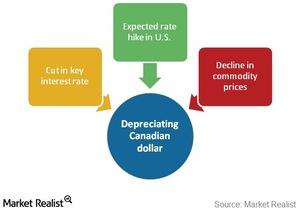

3 key factors affecting Canadian currency depreciation

The availability of easy money leads to currency depreciation, which benefits exporters, but is counterproductive for importers.

Economic essentials: The key interest rate and the prime rate

The key interest rate and the prime rate are central to the Canadian financial system. They key interest drives lending rates at the big banks.

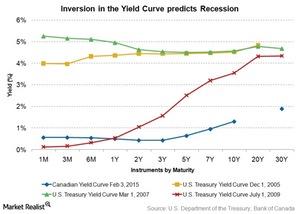

Could Canada’s inverted sovereign yield curve mean recession?

Canada’s inverted sovereign yield curve could be an indication of an upcoming recession. US yields exhibited similar curves prior to the 2008 recession.

Key challenges facing the Canadian economy

One of the challenges facing the Canadian economy is a lack diversification. More than 70% of the TSX Composite Index is made up of only three sectors.