Constellium NV

Latest Constellium NV News and Updates

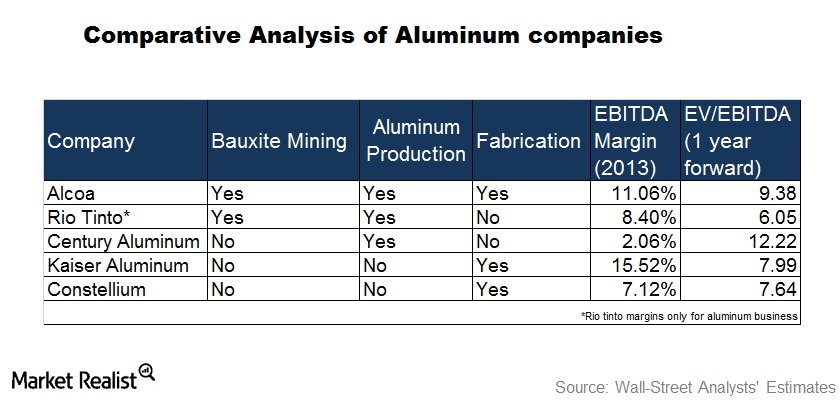

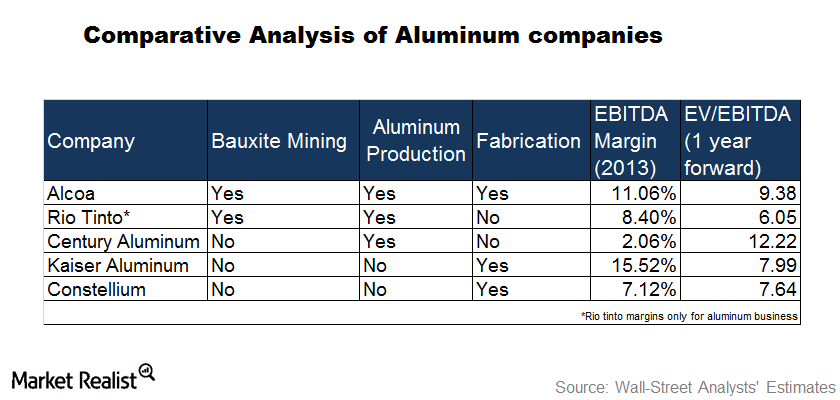

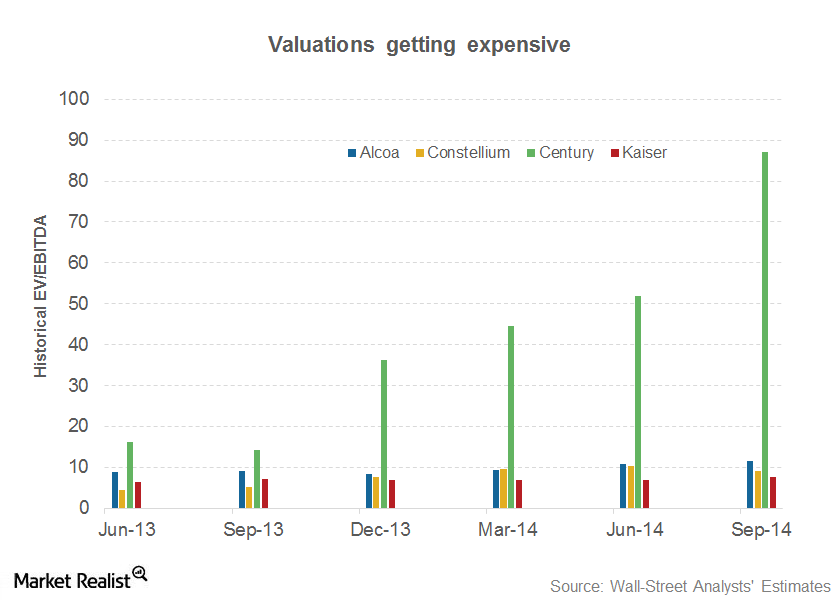

Aluminum company metrics compared

Trading on the London metal exchange determines the price for primary aluminum. Any increase in the price of aluminum benefits companies that produce primary aluminum.

Must-know: Alcoa is placed better than other aluminum companies

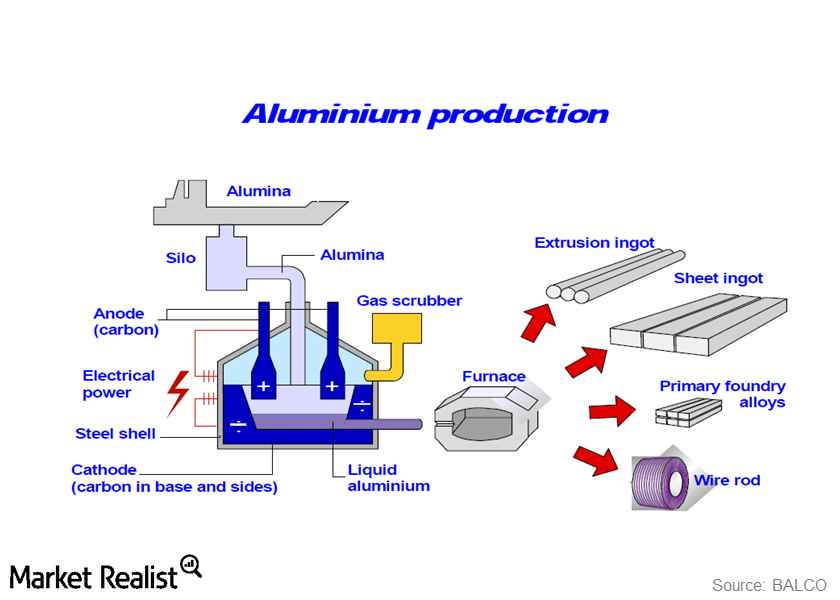

The aluminum process starts by extracting bauxite from the Earth’s crust. The bauxite is refined into alumina. Alumina is a key raw material—along with carbon and electricity.

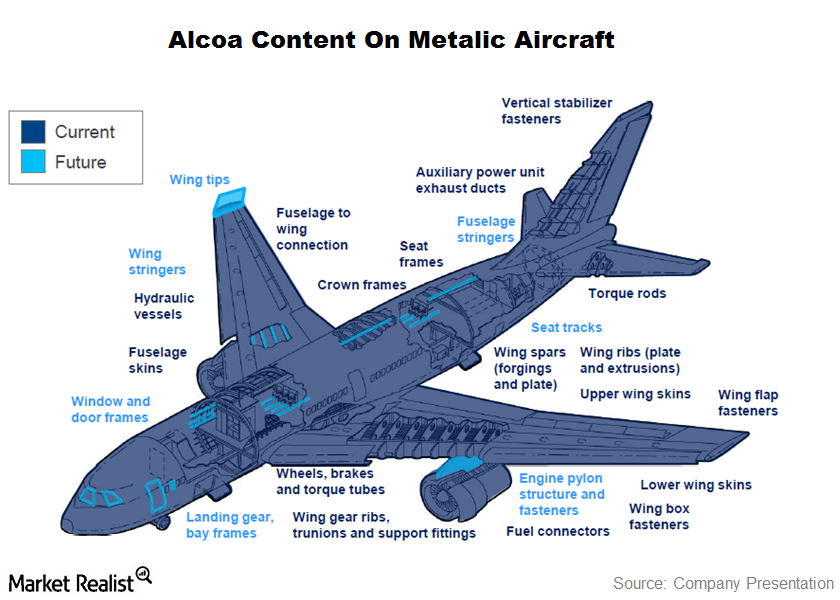

Must-know: Alcoa’s Aerospace Segment Is Important

The aerospace segment is the one of the biggest aluminum consumers in the world. Alcoa (AA) got $4 billion in revenue from aerospace companies last year.

How Alcoa Looked In 2014

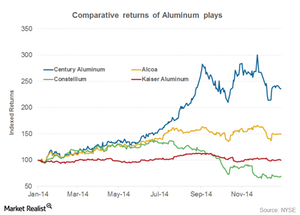

In this series, we’ll pay special attention to Alcoa’s 2014 performance and to how investors can play Alcoa and other aluminum companies in 2015.Materials Must-know: Playing the aluminum value chain

Bauxite is the most abundant metal in the earth’s crust. Because of the many impurities in bauxite, it must be refined to produce alumina.

Must-know: 3 risks that aluminum company investors face

Litigations can be a big blow for aluminum producers. Litigations are expected to decrease aluminum prices and premiums. This will be negative for aluminum companies like Alcoa Inc. (AA), Century Aluminum (CENX), Kaiser Aluminum Corp. (KALU), and Constellium (CSTM).Materials Why Alcoa is positioned well to serve the automotive industry

Alcoa is working to expand its capacity in Tennessee. It’s a $275 million investment. Alcoa expects that the facility will be operational by mid-2015.

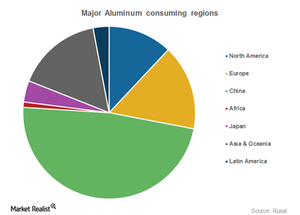

What Are The Major Regions That Consume Aluminum?

China is the biggest consumer. It consumes almost half of the aluminum that’s produced globally. However, this isn’t surprising. China is the biggest consumer of most industrial commodities.Materials Why investors should understand Alcoa’s business model

Alcoa is an integrated player in the aluminum value chain. This means its operations extend from bauxite refining to aluminum fabrication.

Overview: An investor’s guide to the aluminum industry

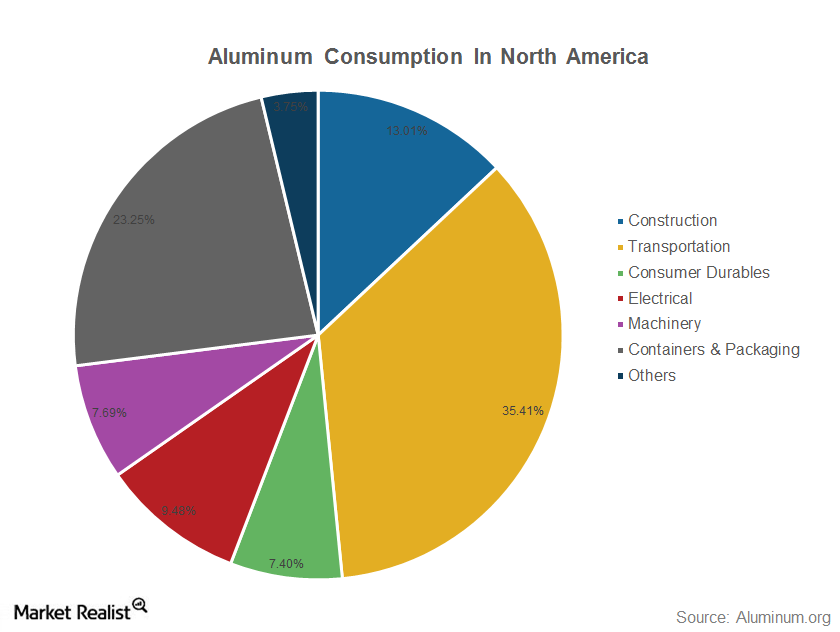

Aluminum is the most abundant metal found in the earth’s crust. It’s soft, lightweight, and durable in nature. Its low density and resistance to corrosion make it a very important metal that a lot of industries use.

Must-know: Understanding aluminum’s value chain

The aluminum industry has a value chain that consists of both upstream and downstream companies. Upstream companies are engaged in the mining and refining operations.

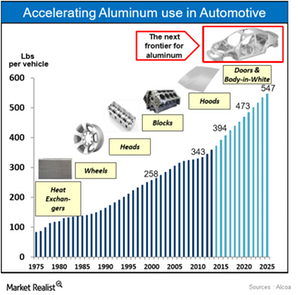

The Auto Industry’s Aluminum Usage Is Increasing

The usage of aluminum in automobiles has been gradually increasing, as it improves vehicle performance, reduces CO2 emissions, and boosts fuel economy.

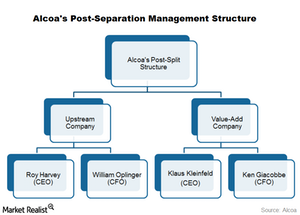

No Surprises in Alcoa’s Post-Separation Management Structure

On November 24, Alcoa announced the executive management structure to be introduced following its split.

What’s Driving Alcoa’s Stock?

Alcoa’s stock has witnessed a decent upwards move over the last few trading sessions, gaining more than 16% since November 12.

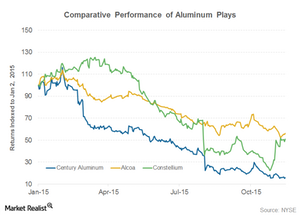

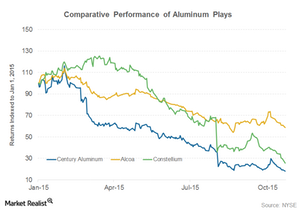

Will Century Aluminum Post a Larger-Than-Expected Loss in 3Q15?

Analysts expect Century Aluminum (CENX) to post a loss when it releases its 3Q15 results on October 29, 2015. Earnings season for the aluminum industry has started on a dull note.