Credit Suisse Group

Latest Credit Suisse Group News and Updates

Ulrich Körner Is the New CEO of Credit Suisse — How Much Will He Get Paid?

After a $1.65 billion loss, Credit Suisse has named Ulrich Körner as the new CEO — so what is the expected salary of the Swiss-German businessman?

Credit Suisse Data Leak and the Pakistan Connection, Explained

A whistleblower has leaked the account details of over 18,000 Credit Suisse account holders. What are the implications and the Pakistan connection?

Why Credit Suisse Is Betting on These Five Rebound Stocks

Credit Suisse has identified five rebound stocks that will benefit from the rapid expansion of the U.S. economy. Should you own any of these?

Credit Suisse Announces Major Layoffs Following Archegos Scandal

Credit Suisse executives are leaving after multibillion-dollar losses from the Archegos sell-off. What happened and who's leaving the company?

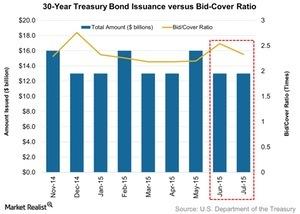

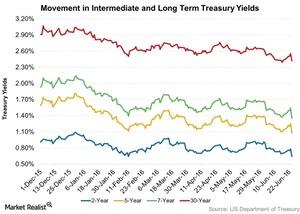

10-Year Treasury Note Market Demand Barely Moved Last Week

On July 8, ten-year Treasury notes worth $21 billion were auctioned—the same as the previous week.

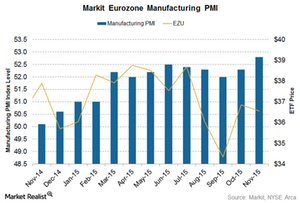

Credit Suisse and Barclays Are Bullish on European Equity for 2016

Credit Suisse (CS) strategists forecast 10% earnings growth in Europe versus a 6.8% growth expected from the US.

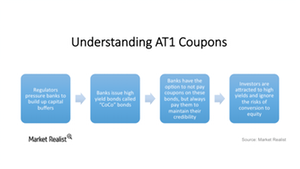

Why Are Deutsche Bank Investors So Concerned About AT1 Coupons?

Shares of Deutsche Bank (DB) have fallen nearly 10% in the last three trading sessions. Efforts to reassure investors about its ability to pay coupons on its AT1 bonds were in vain.

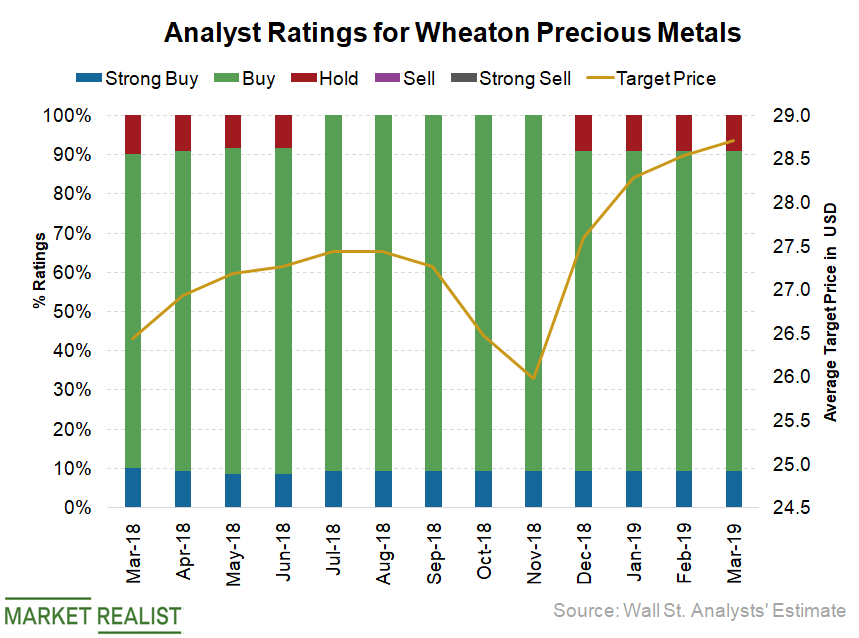

Why Wheaton Precious Metals Is Still Analysts’ Top Gold Bet

Among major gold (GLD)(IAU) mining and gold streaming companies (GOAU), Wheaton Precious Metals (WPM) is analysts’ favorite and has received the most “buy” recommendations at 91%.

Brexit Vote: How Did US Treasury Auctions React?

The US Treasury auctioned 30-year TIPS (VIPSX)(LTPZ) worth $5 billion on June 22.

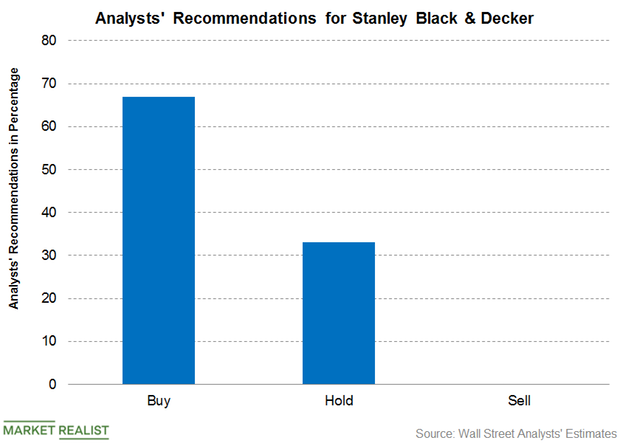

Stanley Black & Decker: Analysts’ Recommendations

Currently, 21 analysts are actively tracking Stanley Black & Decker. Among the analysts, 67% recommend a “buy,” while 33% recommend a “hold.”

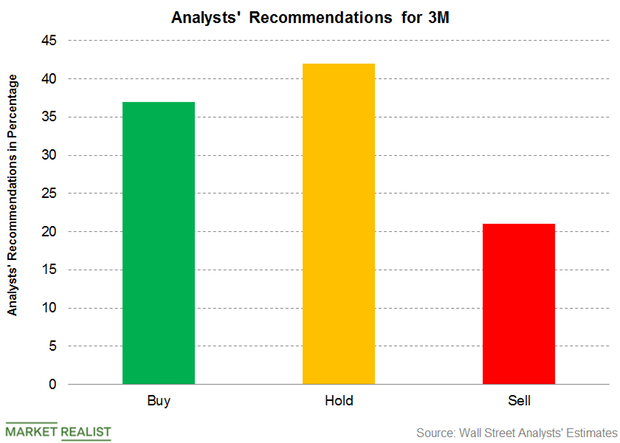

3M: Analysts Revised the Target Price

For 3M stock, 37% of the analysts recommended a “buy,” 42% recommended a “hold,” and 21% recommended a “sell.”

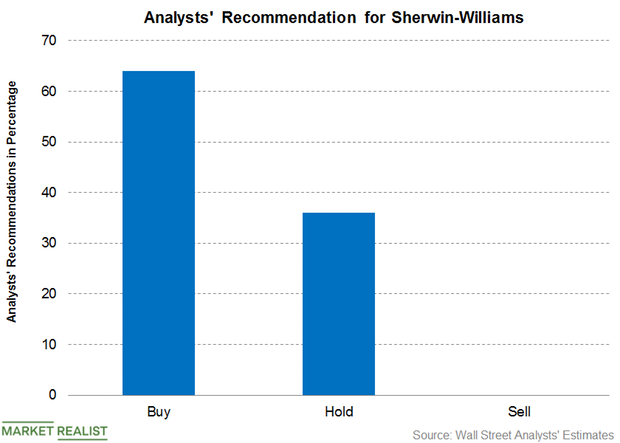

Sherwin-Williams: Analysts’ Recommendations

For Sherwin-Williams, 64% of the analysts recommended a “buy,” 36% recommended a “hold,” and none of the analysts recommended a “sell.”

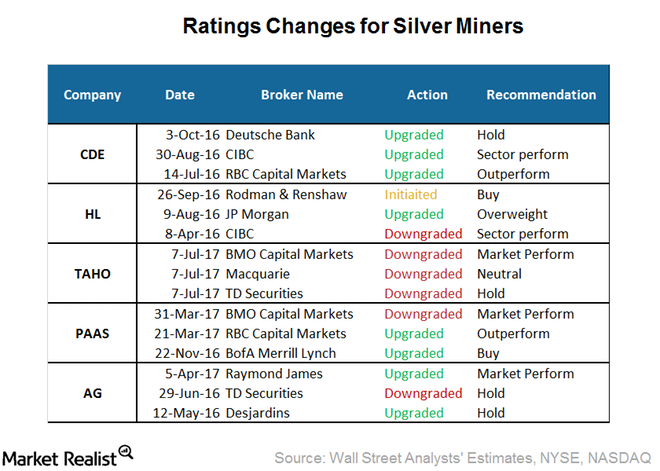

Behind the Recent Analyst Rating Changes for Silver Miners

After the Guatemalan government’s decision to suspend Tahoe Resources’ (TAHO) license, the company saw several downgrades.

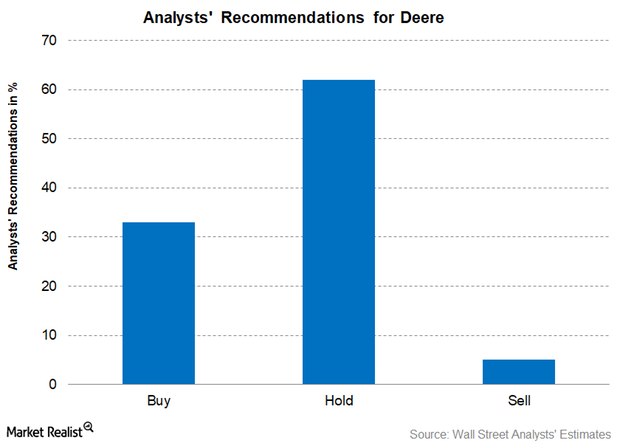

Deere: Analysts’ Recommendations and Target Prices

For Deere, 33% of the analysts recommended the stock as a “buy,” 62% recommended the stock as a “hold,” and 5% recommended the stock as a “sell.”

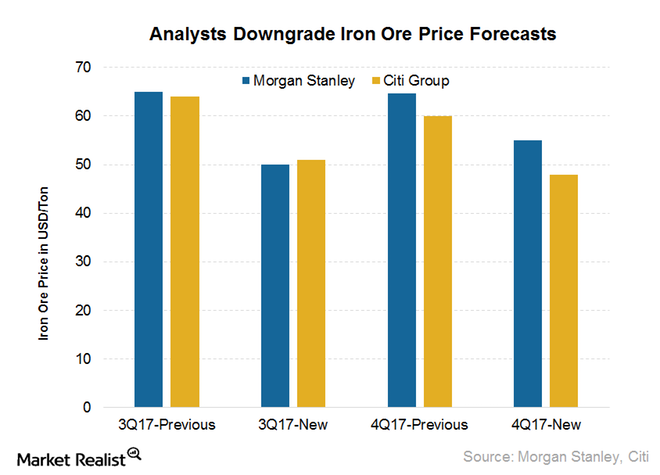

Analysts’ Views: What Iron Ore Price Could Bring Balance?

While iron ore prices have rebounded recently, analysts are still skeptical about the long term. Morgan Stanley has reduced its iron ore price forecast for 3Q17 by 23% to $50 per ton.

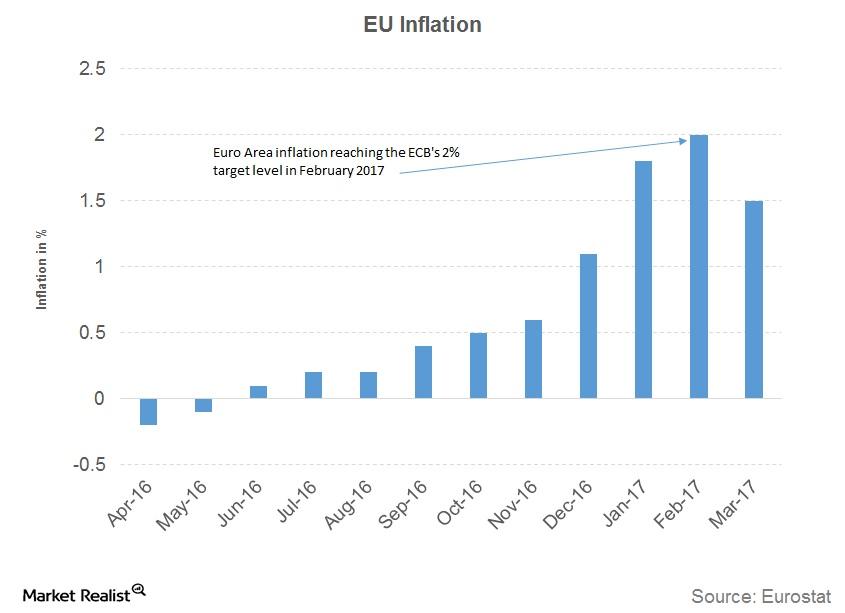

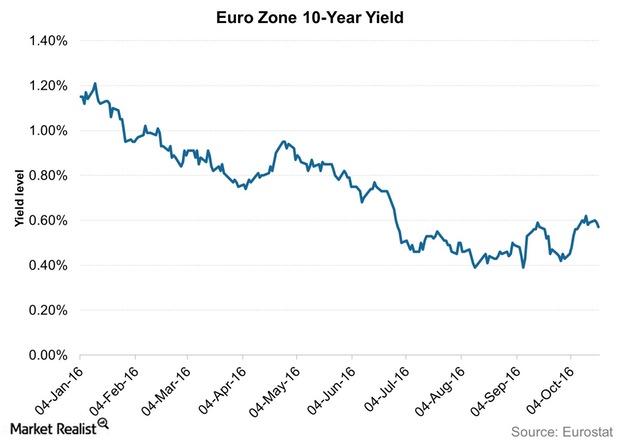

Will the European Central Bank Follow the Fed?

On its own stage across the Atlantic from the US Fed, the ECB (European Central Bank) has had its own quantitative easing program.

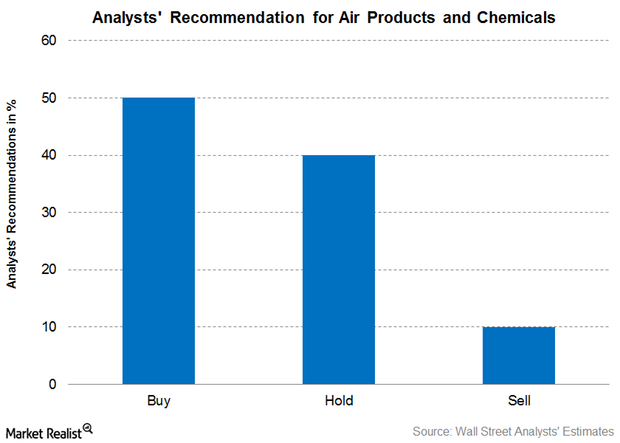

Analysts’ Latest Recommendations for Air Products & Chemicals

As of March 29, 2017, 20 brokerage firms were actively tracking Air Products & Chemicals (APD). About 50.0% of them recommended a “buy” for the stock.

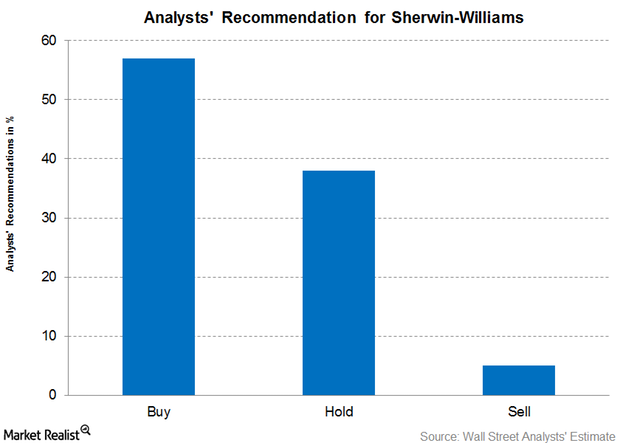

Analysts’ Latest Recommendations for Sherwin-Williams

As of February 27, 21 brokerage firms were actively tracking Sherwin-Williams stock—57% gave it a “buy,” 38% gave it a “hold,” and 5% gave it a “sell.”

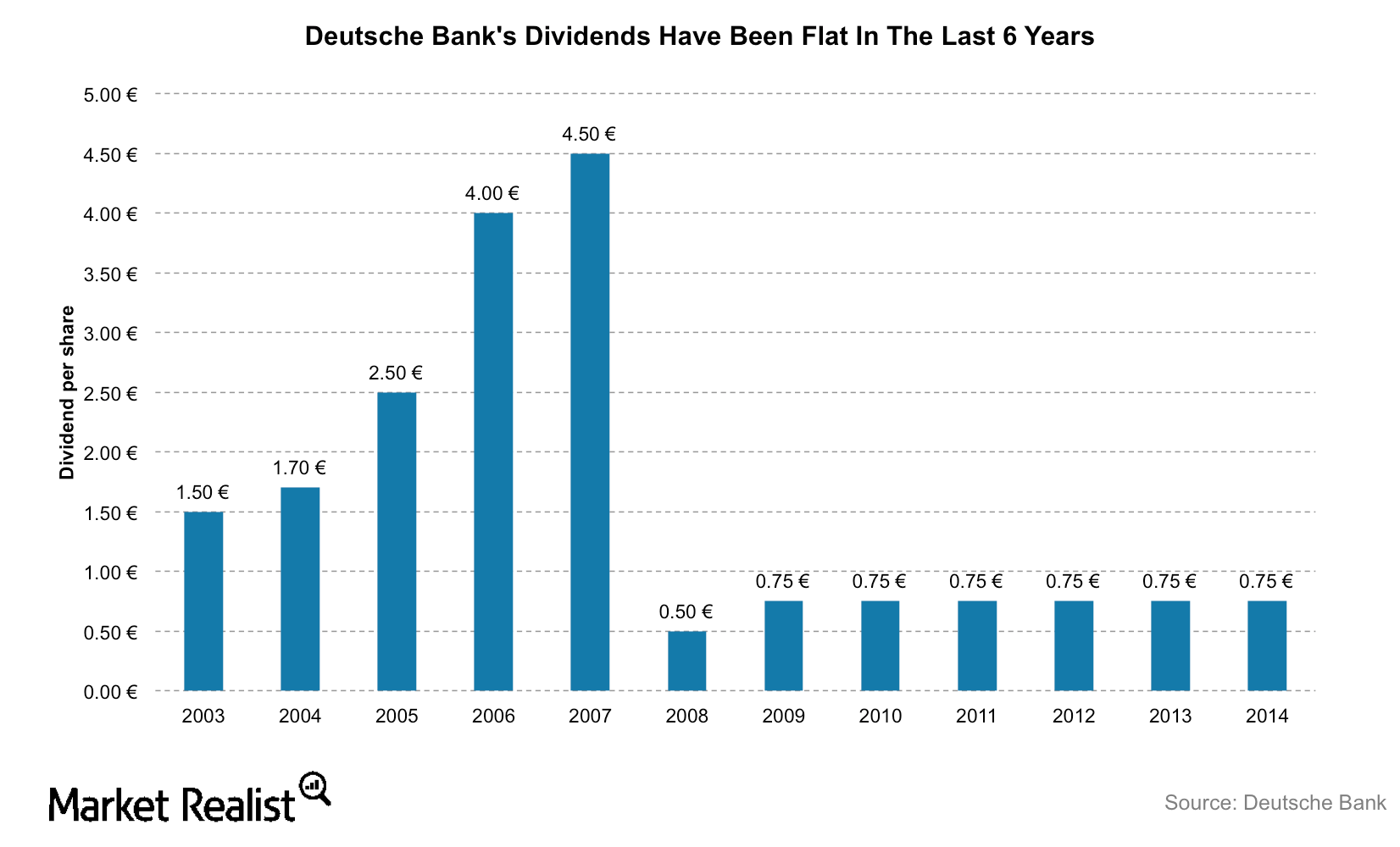

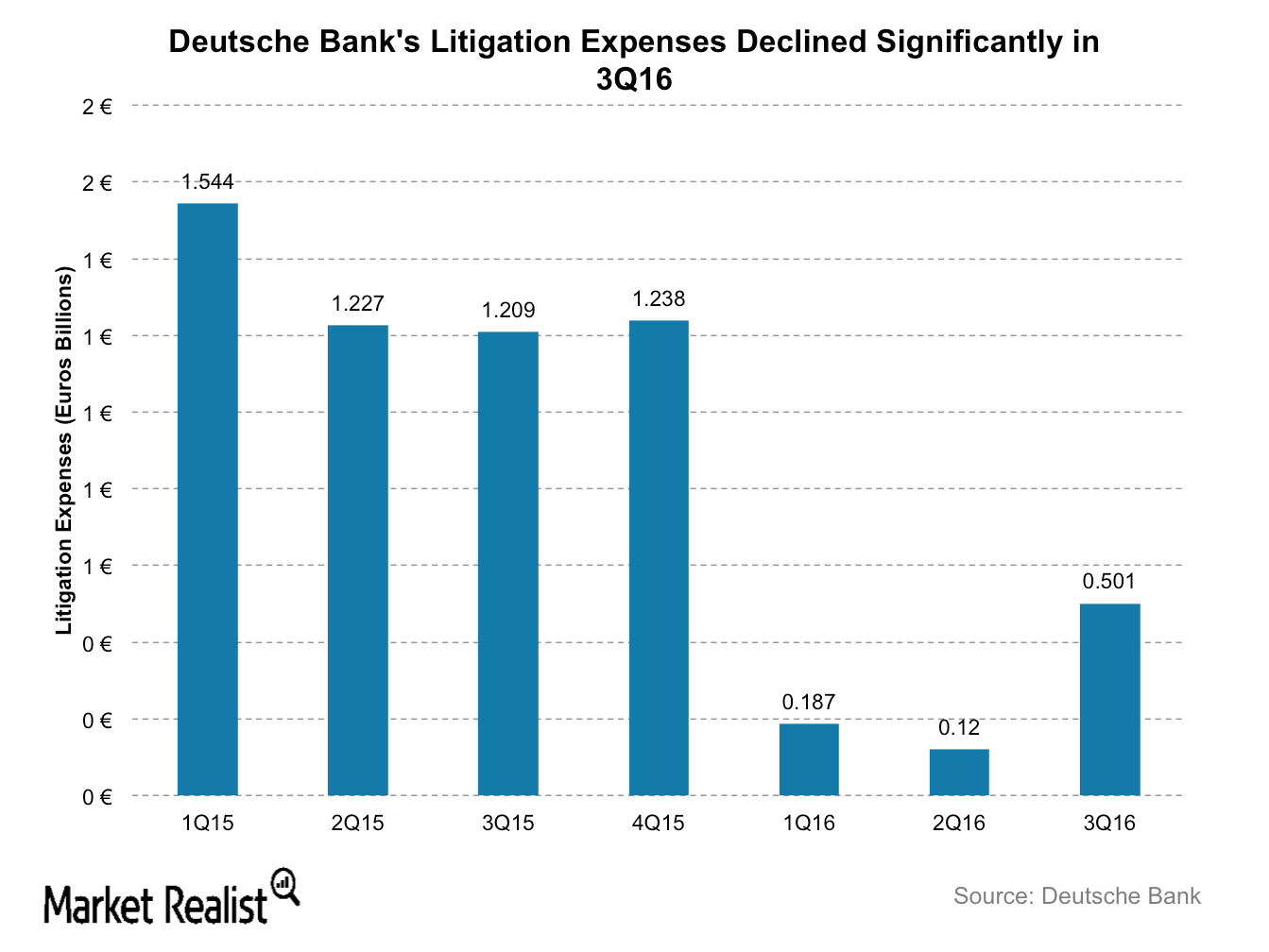

Why Deutsche Bank Scrapped Dividends in 2016

Germany-based Deutsche Bank (DB) announced plans to cut dividend payments for 2015 and 2016 as part of its plans to strengthen the bank’s capital.

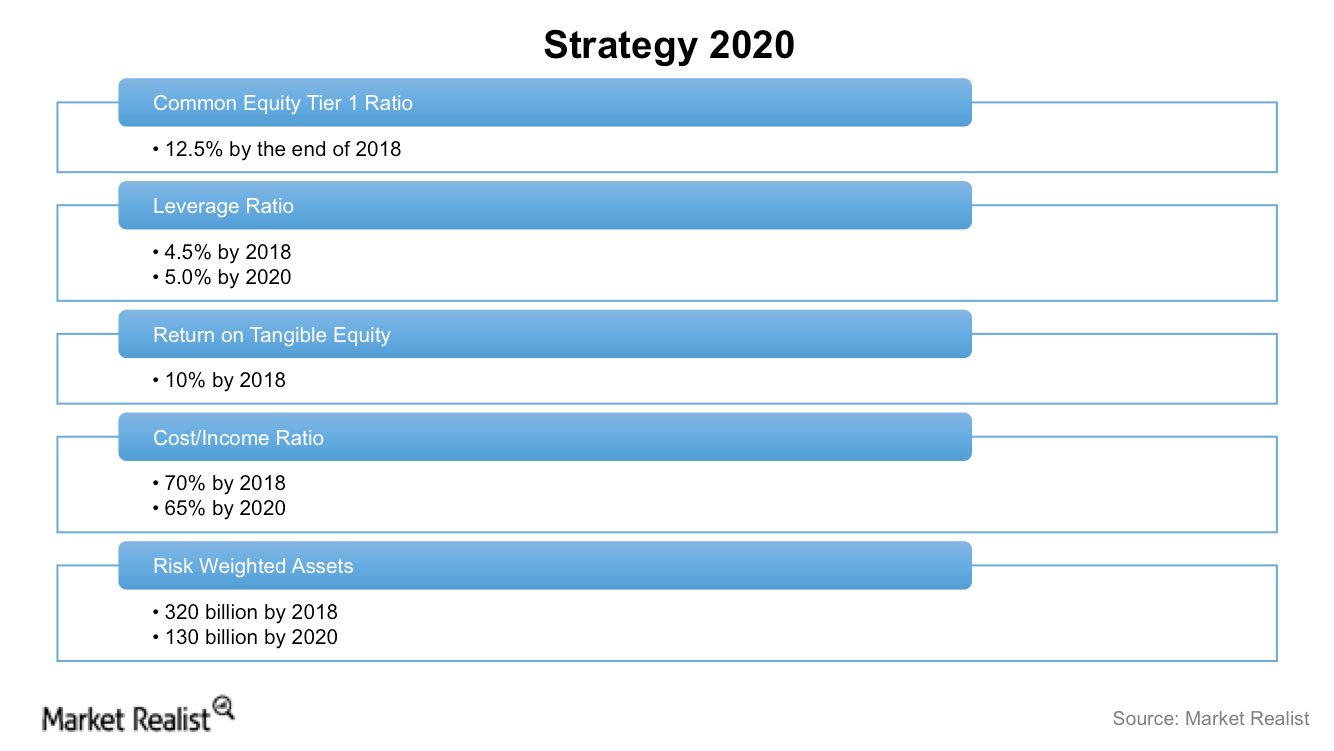

Will Deutsche Bank’s Overhaul Plan Work?

Investors who are concerned about Deutsche Bank’s bankruptcy are looking at CEO John Cryan’s plan to restructure the company’s operations.

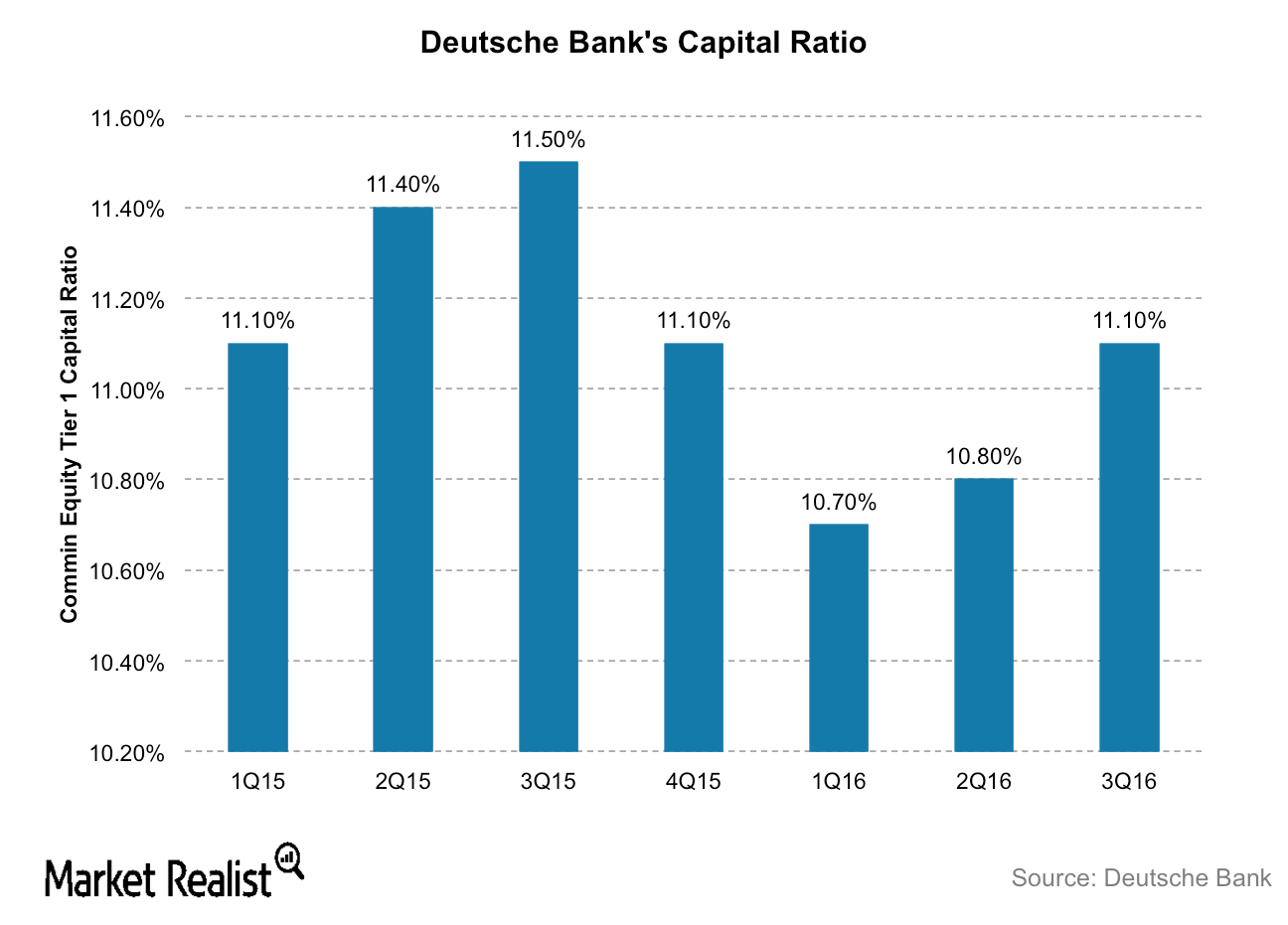

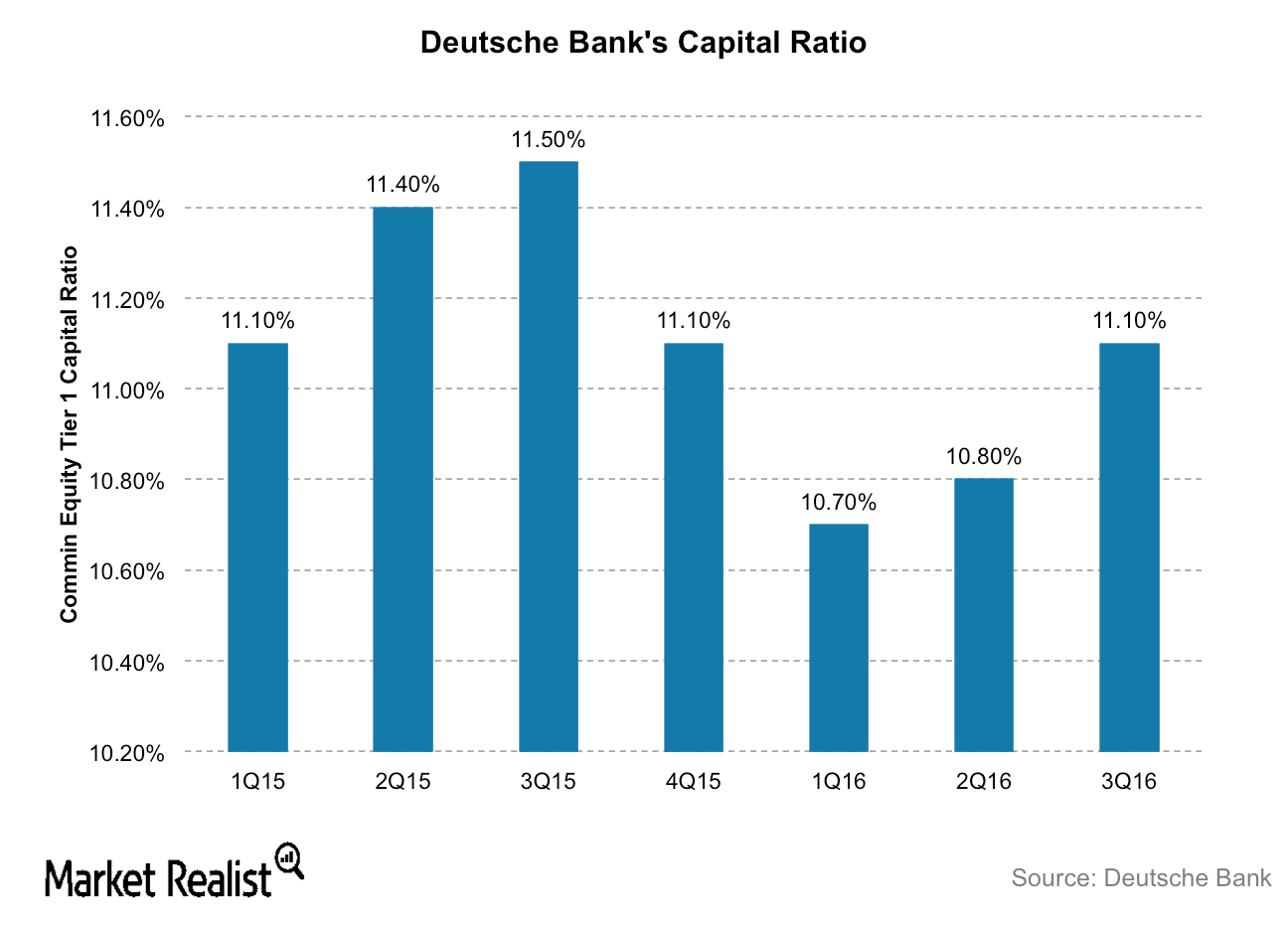

Deutsche Bank: Analyzing Its Capital Levels

Deutsche Bank is proving to be the most dangerous bank to the global economy. It failed the Fed’s 2016 stress tests in June 2016.

Can Trump Save Deutsche Bank from Bankruptcy?

Deutsche Bank could be the biggest beneficiary under Trump, having been on the brink of bankruptcy until its stock spiked nearly 20% after the election.

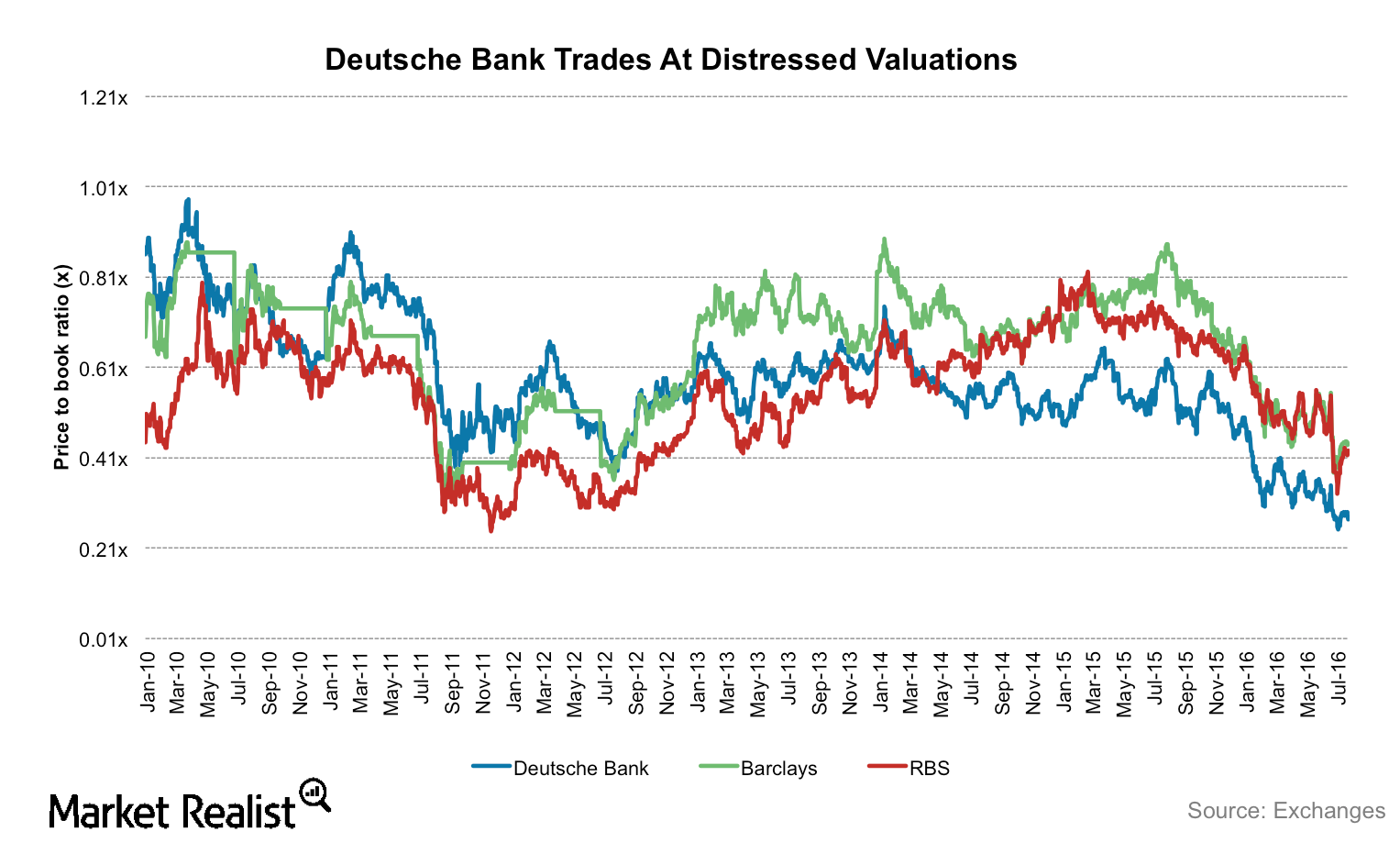

Do Distressed Valuations Offer a Good Chance to Buy Deutsche Bank?

Deutsche Bank’s (DB) shares are currently trading at distressed valuations. The bank’s shares are trading at the steepest discount to its book value, worse than the 2008 financial crisis.

Deutsche Bank’s Capital Levels Struggle to Meet Regulatory Requirements

Deutsche Bank’s stock is down nearly 40% in 2016 so far. Capital reserves are important to restore the confidence of regulators and investors.

No Tapering, No Extension: ECB Avoids Future Talk on QE

ECB chief Mario Draghi had nothing to say about either tapering or extension of the bond buying program.

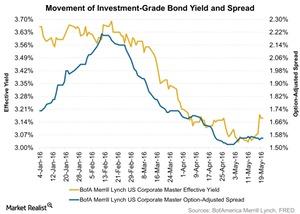

High-Grade Bond Yields Rise on Better Odds of a Rate Hike

Last week, investment-grade bond yields jumped 12 basis points and ended at 3.16%, the highest level since April 5, 2016.

What Are TIPS and How Do They Benefit Investors?

Treasury inflation-protected securities (or TIPS) protect the value of debt securities from eroding due to a rise in inflation.

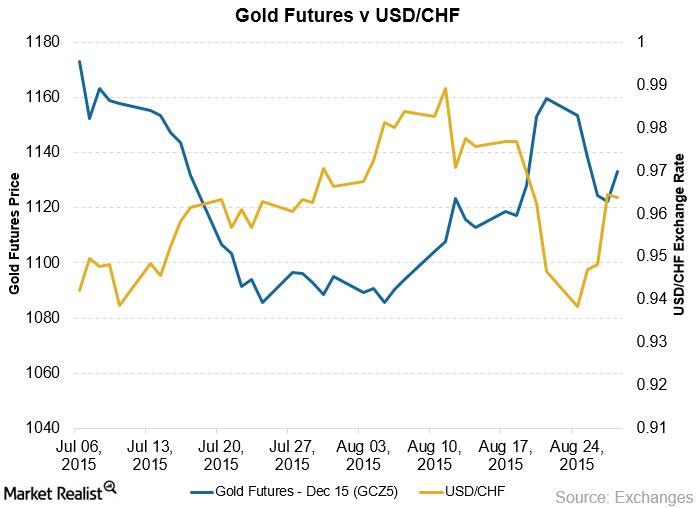

Why the Swiss Franc Is the Golden Currency

Recently, the safe haven currencies like the Swiss franc and the Japanese yen are the ones that are showing a greater correlation to gold.